Attorney-Approved Deed in Lieu of Foreclosure Template for the State of California

Form Specifications

| Fact Name | Description |

|---|---|

| Definition | A Deed in Lieu of Foreclosure is a legal document where a borrower voluntarily transfers property ownership to the lender to avoid foreclosure. |

| Governing Law | California Civil Code Sections 1475-1480 govern the process and requirements for a Deed in Lieu of Foreclosure in California. |

| Eligibility | Homeowners facing financial hardship and unable to keep up with mortgage payments may qualify for this option. |

| Advantages | This process can help homeowners avoid the lengthy and stressful foreclosure process, protecting their credit score to some extent. |

| Requirements | Borrowers typically need to provide financial documentation and may need to negotiate terms with their lender. |

| Impact on Credit | While a Deed in Lieu of Foreclosure is less damaging than a foreclosure, it may still negatively affect the borrower's credit score. |

Dos and Don'ts

When filling out the California Deed in Lieu of Foreclosure form, it is essential to be thorough and accurate. Here are ten important do's and don'ts to consider:

- Do ensure that all property details are accurate and complete.

- Don't leave any sections of the form blank; every part is important.

- Do provide your current contact information for follow-up communication.

- Don't use legal jargon or complicated language; keep it simple and clear.

- Do review the form multiple times before submitting.

- Don't rush the process; take your time to ensure accuracy.

- Do consult with a legal expert if you have questions about the form.

- Don't sign the form until you fully understand its implications.

- Do keep copies of all documents submitted for your records.

- Don't forget to check the specific requirements for your county, as they may vary.

Create Popular Deed in Lieu of Foreclosure Forms for Different States

Deed in Lieu - This option can simplify the exit for homeowners struggling to keep up with mortgage payments.

Deed in Lieu of Foreclosure Form - This form of property transfer often requires that the borrower vacate the premises upon completion.

In situations where a parent or guardian is unable to be present for their child's care, utilizing a Georgia Power of Attorney for a Child form can be crucial. This legal tool empowers another trusted adult to make essential decisions regarding the child's welfare, including education and healthcare. For more detailed information and resources, you can visit https://georgiaform.com/.

What Does an Arizona Homeowner Lose When Choosing to Use Deed in Lieu of Foreclosure? - It can be a less stressful alternative for homeowners facing financial challenges, offering a clean break.

Sale in Lieu of Foreclosure - It's advisable for borrowers to explore all options before opting for a Deed in Lieu.

Common mistakes

-

Not verifying ownership: Before filling out the form, individuals often forget to confirm that they are the legal owners of the property. This step is crucial, as only the rightful owner can transfer the deed.

-

Incomplete information: Many people leave sections of the form blank. Omitting details such as the property address or legal description can lead to delays or complications in the process.

-

Failing to understand the implications: Some individuals do not fully grasp the consequences of signing a deed in lieu of foreclosure. This action can impact credit scores and future borrowing capabilities.

-

Not obtaining necessary signatures: A common mistake is neglecting to gather all required signatures. If multiple parties are involved, every owner must sign the document for it to be valid.

-

Ignoring local laws: People often overlook the specific requirements that may vary by county or city. Familiarizing oneself with local regulations is essential to ensure compliance and avoid issues.

Documents used along the form

A Deed in Lieu of Foreclosure is a legal document that allows a borrower to transfer ownership of their property to the lender to avoid foreclosure. Several other forms and documents are commonly used in conjunction with this process to ensure that all parties understand their rights and obligations. Below is a list of these documents, each described briefly.

- Loan Modification Agreement: This document outlines the terms of a change in the loan agreement, which may include adjustments to the interest rate, payment schedule, or principal balance. It is often used as an alternative to foreclosure.

- Notice of Default: A formal notification sent by the lender to the borrower indicating that the borrower has defaulted on the loan. This document serves as a precursor to foreclosure proceedings.

- Release of Liability: This document releases the borrower from any further obligations related to the mortgage after the property has been transferred to the lender. It is essential for protecting the borrower's credit and financial future.

- Settlement Statement: Also known as a HUD-1, this document provides a detailed account of all financial transactions related to the property transfer, including any fees or costs incurred during the process.

- Affidavit of Title: This sworn statement confirms the borrower's ownership of the property and discloses any liens or encumbrances. It helps ensure that the lender receives clear title to the property.

- Property Condition Disclosure: This document provides information about the condition of the property, including any known defects or issues. It is important for the lender to understand what they are acquiring.

- Ohio Operating Agreement: The Ohio Operating Agreement is a crucial document for limited liability companies (LLCs) in Ohio, outlining the management structure and operational procedures of the business. This agreement serves as a roadmap for members, detailing their rights, responsibilities, and the distribution of profits and losses. Understanding this form is essential for ensuring compliance and fostering a harmonious business environment. For more information, you can visit Ohio PDF Forms.

- Escrow Instructions: This document outlines the terms and conditions under which the escrow agent will operate, including how funds and documents will be handled during the transfer process.

