Attorney-Approved Gift Deed Template for the State of California

Form Specifications

| Fact Name | Description |

|---|---|

| Definition | A California Gift Deed is a legal document used to transfer property from one person to another without any exchange of money. |

| Governing Law | The California Gift Deed is governed by California Civil Code Section 11911. |

| Purpose | This deed is commonly used to give real estate as a gift, often between family members or friends. |

| Requirements | The deed must be signed by the donor (the person giving the gift) and notarized. |

| Recording | To be legally effective, the Gift Deed should be recorded with the county recorder's office where the property is located. |

| Tax Implications | Gift deeds may have tax implications for both the giver and the receiver, including potential gift tax obligations. |

| Revocation | Once executed, a Gift Deed generally cannot be revoked unless specific conditions are met. |

| Consideration | Unlike other types of deeds, a Gift Deed does not require any consideration (payment) to be valid. |

| Legal Advice | It is often advisable to seek legal advice before executing a Gift Deed to ensure compliance with state laws. |

| Common Uses | Gift Deeds are frequently used for estate planning, allowing individuals to transfer property to heirs without going through probate. |

Dos and Don'ts

When filling out the California Gift Deed form, it’s essential to approach the task with care. Here’s a list of things you should and shouldn’t do to ensure the process goes smoothly.

- Do ensure that all information is accurate and complete.

- Do include the full legal names of both the donor and the recipient.

- Do provide a clear description of the property being gifted.

- Do sign the form in front of a notary public.

- Do keep a copy of the completed form for your records.

- Don’t leave any sections blank; incomplete forms can lead to delays.

- Don’t use nicknames or abbreviations for names.

- Don’t forget to check for any local requirements that may apply.

- Don’t submit the form without verifying that it has been properly notarized.

- Don’t overlook the importance of consulting with a legal professional if needed.

Create Popular Gift Deed Forms for Different States

Texas Gift Deed Pdf - A Gift Deed is a legal way to avoid probate issues.

When transferring ownership of a vehicle or vessel in California, it is crucial to complete the California Form REG 262, which serves as the Vehicle/Vessel Transfer and Reassignment Form. This form plays a vital role in the transaction, as it must accompany the title or application for a duplicate title. For detailed guidance on this process, you can refer to californiadocsonline.com/california-fotm-reg-262-form/, ensuring that both buyers and sellers adhere to state laws and safeguard their rights during the transfer.

Common mistakes

-

Not Including a Legal Description of the Property: One common mistake is failing to provide a complete legal description of the property being gifted. This information is crucial for identifying the property in public records.

-

Incorrect Names of Parties: Ensure that the names of both the giver and the recipient are spelled correctly and match their legal identification. Mistakes here can lead to complications in the transfer process.

-

Omitting the Date: Forgetting to include the date of the transaction can create confusion. It’s important to document when the gift was made to establish a clear timeline.

-

Not Notarizing the Document: A Gift Deed must be notarized to be legally binding. Skipping this step can invalidate the deed and prevent the transfer from being recognized.

-

Failure to Check Local Requirements: Each county may have specific requirements for filing a Gift Deed. Not checking these can lead to delays or rejections.

-

Ignoring Tax Implications: Some people overlook the potential tax consequences of gifting property. It’s wise to consult with a tax professional to understand any obligations that may arise.

-

Not Keeping Copies: After completing the Gift Deed, it’s important to keep copies for your records. This ensures that you have proof of the transaction in case any questions arise in the future.

Documents used along the form

When dealing with the California Gift Deed form, several other documents may be necessary to ensure a smooth transfer of property ownership. These forms help clarify the intentions of the parties involved and comply with legal requirements. Below is a list of commonly used forms and documents that often accompany the Gift Deed.

- Grant Deed: This document is used to transfer real property and includes warranties that the grantor has not previously conveyed the title to anyone else.

- Quitclaim Deed: A quitclaim deed allows the grantor to transfer any interest in the property without making any guarantees about the title's validity.

- Property Transfer Tax Declaration (Form BOE-58): This form must be filed with the county assessor to report the value of the property being transferred and may be required for tax purposes.

- Statement of Information: This document provides the title company with information about the parties involved in the transaction, helping to identify any potential claims against the property.

- Affidavit of Value: An affidavit that states the fair market value of the property at the time of transfer, which may be required for tax assessments.

- Title Insurance Policy: This policy protects the buyer against losses arising from disputes over property ownership and ensures that the title is clear.

- Trustee's Deed: Used when property is transferred from a trust, this deed confirms that the trustee has the authority to make the transfer.

- Residential Lease Agreement: Essential for outlining landlord-tenant relationships in Ohio, this document can be accessed through Ohio PDF Forms to ensure all terms are clear and legally binding.

- Power of Attorney: A legal document that allows one person to act on behalf of another, which may be necessary if the grantor cannot be present to sign the Gift Deed.

