Valid Business Purchase and Sale Agreement Form

Form Specifications

| Fact Name | Description |

|---|---|

| Definition | A Business Purchase and Sale Agreement is a legal document outlining the terms of a sale of a business from one party to another. |

| Parties Involved | The agreement typically includes the seller, who is transferring ownership, and the buyer, who is acquiring the business. |

| Governing Law | The laws of the state where the business operates govern the agreement. For example, California law may apply for businesses located in California. |

| Key Components | Common components include purchase price, payment terms, and representations and warranties of both parties. |

| Contingencies | Contingencies may be included, such as financing conditions or the need for regulatory approvals. |

| Confidentiality Clause | This clause protects sensitive information shared during the negotiation process from being disclosed to third parties. |

| Closing Process | The agreement outlines the closing process, detailing when and how the transfer of ownership will occur. |

| Dispute Resolution | Many agreements include provisions for how disputes will be resolved, such as through mediation or arbitration. |

Dos and Don'ts

When filling out a Business Purchase and Sale Agreement form, attention to detail is crucial. Here are some essential do's and don'ts to guide you through the process.

- Do read the entire agreement thoroughly before filling it out.

- Do ensure all parties involved are clearly identified, including their legal names and addresses.

- Do include all relevant details about the business being sold, such as its assets, liabilities, and financial performance.

- Do seek legal advice if you have any questions or concerns about the terms of the agreement.

- Don't leave any blank spaces in the form; if a section does not apply, indicate that clearly.

- Don't rush through the process; take your time to ensure accuracy and completeness.

Popular Templates:

Participants of the Study - It plays a crucial role in fostering an environment of informed choice.

Lease Non Renewal Notice - It may necessitate a final walk-through inspection of the property.

When engaging in the sale of a motor vehicle, it is essential to utilize the proper documentation to ensure a clear and legitimate transaction. The Washington Motor Vehicle Bill of Sale serves as a vital record that reinforces the transfer of ownership and can help mitigate any misunderstandings between the parties involved. For those seeking a reliable template for this essential form, Forms Washington offers a comprehensive resource to aid in the process.

Lift Inspection Form - Inspect the remote keyless entry system, if applicable, for functionality.

Common mistakes

-

Neglecting to include essential details: Many individuals overlook critical information such as the names of the parties involved, the business name, and the address. This omission can lead to confusion and potential disputes later on.

-

Failing to specify the purchase price: It's crucial to clearly state the agreed-upon purchase price. Without this, the agreement lacks clarity and can create misunderstandings.

-

Ignoring contingencies: Buyers and sellers often forget to include contingencies that protect their interests. Examples include financing conditions or inspections. These contingencies are vital for a smooth transaction.

-

Not addressing liabilities: Some parties fail to clarify which liabilities will be assumed by the buyer. This oversight can lead to unexpected financial burdens after the sale.

-

Omitting representations and warranties: Both parties should include representations and warranties about the business's condition. Without these statements, one party may later claim they were misled.

-

Using vague language: Ambiguities in language can lead to different interpretations of the agreement. Clear and precise wording is essential to avoid disputes.

-

Failing to include a timeline: A lack of deadlines for key actions can result in delays. Establishing a timeline helps keep both parties accountable and on track.

-

Not addressing post-sale obligations: Some agreements neglect to outline any post-sale obligations, such as training or consulting. These details are important for a smooth transition.

-

Overlooking legal compliance: Parties sometimes forget to ensure that the agreement complies with local, state, and federal laws. This oversight can render the agreement unenforceable.

-

Failing to seek professional assistance: Many individuals attempt to navigate the complexities of the agreement without legal or financial advice. This can lead to costly mistakes and unfavorable terms.

Documents used along the form

When engaging in a business transaction, several documents accompany the Business Purchase and Sale Agreement to ensure clarity and protect the interests of all parties involved. Each of these documents plays a vital role in the transaction process.

- Letter of Intent (LOI): This document outlines the preliminary understanding between the buyer and seller regarding the sale. It serves as a foundation for negotiations and may include key terms, such as price and timeline.

- Confidentiality Agreement: Also known as a Non-Disclosure Agreement (NDA), this document protects sensitive information shared during the negotiation process. It ensures that both parties keep proprietary information confidential.

- Due Diligence Checklist: This is a comprehensive list of items that the buyer needs to review before finalizing the purchase. It typically includes financial records, legal documents, and operational details of the business.

- Asset Purchase Agreement: If the sale involves specific assets rather than the entire business entity, this agreement details the assets being sold and the terms of the sale.

- Bill of Sale: This document serves as proof of the transfer of ownership of tangible assets from the seller to the buyer. It includes a description of the assets and the sale price.

- Employment Agreements: If key employees are to remain with the business post-sale, these agreements outline the terms of their employment, including compensation and responsibilities.

- Employment Verification Form: Essential for confirming an individual's employment status, this document can be utilized for various purposes, including loan applications and housing requests. For more information, visit californiadocsonline.com/employment-verification-form/.

