Attorney-Approved Affidavit of Death Template for the State of California

Form Specifications

| Fact Name | Description |

|---|---|

| Purpose | The California Affidavit of Death is used to officially declare the death of an individual. |

| Governing Law | This form is governed by California Probate Code Section 13100. |

| Who Can File | Any interested party, such as a family member or executor, can file the affidavit. |

| Required Information | The affidavit requires the deceased's full name, date of birth, and date of death. |

| Signature Requirement | The form must be signed under penalty of perjury by the person filing it. |

| Use in Estate Administration | This affidavit can help simplify the transfer of the deceased's assets. |

| Filing Location | The affidavit should be filed with the county recorder's office in the county where the deceased resided. |

| No Court Hearing | Filing this affidavit does not require a court hearing, making the process more straightforward. |

| Additional Documentation | A certified copy of the death certificate is typically required to accompany the affidavit. |

| Public Record | Once filed, the affidavit becomes part of the public record and is accessible to the public. |

Dos and Don'ts

When filling out the California Affidavit of Death form, it is essential to approach the task with care and attention to detail. Here are five important do's and don'ts to consider:

- Do ensure that all information is accurate and complete. Double-check names, dates, and other pertinent details.

- Do sign the affidavit in the presence of a notary public to validate the document.

- Do provide the correct identification of the deceased, including any relevant identification numbers.

- Don't omit any required signatures or information, as this can lead to delays or rejection of the form.

- Don't use white-out or other correction methods on the form. If a mistake is made, it is better to start over with a new form.

Create Popular Affidavit of Death Forms for Different States

Texas Affidavit of Death - An Affidavit of Death can be filed alongside other probate documents.

The Washington Articles of Incorporation form is a crucial document that establishes a corporation in the state of Washington. This form outlines essential information about the business, such as its name, purpose, and structure. By filing this document, you create a legal entity that can operate independently and protect its owners from personal liability. For those seeking guidance on this process, resources like Forms Washington can be invaluable.

Common mistakes

-

Incorrect Name Spelling: People often misspell the deceased's name. It’s essential to ensure that the name matches official documents.

-

Missing Date of Death: Failing to provide the exact date of death can lead to delays. This date should be clearly stated.

-

Wrong Signature: The affidavit must be signed by the correct person. Sometimes, individuals sign on behalf of someone else, which is not permitted.

-

Not Including Required Witnesses: Some forms require witnesses. Forgetting to have the necessary witnesses can invalidate the affidavit.

-

Inaccurate Relationship to Deceased: Clearly stating your relationship to the deceased is crucial. Misrepresenting this can cause complications.

-

Omitting Supporting Documentation: Many times, people fail to attach required documents, such as a death certificate. This can lead to rejection of the affidavit.

-

Not Notarizing the Document: Some affidavits need to be notarized. Neglecting this step can render the document ineffective.

-

Using Outdated Forms: Laws change, and so do forms. Using an outdated version of the affidavit can lead to issues.

-

Failure to Read Instructions: Skimming through or ignoring the instructions can lead to mistakes. It’s important to read all guidelines thoroughly.

Documents used along the form

When handling the affairs of a deceased individual in California, several forms and documents may be necessary in addition to the California Affidavit of Death. Each document serves a specific purpose in the process of settling the estate and ensuring that the deceased's wishes are honored. Below is a list of commonly used forms that may accompany the Affidavit of Death.

- Death Certificate: This official document verifies the death of an individual. It is often required for legal proceedings and for settling the deceased's estate.

- Will: If the deceased left a will, this document outlines their wishes regarding the distribution of their assets. It is essential for probate proceedings.

- Trust Documents: If the deceased had a trust, these documents detail the management and distribution of assets held within the trust, bypassing the probate process.

- Petition for Probate: This form is filed with the court to initiate the probate process, allowing the deceased's estate to be administered according to their will or state laws.

- Divorce Settlement Agreement: Prior to finalizing your divorce, ensure you understand the terms with the essential Divorce Settlement Agreement guidelines to facilitate a fair division of assets.

- Inventory and Appraisal: This document lists the deceased's assets and their estimated values, providing a clear picture of the estate for probate purposes.

- Notice of Hearing: This form informs interested parties about the probate hearing, ensuring that all relevant individuals are aware of the proceedings.

- Claim Against Estate: Creditors may use this form to file claims against the estate for debts owed by the deceased, which must be addressed during the probate process.

Understanding these documents and their roles can facilitate a smoother transition during a challenging time. Properly managing the estate requires attention to detail and adherence to legal requirements, ensuring that the wishes of the deceased are respected and fulfilled.

Misconceptions

- Misconception 1: The Affidavit of Death is only necessary for probate.

- Misconception 2: Anyone can fill out the Affidavit of Death.