- Notice of Transfer: A document filed with the county to inform local authorities about the change in property ownership, ensuring proper records are maintained.

Each of these documents plays a vital role in the property transfer process. Utilizing them correctly can help avoid legal complications and ensure that the transfer of ownership is recognized and recorded appropriately.

Misconceptions

Understanding the California Gift Deed form is essential for anyone considering transferring property as a gift. However, several misconceptions can lead to confusion. Below are six common misunderstandings about this important legal document:

-

A Gift Deed is the same as a Sale Deed.

This is not true. A Gift Deed involves transferring property without any exchange of money or consideration, while a Sale Deed requires payment in exchange for the property.

-

All gifts of property must be documented with a Gift Deed.

While it is highly recommended to document the transfer with a Gift Deed for legal clarity and to avoid disputes, not all gifts require a formal deed. However, having a written record can protect both parties.

-

Gift Deeds cannot be revoked once executed.

This misconception is misleading. Although a Gift Deed is generally irrevocable, there may be specific circumstances under which a donor can revoke the gift, particularly if the deed was executed under duress or fraud.

-

A Gift Deed does not require notarization.

In California, a Gift Deed must be notarized to be legally valid. This step is crucial for ensuring that the document holds up in court and that the transfer is recognized by the state.

-

Taxes are not applicable on gifts made through a Gift Deed.

This is incorrect. While there may not be immediate income tax implications for the recipient, the donor could still be subject to gift tax regulations. It is essential to consult a tax professional to understand potential tax liabilities.

-

Anyone can create a Gift Deed without legal assistance.

While it is possible for individuals to draft their own Gift Deeds, it is advisable to seek legal assistance. A legal professional can ensure that the deed complies with all state laws and adequately reflects the intentions of the parties involved.

By dispelling these misconceptions, individuals can approach the process of transferring property as a gift with greater confidence and understanding.

