Fill Out a Valid Adp Pay Stub Template

Form Specs

| Fact Name | Description |

|---|---|

| Purpose | The ADP Pay Stub form provides employees with a detailed breakdown of their earnings, deductions, and net pay for each pay period. |

| Components | The form typically includes information such as gross pay, taxes withheld, benefits deductions, and any other withholdings. |

| Frequency of Issuance | Employers are required to provide pay stubs at each pay period, whether it is weekly, bi-weekly, or monthly, depending on company policy. |

| State-Specific Requirements | Some states have specific laws regarding the information that must be included on pay stubs. For example, California requires itemized deductions and hours worked. |

| Access | Employees can often access their pay stubs electronically through an online portal provided by their employer, enhancing convenience and record-keeping. |

| Legal Importance | Pay stubs serve as essential documentation for employees, especially when applying for loans or verifying income for other purposes. |

Dos and Don'ts

When filling out the ADP Pay Stub form, it’s essential to be precise and careful. Here’s a guide on what to do and what to avoid.

- Do double-check your personal information for accuracy, including your name and address.

- Do ensure that your pay period dates are correct to avoid any discrepancies.

- Do review your deductions and contributions to confirm they reflect your expectations.

- Do keep a copy of the completed form for your records.

- Don't leave any sections blank; incomplete forms can lead to processing delays.

- Don't use abbreviations or shorthand that might confuse the payroll department.

- Don't forget to sign and date the form if required; an unsigned form may be considered invalid.

- Don't ignore any instructions provided with the form; they are there for a reason.

Other PDF Documents

What Is an I9 - This verification assists in maintaining industry standards in hiring practices.

Obtaining an Emotional Support Animal Letter is a vital step for those seeking to ensure their mental health needs are met, especially in housing and travel situations where pet fees often apply. To facilitate this process, individuals can refer to resources available at Top Document Templates, which provide guidance on how to fill out the necessary form with the help of a licensed mental health professional.

Warranty on Roof - Transitioning ownership? Don't forget to transfer the warranty!

Printable Odometer Reading Form - The document serves as a legal record of the odometer reading at the time of sale.

Common mistakes

-

Failing to double-check personal information. It is crucial to ensure that your name, address, and Social Security number are correct. Mistakes in these areas can lead to significant issues with your payroll.

-

Not updating changes in employment status. If you have had a change in position, hours, or salary, it’s important to reflect these changes accurately on your pay stub.

-

Ignoring tax withholding selections. Make sure that the correct federal and state tax withholding options are selected. Incorrect selections can result in underpayment or overpayment of taxes.

-

Overlooking deductions. Review all deductions carefully. Mistakes in health insurance, retirement contributions, or other deductions can affect your take-home pay.

-

Neglecting to include overtime or bonus pay. If you are entitled to overtime or bonuses, ensure these amounts are accurately reflected on your pay stub.

-

Misunderstanding the pay period. It is important to know the specific dates that your pay stub covers. Confusion can lead to miscalculating your earnings.

-

Failing to keep a copy of your pay stubs. Always save a copy for your records. This can be helpful for future reference or in case of discrepancies.

-

Not seeking clarification when in doubt. If something on the pay stub is unclear, do not hesitate to ask your HR department or payroll specialist for assistance.

-

Rushing through the process. Take your time when filling out the form. Hasty mistakes can lead to complications that might take time to resolve.

-

Forgetting to sign and date the form. Always remember to sign and date your pay stub to ensure it is valid and processed correctly.

Documents used along the form

The ADP Pay Stub form is an important document for employees, as it provides a detailed breakdown of their earnings, deductions, and net pay. Several other forms and documents often accompany the pay stub to provide additional information regarding employment, taxes, and benefits. Below is a list of these commonly used documents.

- W-2 Form: This form summarizes an employee's annual wages and the taxes withheld. Employers provide it at the end of the year for tax filing purposes.

- Direct Deposit Authorization Form: Employees complete this form to authorize their employer to deposit their pay directly into their bank account, ensuring timely access to funds.

