Attorney-Approved Employment Verification Template for the State of California

Form Specifications

| Fact Name | Description |

|---|---|

| Purpose | The California Employment Verification form is used to confirm an employee's employment status and details for various purposes, including loan applications and government benefits. |

| Governing Law | This form is governed by California Labor Code Section 1198.5, which ensures employees have the right to access their employment records. |

| Who Can Request | Both employees and authorized third parties, such as lenders or government agencies, can request verification of employment. |

| Required Information | The form typically requires details such as the employee's name, job title, employment dates, and possibly salary information. |

| Response Time | Employers are generally required to respond to requests for employment verification within a reasonable timeframe, often within 5 business days. |

| Confidentiality | Employers must handle the information provided in the verification form with care, respecting the employee's privacy rights under California law. |

Dos and Don'ts

When filling out the California Employment Verification form, it is essential to follow specific guidelines to ensure accuracy and compliance. Here is a list of things you should and shouldn't do:

- Do provide accurate and complete information about your employment history.

- Do include your current employer's contact information.

- Do sign and date the form before submission.

- Do review the form for any errors or omissions.

- Don't leave any sections blank unless instructed otherwise.

- Don't provide false or misleading information.

- Don't forget to keep a copy of the completed form for your records.

Create Popular Employment Verification Forms for Different States

Ohio Certification Verification - It’s important to know your rights regarding this verification.

The EDD DE 2501 form is an important document used to apply for California Disability Insurance benefits. It allows individuals who are unable to work due to a non-work-related illness or injury to receive financial assistance. To simplify the process of filling out this form, you may want to refer to resources available at Top Document Templates, as accuracy is essential for ensuring timely support, so consider submitting it by clicking the button below.

Verification of Employment/loss of Income - This document can confirm an employee's eligibility for certain licenses or permits.

Common mistakes

-

Incomplete Information: Failing to provide all required details can lead to delays. Ensure that every section is filled out completely.

-

Incorrect Dates: Providing inaccurate employment dates can create confusion. Double-check the start and end dates of employment.

-

Wrong Job Title: Listing an incorrect job title may misrepresent the employee’s role. Verify the title with the employee’s records.

-

Missing Employer Information: Omitting the employer’s contact details can hinder verification. Include a valid phone number and address.

-

Signature Errors: Not signing the form or using an incorrect signature can invalidate it. Make sure the signature matches the name provided.

-

Using Abbreviations: Abbreviating terms can lead to misunderstandings. Use full names and titles to ensure clarity.

-

Neglecting to Date the Form: Forgetting to include the date of completion can cause issues. Always date the form before submission.

-

Providing Unverified Information: Including details that cannot be verified can lead to complications. Ensure all information is accurate and can be confirmed.

-

Ignoring Privacy Concerns: Not considering the confidentiality of the information shared can lead to breaches. Be mindful of the sensitive nature of employment details.

Documents used along the form

When navigating the employment verification process in California, several forms and documents may be required alongside the California Employment Verification form. Each of these documents serves a unique purpose and contributes to establishing a comprehensive employment history. Below is a list of commonly used forms that can facilitate this process.

- W-2 Form: This form reports an employee's annual wages and the taxes withheld from their paycheck. Employers provide it to employees at the end of each tax year, and it is often used to verify income and employment status.

- Pay Stubs: These are documents provided by employers that detail an employee's earnings for a specific pay period. They include information on gross pay, deductions, and net pay, making them useful for verifying current employment and income.

- Offer Letter: This document outlines the terms of employment, including job title, salary, and benefits. It is typically provided to new hires and can help verify the initial employment agreement.

- Employment Contract: A formal agreement between an employer and employee that specifies job duties, salary, and other employment terms. This document can clarify the nature of the employment relationship.

- Reference Letters: These letters are written by previous employers or colleagues attesting to an individual's work ethic and capabilities. They can support the employment verification process by providing additional context about the employee's past roles.

- Social Security Card: While not always required, this card verifies an employee's identity and eligibility to work in the United States. It can be helpful for confirming employment eligibility.

- Tax Returns: Personal tax returns can provide a comprehensive view of an individual’s income over several years. They are sometimes requested to verify income, especially for loans or rental applications.

