Fill Out a Valid Business Credit Application Template

Form Specs

| Fact Name | Description |

|---|---|

| Purpose | The Business Credit Application form is used by businesses to apply for credit from lenders or suppliers. |

| Information Required | The form typically requires details about the business, including its legal structure, ownership, and financial information. |

| Credit History | Lenders often assess the credit history of the business and its owners when reviewing the application. |

| Governing Laws | State-specific forms may be subject to the Uniform Commercial Code (UCC) and other state laws governing credit agreements. |

| Signature Requirement | Most applications require signatures from authorized representatives of the business to validate the information provided. |

| Confidentiality | Information submitted in the application is generally kept confidential, although lenders may share it with credit reporting agencies. |

| Processing Time | The time it takes to process a business credit application can vary, often ranging from a few days to several weeks. |

Dos and Don'ts

When filling out a Business Credit Application form, attention to detail is crucial. Here are some important dos and don'ts to consider:

- Do read the entire application thoroughly before starting.

- Do provide accurate and up-to-date information.

- Do include all required documents, such as financial statements and tax returns.

- Do double-check your calculations and figures.

- Do ensure that all signatures are included where necessary.

- Don't leave any sections blank unless instructed to do so.

- Don't use vague language or abbreviations that may confuse the reviewer.

- Don't provide misleading information or exaggerate your financial situation.

- Don't forget to follow up after submission to confirm receipt.

Other PDF Documents

Bbb Complaint Form - The website offered options that were not available.

Geico Supplement - Ensure accuracy in the claim number to prevent delays.

Doctors Note Template - A key piece of documentation for many employee handbooks and school policies.

Common mistakes

-

Incomplete Information: Many applicants forget to fill out all required fields. Missing details can delay the approval process.

-

Incorrect Business Structure: Some people misidentify their business type. This can lead to confusion about eligibility and terms.

-

Not Providing Accurate Financials: Applicants often provide outdated or incorrect financial statements. This can raise red flags for lenders.

-

Ignoring Credit History: Some applicants overlook the importance of their business credit history. A poor credit score can impact approval chances.

-

Failure to Sign: It's surprising how often people forget to sign the application. Without a signature, the application is considered incomplete.

Documents used along the form

When applying for business credit, the Business Credit Application form is just one piece of the puzzle. Several other documents often accompany this application to provide lenders with a comprehensive view of your business's financial health and credibility. Below is a list of common forms and documents that may be required.

- Personal Guarantee: This document is a promise made by an individual to repay credit extended to a business if the business fails to do so. It often requires the personal financial information of the guarantor.

- Business Plan: A detailed outline of your business’s goals, strategies, and financial projections. This helps lenders understand your vision and the potential for profitability.

- Financial Statements: These typically include balance sheets, income statements, and cash flow statements. They provide a snapshot of your business’s financial health over a specific period.

- Tax Returns: Personal and business tax returns for the past few years give lenders insight into your financial history and stability.

- Bank Statements: Recent bank statements can demonstrate cash flow and financial activity, helping to assess your ability to manage credit responsibly.

- Trade References: These are contacts from suppliers or vendors who can vouch for your payment history and business reliability, adding credibility to your application.

- Business License: A copy of your business license shows that your business is legally registered and authorized to operate in your industry.

- Articles of Incorporation: For corporations, this document outlines the business’s structure and is essential for proving its legal existence.

Gathering these documents can seem daunting, but they are crucial in establishing your business’s creditworthiness. By providing a complete picture of your financial situation, you enhance your chances of securing the credit needed to grow your business.

Misconceptions

When it comes to the Business Credit Application form, several misconceptions can lead to confusion. Here are four common misunderstandings:

- It’s only for large businesses. Many people believe that only large corporations need to fill out a Business Credit Application. In reality, small businesses and startups also benefit from establishing credit. This application helps any size business build a credit history.

- It guarantees credit approval. Another misconception is that submitting the application ensures automatic approval for credit. This is not true. Lenders assess various factors, including credit history and financial stability, before making a decision.

- It’s a one-time process. Some assume that once the application is submitted, they never have to think about it again. In fact, businesses may need to update their information regularly or reapply as their financial situation changes.

