Attorney-Approved Articles of Incorporation Template for the State of California

Form Specifications

| Fact Name | Description |

|---|---|

| Purpose | The California Articles of Incorporation form is used to create a corporation in California. |

| Governing Law | The form is governed by the California Corporations Code. |

| Filing Requirement | It must be filed with the California Secretary of State to legally establish a corporation. |

| Information Needed | Basic information such as the corporation's name, purpose, and address is required. |

| Registered Agent | A registered agent must be designated to receive legal documents on behalf of the corporation. |

| Duration | The form allows for specifying the duration of the corporation, which can be perpetual or for a limited time. |

| Share Structure | The Articles must outline the share structure, including the number of shares and their par value. |

| Signature Requirement | Incorporators must sign the form, affirming the information provided is accurate. |

| Filing Fee | A filing fee is required, which varies based on the type of corporation being formed. |

| Amendments | If changes are needed later, amendments to the Articles of Incorporation can be filed with the Secretary of State. |

Dos and Don'ts

When filling out the California Articles of Incorporation form, it's important to follow specific guidelines to ensure accuracy and compliance. Here’s a list of things to do and avoid:

- Do provide a clear and concise name for your corporation.

- Do include the purpose of the corporation in simple terms.

- Do list the initial registered agent and their address accurately.

- Do ensure the number of shares the corporation is authorized to issue is stated.

- Do sign the form with the correct title, such as incorporator.

- Don't use a name that is already taken by another corporation in California.

- Don't leave any required fields blank; incomplete forms may be rejected.

- Don't forget to include the correct filing fee with your submission.

- Don't use legal jargon or overly complex language in the purpose statement.

- Don't submit the form without reviewing it for errors first.

Create Popular Articles of Incorporation Forms for Different States

Llc Filing Ohio - This form sets the stage for corporate governance and decision-making.

Incorporating in Nc - Review the Articles periodically for necessary updates.

Articles of Incorporation Texas - This document outlines the basic information about the corporation.

Corporate Form - Specify the duration of the corporation, if not perpetual.

Common mistakes

-

Failing to choose a unique name for the corporation. The name must not be identical or too similar to existing entities registered in California.

-

Neglecting to include the purpose of the corporation. A clear and specific purpose is essential for legal compliance.

-

Not providing a valid business address. The address must be a physical location where the corporation can be reached, not just a P.O. Box.

-

Omitting the name and address of the registered agent. This individual or business must be available during business hours to receive legal documents.

-

Incorrectly stating the number of shares the corporation is authorized to issue. Ensure that this number aligns with the corporation's financial structure.

-

Using the wrong form version. Always check for the most recent version of the Articles of Incorporation form, as updates may occur.

-

Failing to sign the document. All incorporators must sign the form to validate it.

-

Not including the correct filing fee. Ensure that the payment is accurate and submitted with the form to avoid delays.

-

Providing incomplete or inaccurate information. Double-check all entries for accuracy to prevent processing issues.

-

Ignoring state-specific requirements. Each state may have unique regulations that must be followed, so review California's specific guidelines.

Documents used along the form

When forming a corporation in California, the Articles of Incorporation is a crucial document. However, several other forms and documents may also be needed to ensure compliance with state regulations. Here’s a list of some commonly used forms that accompany the Articles of Incorporation.

- Bylaws: This document outlines the rules and procedures for managing the corporation. Bylaws cover aspects like the responsibilities of directors and officers, meeting procedures, and how decisions are made.

- Statement of Information: California requires corporations to file this document within 90 days of incorporation. It provides essential information about the corporation, including its address, officers, and agent for service of process.

- Employer Identification Number (EIN): This is a federal tax identification number required by the IRS. It is necessary for tax purposes and to open a business bank account.

- Initial Board of Directors Meeting Minutes: This document records the decisions made during the first meeting of the board of directors. It typically includes the appointment of officers and the adoption of bylaws.

- Business License: Depending on the type of business and location, a city or county business license may be required. This license allows the corporation to operate legally within its jurisdiction.

- Fictitious Business Name Statement: If the corporation plans to operate under a name different from its legal name, it must file this statement. It ensures that the public is aware of who is behind the business.

