Fill Out a Valid Auto Insurance Card Template

Form Specs

| Fact Name | Description |

|---|---|

| Purpose | The Auto Insurance Card serves as proof of insurance coverage for the vehicle listed. It must be kept in the vehicle at all times. |

| State Requirements | Each state has specific laws governing the issuance and use of auto insurance cards. For example, in California, the law requires that drivers present their insurance card upon request by law enforcement. |

| Information Included | The card includes essential details such as the company name, policy number, effective and expiration dates, vehicle identification number, and the agency issuing the card. |

| Accident Protocol | In the event of an accident, the card advises the insured to report the incident to their insurance agent promptly and gather necessary information from all parties involved. |

Dos and Don'ts

When filling out the Auto Insurance Card form, it’s essential to ensure that all information is accurate and complete. Here are some important dos and don’ts to keep in mind:

- Do double-check all information before submitting the form.

- Do ensure that the insurance identification card is kept in the insured vehicle at all times.

- Do report any accidents to your insurance agent or company as soon as possible.

- Do include the year, make, and model of your vehicle accurately.

- Do provide the correct vehicle identification number (VIN).

- Don't leave any sections of the form blank.

- Don't forget to include the effective and expiration dates of the policy.

- Don't ignore the important notice on the reverse side of the card.

- Don't present the card if it is outdated or if the policy has lapsed.

By following these guidelines, you can ensure that your Auto Insurance Card is filled out correctly and serves its purpose effectively.

Other PDF Documents

What Is a 1098 Form - Recent account history provides a snapshot of your payment status over the previous months.

Doctors Note Template - A documentation tool for tracking medical visits and their outcomes.

The California Homeschool Letter of Intent form is a crucial document that parents must submit to officially declare their intention to homeschool their children. To learn more about this important step in ensuring compliance with state laws regarding homeschooling, parents can visit https://californiadocsonline.com/homeschool-letter-of-intent-form, where they can find valuable resources and guidance to help navigate the homeschooling process smoothly.

Printable:5s6uydlipco= Living Will Template - Choosing a healthcare agent through Five Wishes allows someone to advocate for you in tough situations.

Common mistakes

-

Omitting Important Information: One common mistake is failing to fill in all required fields. This includes the insurance company name, policy number, and vehicle identification number (VIN). Each piece of information is crucial for proper identification and coverage verification.

-

Incorrect Dates: People often make errors when entering the effective and expiration dates of their policy. Double-checking these dates ensures that the insurance is valid and active when needed.

-

Misidentifying the Vehicle: Another frequent error is listing the wrong make or model of the vehicle. This can lead to issues with claims if the vehicle does not match the information on file with the insurance company.

-

Neglecting to Review the Card: Some individuals forget to review their insurance card before submitting it. This simple step can help catch any mistakes or discrepancies that could cause problems later on.

-

Failing to Keep the Card in the Vehicle: Lastly, a critical mistake is not keeping the insurance card in the vehicle. This card must be readily available for presentation during an accident or traffic stop, and failing to do so can lead to fines or complications.

Documents used along the form

When managing auto insurance, several documents often accompany the Auto Insurance Card. Each of these forms serves a specific purpose and is important for ensuring compliance and protection. Below is a list of commonly used documents.

- Insurance Policy Document: This document outlines the terms of your insurance coverage, including what is covered, the limits of coverage, and any exclusions. It is essential to understand your rights and responsibilities.

- Claim Form: If you need to file a claim after an accident, this form is necessary. It collects details about the incident and the damages, allowing the insurance company to process your claim.

- Proof of Insurance Certificate: This document serves as evidence that you have active insurance coverage. It may be required for vehicle registration or when requested by law enforcement.

- Quitclaim Deed Form: This form is essential for transferring ownership of real property without warranties about the title's quality. For those interested in this process, the form can be accessed at formsillinois.com/.

- Vehicle Registration: This is the official document that proves your vehicle is registered with the state. It includes details such as the vehicle's identification number (VIN) and owner information.

- Accident Report Form: In the event of an accident, this form helps document the details of the incident. It is often required by insurance companies and may be submitted to law enforcement.

- Endorsement Forms: These forms are used to make changes to your existing policy, such as adding a new driver or changing coverage limits. They ensure that your policy reflects your current needs.

- Renewal Notice: This document notifies you when your policy is up for renewal. It includes important information about your coverage options and any changes in premium costs.