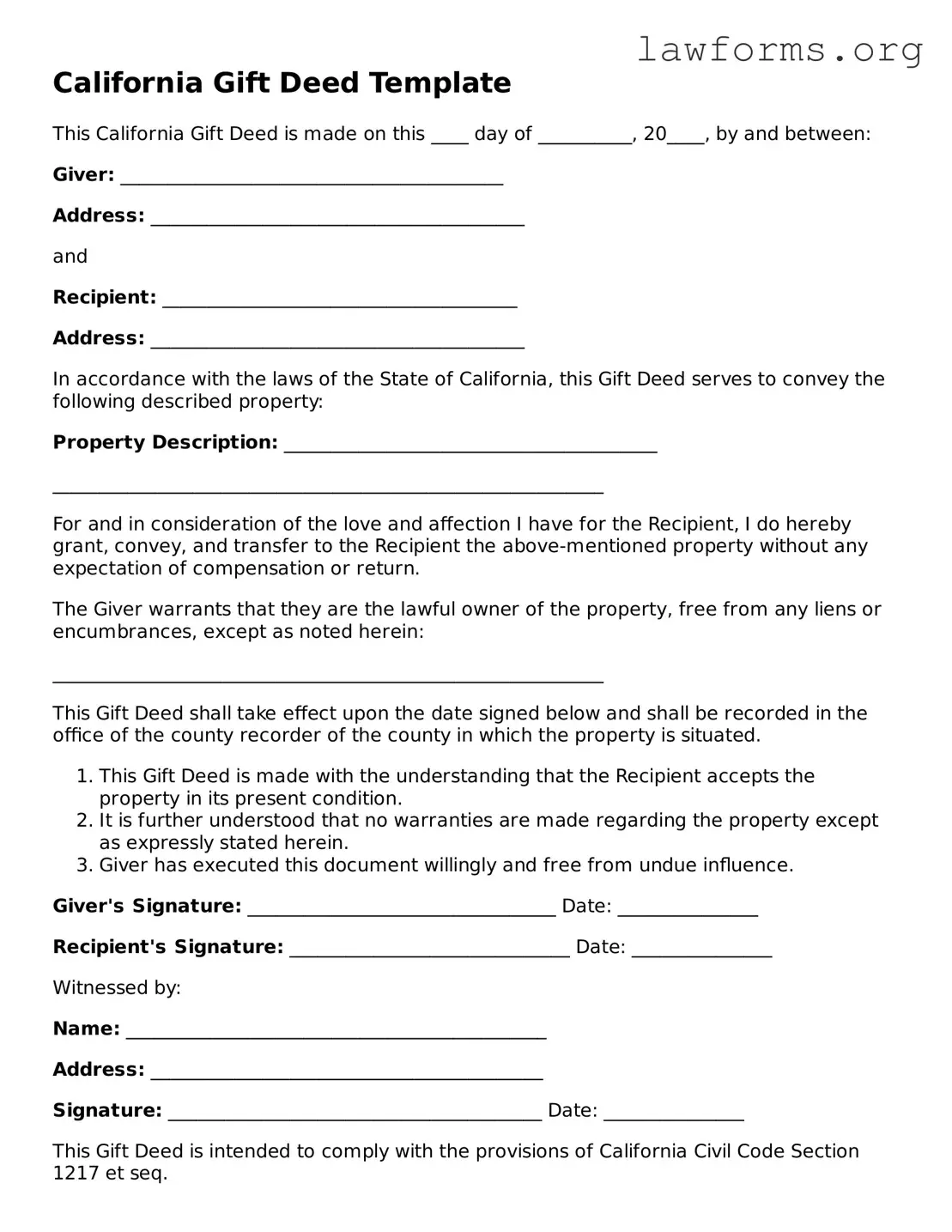

Preview - California Gift Deed Form

California Gift Deed Template

This California Gift Deed is made on this ____ day of __________, 20____, by and between:

Giver: _________________________________________

Address: ________________________________________

and

Recipient: ______________________________________

Address: ________________________________________

In accordance with the laws of the State of California, this Gift Deed serves to convey the following described property:

Property Description: ________________________________________

___________________________________________________________

For and in consideration of the love and affection I have for the Recipient, I do hereby grant, convey, and transfer to the Recipient the above-mentioned property without any expectation of compensation or return.

The Giver warrants that they are the lawful owner of the property, free from any liens or encumbrances, except as noted herein:

___________________________________________________________

This Gift Deed shall take effect upon the date signed below and shall be recorded in the office of the county recorder of the county in which the property is situated.

- This Gift Deed is made with the understanding that the Recipient accepts the property in its present condition.

- It is further understood that no warranties are made regarding the property except as expressly stated herein.

- Giver has executed this document willingly and free from undue influence.

Giver's Signature: _________________________________ Date: _______________

Recipient's Signature: ______________________________ Date: _______________

Witnessed by:

Name: _____________________________________________

Address: __________________________________________

Signature: ________________________________________ Date: _______________

This Gift Deed is intended to comply with the provisions of California Civil Code Section 1217 et seq.

Key takeaways

When dealing with the California Gift Deed form, there are several important aspects to keep in mind. Understanding these key points can simplify the process and ensure that the transfer of property is executed smoothly.

- Purpose of the Gift Deed: This form is specifically designed to transfer property as a gift without any exchange of money. It is essential to clarify that no compensation is involved in the transaction.

- Eligibility: Both the giver (donor) and the receiver (donee) must be legally capable of entering into a contract. This means they should be of legal age and mentally competent.

- Property Description: A clear and accurate description of the property being gifted is crucial. This includes the address and any relevant parcel numbers to avoid confusion.

- Signatures Required: The Gift Deed must be signed by the donor. In some cases, notarization may be necessary to validate the document, especially if the deed is recorded.

- Recording the Deed: After filling out the form, it is advisable to record the Gift Deed with the local county recorder's office. This step provides public notice of the transfer and protects the rights of the donee.

By keeping these points in mind, individuals can navigate the process of using a California Gift Deed more effectively. Whether gifting property to a family member or a friend, understanding the nuances of this form is essential for a successful transaction.

Similar forms

A Gift Deed is a specific legal document that allows one party to transfer ownership of property or assets to another party without expecting anything in return. There are several other documents that share similarities with a Gift Deed, each serving its own purpose in property and asset transfer. Here are six documents that are similar to a Gift Deed:

- Quitclaim Deed: This document transfers whatever interest the grantor has in a property to the grantee. Unlike a Gift Deed, it does not guarantee that the grantor holds clear title, but it is often used in informal transfers, similar to gifting property.

- WC-200a Form: The WC-200a form facilitates the Change of Physician / Additional Treatment by Consent in workers' compensation cases, ensuring smooth transitions for injured employees regarding their healthcare providers, as detailed at https://georgiaform.com.

- Warranty Deed: This type of deed provides a guarantee that the grantor holds clear title to the property and has the right to transfer it. While a Gift Deed does not include warranties, both documents facilitate the transfer of property ownership.

- Transfer on Death Deed (TOD): A TOD allows an individual to transfer property to a beneficiary upon their death without going through probate. Like a Gift Deed, it is a way to transfer property, but it only takes effect after the owner passes away.

- Bill of Sale: This document is used to transfer ownership of personal property, such as vehicles or equipment. While a Gift Deed pertains to real estate, both documents serve to officially record the transfer of ownership without a monetary exchange.

- Power of Attorney: This document grants someone the authority to act on another person's behalf, including making decisions about property transfers. Although it does not transfer ownership directly, it can facilitate the execution of a Gift Deed.

- Trust Agreement: A trust agreement allows a person to place their assets into a trust for the benefit of another party. Similar to a Gift Deed, it can be used to transfer property, but it involves more complex management of the assets over time.

Understanding these documents can help clarify the different ways property and assets can be transferred. Each serves its unique purpose, but they all share the common goal of facilitating ownership changes.