Fill Out a Valid California Death of a Joint Tenant Affidavit Template

Form Specs

| Fact Name | Description |

|---|---|

| Purpose | The California Death of a Joint Tenant Affidavit is used to remove a deceased joint tenant's name from the title of property. |

| Governing Law | This form is governed by California Probate Code Section 5600 and related statutes. |

| Eligibility | Only the surviving joint tenant can complete and file this affidavit after the death of the other joint tenant. |

| Required Information | The affidavit requires details such as the names of the joint tenants, the date of death, and a description of the property. |

| Filing Process | The completed affidavit must be filed with the county recorder's office where the property is located. |

| Effect on Ownership | Once filed, the property will be solely owned by the surviving joint tenant, simplifying the transfer of ownership. |

Dos and Don'ts

When completing the California Death of a Joint Tenant Affidavit form, it is important to follow specific guidelines to ensure accuracy and compliance. Here are some key points to consider:

- Do provide accurate information about the deceased joint tenant.

- Do include your contact information for any follow-up questions.

- Do sign and date the affidavit in the appropriate section.

- Do check for any required witnesses or notarization before submission.

- Don't leave any sections of the form blank; fill out all required fields.

- Don't use white-out or erasers; if you make a mistake, cross it out and initial it.

- Don't submit the form without making copies for your records.

- Don't forget to review the form for accuracy before submission.

- Don't overlook any specific instructions provided with the form.

Other PDF Documents

Final Waiver of Lien Chicago Title - The aim is to protect property owners while also ensuring contractors are duly recognized for their services rendered.

Understanding the importance of proper documentation is essential for navigating workers' compensation claims effectively. The WC-200a form not only allows injured employees to manage their medical treatment but is also vital in establishing a clear line of communication between all parties involved. For those seeking guidance and additional resources, you can visit https://georgiaform.com to find more information on the processes and requirements associated with this important form.

Medication Administration Record Printable - Includes a section for changes in medication routine.

Common mistakes

-

Not Providing Accurate Information: Many individuals fail to provide complete and accurate details about the deceased joint tenant. This includes their full name, date of birth, and date of death. Missing or incorrect information can lead to delays or complications in the processing of the affidavit.

-

Incorrectly Identifying the Property: It's crucial to correctly identify the property in question. This includes the full address and legal description. Errors here can cause issues in transferring ownership.

-

Failing to Sign the Affidavit: Some individuals forget to sign the affidavit. Without a signature, the document is not valid, and the process cannot move forward.

-

Not Notarizing the Document: In California, the affidavit typically needs to be notarized. Failing to have it notarized can render the document unusable in legal proceedings.

-

Omitting Required Witnesses: Depending on the situation, the affidavit may need to be signed in front of witnesses. Not including the necessary witnesses can invalidate the affidavit.

-

Ignoring Filing Requirements: After completing the affidavit, individuals must file it with the appropriate county office. Some forget this step, which is essential for the transfer of property ownership.

-

Using Outdated Forms: Laws and forms can change. Using an outdated version of the affidavit can lead to problems. Always ensure you have the most current form.

-

Not Seeking Legal Advice: Some individuals attempt to fill out the affidavit without consulting a legal expert. This can lead to mistakes that may complicate the process or create legal issues later on.

Documents used along the form

When dealing with the death of a joint tenant in California, several forms and documents may be necessary to ensure a smooth transfer of property. Each document serves a specific purpose and can help clarify the situation for all parties involved.

- Death Certificate: This official document confirms the death of the joint tenant and is often required for legal and administrative processes.

- Grant Deed: This form is used to transfer ownership of property from the deceased joint tenant to the surviving tenant, ensuring the title reflects the change.

- Affidavit of Death: Similar to the Death of a Joint Tenant Affidavit, this document can be used to provide proof of death for various legal purposes.

- Property Tax Records: Updated property tax information may be necessary to reflect the change in ownership and ensure proper tax assessments.

- Trust Documents: If the property is part of a trust, relevant trust documents may need to be reviewed or updated to reflect the change in ownership.

- Will: If the deceased had a will, it may contain instructions regarding the property and can be important for understanding the deceased's wishes.

- Probate Documents: If the estate goes through probate, various documents related to the probate process may be required for the transfer of property.

- Title Insurance Policy: Reviewing the title insurance policy can help clarify any potential issues with the property's title after the joint tenant's death.

- Notice of Change of Ownership: This form is often required by local tax authorities to update records following a change in property ownership.

- California Form REG 262: This form is required for the transfer of ownership of a vehicle or vessel in California, ensuring compliance with state laws. For more details, visit californiadocsonline.com/california-fotm-reg-262-form.

- Affidavit of Surviving Joint Tenant: This document may be used to affirm the status of the surviving joint tenant and their rights to the property.