Each of these documents plays a vital role in managing your auto insurance effectively. Keeping them organized and accessible will help you navigate any situation that may arise.

Misconceptions

Understanding auto insurance cards is crucial for drivers. However, several misconceptions can lead to confusion. Below are six common misconceptions about the Auto Insurance Card form, along with clarifications.

- Misconception 1: The card is not necessary if I have digital insurance.

- Misconception 2: The expiration date is just a suggestion.

- Misconception 3: The card only needs to be shown after an accident.

- Misconception 4: All information on the card is optional.

- Misconception 5: The watermark is just for decoration.

- Misconception 6: I can use someone else's insurance card.

Many people believe that having digital proof of insurance eliminates the need for a physical card. In most states, however, drivers are required to carry a physical card in their vehicles.

Some assume that the expiration date on the card is not critical. In reality, driving with an expired insurance card can lead to penalties and fines.

It is a common belief that the insurance card is only necessary during an accident. In fact, it should be presented upon demand by law enforcement or other parties involved in an incident.

Some individuals think that they can ignore certain details on the card. However, every piece of information, such as the policy number and vehicle identification number, is essential for proper identification and processing.

Many people overlook the watermark on the card, thinking it serves no purpose. This watermark is an important security feature designed to prevent fraud.

Some drivers mistakenly believe they can present another person's insurance card if they are driving that vehicle. This is not advisable, as it can lead to legal complications and potential liability issues.