- Financing Agreement: If the buyer requires financing to complete the purchase, this document details the terms of the loan, including repayment schedules and interest rates.

- Closing Statement: This document summarizes the financial aspects of the transaction at closing. It includes the final purchase price, adjustments, and any fees associated with the sale.

These documents collectively ensure a smooth transaction process and protect the rights of both the buyer and seller. Understanding each document's purpose can significantly contribute to the success of the business purchase and sale agreement.

Misconceptions

Many individuals and businesses encounter the Business Purchase and Sale Agreement (BPSA) when considering the sale or purchase of a business. However, several misconceptions can cloud understanding of this important document. Here are four common misconceptions:

- The BPSA is only necessary for large businesses. This is false. Regardless of the size of the business, a BPSA is crucial for clearly outlining the terms of the sale. Small businesses benefit just as much from having a formal agreement.

- Once signed, the BPSA cannot be changed. This is not entirely accurate. While the BPSA is a binding contract, parties can negotiate modifications before finalizing the agreement. Changes can be made if both parties consent.

- The BPSA covers all legal aspects of the sale. This misconception overlooks the fact that the BPSA focuses primarily on the terms of the sale itself. Other legal considerations, such as regulatory compliance and tax implications, may require additional agreements or documents.

- A verbal agreement is sufficient if both parties are in agreement. Relying on a verbal agreement can lead to misunderstandings and disputes. A written BPSA provides clarity and serves as a legal record, protecting both parties' interests.

Understanding these misconceptions can help buyers and sellers navigate the complexities of business transactions more effectively.

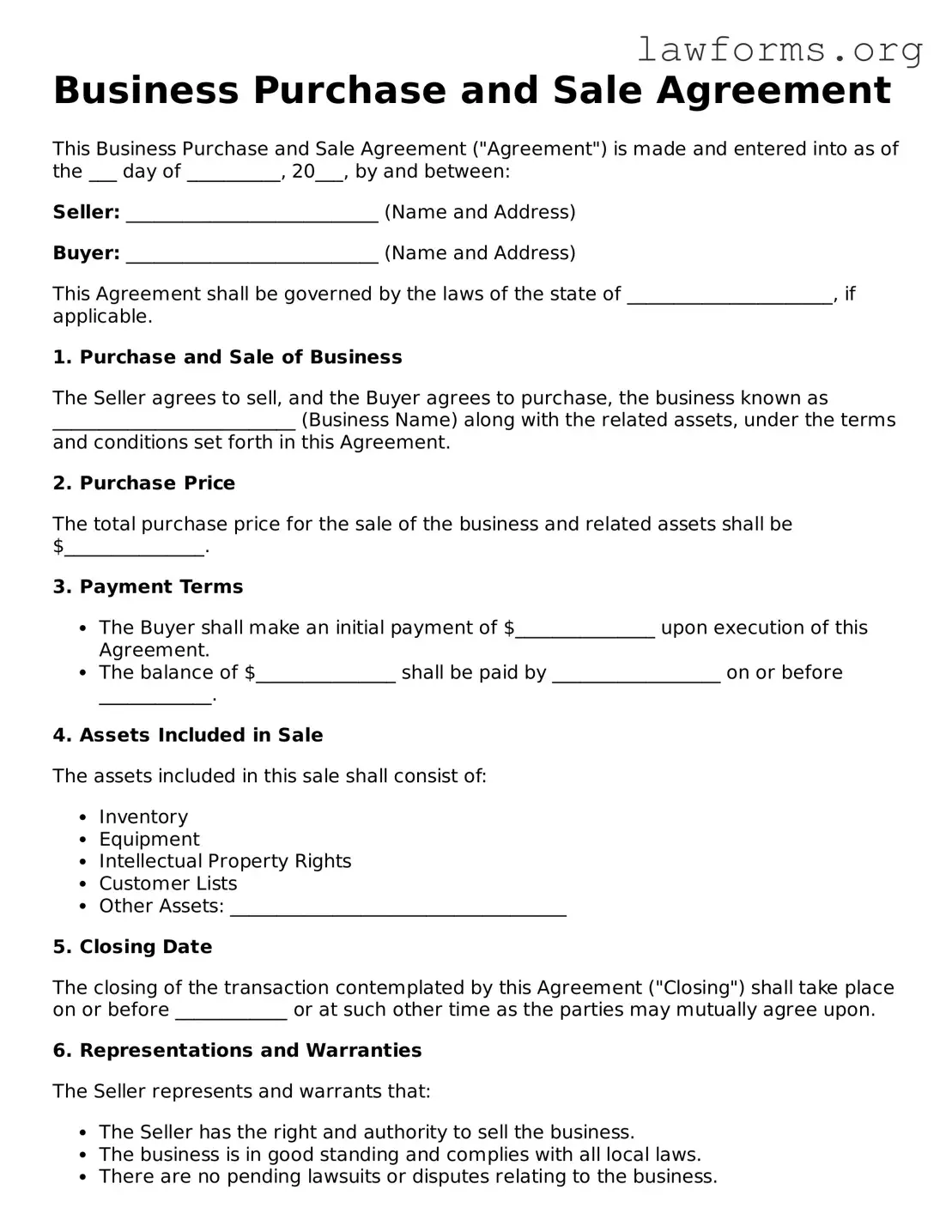

Preview - Business Purchase and Sale Agreement Form

Business Purchase and Sale Agreement

This Business Purchase and Sale Agreement ("Agreement") is made and entered into as of the ___ day of __________, 20___, by and between:

Seller: ___________________________ (Name and Address)

Buyer: ___________________________ (Name and Address)

This Agreement shall be governed by the laws of the state of ______________________, if applicable.