- Misconception 3: The Affidavit of Death is the same as a death certificate.

- Misconception 4: You need a lawyer to complete the form.

- Misconception 5: The Affidavit of Death must be notarized.

- Misconception 6: The Affidavit of Death can only be used for certain types of property.

- Misconception 7: You need to file the Affidavit of Death with the court.

- Misconception 8: The Affidavit of Death is only for immediate family members.

- Misconception 9: The form is only valid for a limited time after death.

- Misconception 10: Once the Affidavit of Death is filed, the estate is automatically settled.

Many people believe that this document is only relevant in probate cases. However, it can also be used to transfer assets, change titles, or update accounts without going through the probate process.

While the form may seem straightforward, it is essential that the person filling it out has the correct information and understands the implications. Incorrect information can lead to legal issues.

A death certificate is an official document issued by the state, while the Affidavit of Death is a sworn statement that may be used to affirm the death for legal purposes. They serve different functions.

Although legal advice can be helpful, it is not mandatory to have a lawyer complete the Affidavit of Death. Many individuals can manage the process themselves if they understand the requirements.

While notarization can add credibility, it is not always a legal requirement for the Affidavit of Death. Check local laws to determine if notarization is necessary in your situation.

This form can be used for various types of property, including real estate, bank accounts, and personal belongings. Its applicability is broader than many realize.

In most cases, the Affidavit of Death does not need to be filed with the court. Instead, it is typically presented to institutions like banks or title companies to facilitate asset transfer.

Anyone with a legitimate interest in the deceased's assets can complete the Affidavit of Death. This includes friends, business partners, or other relatives.

There is no strict deadline for using the Affidavit of Death. However, it is advisable to complete it sooner rather than later to avoid complications in transferring assets.

Filing the Affidavit of Death does not settle the estate. It is merely a tool to facilitate the transfer of assets. Other steps may still be required to fully resolve the estate.

