Fill Out a Valid 1099 Nec Template

Form Specs

| Fact Name | Description |

|---|---|

| Purpose of Form | The 1099-NEC form is used to report nonemployee compensation to the IRS. This is relevant for freelancers, independent contractors, and other non-employees who receive payments for services rendered. |

| Filing Requirement | If a payer pays $600 or more to a nonemployee in a calendar year, they must file a 1099-NEC form. This ensures that the IRS is aware of income that may not have had taxes withheld. |

| Copy A | Copy A of the 1099-NEC is provided for informational purposes only and appears in red. It must be filed with the IRS and must be printed from an official source to ensure it is scannable. |

| Penalties for Incorrect Filing | Filing a non-scannable version of Copy A can lead to penalties. It is essential to obtain the official printed version from the IRS to avoid issues. |

| Electronic Filing | Payers can file the 1099-NEC electronically using the IRS FIRE system. This is often a faster and more efficient way to submit the required information. |

| State-Specific Requirements | Some states have their own requirements for reporting nonemployee compensation. For example, California requires a state-specific form to be filed along with the 1099-NEC. |

| Recipient's Responsibilities | Recipients of the 1099-NEC must report the income on their tax returns. If they believe they are misclassified as non-employees, they should take action to correct this with the payer. |

| Backup Withholding | If a taxpayer does not provide their Taxpayer Identification Number (TIN), the payer may be required to withhold taxes on payments. This is known as backup withholding. |

| Form Updates | The 1099-NEC form is subject to updates and changes. It is important to check the IRS website for the most current version and instructions. |

| Order Official Forms | Payers can order official copies of the 1099-NEC from the IRS website. This ensures they receive the correct forms for filing. |

Dos and Don'ts

Things You Should Do When Filling Out the 1099-NEC Form:

- Ensure you use the official IRS version of the form, especially for Copy A, to avoid penalties.

- Provide accurate taxpayer identification numbers (TINs) for both the payer and the recipient.

- Print and distribute Copy B and other copies in black, as these can be used for recipient information.

- File the form electronically through the IRS FIRE system for convenience and efficiency.

- Double-check all amounts reported to ensure they reflect the correct nonemployee compensation.

- Keep a copy of the completed form for your records, as it may be needed for future reference.

Things You Shouldn't Do When Filling Out the 1099-NEC Form:

- Do not print and file Copy A downloaded from the IRS website, as it is not scannable.

- Avoid using outdated versions of the form; always use the most current revision.

- Do not leave any boxes blank; ensure all relevant information is filled out completely.

- Do not forget to check for any penalties associated with incorrect or incomplete filings.

- Do not use the form for employee compensation; it is specifically for nonemployee payments.

- Never ignore deadlines for filing; timely submission is crucial to avoid fines.

Other PDF Documents

How to Estimate Roof Cost - Initiate the process for your roofing estimate now.

Utilizing a Texas Notary Acknowledgement form is crucial for individuals who aim to authenticate their documents effectively. This form serves to reassure all parties involved of the signature's legitimacy and the signer's intent. For further information, you can explore a detailed guide on the important Notary Acknowledgement process.

Can You Print Out a W9 Form - A completed W-9 helps ensure that you receive a correct 1099 form at year-end.

Common mistakes

-

Using the wrong version of the form: Many people mistakenly download and print Copy A of the 1099-NEC form from the IRS website. This version is for informational purposes only and cannot be filed with the IRS. Using it can lead to penalties.

-

Incorrectly entering taxpayer identification numbers (TINs): Failing to provide accurate TINs for both the payer and the recipient is a common mistake. An incorrect TIN can delay processing and may result in penalties for both parties.

-

Omitting necessary information: Some filers forget to include essential details, such as the payer's address or the amount of nonemployee compensation. Omissions can cause the IRS to reject the form or lead to further inquiries.

-

Not filing on time: Timeliness is crucial. Failing to file the 1099-NEC by the deadline can result in significant penalties. It's important to be aware of the due dates and plan accordingly.

