Attorney-Approved Last Will and Testament Template for the State of California

Form Specifications

| Fact Name | Description |

|---|---|

| Definition | A Last Will and Testament is a legal document that outlines how a person's assets will be distributed after their death. |

| Governing Law | California Probate Code governs the creation and execution of wills in California. |

| Age Requirement | In California, individuals must be at least 18 years old to create a valid will. |

| Witness Requirement | Two witnesses are required to sign the will, confirming that the testator was of sound mind. |

| Revocation | A will can be revoked at any time by the testator through a new will or a written declaration. |

| Holographic Wills | California recognizes holographic wills, which are handwritten and do not require witnesses if signed by the testator. |

| Probate Process | After death, the will must go through probate, a legal process to validate the will and distribute assets. |

| Executor Role | The executor, named in the will, is responsible for carrying out the instructions and managing the estate. |

Dos and Don'ts

When filling out the California Last Will and Testament form, it's important to approach the process with care. Here are some guidelines to consider:

- Do ensure you are of sound mind when creating your will.

- Do clearly identify yourself and your beneficiaries.

- Do specify how your assets should be distributed.

- Do sign the document in the presence of two witnesses.

- Don't use vague language that could lead to confusion.

- Don't forget to date the will to establish its validity.

- Don't leave out any debts or obligations that need to be addressed.

- Don't attempt to make changes without following proper procedures.

By adhering to these do's and don'ts, individuals can create a clear and effective Last Will and Testament that meets their needs and reflects their wishes.

Create Popular Last Will and Testament Forms for Different States

Last Will and Testament Sample - A vital component of estate planning to ensure your wishes are honored.

The California Employment Verification form is a document used by employers to confirm the employment status of an individual. This form is essential for various purposes, including loan applications and housing requests, making it crucial for employees to fully understand its importance, which can be further explored at https://californiadocsonline.com/employment-verification-form/.

How to Write a Will in Nc - This document can include specific conditions for inheritance, such as age or milestones for beneficiaries.

New Jersey Will Template - Creates a formal framework for handling debts and final expenses.

Simple Will Florida - Gives peace of mind knowing your affairs are in order.

Common mistakes

-

Failing to sign the will. A will must be signed by the testator, which is the person making the will, to be considered valid. Without a signature, the document may not hold legal weight.

-

Not having witnesses present. In California, at least two witnesses must be present when the will is signed. If the witnesses do not sign, the will may be challenged in court.

-

Using outdated forms. Laws can change, and using an old version of the will form may lead to complications. It is important to ensure the form is current.

-

Overlooking specific bequests. When listing assets or beneficiaries, it is crucial to be clear and specific. Ambiguity can lead to disputes among heirs.

-

Not updating the will after major life events. Changes such as marriage, divorce, or the birth of children should prompt a review and possible update of the will.

-

Neglecting to include a residuary clause. This clause addresses any assets not specifically mentioned in the will, ensuring they are distributed according to the testator's wishes.

-

Failing to consider tax implications. Not addressing potential estate taxes can lead to unexpected burdens on heirs. Consulting with a financial advisor may be beneficial.

-

Not storing the will in a safe place. A will should be kept in a secure location, such as a safe deposit box or with a trusted attorney. If it cannot be found, the testator's wishes may not be honored.

Documents used along the form

When creating a California Last Will and Testament, several other forms and documents may be necessary to ensure that your estate is managed according to your wishes. These documents can help clarify your intentions and provide legal backing for your decisions. Below is a list of commonly used forms that complement a will.

- Durable Power of Attorney: This document allows you to designate someone to make financial decisions on your behalf if you become incapacitated. It remains effective even if you are unable to make decisions yourself.

- Advance Healthcare Directive: This form outlines your preferences for medical treatment and appoints someone to make healthcare decisions for you if you cannot communicate your wishes.

- Revocable Living Trust: A trust that can be altered or revoked during your lifetime. It allows you to manage your assets while you are alive and can help avoid probate after your death.

- Beneficiary Designation Forms: These forms are used for accounts like life insurance policies and retirement accounts. They specify who will receive the assets directly, bypassing the will.

- Codicil: This is an amendment to your existing will. It allows you to make changes without creating an entirely new document, provided it meets legal requirements.

