Valid Articles of Incorporation Form

State-specific Articles of Incorporation Documents

Form Specifications

| Fact Name | Description |

|---|---|

| Definition | The Articles of Incorporation is a legal document that establishes a corporation in the eyes of the state. |

| Purpose | This document outlines the corporation's basic information, including its name, purpose, and structure. |

| State-Specific Requirements | Each state has its own requirements for the Articles of Incorporation, including specific information that must be included. |

| Governing Law | In the United States, the governing law for Articles of Incorporation varies by state, typically found in the state’s corporation code. |

| Filing Process | To create a corporation, the Articles of Incorporation must be filed with the appropriate state agency, often the Secretary of State. |

| Fees | Filing fees for the Articles of Incorporation vary by state and can range from a few hundred to several hundred dollars. |

| Public Record | Once filed, the Articles of Incorporation become a public record, accessible to anyone who wishes to view them. |

| Amendments | Corporations can amend their Articles of Incorporation to change their name, purpose, or other details, following state procedures. |

Dos and Don'ts

When filling out the Articles of Incorporation form, it's essential to follow some best practices to ensure a smooth process. Here’s a list of things you should and shouldn't do:

- Do provide accurate and complete information. Double-check all details before submission.

- Do include the name of your corporation as it will appear on official documents.

- Do specify the purpose of your corporation clearly and concisely.

- Do include the names and addresses of the initial directors.

- Don't use a name that is too similar to an existing corporation in your state.

- Don't forget to sign and date the form. An unsigned form may be rejected.

- Don't leave any required fields blank. This could delay the processing of your application.

Popular Templates:

Acord Insurance Forms - Employers can enhance their insurance offerings by accurately completing the form.

A prenuptial agreement form in Ohio is a legal document that couples complete before marriage to outline the division of assets and responsibilities in the event of divorce or separation. This agreement helps protect individual interests and provides clarity on financial matters. Additionally, resources such as Ohio PDF Forms can be valuable for those looking to complete their prenuptial agreement efficiently. Understanding the importance of this form can lead to a more secure and transparent relationship.

Permission to Use Artwork Form - Sign this form to let your artwork be included in events and festivals.

Common mistakes

-

Incorrect Business Name: Many individuals choose a name that is either too similar to an existing business or does not comply with state naming rules. It’s crucial to check the availability of the business name and ensure it includes required identifiers like "Incorporated" or "Inc."

-

Missing Registered Agent Information: A registered agent is necessary for receiving legal documents. Failing to provide accurate details about the registered agent can lead to complications. Ensure the agent’s name and address are correct and up to date.

-

Improper Purpose Statement: Some applicants fail to clearly define the purpose of their business. A vague or overly broad statement can lead to questions from state officials. Be specific about what your business will do.

-

Neglecting to Include Initial Directors: The form often requires the names and addresses of initial directors. Omitting this information can delay the incorporation process. Ensure that this section is filled out completely and accurately.

-

Incorrect Filing Fees: Each state has specific filing fees that must be paid when submitting the Articles of Incorporation. Failing to include the correct payment can result in rejection of the application. Always check the fee schedule before submitting.

-

Not Reviewing for Errors: Simple typos or mistakes can lead to significant delays. After completing the form, take the time to review it carefully. Consider having someone else look over it as well to catch any errors you might have missed.

Documents used along the form

When forming a corporation, the Articles of Incorporation is a key document that establishes the existence of the corporation. However, there are several other forms and documents that are often needed to complete the incorporation process and ensure compliance with legal requirements. Below is a list of these important documents.

- Bylaws: This document outlines the internal rules and procedures for the corporation's operation. Bylaws typically cover aspects such as how meetings are conducted, the roles of officers, and how decisions are made.

- RV Bill of Sale: Essential for buyers in Georgia, this document records the sale of a Recreational Vehicle and is necessary for registering the vehicle in the buyer's name. More details can be found at georgiaform.com/.

- Initial Board of Directors Resolution: This resolution appoints the initial board members and outlines their responsibilities. It is an important step in establishing governance for the corporation.

- Registered Agent Consent Form: A registered agent is required to receive legal documents on behalf of the corporation. This form confirms that the agent has agreed to take on this role.

- Employer Identification Number (EIN) Application: An EIN is necessary for tax purposes. This application, often submitted to the IRS, allows the corporation to hire employees and open a business bank account.

- State Business License: Depending on the state and type of business, a specific license may be required to operate legally. This document varies by location and industry.

- Operating Agreement: Although typically used for LLCs, corporations may also have an operating agreement that outlines the management structure and operational procedures, particularly for multi-member corporations.