- Pay Rate Change Notice: This document informs employees of any changes to their pay rate. It includes the effective date and details about the new pay structure.

- Tax Withholding Certificate (W-4): Employees use this form to indicate their tax withholding preferences. It helps employers determine the amount of federal income tax to withhold from each paycheck.

- Benefits Enrollment Form: This form allows employees to enroll in company-sponsored benefits, such as health insurance or retirement plans. It includes options and coverage details.

- Time Off Request Form: Employees submit this form to request time off from work. It outlines the dates requested and the reason for the absence.

These documents work together to provide a comprehensive overview of an employee's financial and employment status. Understanding each form can help employees manage their finances and benefits effectively.

Misconceptions

Understanding the ADP pay stub form is essential for employees and employers alike. However, several misconceptions can lead to confusion. Here are ten common misconceptions about the ADP pay stub form:

- All pay stubs look the same. Many people believe that all pay stubs from ADP are identical. In reality, the format can vary based on the employer's preferences and the specific payroll settings.

- ADP pay stubs are only available online. Some think that ADP pay stubs can only be accessed through online portals. While online access is common, paper pay stubs can still be provided by employers.

- The pay stub shows only gross pay. A common misconception is that the pay stub only reflects gross earnings. In fact, it details gross pay, deductions, and net pay, giving a comprehensive view of an employee's earnings.

- All deductions are clearly labeled. Employees often assume that every deduction on their pay stub is labeled. While most are, some deductions may appear as codes or abbreviations, leading to confusion.

- Pay stubs are only for salaried employees. Many believe that only salaried employees receive pay stubs. However, hourly employees also receive them, detailing hours worked and wages earned.

- ADP pay stubs cannot be corrected. Some think that once a pay stub is issued, it cannot be changed. Corrections can be made if errors are identified, and employers can issue corrected pay stubs.

- Pay stubs are not important. Many underestimate the importance of pay stubs. They are crucial for tracking earnings, verifying income for loans, and understanding tax implications.

- All states have the same requirements for pay stubs. There is a belief that all states have uniform laws regarding pay stubs. In reality, requirements can vary significantly from one state to another.

- ADP pay stubs do not include year-to-date information. Some people think that pay stubs only reflect the current pay period. Most ADP pay stubs include year-to-date earnings and deductions, providing a broader financial picture.

- Employees cannot access their pay stubs after leaving a job. A misconception is that once an employee leaves a job, they lose access to their pay stubs. Former employees can often still access their pay stubs through ADP's online portal, depending on company policies.

Clarifying these misconceptions can help employees better understand their pay stubs and manage their finances effectively.