- California Franchise Tax Board (FTB) Registration: Corporations must register with the FTB to fulfill state tax obligations. This registration is essential for compliance with California tax laws.

- Shareholder Agreement: While not mandatory, this document can be beneficial. It outlines the rights and responsibilities of shareholders, including how shares can be transferred and how disputes will be resolved.

Each of these documents plays a vital role in establishing a corporation in California. Properly preparing and filing them can help ensure a smooth start for your business. Always consider consulting a professional if you have questions or need assistance with these forms.

Misconceptions

Understanding the California Articles of Incorporation form is crucial for anyone looking to establish a corporation in the state. However, several misconceptions can lead to confusion. Here are six common misconceptions:

- All corporations must file Articles of Incorporation. While most corporations do need to file this document, certain entities, like limited liability companies (LLCs), have different formation requirements.

- The Articles of Incorporation are the only requirement to start a business. Filing the Articles is just one step. Other requirements, such as obtaining business licenses and permits, also need to be fulfilled.

- Once filed, the Articles of Incorporation cannot be changed. This is not true. Amendments can be made to the Articles if necessary, allowing for flexibility as the business evolves.

- All information in the Articles of Incorporation is public. While much of the information is accessible, certain details may remain confidential, depending on state laws and regulations.

- Filing the Articles guarantees the corporation will be successful. The filing is merely a legal formality. Success depends on various factors, including business planning and market conditions.

- You must hire a lawyer to file the Articles of Incorporation. Although legal assistance can be helpful, it is not mandatory. Many individuals successfully file the form on their own.

Recognizing these misconceptions can help aspiring business owners navigate the incorporation process more effectively.