- Background Check Authorization: This form allows an employer to conduct a background check on a potential employee. It is often part of the hiring process and can help verify an applicant's employment history.

Understanding these documents can help streamline the employment verification process, ensuring that all necessary information is gathered efficiently. Having these forms ready can facilitate smoother communication between employers and employees, ultimately supporting a successful employment relationship.

Misconceptions

Understanding the California Employment Verification form is crucial for both employers and employees. However, several misconceptions exist about this important document. Below are eight common misconceptions, along with explanations to clarify the truth.

- Misconception 1: The Employment Verification form is only for new hires.

- Misconception 2: Employers are required to use a specific format for the form.

- Misconception 3: Only full-time employees need to be verified.

- Misconception 4: The form can be filled out by anyone in the company.

- Misconception 5: Employees cannot contest the information on the form.

- Misconception 6: The form is not legally binding.

- Misconception 7: Employers can disclose any information they want on the form.

- Misconception 8: The Employment Verification form is only necessary for certain industries.

This is incorrect. While the form is often used during the hiring process, it can also be utilized for existing employees, especially when verifying employment history for loans or other purposes.

There is no mandated format that employers must follow. They can create their own version of the Employment Verification form as long as it includes the necessary information.

Employment verification applies to all types of employees, including part-time, temporary, and contract workers. Their employment history may also be relevant for various applications.

Typically, only authorized personnel, such as HR representatives or direct supervisors, should complete the Employment Verification form to ensure accuracy and compliance.

Employees have the right to review and contest any inaccuracies on the Employment Verification form. They should communicate any discrepancies to their employer promptly.

While the Employment Verification form itself may not be a contract, the information provided can have legal implications, especially if it is used in employment decisions or loan applications.

Employers must adhere to privacy laws and regulations when completing the form. They should only disclose information that is factual and relevant to the employee’s work history.

In reality, the need for employment verification spans across all industries. Many employers require it as part of their standard hiring or lending processes, regardless of the field.

