Valid Business Bill of Sale Form

Form Specifications

| Fact Name | Description |

|---|---|

| Purpose | A Business Bill of Sale form documents the transfer of ownership of a business or its assets from one party to another. |

| Key Components | The form typically includes details about the buyer, seller, the business being sold, and the purchase price. |

| State-Specific Requirements | Different states may have specific requirements for the Bill of Sale. For example, in California, it must comply with the Uniform Commercial Code. |

| Legal Implications | Once signed, the Bill of Sale serves as a legal document that protects both parties and can be used in case of disputes. |

Dos and Don'ts

When filling out the Business Bill of Sale form, it is important to follow certain guidelines to ensure accuracy and legality. Here are ten things to do and not do:

- Do provide accurate information about the business being sold.

- Do include the full names and addresses of both the buyer and the seller.

- Do specify the sale price clearly and accurately.

- Do describe the assets included in the sale in detail.

- Do ensure both parties sign and date the document.

- Don't leave any sections blank; fill in all required fields.

- Don't use vague language; be specific about terms and conditions.

- Don't forget to keep a copy of the signed document for your records.

- Don't rush through the form; take your time to review all information.

- Don't ignore local laws or regulations that may apply to the sale.

Create Popular Types of Business Bill of Sale Documents

Furniture Purchase Agreement Template - An easy way to confirm ownership transfer of a piece of furniture.

When engaging in a firearm transaction in the District of Columbia, it's important to utilize the proper documentation to ensure a smooth process. The District of Columbia Firearm Bill of Sale form is a legal document that not only records the sale but also provides the necessary proof of the transaction. For more detailed information, you can refer to the Bill of Sale for a Gun, which outlines essential aspects such as the firearm's description and the parties involved, making it an invaluable resource for both buyers and sellers.

Bill of Sale Atv - The use of a Bill of Sale can lend credibility to private sales of ATVs.

Common mistakes

-

Incorrect Business Information: Many individuals fail to provide accurate details about the business being sold. This includes the legal name, address, and other identifying information. Any discrepancies can lead to legal complications down the line.

-

Omitting Sale Terms: It’s crucial to clearly outline the terms of the sale. Some people neglect to include important details such as payment methods, deposit amounts, and timelines, which can create confusion and disputes later.

-

Not Including Assets: When completing the form, it’s essential to list all assets being sold. Forgetting to mention equipment, inventory, or intellectual property can result in misunderstandings and potential loss of value.

-

Failure to Specify Liabilities: Sellers often overlook the importance of detailing any existing liabilities. This includes debts or obligations that may transfer to the buyer, which can lead to future legal issues if not properly addressed.

-

Neglecting Signatures: A common mistake is forgetting to obtain signatures from both the buyer and seller. Without these signatures, the document may not hold legal weight, rendering the sale invalid.

-

Not Consulting a Professional: Some individuals choose to fill out the form without legal advice. This can lead to errors or omissions that could have been avoided with the guidance of a lawyer or a qualified professional.

-

Ignoring State Requirements: Each state may have specific requirements for a Business Bill of Sale. Failing to comply with local laws can result in the form being rejected or the sale being contested.

-

Inadequate Record Keeping: After filling out the form, it’s important to keep a copy for your records. Many people neglect this step, which can complicate future transactions or disputes regarding the sale.

Documents used along the form

A Business Bill of Sale form is crucial for transferring ownership of a business. However, several other documents often accompany this form to ensure a smooth transaction. Below is a list of essential forms and documents that are commonly used in conjunction with a Business Bill of Sale.

- Purchase Agreement: This document outlines the terms and conditions of the sale, including the purchase price and any contingencies. It serves as a binding contract between the buyer and seller.

- Non-Disclosure Agreement (NDA): An NDA protects sensitive information shared during the sale process. It ensures that both parties keep proprietary details confidential.

- Asset List: This list details all assets included in the sale, such as equipment, inventory, and intellectual property. It helps clarify what the buyer is acquiring.

- Liabilities Statement: This document outlines any outstanding debts or obligations associated with the business. It provides transparency regarding financial responsibilities.

- Employee Agreements: If the business has employees, these agreements may need to be transferred or renegotiated. They outline employment terms and conditions.

- Business License Transfer: This document facilitates the transfer of any necessary business licenses or permits from the seller to the buyer, ensuring compliance with local regulations.