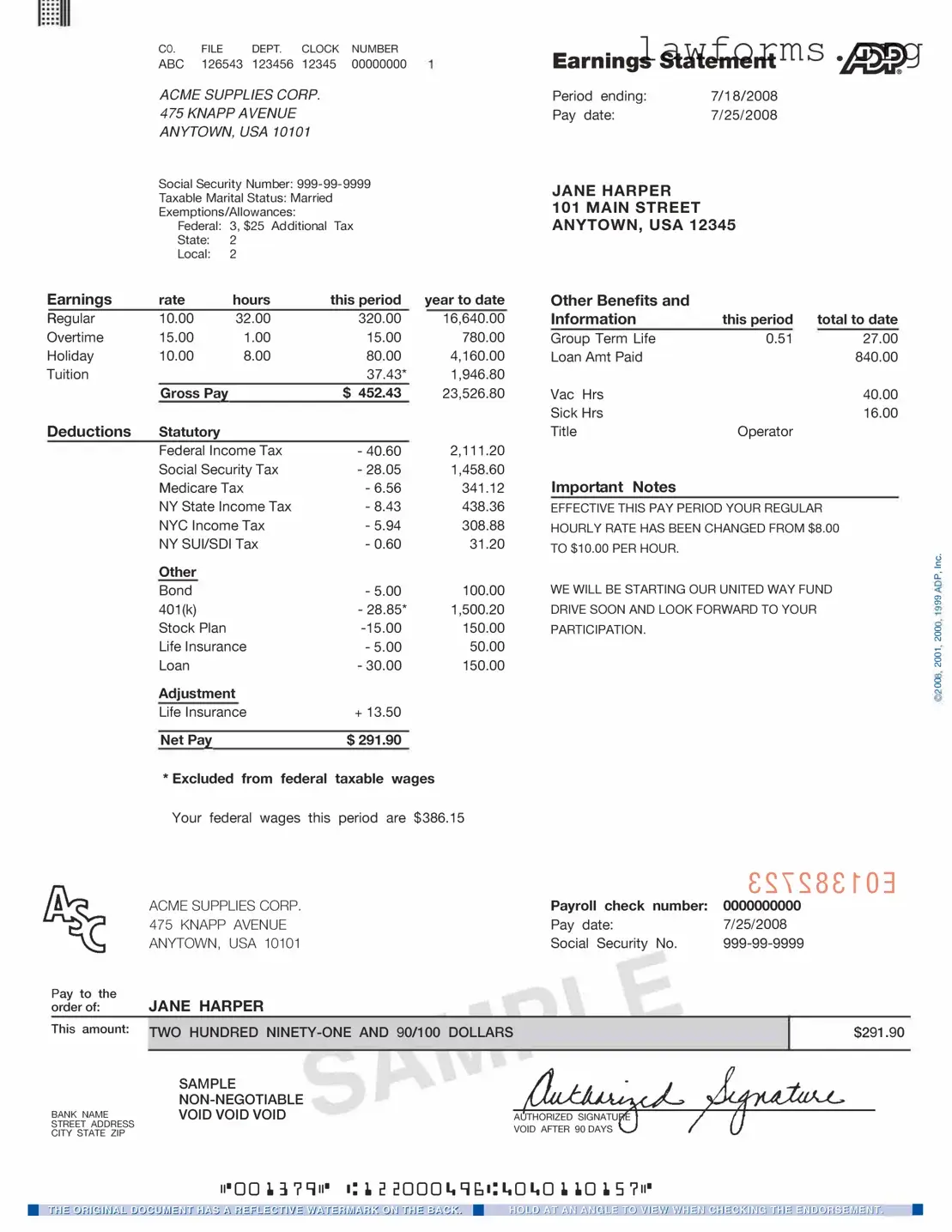

Preview - Adp Pay Stub Form

|

CO. |

FILE |

DEPT. |

CLOCK |

NUMBER |

|

|

ABC |

126543 123456 |

12345 |

00000000 |

|

|

|

ACME SUPPLIES CORP. |

|

|

|||

|

475 KNAPP AVENUE |

|

|

|

||

|

ANYTOWN, USA 10101 |

|

|

|||

|

Social Security Number: |

|

||||

|

Taxable Marital Status: Married |

|

|

|||

|

Exemptions/Allowances: |

|

|

|

||

|

Federal: 3, $25 Additional Tax |

|

||||

|

State: |

2 |

|

|

|

|

|

Local: |

2 |

|

|

|

|

Earnings |

rate |

|

hours |

this period |

year to date |

|

Regular |

10.00 |

|

32.00 |

|

320.00 |

16,640.00 |

Overtime |

15.00 |

|

1.00 |

|

15.00 |

780.00 |

Holiday |

10.00 |

|

8.00 |

|

80.00 |

4,160.00 |

Tuition |

|

|

|

|

37.43* |

1,946.80 |

|

Gross Pa� |

|

|

$ 452.43 |

23,526.80 |

|

Deductions |

Statutory |

|

|

|

2,111.20 |

|

|

Federal Income Tax |

|

- 40.60 |

|||

|

Social Security Tax |

|

- 28.05 |

1,458.60 |

||

|

Medicare Tax |

|

- 6.56 |

341.12 |

||

|

NY State Income Tax |

|

- 8.43 |

438.36 |

||

|

NYC Income Tax |

|

- 5.94 |

308.88 |

||

|

NY SUI/SDI Tax |

|

- 0.60 |

31.20 |

||

|

Other |

|

|

|

|

|

|

Bond |

|

|

|

- 5.00 |

100.00 |

|

401(k) |

|

|

|

- 28.85* |

1,500.20 |

|

Stock Plan |

|

|

150.00 |

||

|

Life Insurance |

|

- 5.00 |

50.00 |

||

|

Loan |

|

|

|

- 30.00 |

150.00 |

|

Adjustment |

|

|

|

||

|

Life Insurance |

|

+ 13.50 |

|

||

|

Net Pa� |

|

|

$291.90 |

|

|

*Excluded from federal taxable wages Your federal wages this period are $386.15

ACME SUPPLIES CORP. 475 KNAPP AVENUE ANYTOWN, USA 10101

Pay to the

order of: JANE HARPER

This amount: TWO HUNDRED

SAMPLE

BANK NAMEVOID VOID VOID

STREET ADDRESS

CITY STATE ZIP

Earnings Statement

Period ending: |

7/18/2008 |

Pay date: |

7/25/2008 |

JANE HARPER

101MAIN STREET

ANYTOWN, USA 12345

Other Benefits and

Information |

this period |

total to date |

|

|

Group Term Life |

0.51 |

27.00 |

|

|

Loan Amt Paid |

|

840.00 |

|

|

Vac Hrs |

|

40.00 |

|

|

Sick Hrs |

|

16.00 |

|

|

Title |

Operator |

|

|

|

Important Notes |

|

|

|

|

EFFECTIVE THIS PAY PERIOD YOUR REGULAR |

|

|||

HOURLY RATE HAS BEEN CHANGED FROM $8.00 |

|

|||

TO $10.00 PER HOUR. |

|

|