- Stock Certificates: If the corporation issues stock, stock certificates serve as proof of ownership. They are important for both shareholders and the corporation's records.

- Annual Report: Many states require corporations to file an annual report to maintain good standing. This document provides updated information about the corporation's activities and structure.

Understanding these documents is essential for anyone looking to incorporate a business. Each plays a vital role in ensuring the corporation is set up correctly and operates within the legal framework. Proper preparation and filing can help avoid complications down the road.

Misconceptions

Many people have misconceptions about the Articles of Incorporation form. Understanding the truth can help you navigate the process more effectively. Here are six common misconceptions:

-

It's only for large businesses.

Many believe that only big corporations need to file Articles of Incorporation. In reality, any business entity, regardless of size, can benefit from formal incorporation.

-

Filing is the same as starting a business.

While filing Articles of Incorporation is an important step, it does not automatically mean your business is operational. You still need to take care of other requirements, like obtaining licenses and permits.

-

Articles of Incorporation are the same in every state.

Each state has its own specific requirements and formats for Articles of Incorporation. It’s crucial to check the regulations in your state to ensure compliance.

-

Once filed, they can never be changed.

This is not true. You can amend your Articles of Incorporation if needed. Changes might be necessary as your business grows or evolves.

-

Incorporation protects personal assets automatically.

While incorporation does provide a level of protection, it’s not foolproof. Proper business practices and compliance with laws are essential to maintain that protection.

-

It's a complicated process.

Many think the process of filing Articles of Incorporation is overly complex. With the right resources and guidance, it can be straightforward and manageable.

Addressing these misconceptions can help you make informed decisions about incorporating your business.

