Attorney-Approved Durable Power of Attorney Template for the State of California

Form Specifications

| Fact Name | Description |

|---|---|

| Definition | A California Durable Power of Attorney allows an individual to appoint someone to make financial and legal decisions on their behalf. |

| Governing Law | The form is governed by the California Probate Code, specifically Sections 4000-4545. |

| Durability | This document remains effective even if the principal becomes incapacitated. |

| Agent Authority | The appointed agent can perform a variety of financial tasks, including managing bank accounts and selling property. |

| Principal's Signature | The principal must sign the document for it to be valid, and it should be dated. |

| Witness Requirements | Two witnesses or a notary public must acknowledge the principal's signature on the document. |

| Revocation | The principal can revoke the Durable Power of Attorney at any time, as long as they are competent. |

| Agent's Duties | The agent is required to act in the best interest of the principal and manage their affairs responsibly. |

| Limitations | Some powers, such as making medical decisions, require a separate document, like an Advance Health Care Directive. |

Dos and Don'ts

When filling out the California Durable Power of Attorney form, it is crucial to adhere to specific guidelines to ensure that your document is valid and effective. Below is a list of ten important dos and don'ts.

- Do clearly identify the principal and agent by providing full names and addresses.

- Do specify the powers granted to the agent in clear and concise language.

- Do date and sign the document in the presence of a notary public.

- Do discuss your intentions with your chosen agent before completing the form.

- Do keep copies of the completed document for your records and provide one to your agent.

- Don't leave any sections of the form blank; ensure all required fields are filled out.

- Don't use vague language that could lead to misinterpretation of your wishes.

- Don't sign the document without understanding the powers you are granting.

- Don't assume that a verbal agreement suffices; written documentation is necessary.

- Don't forget to review and update the document if your circumstances change.

By following these guidelines, you can help ensure that your Durable Power of Attorney form is completed correctly and meets your needs.

Create Popular Durable Power of Attorney Forms for Different States

Power of Attorney Texas Form - Choosing this route can help avoid potential legal complications later on.

Financial Power of Attorney New Jersey - You can have specific instructions included in the document to guide your agent's actions.

Common mistakes

-

Not Understanding the Purpose: Many individuals fill out the Durable Power of Attorney form without fully understanding its purpose. This document allows a designated person to make decisions on your behalf if you become unable to do so.

-

Choosing the Wrong Agent: Selecting an agent who is not trustworthy or lacks the necessary skills can lead to complications. It is crucial to choose someone who understands your values and wishes.

-

Failing to Specify Powers: Some people overlook the importance of clearly specifying the powers granted to the agent. Vague language can lead to misunderstandings about what the agent is authorized to do.

-

Not Including Successor Agents: Failing to name a successor agent can create a gap in decision-making if the primary agent is unavailable. It is wise to have a backup to ensure continuity.

-

Neglecting to Sign and Date: A common oversight is not signing and dating the document. Without these, the form may be considered invalid, leaving your wishes unfulfilled.

-

Inadequate Witnessing or Notarization: Some individuals forget that the Durable Power of Attorney must be witnessed or notarized. This step is essential to ensure the document is legally binding.

-

Not Reviewing the Document Regularly: Once completed, people often neglect to review their Durable Power of Attorney. Changes in circumstances may necessitate updates to the document.

-

Ignoring State-Specific Requirements: Each state has specific laws regarding Durable Power of Attorney forms. Failing to adhere to California's requirements can invalidate the document.

Documents used along the form

A California Durable Power of Attorney is an essential document that allows you to appoint someone to manage your financial and legal affairs if you become incapacitated. To ensure comprehensive planning, consider these additional forms and documents that often accompany the Durable Power of Attorney.

- Advance Healthcare Directive: This document outlines your healthcare preferences and appoints someone to make medical decisions on your behalf if you are unable to do so.

- Last Will and Testament: A legal document that specifies how your assets will be distributed after your death and can name guardians for minor children.

- Revocable Living Trust: This trust holds your assets during your lifetime and allows for a smooth transfer to your beneficiaries upon your death, avoiding probate.

- HIPAA Authorization: This form grants permission for healthcare providers to share your medical information with designated individuals, ensuring they can make informed decisions.

- Financial Power of Attorney: Similar to the Durable Power of Attorney, this document specifically focuses on financial matters, allowing someone to manage your finances and property.