- Tax Documents: Relevant tax documents, such as recent tax returns or tax clearance certificates, may be required to verify the financial status of the business.

- Minnesota Bill of Sale form: This is essential for the legal transfer of ownership in Minnesota, especially for significant assets. It's important to utilize a reliable template, such as the one from Formaid Org, to ensure all legal aspects are covered.

- Closing Statement: A closing statement summarizes the financial details of the transaction, including the final sale price and any adjustments. It serves as a record of the closing process.

- Due Diligence Checklist: This checklist helps buyers conduct a thorough investigation of the business before the sale. It includes items to review, such as financial records and legal compliance.

Using these documents in conjunction with the Business Bill of Sale form ensures that both parties are protected and that the transaction is completed smoothly. Each document plays a vital role in clarifying responsibilities, protecting interests, and ensuring compliance with legal requirements.

Misconceptions

The Business Bill of Sale form is a crucial document in the transfer of ownership of a business. However, several misconceptions often arise regarding its purpose and function. Here are five common misunderstandings:

- It is only necessary for large businesses. Many believe that only large corporations require a Bill of Sale. In reality, any business transaction involving the sale of assets, regardless of size, benefits from this document.

- It serves as a contract for employment. Some people confuse the Bill of Sale with employment contracts. The Bill of Sale specifically addresses the transfer of ownership and does not govern employment relationships.

- It is not legally binding. There is a misconception that a Bill of Sale lacks legal weight. In fact, when properly executed, it is a legally binding document that can protect both the buyer and seller.

- It does not require signatures. Some individuals think that a verbal agreement suffices. However, a Bill of Sale must be signed by both parties to validate the transaction.

- It is only needed for tangible assets. While it is true that the Bill of Sale is commonly used for physical assets, it can also apply to intangible assets, such as intellectual property or business goodwill.

