Fill Out a Valid Authorization And Direction Pay Template

Form Specs

| Fact Name | Details |

|---|---|

| Purpose | The Authorization and Direction Pay form allows a policyholder to direct an insurance company to pay a repair facility directly for services rendered. |

| Claim Information | This form collects essential information, including the owner's name, license plate, address, and claim number. |

| Authorization | The form requires the policyholder's authorization for the insurance company to pay the specified repair facility. |

| Notification Requirement | If the insurance company mistakenly sends the payment to the policyholder, they must notify the repair facility and deliver the check within 24 hours. |

| Body Shop Details | Information about the body shop, including its name, tax ID, address, and contact information, is also required. |

| Signature Requirement | The form must be signed by the customer to validate the authorization and direction to pay. |

| State-Specific Forms | Different states may have specific requirements or variations of this form, so it's important to check local laws. |

| Governing Laws | In many states, laws governing insurance payments and repair shop authorizations apply. Examples include the California Insurance Code and Texas Insurance Code. |

| Record Keeping | Both the policyholder and the repair facility should keep a copy of the completed form for their records. |

Dos and Don'ts

When filling out the Authorization And Direction Pay form, it is essential to follow certain guidelines to ensure accuracy and compliance. Below is a list of what you should and shouldn't do:

- Do provide complete and accurate information in all fields.

- Do double-check your claim number for correctness.

- Do ensure that the insurance company name is spelled correctly.

- Do sign and date the form to validate your authorization.

- Don't leave any sections blank; fill in all required fields.

- Don't forget to include your contact information for any follow-up.

- Don't misrepresent the amount you are authorizing for payment.

- Don't ignore the instructions regarding the delivery of checks in case of an error.

Other PDF Documents

Geico Supplement - Include any relevant information that may support the request.

How to Balance a Cash Drawer - Provides a clear snapshot of cash on hand.

A Quitclaim Deed is a legal document used in Ohio to transfer ownership of property from one party to another without guaranteeing the title's validity. This form is often used among family members or in situations where the parties know each other well. Understanding how to properly fill out and file this form is crucial for a smooth transfer of property rights, and resources like Ohio PDF Forms can provide valuable assistance in this process.

How to Create a Column Graph in Excel - Highlighting Uncertainties: Documenting areas that require further investigation.

Common mistakes

-

Incomplete Personal Information: Failing to provide all necessary personal details, such as name, address, and phone number, can lead to delays in processing the claim.

-

Incorrect License Plate Number: Entering an incorrect license plate number can cause confusion and may result in the denial of the claim.

-

Missing Insurance Information: Omitting the name of the insurance company or the claim number makes it difficult for the insurance provider to identify the claim.

-

Failure to Specify Payment Amount: Not stating the exact amount to be paid can lead to misunderstandings and may delay payment to the repair facility.

-

Not Signing the Form: Forgetting to sign the form is a common mistake that can render the authorization invalid, preventing the insurance company from processing the payment.

-

Ignoring the Notification Requirement: Failing to acknowledge the obligation to notify the repair facility about receiving a check can lead to complications in the payment process.

-

Providing Incorrect Body Shop Information: Listing inaccurate details about the body shop, such as the tax ID or contact information, can hinder the payment process and cause further delays.

Documents used along the form

The Authorization And Direction Pay form is an essential document in the claims process, particularly when dealing with insurance payouts for vehicle repairs. However, it is often accompanied by several other forms and documents that help streamline the process and ensure all parties are on the same page. Below is a list of commonly used forms that complement the Authorization And Direction Pay form.

- Claim Form: This document initiates the claims process. It provides essential details about the incident, the insured party, and the damages incurred. Submitting a claim form is typically the first step in seeking compensation from an insurance company.

- Estimate of Repairs: This document outlines the anticipated costs for repairing the vehicle. It is usually prepared by the repair facility and includes a breakdown of labor and parts. Insurance companies often require this estimate to assess the validity of the claim.

- Proof of Loss: This form is a statement that the insured submits to the insurance company detailing the extent of the loss or damage. It typically includes information about the incident and can serve as a formal notification of the claim.

- Release of Liability: This document is signed to release the insurance company from any further obligations once the claim is settled. It ensures that the claimant cannot pursue additional claims related to the same incident after receiving payment.

- Articles of Incorporation Form: This essential document establishes a corporation in the state of Washington, providing legal structure and protection for owners. For a template, you can refer to Forms Washington.

- Repair Authorization: This form grants the repair facility permission to proceed with the necessary repairs. It confirms that the vehicle owner agrees to the repairs and acknowledges the associated costs, which may be covered by insurance.

- Payment Authorization Form: This document allows the insurance company to make payments directly to the repair facility. It is crucial for ensuring that funds are allocated correctly and helps expedite the payment process.

Understanding these forms and their purposes can significantly enhance your experience during the claims process. By ensuring that all necessary documents are in order, you can help facilitate a smoother transaction between yourself, the insurance company, and the repair facility.

