Attorney-Approved Deed Template for the State of California

Form Specifications

| Fact Name | Description |

|---|---|

| Definition | A California Deed form is a legal document used to transfer ownership of real property from one party to another. |

| Types of Deeds | Common types include Grant Deeds, Quitclaim Deeds, and Warranty Deeds, each serving different purposes in property transfer. |

| Governing Law | The California Civil Code governs the use and requirements of deed forms in the state. |

| Signature Requirement | The deed must be signed by the grantor (the person transferring the property) to be valid. |

| Notarization | Although not always required, notarization is highly recommended to ensure the deed's authenticity. |

| Recording | To provide public notice of the property transfer, the deed should be recorded with the county recorder's office. |

| Legal Description | A precise legal description of the property must be included to identify it clearly in the deed. |

| Consideration | The deed should state the consideration, or payment, involved in the property transfer, although it may be nominal. |

| Revocation | Once recorded, a deed cannot be easily revoked; a new deed must be executed to change ownership. |

Dos and Don'ts

When filling out the California Deed form, attention to detail is crucial. Here are six important guidelines to follow:

- Do ensure that all names are spelled correctly. Accurate spelling prevents future legal complications.

- Do provide a complete and accurate description of the property. This includes the address and any relevant parcel numbers.

- Do sign the form in the presence of a notary public. A notarized deed is often required for it to be legally binding.

- Do check local requirements. Some counties may have specific rules regarding deed filings.

- Don't leave any fields blank. Incomplete forms may be rejected or cause delays in processing.

- Don't use white-out or make alterations on the form. Any changes should be initialed by all parties involved.

Create Popular Deed Forms for Different States

Sample Deed - Not every transfer of property requires a deed; some may occur under different legal processes.

Florida Deed Form - Helps prevent disputes about property ownership and rights.

When completing a transaction involving the transfer of ownership of a mobile home, it is vital to utilize the appropriate legal documentation to prevent any misunderstandings. The Washington Mobile Home Bill of Sale form is essential in this process, as it captures vital information regarding the buyer and seller, along with specific details about the mobile home and the agreed sale price. For those needing assistance in creating this document, Resources from Forms Washington can be invaluable in ensuring that all necessary components are properly included.

Deed Transfer Nj - A deed can include provisions for the rights of future owners regarding property use and maintenance.

Common mistakes

-

Incorrect Names: One common mistake is misspelling names or using incorrect legal names. Ensure that all parties’ names match their official identification documents.

-

Missing Signatures: Failing to sign the deed is a frequent oversight. All parties involved must sign the document for it to be valid.

-

Improper Notarization: Some individuals neglect to have the deed properly notarized. A notary public must witness the signatures for the deed to be legally binding.

-

Incorrect Property Description: Providing an inaccurate or vague description of the property can lead to legal complications. Always include the complete legal description as it appears in public records.

-

Omitting the Date: Forgetting to date the deed can create confusion regarding when the transfer took place. Always include the date of execution.

-

Failure to Identify Grantee: Not clearly identifying the grantee can render the deed ineffective. Make sure to provide the full name and address of the person receiving the property.

-

Inaccurate Tax Information: Misreporting property tax information or failing to include it can lead to tax issues later. Verify all tax details before submission.

-

Ignoring Local Requirements: Different counties may have specific requirements for deed forms. Always check local regulations to ensure compliance.

-

Using Outdated Forms: Utilizing an outdated version of the deed form can cause problems. Always obtain the latest form from a reliable source.

-

Not Keeping Copies: Failing to keep copies of the completed deed can lead to issues in the future. Always retain a signed copy for your records.

Documents used along the form

When completing a property transfer in California, several forms and documents may accompany the California Deed form. Each of these documents serves a specific purpose and helps ensure that the transaction is legally sound and properly recorded. Below is a list of common forms and documents that are often used alongside the California Deed.

- Grant Deed: This document is used to transfer ownership of real property from one party to another. It includes a guarantee that the property has not been sold to anyone else and that there are no undisclosed encumbrances.

- Quitclaim Deed: A quitclaim deed transfers whatever interest the grantor has in the property without making any promises about the quality of the title. This is often used between family members or in divorce settlements.

- Title Report: This document provides a detailed history of the property’s title, including any liens, easements, or other claims against it. It helps buyers understand the legal standing of the property.

- Marital Separation Agreement: To clearly outline the terms of your separation, consider utilizing the comprehensive Marital Separation Agreement resource that defines asset division and custody arrangements.

- Preliminary Change of Ownership Report: Required by the county assessor, this form informs the county of a change in property ownership and helps determine property taxes.

- Affidavit of Death: This document is used to transfer property ownership when the owner has passed away. It provides proof of death and may simplify the transfer process.

- Power of Attorney: If a party is unable to sign the deed in person, a power of attorney allows another person to act on their behalf, facilitating the property transfer.