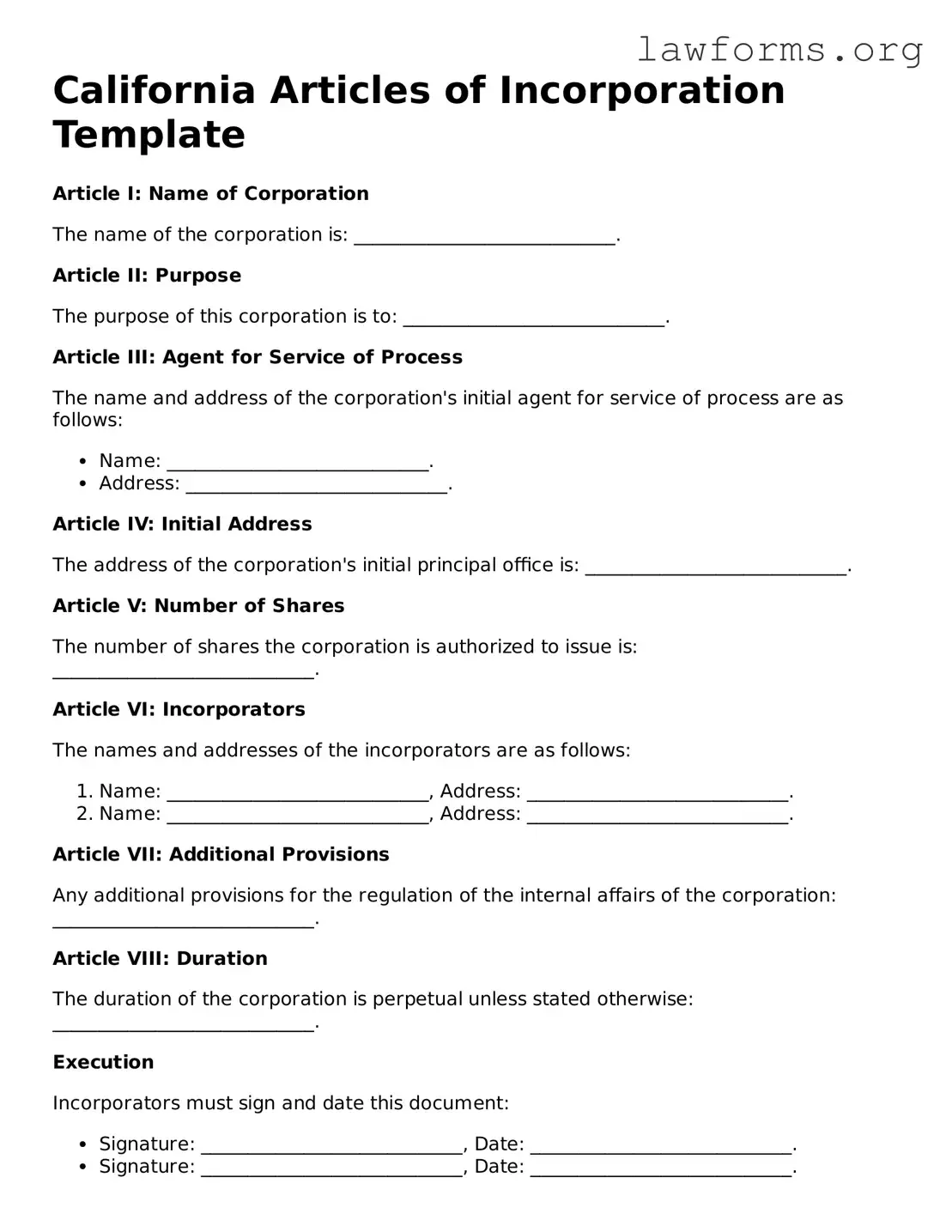

Preview - California Articles of Incorporation Form

California Articles of Incorporation Template

Article I: Name of Corporation

The name of the corporation is: ____________________________.

Article II: Purpose

The purpose of this corporation is to: ____________________________.

Article III: Agent for Service of Process

The name and address of the corporation's initial agent for service of process are as follows:

- Name: ____________________________.

- Address: ____________________________.

Article IV: Initial Address

The address of the corporation's initial principal office is: ____________________________.

Article V: Number of Shares

The number of shares the corporation is authorized to issue is: ____________________________.

Article VI: Incorporators

The names and addresses of the incorporators are as follows:

- Name: ____________________________, Address: ____________________________.

- Name: ____________________________, Address: ____________________________.

Article VII: Additional Provisions

Any additional provisions for the regulation of the internal affairs of the corporation: ____________________________.

Article VIII: Duration

The duration of the corporation is perpetual unless stated otherwise: ____________________________.

Execution

Incorporators must sign and date this document:

- Signature: ____________________________, Date: ____________________________.

- Signature: ____________________________, Date: ____________________________.

Key takeaways

When filling out and using the California Articles of Incorporation form, keep the following key takeaways in mind:

- Understand the purpose: This form is essential for legally establishing your corporation in California.

- Choose the right name: Ensure your corporation's name is unique and complies with California naming rules.

- Designate a registered agent: A registered agent is required to receive legal documents on behalf of your corporation.

- Include the correct information: Provide accurate details about your corporation, including the business address and purpose.

- File with the right office: Submit the completed form to the California Secretary of State’s office for processing.

- Pay the filing fee: Be prepared to pay the necessary filing fee when submitting your Articles of Incorporation.

- Obtain copies: After filing, request certified copies for your records and for any future business needs.

- Stay compliant: After incorporation, ensure you follow ongoing compliance requirements to maintain your corporation's good standing.

Similar forms

- Bylaws: Bylaws outline the internal rules and procedures for managing a corporation. Like Articles of Incorporation, they are essential for establishing how the organization operates, but they focus more on governance rather than formation.

- Emotional Support Animal Letter: An important document verifying the need for an emotional support animal, this letter can assist individuals in securing housing and travel accommodations without incurring extra pet fees. To obtain this letter, refer to Top Document Templates.

- Certificate of Incorporation: This document serves as official proof that a corporation has been legally formed. It is similar to Articles of Incorporation as both are filed with the state, but the Certificate of Incorporation is often issued after the Articles are approved.

- Operating Agreement: An Operating Agreement is typically used for LLCs and details the management structure and operational guidelines. It parallels the Articles of Incorporation in that it defines the organization’s framework, but it is more focused on day-to-day operations.

- Partnership Agreement: This document outlines the terms and conditions between partners in a business. While it differs in context, it shares similarities with Articles of Incorporation in that both establish foundational rules for business operations and relationships.