- Personal credit doesn’t matter. Many believe that personal credit scores are irrelevant when applying for business credit. However, lenders often consider the owner’s personal credit history, especially for new businesses without an established credit profile.

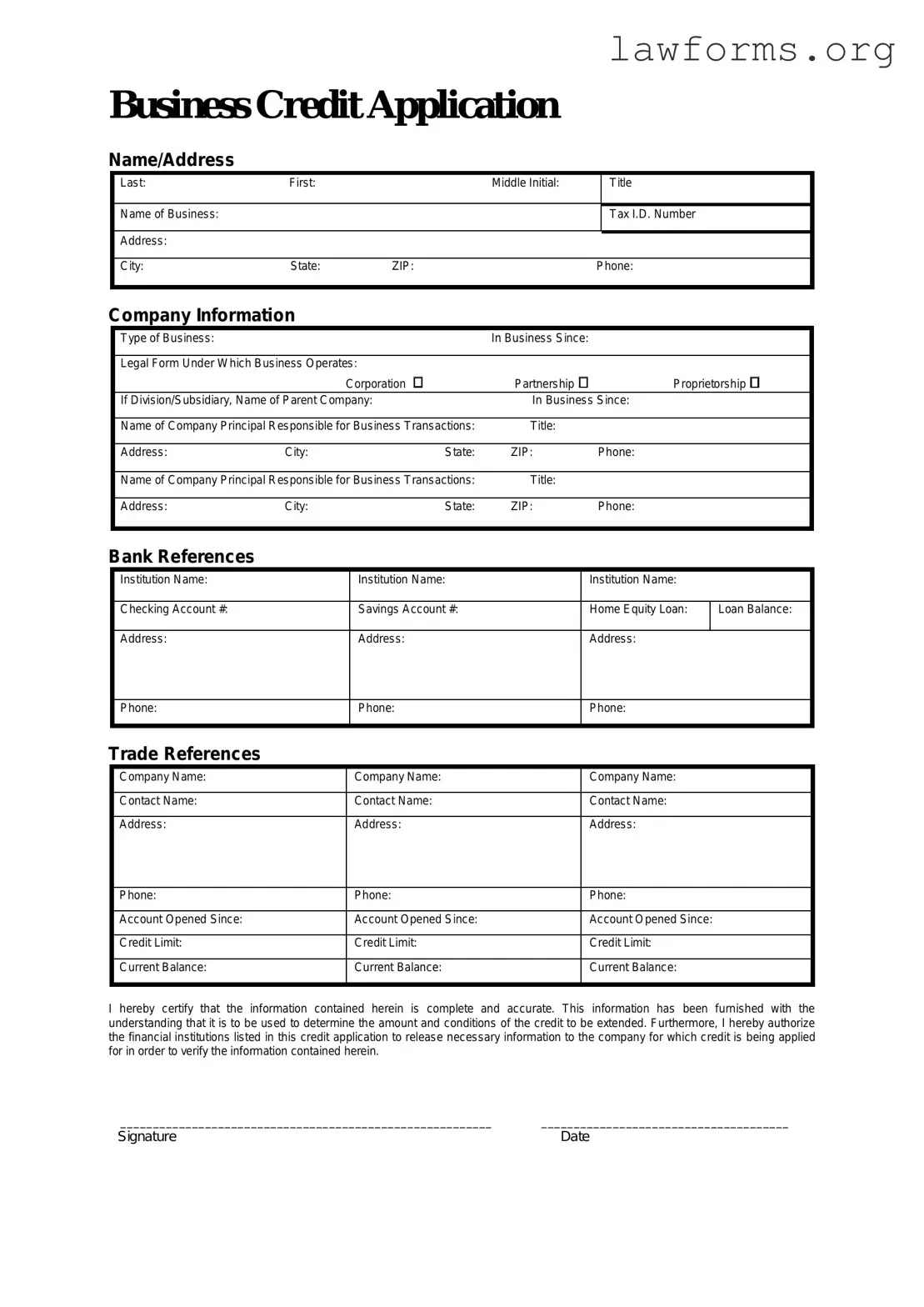

Preview - Business Credit Application Form

Business Credit Application

Name/Address

Last: |

First: |

|

Middle Initial: |

|

Title |

|

|

|

|

|

|

Name of Business: |

|

|

|

|

Tax I.D. Number |

|

|

|

|

|

|

Address: |

|

|

|

|

|

|

|

|

|

|

|

City: |

State: |

ZIP: |

|

Phone: |

|

|

|

|

|

|

|

Company Information

|

Type of Business: |

|

|

|

In Business Since: |

|

|

|

|

|

|

|

|

|

|

||

|

Legal Form Under Which Business Operates: |

|

|

|

|

|||

|

|

|

Corporation |

Partnership |

Proprietorship |

|

||

|

If Division/Subsidiary, Name of Parent Company: |

In Business Since: |

|

|||||

|

|

|

|

|

|

|

||

|

Name of Company Principal Responsible for Business Transactions: |

Title: |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

Address: |

City: |

|

State: |

ZIP: |

Phone: |

|

|

|

|

|

|

|

|

|

||

|

Name of Company Principal Responsible for Business Transactions: |

Title: |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

Address: |

City: |

|

State: |

ZIP: |

Phone: |

|

|

|

|

|

|

|

|

|

|

|

Bank References |

|

|

|

|

|

|

|

|

|

Institution Name: |

|

|

Institution Name: |

|

Institution Name: |

||

|

|

|

|

|

|

|

|

|

|

Checking Account #: |

|

|

Savings Account #: |

|

Home Equity Loan: |

ILoan Balance: |

|

|

Address: |

|

|

Address: |

|

Address: |

|

|

Phone:

Phone:

Phone:

Trade References

Company Name: |

Company Name: |

Company Name: |

|

|

|

Contact Name: |

Contact Name: |

Contact Name: |

|

|

|

Address: |

Address: |

Address: |

|

|

|

Phone: |

Phone: |

Phone: |

|

|

|

Account Opened Since: |

Account Opened Since: |

Account Opened Since: |

|

|

|

Credit Limit: |

Credit Limit: |

Credit Limit: |

|

|

|

Current Balance: |

Current Balance: |

Current Balance: |

|

|

|

I hereby certify that the information contained herein is complete and accurate. This information has been furnished with the understanding that it is to be used to determine the amount and conditions of the credit to be extended. Furthermore, I hereby authorize the financial institutions listed in this credit application to release necessary information to the company for which credit is being applied for in order to verify the information contained herein.