- Certificate of Compliance: This certificate confirms that the property complies with local zoning laws and regulations, which can be crucial for the buyer.

- Escrow Instructions: These are detailed instructions provided to an escrow agent, outlining how to handle the funds and documents involved in the property transaction.

- Homeowner's Association (HOA) Documents: If the property is part of an HOA, these documents provide information about the association's rules, fees, and regulations that the new owner will need to follow.

- Property Tax Statement: This statement outlines the current property taxes owed on the property and is often reviewed during the transfer process to ensure all taxes are up to date.

Understanding these documents can greatly aid in navigating the complexities of property transactions in California. Each form plays a vital role in ensuring that the transfer of ownership is smooth and legally binding. It is always advisable to seek guidance when dealing with property matters to ensure compliance with all legal requirements.

Misconceptions

Many people have misunderstandings about the California Deed form. These misconceptions can lead to confusion and mistakes. Here are nine common misconceptions explained:

- All deeds are the same. This is not true. There are different types of deeds, such as grant deeds and quitclaim deeds, each serving a different purpose.

- A deed must be notarized to be valid. While notarization is often recommended, it is not always required for a deed to be valid in California.

- Only a lawyer can prepare a deed. This is a misconception. Many people can prepare their own deeds, but it is wise to seek legal advice to ensure accuracy.

- Once a deed is signed, it cannot be changed. This is false. Deeds can be amended or revoked, but the process must be followed correctly.

- Deeds are only for transferring ownership. Deeds can also be used to create certain rights, such as easements, not just to transfer ownership.

- All deeds must be recorded. Recording a deed is important for public notice, but it is not legally required for the deed to be effective.

- Only real estate can be transferred through a deed. This is misleading. While deeds are commonly used for real estate, they can also be used for other types of property.

- Once a deed is recorded, it cannot be challenged. This is incorrect. A recorded deed can still be contested in court under certain circumstances.

- The California Deed form is complicated. Many find the form straightforward. With some basic understanding, it can be filled out without too much difficulty.

Understanding these misconceptions can help individuals navigate the process of dealing with deeds in California more effectively.