0 |

|

|

|

|

||

|

|

|

.!: |

|

WE WILL BE STARTING OUR UNITED WAY FUND |

0: |

|||

"' |

||||

DRIVE SOON AND LOOK FORWARD TO YOUR |

|

|||

|

|

|||

PARTICIPATION. |

|

|

0 |

|

|

|

|

0 |

|

C\J

0

0

C\J

0

0

|

£�,�8£�03 |

Payroll check number: |

0000000000 |

Pay date: |

7/25/2008 |

Social Security No. |

$291.90

Key takeaways

Understanding the ADP Pay Stub form is essential for both employees and employers. Here are some key takeaways to consider when filling out and using this form:

- Accuracy is Crucial: Ensure that all personal information, including your name, address, and Social Security number, is filled out correctly. Mistakes can lead to issues with tax reporting and benefits.

- Review Your Earnings: Pay attention to the earnings section. It should reflect your gross pay, deductions, and net pay. Regularly reviewing this information helps in tracking your income and understanding your financial situation.

- Understand Deductions: Familiarize yourself with the various deductions listed on the pay stub. This includes taxes, health insurance, and retirement contributions. Knowing what is deducted can assist in financial planning.

- Keep Records: Maintain copies of your pay stubs for your records. They are important for tax purposes and can also be useful when applying for loans or other financial services.

Similar forms

-

W-2 Form: This document summarizes an employee's annual earnings and the taxes withheld. Like the ADP Pay Stub, it provides essential information for tax filing and reflects the employee's income over the year.

-

Paycheck: A paycheck is a physical or electronic document that represents payment for work performed. Similar to the ADP Pay Stub, it details the amount earned, deductions, and net pay, allowing employees to understand their compensation.

-

Direct Deposit Receipt: This receipt confirms the deposit of an employee's paycheck directly into their bank account. It shares similarities with the ADP Pay Stub by providing information on the gross pay, deductions, and net amount deposited.

-

Payroll Summary Report: This report offers a broader overview of an employee's earnings and deductions over a specific period. Like the ADP Pay Stub, it helps employees track their financial information and understand their pay structure.