- Motorcycle Bill of Sale: This legal document records the sale of a motorcycle in Washington, protecting both buyer and seller. For more details, you can refer to Forms Washington.

- Letter of Instruction: While not a legal document, this letter provides guidance to your executor regarding your wishes for funeral arrangements, asset distribution, and other personal matters.

- Estate Inventory: This document lists all of your assets and liabilities. It helps your executor understand the scope of your estate and ensures that all assets are accounted for during the probate process.

Incorporating these documents alongside your Last Will and Testament can help streamline the estate planning process. They provide clarity and direction, ensuring that your wishes are honored and that your loved ones are taken care of in accordance with your preferences.

Misconceptions

Understanding the California Last Will and Testament form is essential for anyone looking to plan their estate. However, several misconceptions can lead to confusion. Here are ten common misconceptions explained:

- A will is only for the wealthy. Many people believe that only those with significant assets need a will. In reality, everyone can benefit from having a will to ensure their wishes are honored.

- Wills are only necessary for older individuals. This misconception overlooks the fact that unexpected events can happen at any age. Having a will is a responsible choice for adults of all ages.

- Once a will is created, it cannot be changed. In California, you can modify or revoke your will at any time as long as you are of sound mind. This flexibility allows you to adapt to changes in your life.

- Oral wills are legally binding. While some states recognize oral wills, California does not. A written will is necessary to ensure its validity.

- Having a will avoids probate. A will does not prevent probate; it simply provides instructions for the probate process. Assets still need to go through this legal procedure unless other arrangements are made.

- All assets automatically go to the spouse. In California, while community property laws apply, not all assets are automatically transferred to a spouse. A will can specify different distributions.

- Only lawyers can create a will. While legal assistance can be beneficial, individuals can create their own wills using templates or online resources, as long as they follow state laws.

- Wills are only for distributing property. Wills can also address guardianship for minor children and specify funeral arrangements, making them comprehensive documents.

- Witnesses are not required for a will. In California, a will must be signed by at least two witnesses to be valid, ensuring that the testator's intentions are verified.

- A will is the only estate planning document needed. While a will is important, it is often part of a broader estate plan that may include trusts, powers of attorney, and health care directives.

By understanding these misconceptions, individuals can make informed decisions about their estate planning and ensure their wishes are respected.