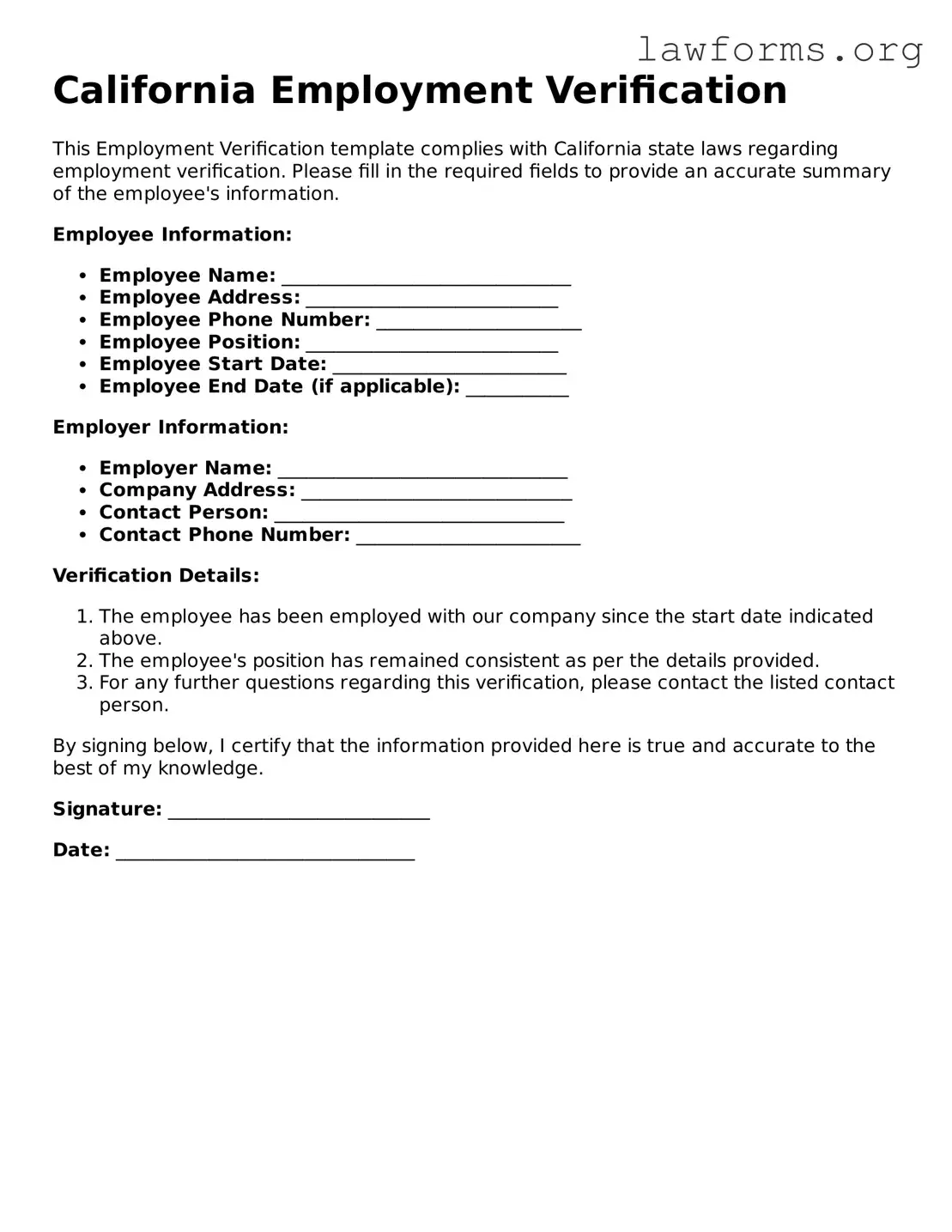

Preview - California Employment Verification Form

California Employment Verification

This Employment Verification template complies with California state laws regarding employment verification. Please fill in the required fields to provide an accurate summary of the employee's information.

Employee Information:

- Employee Name: _______________________________

- Employee Address: ___________________________

- Employee Phone Number: ______________________

- Employee Position: ___________________________

- Employee Start Date: _________________________

- Employee End Date (if applicable): ___________

Employer Information:

- Employer Name: _______________________________

- Company Address: _____________________________

- Contact Person: _______________________________

- Contact Phone Number: ________________________

Verification Details:

- The employee has been employed with our company since the start date indicated above.

- The employee's position has remained consistent as per the details provided.

- For any further questions regarding this verification, please contact the listed contact person.

By signing below, I certify that the information provided here is true and accurate to the best of my knowledge.

Signature: ____________________________

Date: ________________________________

Key takeaways

When filling out and using the California Employment Verification form, it's important to keep several key points in mind. Here are the essential takeaways:

- Purpose: The form serves to verify an individual's employment status, income, and job history for various purposes such as loan applications or rental agreements.

- Accuracy: Ensure that all information provided is accurate and up-to-date. Incorrect details can lead to delays or denials in processing.

- Required Information: Typically, the form will ask for the employee's name, job title, dates of employment, and salary information.

- Employer's Role: The employer must complete the form and provide the necessary details. Their signature is often required to validate the information.

- Confidentiality: Handle the completed form with care. It contains sensitive information that should be kept confidential.

- Submission: Know where and how to submit the completed form. This could be to a lender, landlord, or other requesting party.

- Follow-Up: After submission, follow up to ensure that the form has been received and accepted by the relevant party.

- Legal Compliance: Be aware of any legal requirements surrounding employment verification in California to avoid potential issues.

- Requesting Changes: If corrections are needed after submission, be prepared to request changes promptly to avoid complications.

These takeaways can help streamline the process and ensure that the Employment Verification form is completed correctly and effectively.

Similar forms

- W-2 Form: This document reports an employee's annual wages and the taxes withheld from their paycheck. Like the Employment Verification form, it serves as proof of employment and income, often required for loan applications or tax purposes.

- Pay Stub: A pay stub provides detailed information about an employee's earnings for a specific pay period, including hours worked, deductions, and net pay. Similar to the Employment Verification form, it verifies employment status and income level.

- Offer Letter: An offer letter outlines the terms of employment, including job title, salary, and start date. This document, like the Employment Verification form, confirms an individual's employment with a specific company.

- Tax Return: A tax return summarizes an individual’s income and tax obligations for a given year. It can serve as evidence of employment and income, much like the Employment Verification form, especially when applying for financial assistance or loans.