Preview - California Affidavit of Death Form

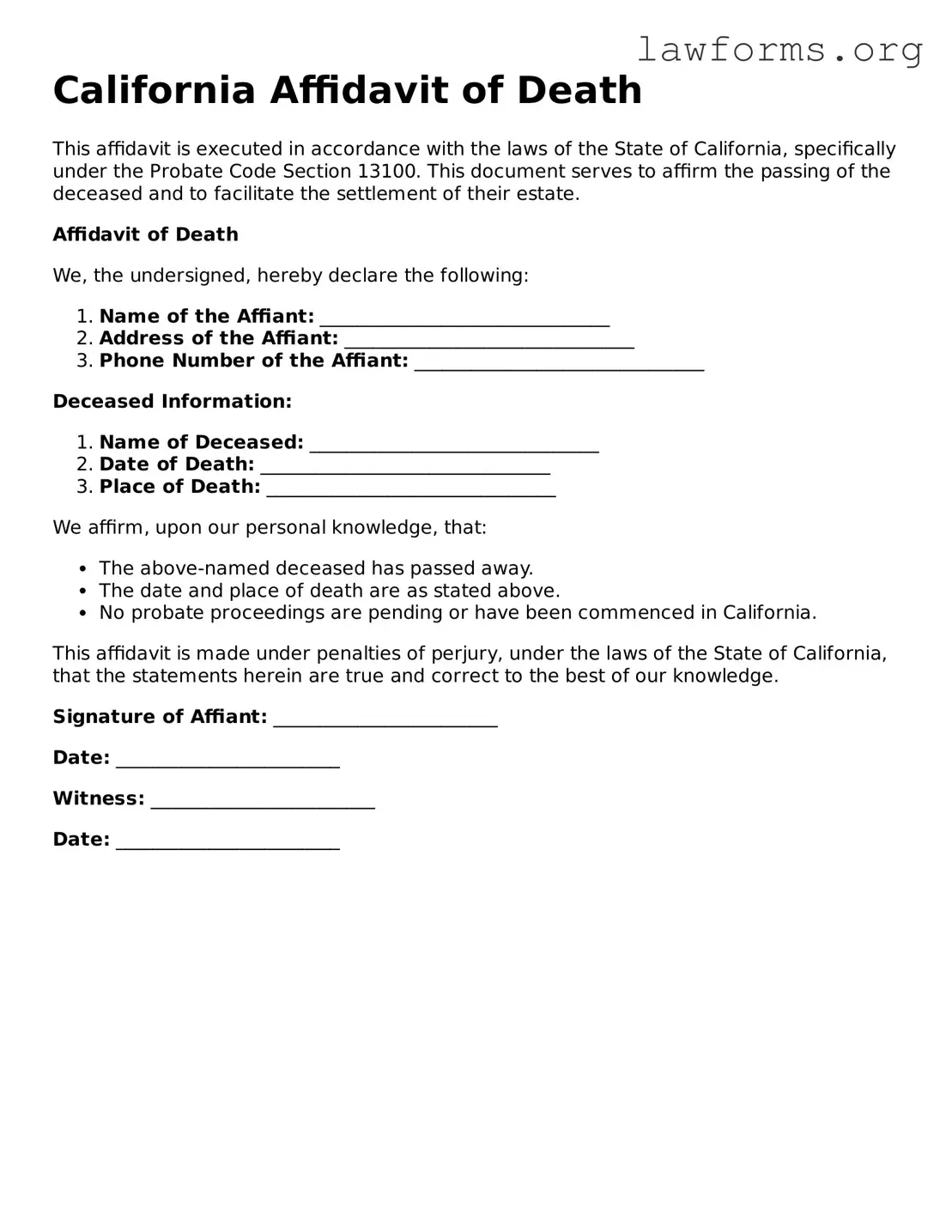

California Affidavit of Death

This affidavit is executed in accordance with the laws of the State of California, specifically under the Probate Code Section 13100. This document serves to affirm the passing of the deceased and to facilitate the settlement of their estate.

Affidavit of Death

We, the undersigned, hereby declare the following:

- Name of the Affiant: _______________________________

- Address of the Affiant: _______________________________

- Phone Number of the Affiant: _______________________________

Deceased Information:

- Name of Deceased: _______________________________

- Date of Death: _______________________________

- Place of Death: _______________________________

We affirm, upon our personal knowledge, that:

- The above-named deceased has passed away.

- The date and place of death are as stated above.

- No probate proceedings are pending or have been commenced in California.

This affidavit is made under penalties of perjury, under the laws of the State of California, that the statements herein are true and correct to the best of our knowledge.

Signature of Affiant: ________________________

Date: ________________________

Witness: ________________________

Date: ________________________

Key takeaways

Filling out the California Affidavit of Death form is an important step in handling the affairs of a deceased person. Here are key takeaways to keep in mind:

- Purpose of the Form: The California Affidavit of Death is used to officially declare the death of an individual and can help facilitate the transfer of property and assets.

- Who Can File: Generally, a relative or a person with a legal interest in the estate can complete and submit the affidavit.

- Gather Necessary Information: Before filling out the form, collect all relevant details about the deceased, including their full name, date of birth, and date of death.

- Signature Requirement: The affidavit must be signed by the person completing it, affirming the truth of the information provided.

- Notarization: Although notarization is not always required, having the affidavit notarized can add an extra layer of authenticity.

- Filing Locations: The completed affidavit should be filed with the county recorder’s office in the county where the deceased lived or owned property.

- Multiple Copies: It’s advisable to prepare multiple copies of the affidavit, as you may need them for different institutions or agencies.

- Additional Documentation: Be prepared to attach any necessary supporting documents, such as a death certificate, to the affidavit when filing.

- Consultation: If unsure about the process, consulting with a legal professional can provide clarity and ensure proper handling of the estate.

By keeping these points in mind, you can navigate the process of completing and using the California Affidavit of Death more effectively.

Similar forms

- Death Certificate: This official document serves as the primary legal proof of a person's death. It includes details such as the deceased's name, date of birth, date of death, and cause of death.

- Will: A will outlines how a person's assets should be distributed after their death. It often names an executor who will manage the estate, similar to how an affidavit may affirm the death for legal purposes.

- Letter of Administration: This document is issued by a court when someone dies without a will. It grants authority to an administrator to manage the deceased's estate, paralleling the role of an affidavit in confirming death.

- Trust Document: A trust can dictate how assets are handled after death. Like an affidavit, it can clarify intentions regarding the deceased's estate.

- Power of Attorney (POA): A POA allows someone to make decisions on behalf of another. When a person dies, the authority granted by the POA ends, similar to how an affidavit confirms the cessation of a person's legal capacity.

- Survivorship Agreement: This document specifies how property is transferred upon death. It can be seen as a proactive measure, similar to an affidavit that addresses the implications of death.

- Trailer Bill of Sale: The Ohio Trailer Bill of Sale form is a critical document for recording trailer ownership transfer in Ohio. It is vital for both buyers and sellers to complete this form accurately to prevent disputes and ensure the proper registration of the trailer. For more information, you can access Ohio PDF Forms.

- Beneficiary Designation Forms: These forms are used to name individuals who will receive assets after death. They work in conjunction with an affidavit by clarifying asset distribution.

- Probate Petition: This legal document initiates the probate process, which validates a will. It often references the death of the individual, much like the affidavit does.

- Insurance Policy Claims: When a policyholder passes away, beneficiaries must submit claims to access benefits. These claims require proof of death, akin to the function of an affidavit.