Documents used along the form

The 1099-NEC form is essential for reporting nonemployee compensation, but it often accompanies several other forms and documents during tax season. Understanding these additional forms can help ensure compliance and streamline the filing process. Below is a list of commonly used documents alongside the 1099-NEC.

- Form W-9: This form is used to request the taxpayer identification number (TIN) of a payee. Businesses typically ask independent contractors to fill out a W-9 before issuing a 1099-NEC.

- Form 1096: This is a summary form that accompanies paper-filed 1099 forms. It provides the IRS with a summary of all 1099 forms submitted by a business for the year.

- Form 1040: This is the standard individual income tax return form. Recipients of 1099-NEC forms will report their nonemployee compensation on this form, typically in the "Other income" section.

- Schedule C: Self-employed individuals use this form to report income or loss from a business. If the 1099-NEC reflects self-employment income, it should be reported here.

- Form 8919: This form is for individuals who believe they were misclassified as independent contractors instead of employees. It helps report the income and calculate any unpaid employment taxes.

- Hold Harmless Agreement: This essential legal document helps protect one party from liability during various business transactions, ensuring clarity and safety in agreements. For more details, visit https://californiadocsonline.com/hold-harmless-agreement-form/.

- Form 1040-ES: This form is used for estimating tax payments. Independent contractors receiving 1099-NEC forms often need to make quarterly estimated tax payments.

- Form 1099-MISC: While the 1099-NEC is specifically for nonemployee compensation, the 1099-MISC is used for various other types of payments, such as rents and prizes. Understanding the distinction is crucial for accurate reporting.

- State Tax Forms: Depending on the state, there may be additional forms required for reporting state income tax withheld from payments reported on the 1099-NEC.

Filing taxes can be complex, especially when multiple forms are involved. Familiarity with these documents can help ensure that all income is reported accurately and that tax obligations are met. Always consider consulting a tax professional for personalized guidance based on individual circumstances.

Misconceptions

Understanding the 1099-NEC form is essential for both payers and recipients. However, several misconceptions can lead to confusion. Here are eight common misconceptions explained:

- Only employees receive 1099-NEC forms. Many believe that only employees receive this form. In reality, the 1099-NEC is used for nonemployees, such as independent contractors or freelancers.

- You can print and file Copy A downloaded from the IRS website. It’s a misconception that you can print Copy A from the IRS website for filing. This version is not scannable, and using it may result in penalties.

- All copies of the 1099-NEC are the same. Some think all copies are identical. However, Copy A is different from Copies B and C. Only Copy A is meant for the IRS, while the others are for the recipient and the payer’s records.

- Filing electronically is not an option. Many assume that filing the 1099-NEC must be done on paper. In fact, it can be filed electronically through the IRS FIRE system, which is often more efficient.

- 1099-NEC forms are only for large payments. There’s a belief that the 1099-NEC is only necessary for large sums. However, any nonemployee compensation of $600 or more in a year requires this form.

- Backup withholding is optional. Some individuals think backup withholding is at the payer’s discretion. In reality, if a recipient does not provide a taxpayer identification number (TIN), the payer is required to withhold taxes.

- Filing a 1099-NEC is a one-time task. It’s a common misconception that filing the 1099-NEC is a one-off obligation. Payers must issue this form annually for each qualifying payment made during the tax year.

- Receiving a 1099-NEC means you owe taxes. Lastly, many recipients worry that receiving a 1099-NEC automatically means they owe taxes. While it does report income, the actual tax liability depends on individual circumstances and deductions.

Being aware of these misconceptions can help both payers and recipients navigate the complexities of tax reporting more effectively. Always consult a tax professional if you have questions about your specific situation.

Preview - 1099 Nec Form

Attention:

Copy A of this form is provided for informational purposes only. Copy A appears in red, similar to the official IRS form. The official printed version of Copy A of this IRS form is scannable, but the online version of it, printed from this website, is not. Do not print and file copy A downloaded from this website; a penalty may be imposed for filing with the IRS information return forms that can’t be scanned. See part O in the current General Instructions for Certain Information Returns, available at www.irs.gov/form1099, for more information about penalties.