- Deed of Trust: A legal document that secures a loan by transferring the property title to a trustee until the borrower repays the loan. It is often involved in the overall mortgage process.

These documents play a crucial role in the Deed in Lieu of Foreclosure process, helping to clarify the responsibilities of each party and facilitate a smoother transition of property ownership. Understanding each document's purpose can assist all involved in navigating the complexities of this legal procedure.

Misconceptions

Understanding the California Deed in Lieu of Foreclosure can be challenging, especially with the many misconceptions surrounding it. Here are eight common misunderstandings:

- It eliminates all debt immediately. Many believe that signing a deed in lieu automatically wipes out all mortgage debt. In reality, while it can relieve you of the mortgage, other debts might still remain.

- It’s the same as a short sale. A deed in lieu is not the same as a short sale. In a short sale, the property is sold for less than what is owed on the mortgage, while a deed in lieu transfers ownership back to the lender without a sale.

- It affects credit the same way as a foreclosure. While both can impact credit scores, a deed in lieu may have a slightly less severe effect than a foreclosure. However, it will still be a negative mark on your credit report.

- All lenders accept deeds in lieu. Not all lenders are open to this option. Some may prefer to go through the foreclosure process, so it’s essential to check with your lender.

- It’s a quick process. Many think that a deed in lieu is a fast way to resolve mortgage issues. In fact, it can take time to negotiate and finalize the agreement with the lender.

- You won’t need legal advice. Some homeowners believe they can navigate the process without professional help. However, consulting with a legal expert can provide valuable guidance and protect your interests.

- It releases all liabilities. A deed in lieu may not release you from all liabilities associated with the property, such as homeowner association fees or property taxes.

- It’s a guaranteed solution to avoid foreclosure. While a deed in lieu can help some homeowners avoid foreclosure, it’s not a guaranteed solution. The lender must agree to the terms, and other factors may come into play.

Being aware of these misconceptions can help homeowners make informed decisions when facing financial difficulties.