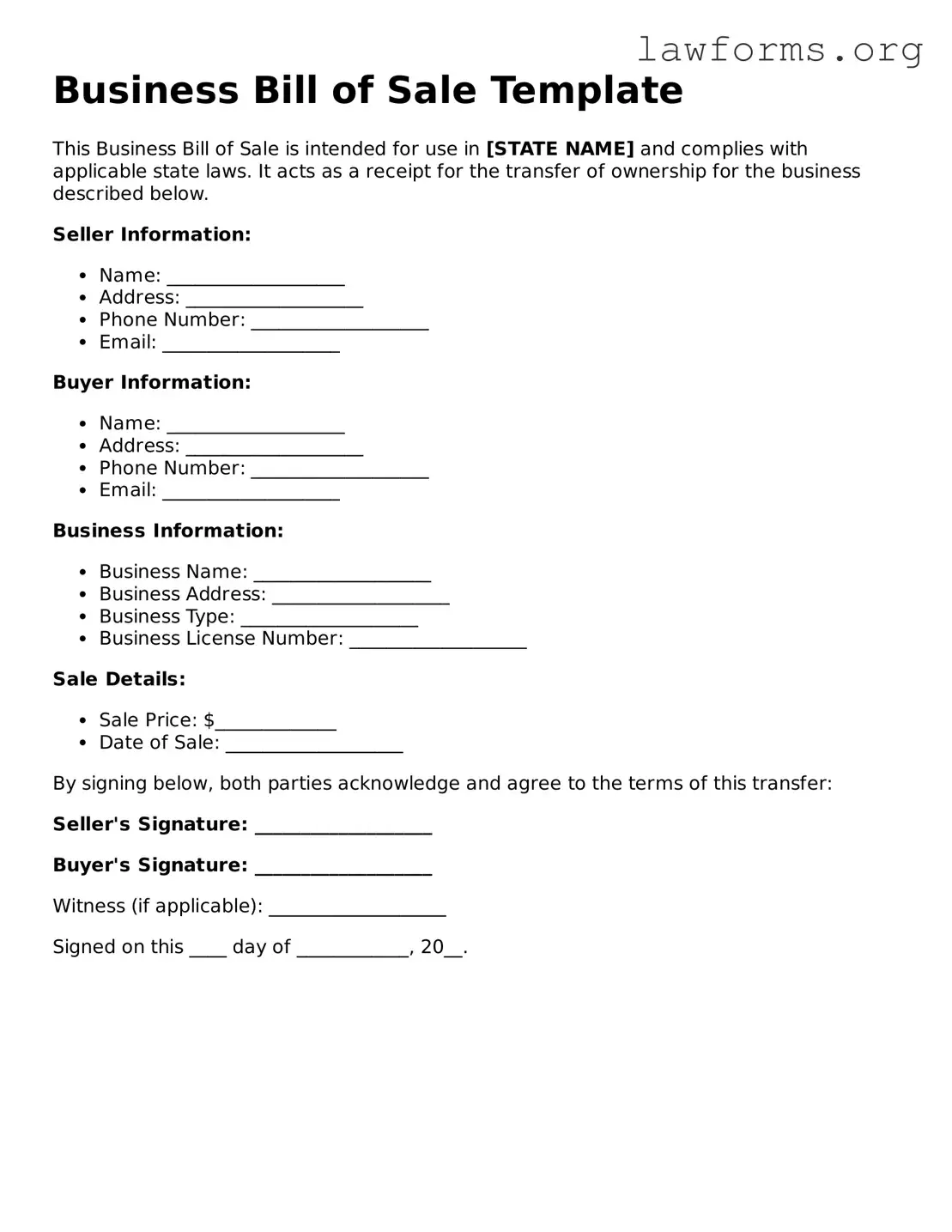

Preview - Business Bill of Sale Form

Business Bill of Sale Template

This Business Bill of Sale is intended for use in [STATE NAME] and complies with applicable state laws. It acts as a receipt for the transfer of ownership for the business described below.

Seller Information:

- Name: ___________________

- Address: ___________________

- Phone Number: ___________________

- Email: ___________________

Buyer Information:

- Name: ___________________

- Address: ___________________

- Phone Number: ___________________

- Email: ___________________

Business Information:

- Business Name: ___________________

- Business Address: ___________________

- Business Type: ___________________

- Business License Number: ___________________

Sale Details:

- Sale Price: $_____________

- Date of Sale: ___________________

By signing below, both parties acknowledge and agree to the terms of this transfer:

Seller's Signature: ___________________

Buyer's Signature: ___________________

Witness (if applicable): ___________________

Signed on this ____ day of ____________, 20__.

Key takeaways

When engaging in the sale of a business, using a Business Bill of Sale form is essential. This document serves as a legal record of the transaction and outlines the terms agreed upon by both parties. Here are key takeaways to consider:

- Understand the Purpose: The Business Bill of Sale acts as proof of the transfer of ownership and can be critical for both legal and tax purposes.

- Include Essential Details: Make sure to include the names of the buyer and seller, the date of the transaction, and a detailed description of the business being sold.

- Document Assets: Clearly list all assets being transferred, including equipment, inventory, and any intangible assets like trademarks or customer lists.

- Specify Payment Terms: Outline the total purchase price and any payment arrangements, such as installments or financing options.

- Consult Legal Advice: It’s wise to have a legal professional review the document to ensure that it complies with local laws and regulations.

- Keep Copies: Both parties should retain copies of the signed Bill of Sale for their records. This can be useful for future reference or disputes.

- Consider Additional Documentation: Depending on the nature of the business, additional agreements may be necessary, such as non-compete clauses or lease agreements.

- Be Honest and Transparent: Full disclosure of any liabilities or issues related to the business is crucial. This builds trust and can prevent future legal complications.

Using the Business Bill of Sale form effectively can facilitate a smoother transaction and protect the interests of both the buyer and seller.

Similar forms

-

Sales Agreement: A sales agreement outlines the terms of a sale between a buyer and a seller. Like the Business Bill of Sale, it serves as a record of the transaction, detailing the items sold, the purchase price, and the parties involved.

- Bill of Sale Form for New York: Essential for transferring ownership of personal property in New York, this document serves as a receipt and contains crucial information about the transaction. For more details, visit nydocuments.com/bill-of-sale-form/.

-

Purchase Order: A purchase order is a document created by a buyer to authorize a purchase transaction. Similar to a Business Bill of Sale, it confirms the buyer's intent to buy and includes details about the goods or services being acquired.

-

Invoice: An invoice is a request for payment issued by a seller to a buyer. It shares similarities with the Business Bill of Sale in that it records the transaction details, including the amount owed and the items or services provided.

-

Receipt: A receipt is a document given to a buyer as proof of payment. It is akin to the Business Bill of Sale because it confirms that a transaction has occurred, detailing the items purchased and the total amount paid.