Please note that Copy B and other copies of this form, which appear in black, may be downloaded and printed and used to satisfy the requirement to provide the information to the recipient.

To order official IRS information returns, which include a scannable Copy A for filing with the IRS and all other applicable copies of the form, visit www.IRS.gov/orderforms. Click on Employer and Information Returns, and we’ll mail you the forms you request and their instructions, as well as any publications you may order.

Information returns may also be filed electronically using the IRS Filing Information Returns Electronically (FIRE) system (visit www.IRS.gov/FIRE) or the IRS Affordable Care Act Information Returns (AIR) program (visit www.IRS.gov/AIR).

See IRS Publications 1141, 1167, and 1179 for more information about printing these tax forms.

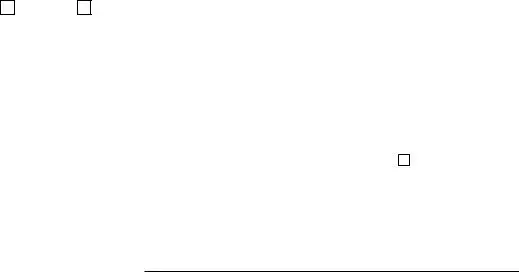

7171 |

VOID |

CORRECTED |

|

|

|

|

|

|

||||

PAYER’S name, street address, city or town, state or province, country, ZIP |

|

|

|

|

OMB No. |

|

|

|||||

or foreign postal code, and telephone no. |

|

|

|

|

|

|

Form |

|

|

|||

|

|

|

|

|

|

|

|

|

Nonemployee |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Rev. January 2022) |

|

Compensation |

||

|

|

|

|

|

|

|

|

For calendar year |

|

|

||

|

|

|

|

|

|

|

|

20 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PAYER’S TIN |

RECIPIENT’S TIN |

|

|

1 |

Nonemployee compensation |

|

Copy A |

|||||

|

|

|

|

$ |

|

|

|

|

|

|

|

For Internal Revenue |

RECIPIENT’S name |

|

|

|

2 |

Payer made direct sales totaling $5,000 or more of |

|

Service Center |

|||||

|

|

|

|

|

consumer products to recipient for resale |

|

File with Form 1096. |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

|

|

|

|

|

|

|

For Privacy Act and |

|

|

|

|

|

|

|

|

|

|

|

|

Paperwork Reduction Act |

Street address (including apt. no.) |

|

|

|

|

|

|

|

|

|

|

|

Notice, see the current |

|

|

|

|

4 |

Federal income tax withheld |

|

General Instructions for |

|||||

|

|

|

|

|

Certain Information |

|||||||

|

|

|

|

$ |

|

|

|

|

|

|

|

|

City or town, state or province, country, and ZIP or foreign postal code |

|

|

|

|

|

|

|

|

Returns. |

|||

|

|

|

|

5 |

State tax withheld |

6 State/Payer’s state no. |

|

7 State income |

||||

|

|

|

$ |

|

|

|

|

|

|

|

$ |

|

Account number (see instructions) |

|

2nd TIN not. |

|

|

|

|

|

|

||||

|

|

|

|

$ |

|

|

|

|

|

|

|

$ |

Form |

Cat. No. 72590N |

|

www.irs.gov/Form1099NEC |

|

Department of the Treasury - Internal Revenue Service |

|||||||

Do Not Cut or Separate Forms on This Page — Do Not Cut or Separate Forms on This Page

|

VOID |

CORRECTED |

|

|

|

|

|

|

|||

PAYER’S name, street address, city or town, state or province, country, ZIP |

|

|

|

|

OMB No. |

|

|

||||

or foreign postal code, and telephone no. |

|

|

|

|

|

Form |

|

|

|||

|

|

|

|

|

|

|

|

Nonemployee |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Rev. January 2022) |

|

Compensation |

||

|

|

|

|

|

|

|

For calendar year |

|

|

||

|

|

|

|

|

|

|

20 |

|

|

|

|

PAYER’S TIN |

RECIPIENT’S TIN |

|

1 |

Nonemployee compensation |

|

Copy 1 |

|||||

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For State Tax |

|

RECIPIENT’S name |

|

|

2 |

Payer made direct sales totaling $5,000 or more of |

|

||||||

|

|

|

|

consumer products to recipient for resale |

|

Department |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

|

|

|

|

|

|

|

|

Street address (including apt. no.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4 |