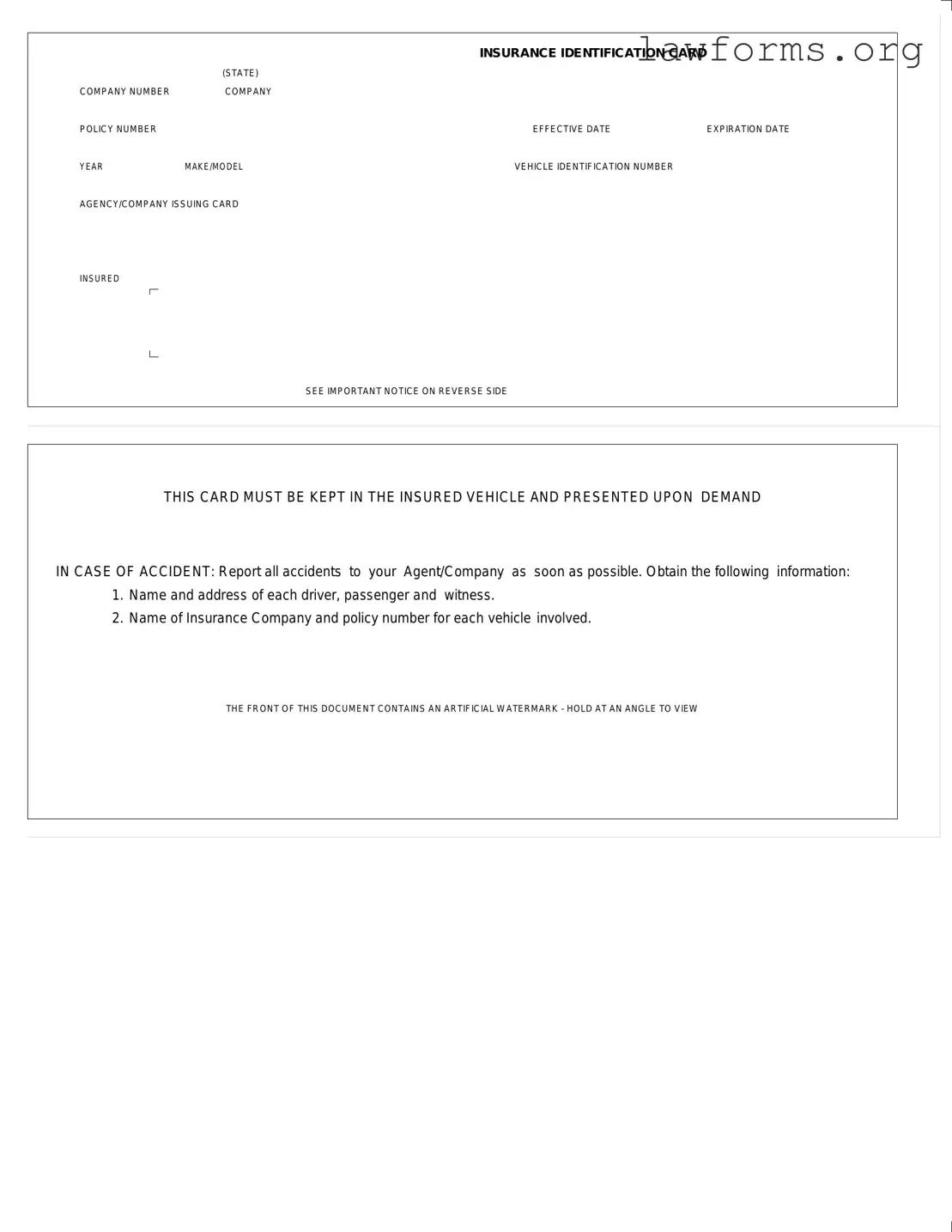

Preview - Auto Insurance Card Form

|

|

INSURANCE IDENTIFICATION CARD |

|

|

(STATE) |

|

|

COMPANY NUMBER |

COMPANY |

|

|

POLICY NUMBER |

|

EFFECTIVE DATE |

EXPIRATION DATE |

YEAR |

MAKE/MODEL |

VEHICLE IDENTIFICATION NUMBER |

|

AGENCY/COMPANY ISSUING CARD

INSURED

SEE IMPORTANT NOTICE ON REVERSE SIDE

THIS CARD MUST BE KEPT IN THE INSURED VEHICLE AND PRESENTED UPON DEMAND

IN CASE OF ACCIDENT: Report all accidents to your Agent/Company as soon as possible. Obtain the following information:

1.Name and address of each driver, passenger and witness.

2.Name of Insurance Company and policy number for each vehicle involved.

THE FRONT OF THIS DOCUMENT CONTAINS AN ARTIFICIAL WATERMARK - HOLD AT AN ANGLE TO VIEW

Key takeaways

When it comes to filling out and using the Auto Insurance Card form, there are several important points to keep in mind. Understanding these key takeaways can help ensure compliance and readiness in case of an accident.

- Accurate Information is Crucial: Ensure that all fields, such as the company number, policy number, and vehicle identification number, are filled out correctly. Inaccuracies can lead to complications when filing a claim.

- Keep it Accessible: This card must be kept in the insured vehicle at all times. In the event of an accident, having it readily available is essential.

- Know the Effective Dates: Be aware of the effective and expiration dates on the card. Driving with an expired insurance card can result in legal penalties.

- Report Accidents Promptly: In case of an accident, report it to your insurance agent or company as soon as possible. Prompt reporting can facilitate a smoother claims process.

- Collect Necessary Information: After an accident, gather information from all parties involved. This includes names and addresses of drivers, passengers, and witnesses, as well as the insurance details for each vehicle.

- Recognize Security Features: The front of the card includes an artificial watermark. Holding the card at an angle can help verify its authenticity.

By keeping these points in mind, individuals can navigate the requirements of the Auto Insurance Card form with greater ease and confidence.

Similar forms

The Auto Insurance Card form shares similarities with several other important documents. Each document serves a specific purpose related to vehicle ownership, insurance, or identification. Below are five documents that resemble the Auto Insurance Card form:

- Vehicle Registration Card: This document verifies that a vehicle is registered with the state. It includes details like the owner's name, vehicle identification number, and registration expiration date, similar to the information found on the Auto Insurance Card.

- Proof of Insurance Letter: This letter is issued by an insurance company and confirms that a policy is active. It typically includes the policy number and coverage details, akin to the coverage information on the Auto Insurance Card.

- Driver’s License: A driver's license serves as an official identification document. It contains personal information and proves the individual’s right to operate a vehicle, paralleling the identification purpose of the Auto Insurance Card.

-

Power of Attorney Form: This essential document allows individuals to appoint an agent for making decisions on their behalf, ensuring that their wishes are respected. For those considering this legal tool, resources such as Forms Washington can provide valuable guidance.

- Accident Report Form: This form is used to document the details of a vehicle accident. It requires information similar to what is requested on the Auto Insurance Card, such as driver and witness information.

- Title Certificate: The title certificate establishes ownership of a vehicle. It includes the owner's name and vehicle identification number, reflecting the ownership aspect found on the Auto Insurance Card.