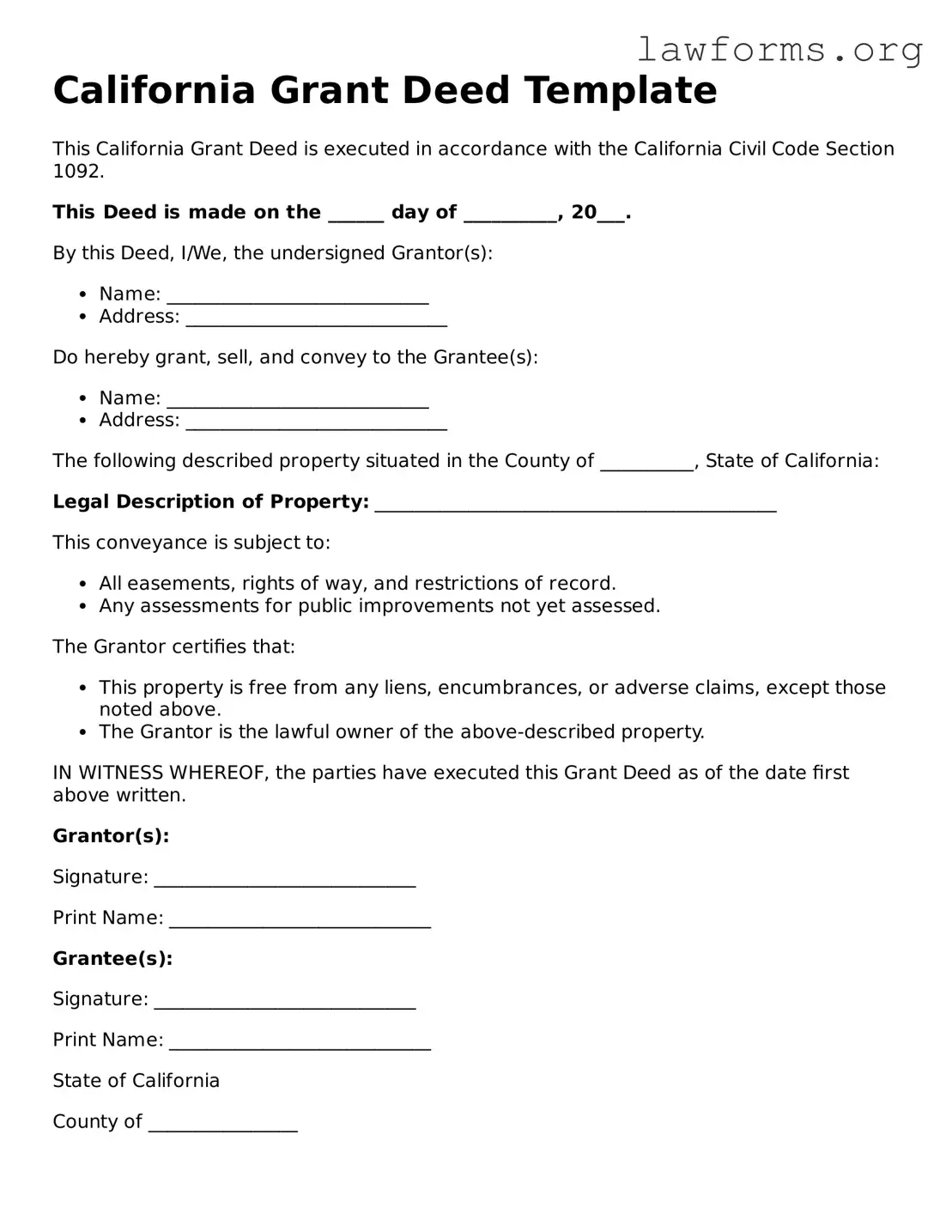

Preview - California Deed Form

California Grant Deed Template

This California Grant Deed is executed in accordance with the California Civil Code Section 1092.

This Deed is made on the ______ day of __________, 20___.

By this Deed, I/We, the undersigned Grantor(s):

- Name: ____________________________

- Address: ____________________________

Do hereby grant, sell, and convey to the Grantee(s):

- Name: ____________________________

- Address: ____________________________

The following described property situated in the County of __________, State of California:

Legal Description of Property: ___________________________________________

This conveyance is subject to:

- All easements, rights of way, and restrictions of record.

- Any assessments for public improvements not yet assessed.

The Grantor certifies that:

- This property is free from any liens, encumbrances, or adverse claims, except those noted above.

- The Grantor is the lawful owner of the above-described property.

IN WITNESS WHEREOF, the parties have executed this Grant Deed as of the date first above written.

Grantor(s):

Signature: ____________________________

Print Name: ____________________________

Grantee(s):

Signature: ____________________________

Print Name: ____________________________

State of California

County of ________________

On this ______ day of __________, 20___, before me, ____________________, a Notary Public in and for said State, personally appeared ____________________, known to me (or proved to me on the oath of ____________________) to be the person(s) whose name(s) is/are subscribed to the within instrument and acknowledged to me that he/she/they executed the same.

WITNESS my hand and official seal.

Signature: ____________________________

Notary Public, State of California

Key takeaways

When filling out and using the California Deed form, it is essential to keep several key points in mind to ensure the process goes smoothly and legally.

- Accuracy is Crucial: Each section of the Deed form must be filled out with precise information. This includes the names of the parties involved, property description, and any relevant legal language. Mistakes can lead to complications in ownership transfer.

- Notarization Requirement: The completed Deed must be notarized. This means that a notary public must witness the signing of the document. Notarization adds a layer of authenticity and helps prevent fraud.

- Recording the Deed: After the Deed is signed and notarized, it should be recorded with the county recorder's office where the property is located. This step is vital as it provides public notice of the change in ownership and protects the new owner's rights.

- Consult Legal Help if Needed: If there are any uncertainties or complexities regarding the Deed, seeking legal advice can be beneficial. A professional can provide guidance on specific circumstances and ensure compliance with all legal requirements.

Similar forms

- Contract: A contract is an agreement between parties that outlines obligations and rights. Like a deed, it requires mutual consent and can be enforceable in court.

- Lease Agreement: A lease agreement allows one party to use another's property for a specified time in exchange for rent. It shares similarities with a deed in that it establishes legal rights to property.

- Bill of Sale: A bill of sale transfers ownership of personal property from one party to another. Both documents formalize the transfer of ownership and are typically signed by both parties.

- Motor Vehicle Bill of Sale: This legal document is crucial for proving the sale and purchase transaction of a vehicle. It records the details of the vehicle and the involved parties, protecting both the seller's and the buyer's interests. For more information and a template, visit Formaid Org.

- Power of Attorney: A power of attorney grants one person the authority to act on another's behalf. Like a deed, it must be executed with specific formalities to be valid.

- Trust Agreement: A trust agreement establishes a trust, allowing one party to hold property for the benefit of another. Both documents create legal relationships regarding property management.

- Mortgage: A mortgage secures a loan with real property. Similar to a deed, it involves the transfer of interest in property and must be recorded to protect the lender's rights.

- Warranty Deed: A warranty deed guarantees that the seller holds clear title to the property. While a deed is a broader category, a warranty deed is a specific type that provides additional assurances.

- Quitclaim Deed: A quitclaim deed transfers any interest the grantor may have in a property without warranties. It is similar to a deed in that it conveys property rights but does so with less assurance.

- Affidavit: An affidavit is a written statement confirmed by oath. Like a deed, it serves as a formal declaration of facts that can be used in legal proceedings.

- Settlement Statement: A settlement statement outlines the financial details of a real estate transaction. It is similar to a deed in that it documents the transfer of property and the associated costs.