Misconceptions

Understanding the Authorization And Direction Pay form is crucial for anyone navigating insurance claims and repairs. However, several misconceptions can lead to confusion. Here are nine common myths and the truths behind them:

- It’s only for auto repairs. Many believe this form is exclusive to vehicle repairs. In reality, it can be used for various types of insurance claims, including property damage.

- Only the policyholder can fill it out. While the policyholder typically completes the form, authorized representatives, such as repair shops, can also assist in the process.

- It guarantees payment from the insurance company. The form directs payment but does not guarantee that the insurance company will approve the claim or the specified amount.

- You can ignore the 24-hour notification rule. Failing to notify the repair facility within 24 hours of receiving a check can lead to complications, including potential legal issues.

- It’s a one-time use form. Some think this form can only be used once. However, it can be utilized for multiple claims as needed, as long as each instance is properly documented.

- There’s no need for a signature. A signature is essential. It confirms that you authorize the payment and understand the terms outlined in the form.

- The body shop doesn’t need to be involved. The body shop plays a critical role in this process. They must be informed and involved to ensure smooth payment and repair processes.

- It’s a complicated form. Many people fear the form is complex. In truth, it is straightforward, requiring basic information and clear instructions.

- Submitting the form is the last step. Submitting the form is just one step in the claims process. Follow-up communication with the insurance company and repair facility is often necessary.

By dispelling these misconceptions, you can navigate the claims process more effectively. Ensure you have the right information and support to make informed decisions.

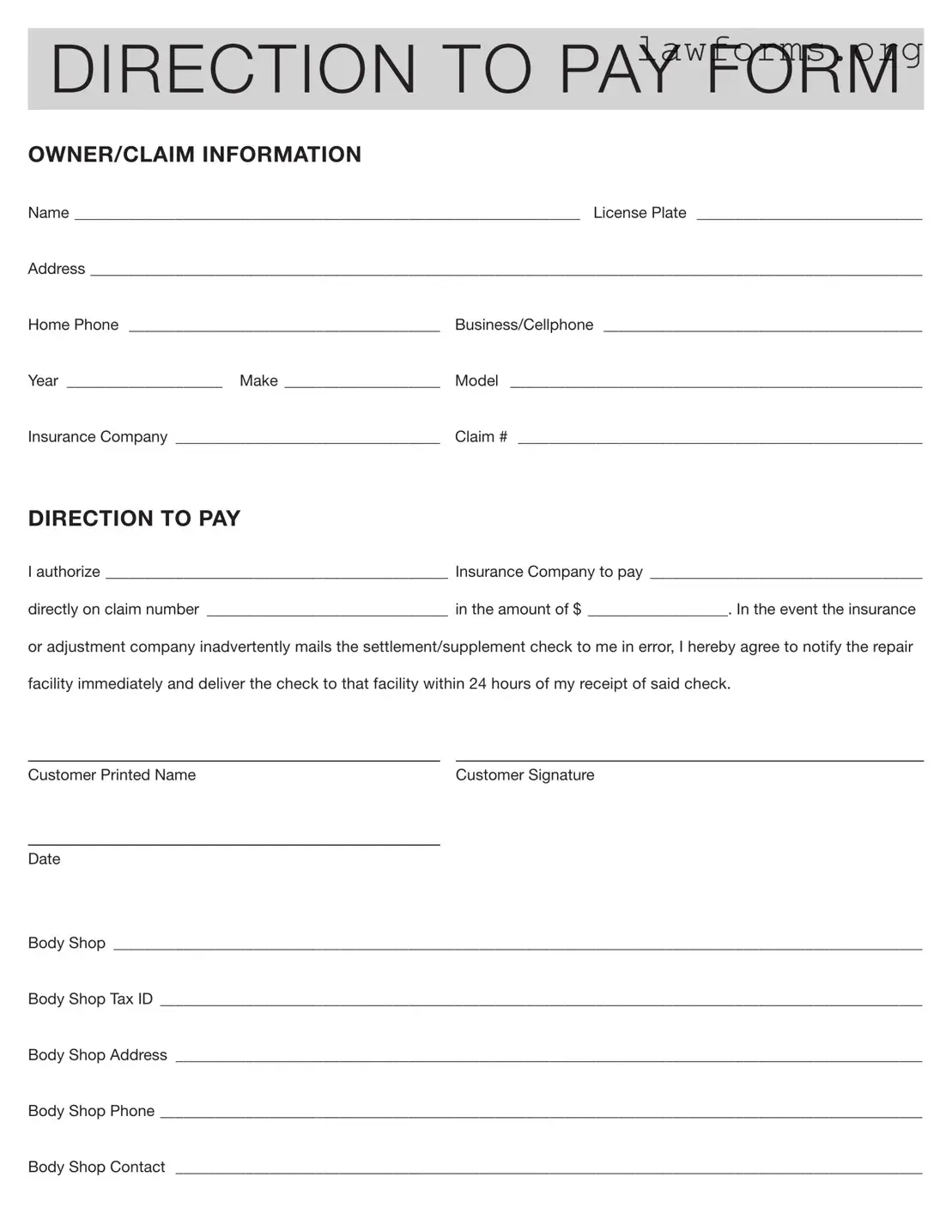

Preview - Authorization And Direction Pay Form

DIRECTION TO PAY FORM

OWNER/CLAIM INFORMATION

Name _________________________________________________________________ License Plate ______________________________