_________________________________________________________ ______________________________________

Signature |

Date |

Key takeaways

Filling out a Business Credit Application form is a crucial step for any business seeking credit. Here are some key takeaways to keep in mind:

- Ensure all information is accurate. Incorrect details can lead to delays or denials.

- Provide complete contact information. Include your business address, phone number, and email.

- Be prepared to disclose financial information. Lenders often require details about your business's revenue and expenses.

- List all owners and their ownership percentages. Transparency about ownership can build trust with lenders.

- Include your business's legal structure. Indicate whether your business is a sole proprietorship, partnership, corporation, or LLC.

- Review the credit terms. Understand the interest rates and repayment terms being offered.

- Attach necessary documentation. This may include tax returns, financial statements, or business licenses.

- Follow up after submission. A prompt follow-up can demonstrate your commitment and may expedite the review process.

Similar forms

- Loan Application Form: Similar to the Business Credit Application, this document requests financial information to assess creditworthiness for loans.

- Motor Vehicle Bill of Sale: This document serves as a formal record of a vehicle's sale, ensuring all details such as make, model, year, and VIN are documented. For a template, visit Formaid Org.

- Vendor Credit Application: This form is used by suppliers to evaluate a business's credit history and payment habits before extending credit terms.

- Lease Application: A lease application collects details about a business's financial status and credit history to determine eligibility for leasing property or equipment.

- Business License Application: This document requires information about the business's structure and financial standing, which can influence credit decisions.

- Partnership Agreement: Similar in that it outlines the financial responsibilities and obligations of business partners, impacting credit assessments.

- Financial Statement: This document provides a snapshot of a business's financial health, similar to how a credit application assesses risk.

- Personal Guarantee Form: Often required alongside business credit applications, this form holds individuals accountable for business debts, linking personal and business credit.

- Business Plan: A business plan outlines financial projections and strategies, which can be used to support credit applications by demonstrating viability.