- Beneficiary Designations: These forms specify who will receive assets from accounts like life insurance, retirement plans, or bank accounts upon your death, overriding your will if necessary.

- Property Deeds: If you own real estate, updating property deeds can clarify ownership and ensure a smooth transfer of property to heirs.

- Guardianship Designation: This document allows you to designate a guardian for your minor children, ensuring their care aligns with your wishes in the event of your passing.

Considering these documents alongside your Durable Power of Attorney can provide peace of mind and ensure your wishes are honored. It's essential to review and update these forms regularly to reflect any changes in your circumstances or preferences.

Misconceptions

Misconceptions about the California Durable Power of Attorney form can lead to confusion and potentially serious consequences. Here are five common misconceptions:

- It only applies to financial matters. Many people believe that a Durable Power of Attorney (DPOA) is limited to financial decisions. However, it can also grant authority for healthcare decisions if specified in the document.

- It becomes invalid if the principal becomes incapacitated. This is incorrect. A DPOA is designed to remain effective even if the principal becomes incapacitated, allowing the agent to act on their behalf.

- Anyone can be appointed as an agent. While it is true that individuals can choose their agents, there are certain restrictions. For example, the agent must be at least 18 years old and cannot be the principal's healthcare provider or an employee of the healthcare provider.

- Once signed, it cannot be changed or revoked. This misconception is false. A principal can revoke or change their DPOA at any time, as long as they are mentally competent to do so.

- It is the same as a regular Power of Attorney. A Durable Power of Attorney differs from a regular Power of Attorney in that it remains effective even if the principal becomes incapacitated. A regular Power of Attorney may terminate under such circumstances.