1. Purchase and Sale of Business

The Seller agrees to sell, and the Buyer agrees to purchase, the business known as __________________________ (Business Name) along with the related assets, under the terms and conditions set forth in this Agreement.

2. Purchase Price

The total purchase price for the sale of the business and related assets shall be $_______________.

3. Payment Terms

- The Buyer shall make an initial payment of $_______________ upon execution of this Agreement.

- The balance of $_______________ shall be paid by __________________ on or before ____________.

4. Assets Included in Sale

The assets included in this sale shall consist of:

- Inventory

- Equipment

- Intellectual Property Rights

- Customer Lists

- Other Assets: ____________________________________

5. Closing Date

The closing of the transaction contemplated by this Agreement ("Closing") shall take place on or before ____________ or at such other time as the parties may mutually agree upon.

6. Representations and Warranties

The Seller represents and warrants that:

- The Seller has the right and authority to sell the business.

- The business is in good standing and complies with all local laws.

- There are no pending lawsuits or disputes relating to the business.

7. Conditions Precedent

The obligations of the Buyer under this Agreement are subject to the fulfillment of the following conditions:

- Completion of a satisfactory due diligence review.

- Obtaining necessary approvals from relevant authorities.

8. Miscellaneous

This Agreement represents the entire understanding between the parties concerning the subject matter hereof and supersedes all prior agreements and understandings, whether written or oral. Any amendments to this Agreement must be in writing and signed by both parties.

IN WITNESS WHEREOF, the parties have executed this Business Purchase and Sale Agreement as of the date first above written.

Seller: ___________________________ Date: _______________

Buyer: ___________________________ Date: _______________

Key takeaways

When filling out and using a Business Purchase and Sale Agreement form, keep these key takeaways in mind:

- Understand the Purpose: This agreement outlines the terms of the sale, protecting both the buyer and the seller.

- Identify the Parties: Clearly state the names and addresses of both the buyer and the seller to avoid confusion.

- Describe the Business: Provide a detailed description of the business being sold, including assets, liabilities, and any included inventory.

- Set the Purchase Price: Clearly specify the total purchase price and any payment terms, such as deposits or financing arrangements.

- Include Contingencies: List any conditions that must be met for the sale to proceed, like financing approval or inspections.

- Outline Closing Procedures: Detail the process for closing the sale, including dates and responsibilities of each party.

- Address Representations and Warranties: Include statements about the business’s condition and any guarantees made by the seller.

- Consider Post-Sale Obligations: If applicable, include any agreements regarding non-compete clauses or training for the buyer.

- Seek Legal Advice: Before finalizing the agreement, consult a legal professional to ensure all terms are clear and enforceable.

Taking these steps will help ensure a smoother transaction and protect the interests of everyone involved.

Similar forms

- Letter of Intent (LOI): This document outlines the preliminary understanding between the buyer and seller. It sets the stage for negotiations and includes key terms that will be formalized in the final agreement.

- Asset Purchase Agreement: Similar to a Business Purchase and Sale Agreement, this document focuses specifically on the purchase of assets rather than the entire business entity. It details which assets are included in the sale.

- Stock Purchase Agreement: This agreement involves the purchase of shares in a company. Like the Business Purchase and Sale Agreement, it outlines terms and conditions but focuses on ownership transfer of stock rather than assets.

- Confidentiality Agreement (NDA): Often used in conjunction with the Business Purchase and Sale Agreement, this document protects sensitive information shared during negotiations. It ensures that both parties keep proprietary information confidential.

- Due Diligence Checklist: This document serves as a guide for the buyer to investigate the business thoroughly before finalizing the purchase. It includes various aspects of the business to assess, similar to the evaluations conducted in a Business Purchase and Sale Agreement.

- Escrow Agreement: This agreement involves a neutral third party holding funds or documents until certain conditions are met. It provides security for both buyer and seller, akin to the terms outlined in a Business Purchase and Sale Agreement.

- Vehicle Release of Liability: To ensure you are clear of responsibilities post-transfer, refer to the thorough Vehicle Release of Liability form guidelines for proper documentation.

- Non-Compete Agreement: This document restricts the seller from starting a competing business after the sale. It often accompanies the Business Purchase and Sale Agreement to protect the buyer’s investment.

- Transition Services Agreement: This agreement may be used when the seller agrees to assist the buyer in the transition period after the sale. It ensures continuity and is complementary to the terms outlined in the Business Purchase and Sale Agreement.