Federal income tax withheld |

|

|

|||||

City or town, state or province, country, and ZIP or foreign postal code |

$ |

|

|

|

|

|

|

|

|

||

|

|

|

5 |

State tax withheld |

6 State/Payer’s state no. |

|

7 State income |

||||

|

|

|

$ |

|

|

|

|

|

|

|

$ |

Account number (see instructions) |

|

|

|

|

|

|

|

|

|||

|

|

|

$ |

|

|

|

|

|

|

|

$ |

Form |

|

www.irs.gov/Form1099NEC |

|

Department of the Treasury - Internal Revenue Service |

|||||||

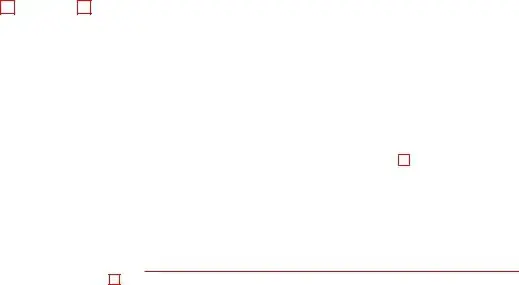

CORRECTED (if checked)

CORRECTED (if checked)

PAYER’S name, street address, city or town, state or province, country, ZIP |

|

|

|

OMB No. |

|

|

|||

or foreign postal code, and telephone no. |

|

|

|

Form |

|

|

|||

|

|

|

|

|

|

Nonemployee |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Rev. January 2022) |

|

Compensation |

||

|

|

|

|

|

For calendar year |

|

|

||

|

|

|

|

|

20 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PAYER’S TIN |

RECIPIENT’S TIN |

1 Nonemployee compensation |

|

|

|

|

Copy B |

||

|

|

$ |

|

|

|

|

|

|

For Recipient |

RECIPIENT’S name |

|

2 Payer made direct sales totaling $5,000 or more of |

|

This is important tax |

|||||

|

|

information and is being |

|||||||

|

|

consumer products to recipient for resale |

|

||||||

|

|

|

furnished to the IRS. If you are |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

3 |

|

|

|

|

|

|

required to file a return, a |

|

|

|

|

|

|

|

|

negligence penalty or other |

|

Street address (including apt. no.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

sanction may be imposed on |

|

|

|

4 Federal income tax withheld |

|

you if this income is taxable |

|||||

|

|

|

and the IRS determines that it |

||||||

City or town, state or province, country, and ZIP or foreign postal code |

$ |

|

|

|

|

|

|

||

|

|

|

|

|

|

has not been reported. |

|||

|

|

5 State tax withheld |

6 State/Payer’s state no. |

|

7 State income |

||||

|

|

$ |

|

|

|

|

|

|

$ |

Account number (see instructions) |

|

|

|

|

|

||||

|

|

$ |

|

|

|

|

|

|

$ |

Form |

(keep for your records) |

www.irs.gov/Form1099NEC |

Department of the Treasury - Internal Revenue Service |

||||||

Instructions for Recipient

You received this form instead of Form

If you believe you are an employee and cannot get the payer to correct this form, report the amount shown in box 1 on the line for “Wages, salaries, tips, etc.” of Form 1040,

If you are not an employee but the amount in box 1 is not self- employment (SE) income (for example, it is income from a sporadic activity or a hobby), report the amount shown in box 1 on the “Other income” line (on Schedule 1 (Form 1040)).