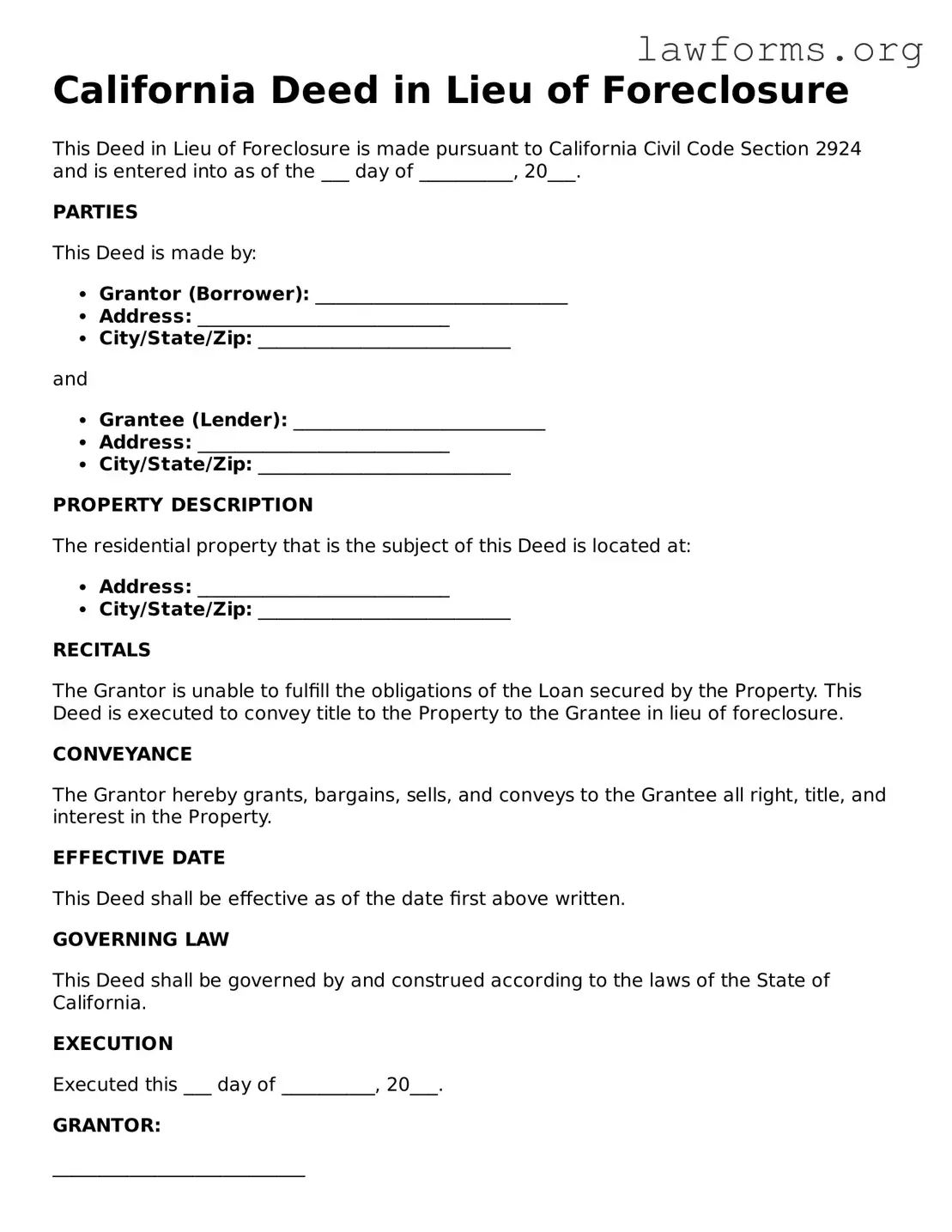

Preview - California Deed in Lieu of Foreclosure Form

California Deed in Lieu of Foreclosure

This Deed in Lieu of Foreclosure is made pursuant to California Civil Code Section 2924 and is entered into as of the ___ day of __________, 20___.

PARTIES

This Deed is made by:

- Grantor (Borrower): ___________________________

- Address: ___________________________

- City/State/Zip: ___________________________

and

- Grantee (Lender): ___________________________

- Address: ___________________________

- City/State/Zip: ___________________________

PROPERTY DESCRIPTION

The residential property that is the subject of this Deed is located at:

- Address: ___________________________

- City/State/Zip: ___________________________

RECITALS

The Grantor is unable to fulfill the obligations of the Loan secured by the Property. This Deed is executed to convey title to the Property to the Grantee in lieu of foreclosure.

CONVEYANCE

The Grantor hereby grants, bargains, sells, and conveys to the Grantee all right, title, and interest in the Property.

EFFECTIVE DATE

This Deed shall be effective as of the date first above written.

GOVERNING LAW

This Deed shall be governed by and construed according to the laws of the State of California.

EXECUTION

Executed this ___ day of __________, 20___.

GRANTOR:

___________________________

Signature of Grantor

GRANTEE:

___________________________

Signature of Grantee

Witnessed by:

___________________________

Signature of Witness

___________________________

Name of Witness

Key takeaways

When considering a Deed in Lieu of Foreclosure in California, it is essential to understand the implications and requirements of the process. Here are some key takeaways to keep in mind:

- Understand the Purpose: A Deed in Lieu of Foreclosure allows a homeowner to voluntarily transfer ownership of their property to the lender to avoid foreclosure.

- Eligibility Requirements: Not all homeowners qualify. Lenders typically require that the borrower is facing financial hardship and cannot continue making mortgage payments.

- Consult with Professionals: It is advisable to seek guidance from a real estate attorney or financial advisor to understand the consequences and benefits of this option.

- Impact on Credit Score: This process can negatively affect your credit score, but it may be less damaging than a foreclosure.

- Negotiate with Your Lender: Before submitting the deed, discuss the terms with your lender. They may agree to forgive any remaining debt after the property transfer.

- Documentation is Key: Complete all necessary forms accurately. This includes the Deed in Lieu of Foreclosure form and any additional documents your lender may require.

- Property Condition: Ensure the property is in good condition. Lenders may refuse the deed if the property is not well-maintained.

- Timing Matters: Initiate the process as early as possible to avoid the impending foreclosure and to give your lender ample time to review your request.

- Seek Alternatives: Explore other options such as loan modification or short sale before committing to a Deed in Lieu of Foreclosure.

Being informed and prepared can make a significant difference in navigating this challenging situation. Take the time to understand each step and make decisions that are in your best interest.

Similar forms

- Short Sale Agreement: This document allows a homeowner to sell their property for less than the amount owed on the mortgage. Like a deed in lieu of foreclosure, it helps avoid foreclosure by transferring ownership to the buyer, often with lender approval.

- Loan Modification Agreement: This document alters the terms of an existing mortgage to make payments more manageable. Similar to a deed in lieu of foreclosure, it seeks to prevent foreclosure while keeping the homeowner in possession of the property.

- Forbearance Agreement: This is an arrangement between a lender and borrower to temporarily suspend or reduce mortgage payments. It shares the goal of preventing foreclosure, allowing the homeowner time to regain financial stability.

- Bankruptcy Filing: Filing for bankruptcy can halt foreclosure proceedings. While it’s a legal process, it serves a similar purpose to a deed in lieu by providing the homeowner with a way to address overwhelming debt and retain some control over their property.

- Civil Case Cover Sheet: The California Civil form, specifically the Civil Case Cover Sheet (CM-010), is essential for initiating civil cases in California, helping the court manage cases effectively. For more information, visit https://californiadocsonline.com/california-civil-form/.

- Quitclaim Deed: This document transfers ownership of a property without warranty. It can be used to transfer property back to the lender, similar to a deed in lieu, though it typically does not involve a negotiated settlement.

- Release of Lien: This document removes a lender's claim on a property after the debt is settled. Like a deed in lieu of foreclosure, it signifies the end of the borrower's obligation, although it usually follows the sale or transfer of the property.