Understanding these documents can help streamline the process after the death of a joint tenant. It is advisable to consult with a legal professional to ensure all necessary forms are completed correctly and submitted on time.

Misconceptions

The California Death of a Joint Tenant Affidavit form is often misunderstood. Below are ten common misconceptions about this form, along with clarifications for each.

-

Only attorneys can complete the form.

Anyone can fill out the affidavit, as long as they have the necessary information regarding the deceased joint tenant and the property in question.

-

The form is only needed for real estate properties.

This affidavit applies to any property held in joint tenancy, including bank accounts and other types of assets.

-

The affidavit must be filed with the court.

It is not required to file the affidavit with the court. Instead, it is typically submitted to the county recorder's office.

-

All joint tenants must sign the affidavit.

Only the surviving joint tenant needs to sign the affidavit to transfer the deceased tenant's interest in the property.

-

The affidavit can be used for any type of death.

This form is specifically for the death of a joint tenant. It does not apply to other situations, such as divorce or property disputes.

-

There is a deadline for filing the affidavit.

While it is advisable to file the affidavit promptly, there is no strict deadline imposed by law.

-

Notarization is required for the affidavit.

The affidavit does not need to be notarized, but it is often recommended to ensure authenticity.

-

The affidavit can be used to transfer property to multiple heirs.

The form only transfers the deceased joint tenant's interest to the surviving joint tenant, not to multiple heirs.

-

Filing the affidavit eliminates the need for probate.

While the affidavit helps transfer ownership, it does not eliminate the need for probate in all cases, especially if there are other assets involved.

-

There is a fee for filing the affidavit.

Most counties do charge a fee to record the affidavit, but the amount can vary by location.