Recipient’s taxpayer identification number (TIN). For your protection, this form may show only the last four digits of your TIN (social security number (SSN), individual taxpayer identification number (ITIN), adoption taxpayer identification number (ATIN), or employer identification number (EIN)). However, the issuer has reported your complete TIN to the IRS.

Account number. May show an account or other unique number the payer assigned to distinguish your account.

Box 1. Shows nonemployee compensation. If the amount in this box is SE income, report it on Schedule C or F (Form 1040) if a sole proprietor, or on Form 1065 and Schedule

Note: If you are receiving payments on which no income, social security, and Medicare taxes are withheld, you should make estimated tax payments. See Form

Box 2. If checked, consumer products totaling $5,000 or more were sold to you for resale, on a

Box 3. Reserved for future use.

Box 4. Shows backup withholding. A payer must backup withhold on certain payments if you did not give your TIN to the payer. See Form

Boxes

Future developments. For the latest information about developments related to Form

Free File Program. Go to www.irs.gov/FreeFile to see if you qualify for

|

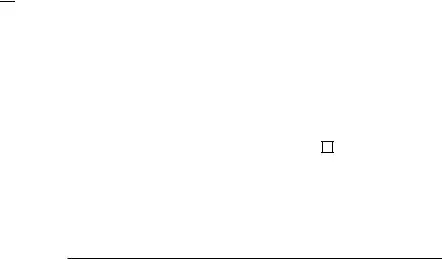

VOID |

CORRECTED |

|

|

|

|

|

|

|||

PAYER’S name, street address, city or town, state or province, country, ZIP |

|

|

|

|

OMB No. |

|

|

||||

or foreign postal code, and telephone no. |

|

|

|

|

|

Form |

|

|

|||

|

|

|

|

|

|

|

|

Nonemployee |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Rev. January 2022) |

|

Compensation |

||

|

|

|

|

|

|

|

For calendar year |

|

|

||

|

|

|

|

|

|

|

20 |

|

|

|

|

PAYER’S TIN |

RECIPIENT’S TIN |

|

1 |

Nonemployee compensation |

|

Copy 2 |

|||||

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

To be filed with |

|

RECIPIENT’S name |

|

|

2 |

Payer made direct sales totaling $5,000 or more of |

|

||||||

|

|

|

|

consumer products to recipient for resale |

|

recipient’s state |

|||||

|

|

|

|

|

|

|

|

|

|

|

income tax |

|

|

|

3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

return, when |

|

Street address (including apt. no.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

required. |

|

|

|

|

4 |

Federal income tax withheld |

|

|

|||||

City or town, state or province, country, and ZIP or foreign postal code |

$ |

|

|

|

|

|

|

|

|

||

|

|

|

5 |

State tax withheld |

6 State/Payer’s state no. |

|

7 State income |

||||

|

|

|

$ |

|

|

|

|

|

|

|

$ |

Account number (see instructions) |

|

|

|

|

|

|

|

|

|||

|

|

|

$ |

|

|

|

|

|

|

|

$ |

Form |

|

www.irs.gov/Form1099NEC |

|

Department of the Treasury - Internal Revenue Service |

|||||||

|

VOID |

|

CORRECTED |

|

|

|

|

|

|

||

PAYER’S name, street address, city or town, state or province, country, ZIP |

|

|

|

OMB No. |

|

|

|||||

or foreign postal code, and telephone no. |

|

|

|

|

|

Form |

|

|

|||

|

|

|

|

|

|

|

|

Nonemployee |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Rev. January 2022) |