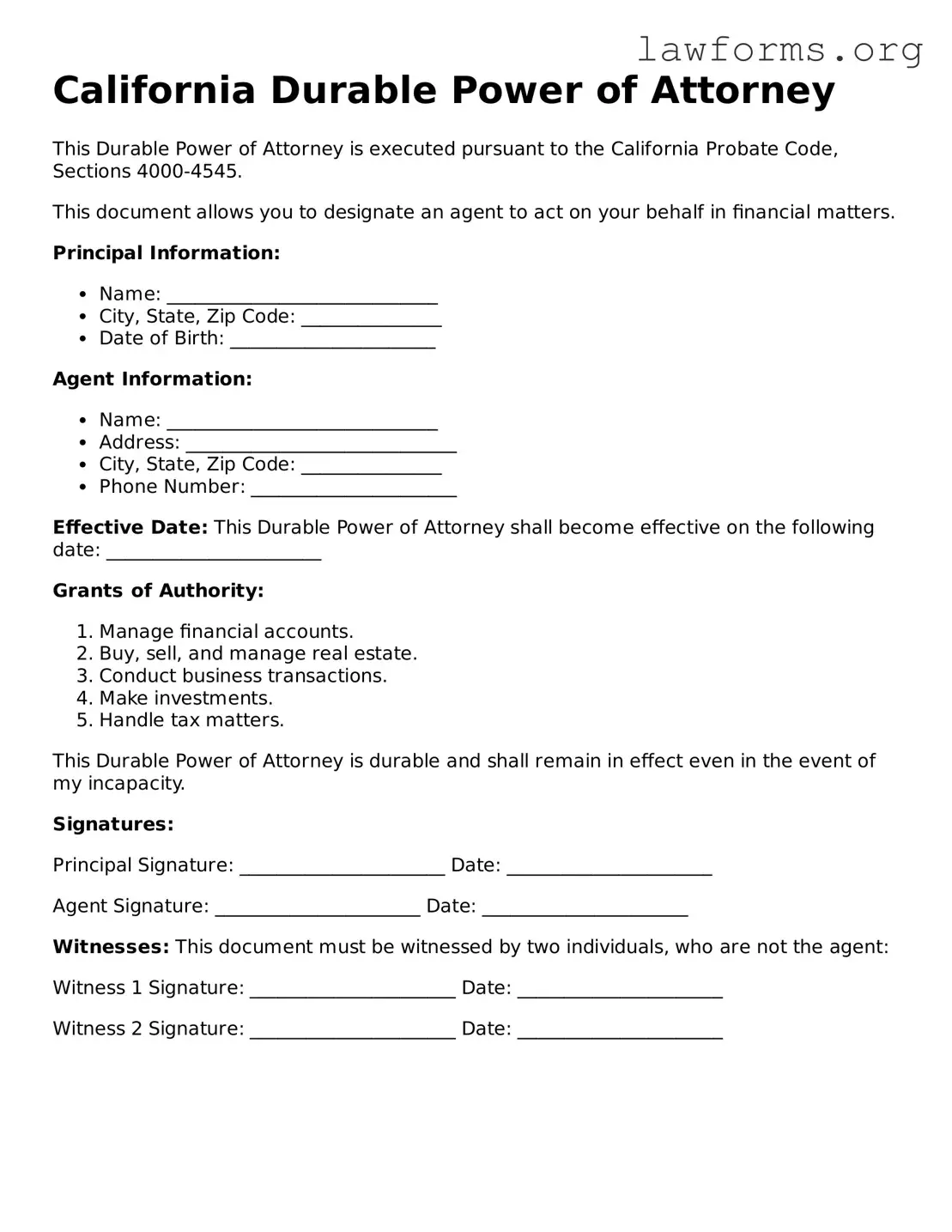

Preview - California Durable Power of Attorney Form

California Durable Power of Attorney

This Durable Power of Attorney is executed pursuant to the California Probate Code, Sections 4000-4545.

This document allows you to designate an agent to act on your behalf in financial matters.

Principal Information:

- Name: _____________________________

- City, State, Zip Code: _______________

- Date of Birth: ______________________

Agent Information:

- Name: _____________________________

- Address: _____________________________

- City, State, Zip Code: _______________

- Phone Number: ______________________

Effective Date: This Durable Power of Attorney shall become effective on the following date: _______________________

Grants of Authority:

- Manage financial accounts.

- Buy, sell, and manage real estate.

- Conduct business transactions.

- Make investments.

- Handle tax matters.

This Durable Power of Attorney is durable and shall remain in effect even in the event of my incapacity.

Signatures:

Principal Signature: ______________________ Date: ______________________

Agent Signature: ______________________ Date: ______________________

Witnesses: This document must be witnessed by two individuals, who are not the agent:

Witness 1 Signature: ______________________ Date: ______________________

Witness 2 Signature: ______________________ Date: ______________________

Key takeaways

When filling out and using the California Durable Power of Attorney form, consider the following key takeaways:

- The form allows you to designate an agent to make decisions on your behalf regarding financial and legal matters.

- It is essential to choose a trustworthy individual as your agent, as they will have significant authority over your affairs.

- The form must be signed in front of a notary public or two witnesses to be legally valid.

- You can specify the powers granted to your agent, including financial transactions, real estate decisions, and managing investments.

- The Durable Power of Attorney remains effective even if you become incapacitated, ensuring continuous management of your affairs.

- Revocation of the Durable Power of Attorney can be done at any time, provided you inform your agent and any relevant institutions.

- It is advisable to provide copies of the completed form to your agent, financial institutions, and healthcare providers.

- Review the form periodically to ensure it still reflects your wishes and circumstances.

Similar forms

- General Power of Attorney: This document grants authority to an agent to make decisions on behalf of the principal. Like the Durable Power of Attorney, it can cover financial and legal matters. However, it typically becomes invalid if the principal becomes incapacitated.

- Healthcare Power of Attorney: This form allows an individual to appoint someone to make medical decisions on their behalf if they are unable to do so. Similar to the Durable Power of Attorney, it ensures that the principal's wishes are respected when they cannot communicate them.

- Living Will: A Living Will outlines a person's preferences regarding medical treatment in end-of-life situations. While it does not appoint an agent, it serves a similar purpose by ensuring that an individual’s healthcare wishes are honored when they cannot express them.

- Revocable Trust: This legal document allows a person to place their assets into a trust during their lifetime. It can be altered or revoked, similar to how a Durable Power of Attorney can be changed while the principal is still competent. Both documents help manage affairs during incapacity.

- Motor Vehicle Bill of Sale: This important document serves as proof of transaction between the seller and the buyer, detailing the specifics of the vehicle and the terms of sale. For a reliable template, visit Formaid Org.

- Advance Healthcare Directive: This document combines a Living Will and a Healthcare Power of Attorney. It provides instructions for medical care and appoints a representative. Like the Durable Power of Attorney, it ensures that decisions align with the individual’s wishes when they cannot voice them.