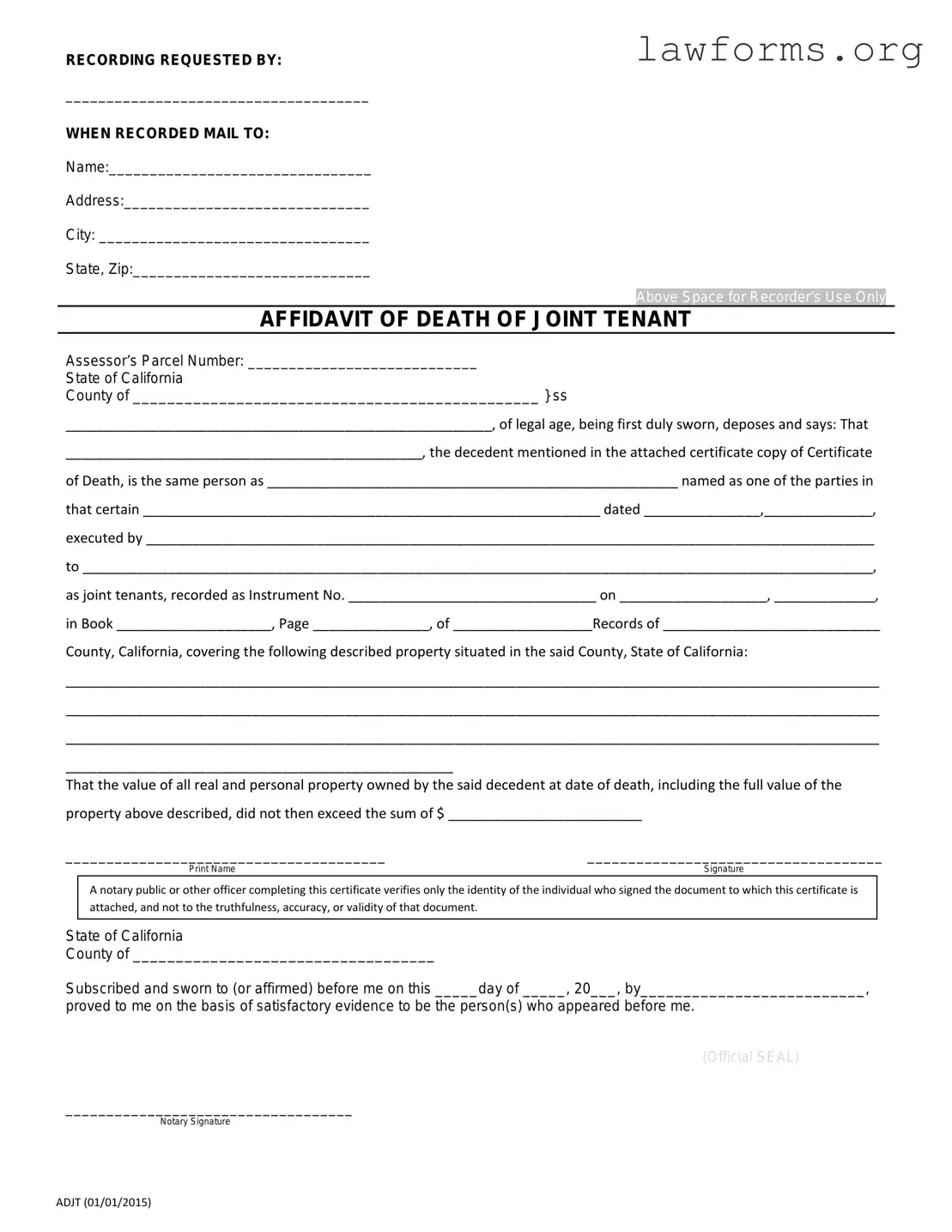

Preview - California Death of a Joint Tenant Affidavit Form

RECORDING REQUESTED BY:

_____________________________________

WHEN RECORDED MAIL TO:

Name:________________________________

Address:______________________________

City: _________________________________

State, Zip:_____________________________

Above Space for Recorder’s Use Only

AFFIDAVIT OF DEATH OF JOINT TENANT

Assessor’s Parcel Number: ____________________________

State of California

County of _______________________________________________ } ss

_______________________________________________________, of legal age, being first duly sworn, deposes and says: That

______________________________________________, the decedent mentioned in the attached certificate copy of Certificate

of Death, is the same person as _____________________________________________________ named as one of the parties in

that certain ___________________________________________________________ dated _______________,______________,

executed by ______________________________________________________________________________________________

to ______________________________________________________________________________________________________,

as joint tenants, recorded as Instrument No. ________________________________ on ___________________, _____________,

in Book ____________________, Page _______________, of __________________Records of ____________________________

County, California, covering the following described property situated in the said County, State of California:

_________________________________________________________________________________________________________

_________________________________________________________________________________________________________

_________________________________________________________________________________________________________

__________________________________________________

That the value of all real and personal property owned by the said decedent at date of death, including the full value of the property above described, did not then exceed the sum of $ _________________________

_______________________________________ |

____________________________________ |

Print Name |

Signature |

A notary public or other officer completing this certificate verifies only the identity of the individual who signed the document to which this certificate is attached, and not to the truthfulness, accuracy, or validity of that document.

State of California

County of ___________________________________

Subscribed and sworn to (or affirmed) before me on this _____day of _____, 20___, by__________________________,

proved to me on the basis of satisfactory evidence to be the person(s) who appeared before me.

(Official SEAL)

___________________________________

Notary Signature

ADJT (01/01/2015)

Key takeaways

When dealing with the California Death of a Joint Tenant Affidavit form, it is essential to understand its purpose and how to complete it properly. This form is used to transfer the property ownership when one joint tenant passes away. Here are some key takeaways to keep in mind:

- The affidavit serves as a legal document that confirms the death of one joint tenant.

- It is typically filed in the county where the property is located.

- Joint tenancy allows for automatic transfer of property rights upon the death of a tenant.

- To complete the form, you will need the deceased tenant's name, date of death, and property details.

- It is important to include a certified copy of the death certificate with the affidavit.

- All surviving joint tenants must sign the affidavit to validate the transfer.

- The form can often be obtained online or at the local county clerk's office.

- Filing the affidavit helps clear the title of the property and updates ownership records.

- Consulting with a legal professional can provide additional guidance and ensure accuracy.

Similar forms

- Affidavit of Surviving Joint Tenant: This document is used when one joint tenant passes away. It serves to confirm the survival of the remaining tenant and their right to the property. Similar to the Death of a Joint Tenant Affidavit, it helps establish ownership without going through probate.

- Grant Deed: A Grant Deed transfers property ownership from one party to another. It can be used to convey property after the death of a joint tenant, ensuring that the remaining tenant is recognized as the sole owner. Both documents facilitate the transfer of property rights.

- Probate Petition: This document is filed to initiate the probate process when someone dies. While the Death of a Joint Tenant Affidavit bypasses probate for joint tenancy properties, a Probate Petition is necessary for assets that do not automatically transfer upon death.

- New York Trailer Bill of Sale: This form is essential for the sale of a trailer, serving as a key record for ownership change. For those interested, you can download and submit the form.

- Transfer on Death Deed (TODD): A TODD allows property owners to designate beneficiaries who will receive the property upon their death. Like the Death of a Joint Tenant Affidavit, it avoids probate, providing a straightforward way to transfer property to heirs.

- Declaration of Trust: This document outlines the terms of a trust, including how property is managed and distributed after death. Similar to the Death of a Joint Tenant Affidavit, it can simplify the transfer of assets, ensuring they are passed on according to the trustor's wishes.