Address ___________________________________________________________________________________________________________

Home Phone _________________________________________ |

Business/Cellphone __________________________________________ |

Year _____________________ Make _____________________ |

Model _ _____________________________________________________ |

Insurance Company ___________________________________ |

Claim # _____________________________________________________ |

DIRECTION TO PAY

I authorize ____________________________________________ Insurance Company to pay ____________________________________

directly on claim number ________________________________ in the amount of $___________________. In the event the insurance

or adjustment company inadvertently mails the settlement/supplement check to me in error, I hereby agree to notify the repair facility immediately and deliver the check to that facility within 24 hours of my receipt of said check.

Customer Printed Name |

Customer Signature |

Date

Body Shop _________________________________________________________________________________________________________

Body Shop Tax ID ___________________________________________________________________________________________________

Body Shop Address _________________________________________________________________________________________________

Body Shop Phone __________________________________________________________________________________________________

Body Shop Contact _________________________________________________________________________________________________

Key takeaways

When filling out the Authorization And Direction Pay form, there are several important points to keep in mind. Understanding these can help ensure a smooth process for receiving payment for your claim.

- Accurate Information: Fill in your name, address, and contact details accurately. This ensures that the insurance company can reach you if needed.

- Vehicle Details: Provide complete information about your vehicle, including the year, make, model, and license plate number. This helps in identifying your claim easily.

- Insurance Information: Clearly state the name of your insurance company and your claim number. This is crucial for processing your request without delays.

- Payment Authorization: Specify the amount you are authorizing the insurance company to pay directly. Double-check this figure to avoid mistakes.

- Notification Requirement: If you receive a settlement check by mistake, notify the repair facility within 24 hours. This helps maintain trust and accountability.

- Signature and Date: Ensure you sign and date the form. This confirms your authorization and is a necessary step for processing.

- Body Shop Information: Include the body shop's name, address, and contact information. This is where the payment will be directed.

- Tax ID Requirement: Provide the body shop’s tax ID number. This is often needed for tax reporting purposes by the insurance company.

- Review Before Submission: Before sending the form, review all entries for accuracy. Small errors can lead to significant delays in processing your claim.

By following these key takeaways, you can facilitate a more efficient claims process and ensure that payments are directed appropriately.

Similar forms

The Authorization and Direction Pay form is a vital document used in insurance claims, particularly when directing payments to repair facilities. Several other documents serve similar purposes in various contexts. Here’s a list of ten documents that share similarities with the Authorization and Direction Pay form:

- Power of Attorney (POA): This document allows one person to act on behalf of another in legal matters. Like the Authorization and Direction Pay form, it involves granting authority to manage financial transactions, including payments.

- Assignment of Benefits (AOB): Common in insurance claims, this form lets a policyholder assign their benefits directly to a service provider. It parallels the direction to pay aspect by allowing the service provider to receive payment directly from the insurer.

- Release of Liability Form: This document releases one party from liability, often used in settlement agreements. It can be similar in that it may involve directing funds to settle a claim, ensuring that payments are handled appropriately.

- Claim Authorization Form: This form is used to authorize an insurance company to process a claim on behalf of a policyholder. It shares the same goal of facilitating payment to the correct party.

- Direct Deposit Authorization Form: This document allows individuals to authorize direct deposit of payments, similar to how the Authorization and Direction Pay form directs payments to a repair facility.

- Payment Authorization Form: This form is used to authorize recurring or one-time payments to a service provider. It functions similarly by ensuring that payments are directed to the intended recipient.

- Vendor Payment Authorization Form: This document is used by businesses to authorize payments to vendors. Like the Authorization and Direction Pay form, it ensures that payments are made directly to the service provider.

-

California Form REG 262: The California Form REG 262 is a Vehicle/Vessel Transfer and Reassignment Form required for the transfer of ownership of a vehicle or vessel in California. This form is essential as it must accompany the title or application for a duplicate title and is not the ownership certificate itself. Proper completion of this form ensures compliance with state laws and protects the rights of both buyers and sellers during the transaction. For more information, visit californiadocsonline.com/california-fotm-reg-262-form/.

- Settlement Agreement: This document outlines the terms of a settlement between parties. It often includes directions on how payments will be made, similar to how the Authorization and Direction Pay form specifies payment details.

- Insurance Claim Form: This is the initial form submitted to an insurance company to initiate a claim. It is related in that it starts the process that may ultimately involve directing payments to service providers.

- Third-Party Payment Authorization Form: This document allows a third party to receive payments on behalf of another. It mirrors the Authorization and Direction Pay form by facilitating direct payments to a designated party.