|

Compensation |

||

|

|

|

|

|

|

|

For calendar year |

|

|

||

|

|

|

|

|

|

|

20 |

|

|

|

|

PAYER’S TIN |

RECIPIENT’S TIN |

|

|

1 Nonemployee compensation |

|

Copy C |

|||||

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For Payer |

|

RECIPIENT’S name |

|

|

|

2 Payer made direct sales totaling $5,000 or more of |

|

||||||

|

|

|

|

|

|||||||

|

|

|

|

consumer products to recipient for resale |

|

For Privacy Act and |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

|

|

|

|

|

|

Paperwork Reduction |

|

|

|

|

|

|

|

|

|

|

Act Notice, see the |

|

|

|

|

|

|

|

|

|

|

|

|

|

Street address (including apt. no.) |

|

|

|

|

|

|

|

|

|

|

current General |

|

|

|

|

|

|

|

|

|

|

|

Instructions for Certain |

|

|

|

|

4 Federal income tax withheld |

|

||||||

|

|

|

|

|

Information Returns. |

||||||

City or town, state or province, country, and ZIP or foreign postal code |

$ |

|

|

|

|

|

|

|

|||

|

|

|

|

5 State tax withheld |

6 State/Payer’s state no. |

|

7 State income |

||||

|

|

|

|

$ |

|

|

|

|

|

|

$ |

Account number (see instructions) |

|

|

2nd TIN not. |

|

|

|

|

||||

|

|

|

|

$ |

|

|

|

|

|

|

$ |

Form |

|

www.irs.gov/Form1099NEC |

|

Department of the Treasury - Internal Revenue Service |

|||||||

Instructions for Payer

To complete Form

•The current General Instructions for Certain Information Returns, and

•The current Instructions for Forms

To order these instructions and additional forms, go to www.irs.gov/EmployerForms.

Caution: Because paper forms are scanned during processing, you cannot file certain Forms 1096, 1097, 1098, 1099, 3921, or 5498 that you print from the IRS website.

Filing and furnishing. For filing and furnishing instructions, including due dates, and to request filing or furnishing extensions, see the current General Instructions for Certain Information Returns.

Need help? If you have questions about reporting on Form

Key takeaways

Here are some key takeaways about filling out and using the 1099-NEC form:

- Copy A is for IRS use only. Do not print and file Copy A downloaded from the IRS website. It must be a scannable version.

- Official copies can be ordered. To obtain the correct forms, visit the IRS website and order the official printed versions.

- Different copies serve different purposes. While Copy A goes to the IRS, Copies B and others can be printed for recipients.

- File electronically if possible. You can use the IRS FIRE system or the AIR program to file your forms electronically.

- Accurate information is crucial. Ensure that all names, addresses, and taxpayer identification numbers (TINs) are correct to avoid penalties.

- Understand your reporting obligations. If you receive a 1099-NEC, report the income accurately on your tax return to avoid penalties.

Similar forms

- Form 1099-MISC: This form reports various types of income, such as rents, prizes, and awards. Like the 1099-NEC, it is used for non-employee compensation but covers a broader range of income types.

- Form W-2: Employers use this form to report wages paid to employees. While the 1099-NEC is for independent contractors, the W-2 focuses on employee compensation and includes tax withholdings.

- Form 1099-INT: This form reports interest income. Similar to the 1099-NEC, it is used to inform the IRS about income received, but it specifically targets interest payments rather than compensation for services.

- Form 1099-DIV: Used for reporting dividends and distributions, this form shares the same purpose of informing the IRS about income, but it focuses on earnings from investments rather than services rendered.

- Motorcycle Bill of Sale: This form is essential for anyone selling or purchasing a motorcycle in Washington, as it serves to document the transaction details clearly. For a template, visit Forms Washington.

- Form 1099-R: This form is for reporting distributions from retirement accounts. Like the 1099-NEC, it is an information return, but it pertains to retirement income rather than compensation for work.

- Form 1099-S: This form reports proceeds from real estate transactions. Similar to the 1099-NEC, it serves as a way to report income, but it is specific to real estate sales rather than service payments.

- Form 1099-C: This form is used to report canceled debts. While the 1099-NEC covers payments for services, the 1099-C focuses on debt forgiveness and its tax implications.

- Form 1099-G: This form reports certain government payments, such as unemployment compensation. It is similar in that it informs the IRS about income, but it pertains to government benefits rather than compensation for services.

- Form 1099-K: This form is used to report payment card and third-party network transactions. It shares the same goal of reporting income, but it is focused on electronic payments rather than direct compensation for services.