Preview - Articles of Incorporation Form

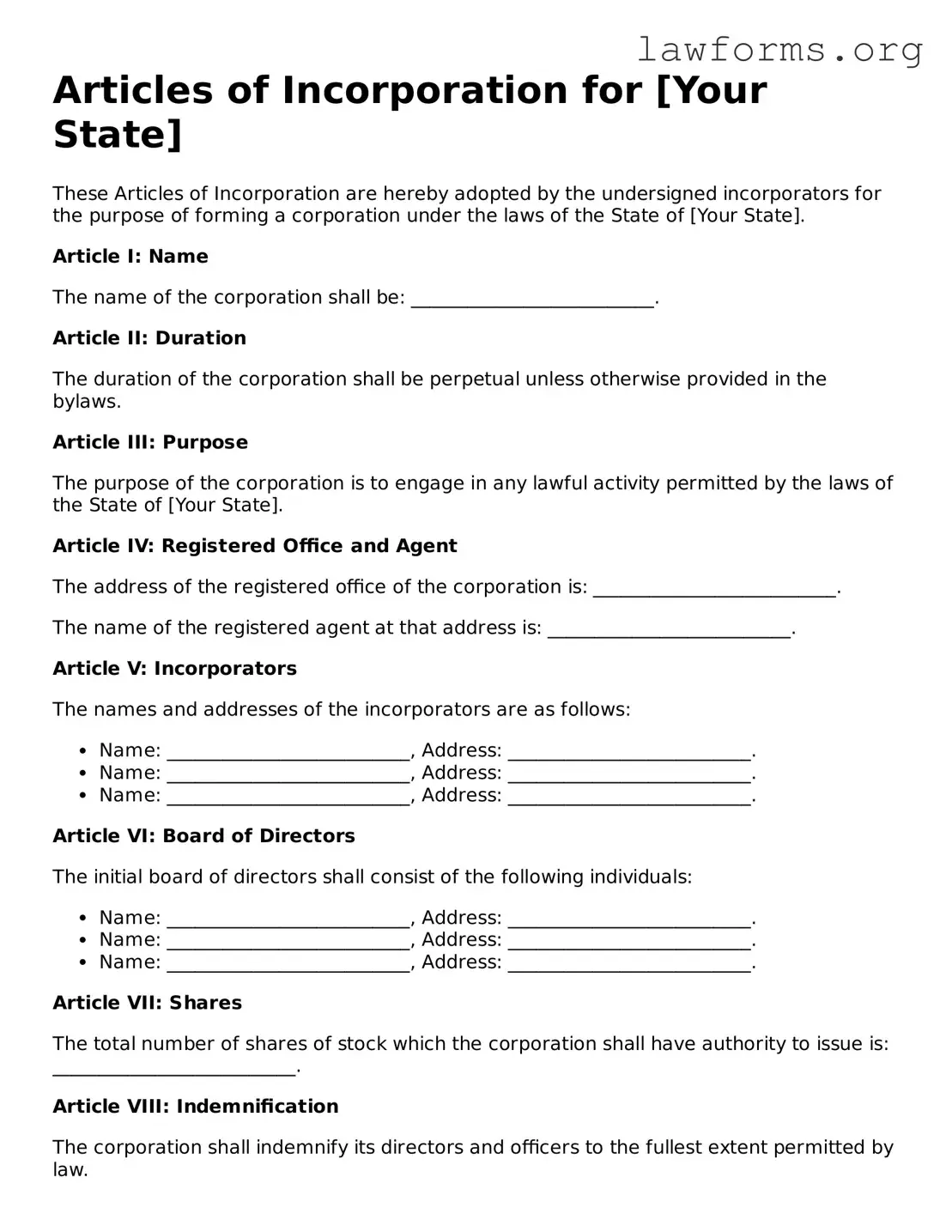

Articles of Incorporation for [Your State]

These Articles of Incorporation are hereby adopted by the undersigned incorporators for the purpose of forming a corporation under the laws of the State of [Your State].

Article I: Name

The name of the corporation shall be: __________________________.

Article II: Duration

The duration of the corporation shall be perpetual unless otherwise provided in the bylaws.

Article III: Purpose

The purpose of the corporation is to engage in any lawful activity permitted by the laws of the State of [Your State].

Article IV: Registered Office and Agent

The address of the registered office of the corporation is: __________________________.

The name of the registered agent at that address is: __________________________.

Article V: Incorporators

The names and addresses of the incorporators are as follows:

- Name: __________________________, Address: __________________________.

- Name: __________________________, Address: __________________________.

- Name: __________________________, Address: __________________________.

Article VI: Board of Directors

The initial board of directors shall consist of the following individuals:

- Name: __________________________, Address: __________________________.

- Name: __________________________, Address: __________________________.

- Name: __________________________, Address: __________________________.

Article VII: Shares

The total number of shares of stock which the corporation shall have authority to issue is: __________________________.

Article VIII: Indemnification

The corporation shall indemnify its directors and officers to the fullest extent permitted by law.

Declaration

The undersigned incorporator(s) hereby declare that the facts stated herein are true and that the incorporator(s) have executed these Articles of Incorporation for the purposes herein stated.

Executed this ___ day of ____________, 20__ by:

__________________________

Signature of Incorporator

__________________________

Printed Name

Key takeaways

Filling out and using the Articles of Incorporation form is a critical step in establishing a corporation. Here are some key takeaways to keep in mind:

- The Articles of Incorporation is a legal document that officially creates your corporation.

- Ensure that you provide the corporation's name, which must be unique and not already in use by another entity in your state.

- Include the purpose of your corporation. This can be a general statement or a specific description of your business activities.

- Designate a registered agent. This person or business will receive legal documents on behalf of the corporation.

- Specify the number of shares the corporation is authorized to issue, as well as the par value of those shares if applicable.

- Provide the names and addresses of the initial directors. This information is crucial for the governance of the corporation.

- Be aware of the filing fees associated with submitting the Articles of Incorporation. These can vary by state.

- After filing, keep a copy of the Articles of Incorporation for your records. This document is essential for future business activities.

Similar forms

The Articles of Incorporation form is a crucial document for establishing a corporation. It shares similarities with several other important documents. Here are six documents that are similar to the Articles of Incorporation:

- Bylaws: These outline the internal rules and regulations of the corporation. Like the Articles of Incorporation, they are essential for governance and operational structure.

- Operating Agreement: Commonly used by LLCs, this document details the management structure and operational procedures. It serves a similar purpose to the Articles of Incorporation by defining the entity's framework.

- Certificate of Formation: This document is often required for LLCs and serves as a foundational document similar to the Articles of Incorporation. It establishes the entity's legal existence.

- Partnership Agreement: This document outlines the roles, responsibilities, and profit-sharing among partners. It is akin to the Articles of Incorporation in that it formalizes the relationship between parties involved in a business.

- California DV-260 Form: This form is essential for individuals seeking protection in domestic violence cases. It ensures that sensitive information is kept confidential while allowing law enforcement and the courts to manage restraining orders effectively. For more information, visit californiadocsonline.com/california-dv-260-form.

- Business License: This is required for legal operation of a business. While it does not establish the entity, it is similar in that it is a necessary document for compliance and legitimacy.

- Tax Identification Number (TIN) Application: This application is essential for tax purposes. Like the Articles of Incorporation, it is a necessary step in the process of establishing a business entity.