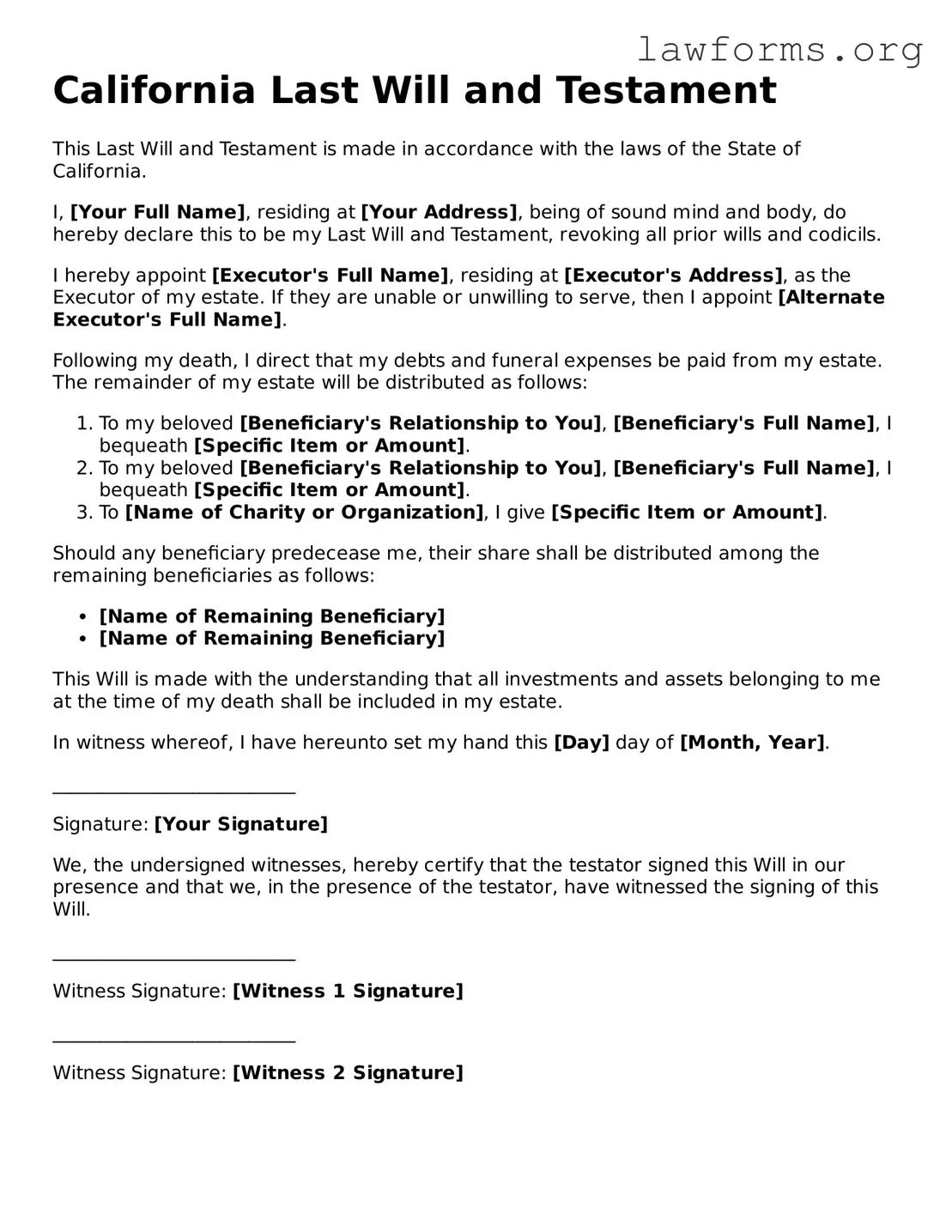

Preview - California Last Will and Testament Form

California Last Will and Testament

This Last Will and Testament is made in accordance with the laws of the State of California.

I, [Your Full Name], residing at [Your Address], being of sound mind and body, do hereby declare this to be my Last Will and Testament, revoking all prior wills and codicils.

I hereby appoint [Executor's Full Name], residing at [Executor's Address], as the Executor of my estate. If they are unable or unwilling to serve, then I appoint [Alternate Executor's Full Name].

Following my death, I direct that my debts and funeral expenses be paid from my estate. The remainder of my estate will be distributed as follows:

- To my beloved [Beneficiary's Relationship to You], [Beneficiary's Full Name], I bequeath [Specific Item or Amount].

- To my beloved [Beneficiary's Relationship to You], [Beneficiary's Full Name], I bequeath [Specific Item or Amount].

- To [Name of Charity or Organization], I give [Specific Item or Amount].

Should any beneficiary predecease me, their share shall be distributed among the remaining beneficiaries as follows:

- [Name of Remaining Beneficiary]

- [Name of Remaining Beneficiary]

This Will is made with the understanding that all investments and assets belonging to me at the time of my death shall be included in my estate.

In witness whereof, I have hereunto set my hand this [Day] day of [Month, Year].

__________________________

Signature: [Your Signature]

We, the undersigned witnesses, hereby certify that the testator signed this Will in our presence and that we, in the presence of the testator, have witnessed the signing of this Will.

__________________________

Witness Signature: [Witness 1 Signature]

__________________________

Witness Signature: [Witness 2 Signature]

Key takeaways

When filling out and using the California Last Will and Testament form, there are several important points to keep in mind. Here are some key takeaways:

- Ensure that you are at least 18 years old and of sound mind when creating your will.

- Clearly identify yourself at the beginning of the document, including your full name and address.

- List your beneficiaries, specifying who will inherit your assets. Be as detailed as possible to avoid confusion.

- Appoint an executor who will be responsible for carrying out the terms of your will. Choose someone you trust.

- Sign the will in front of at least two witnesses who are not beneficiaries. Their signatures will help validate the document.

- Keep your will in a safe place and inform your executor and family members where it can be found.

Following these guidelines can help ensure that your wishes are honored and that the process goes smoothly for your loved ones.

Similar forms

The Last Will and Testament is a crucial document for anyone looking to outline their wishes regarding the distribution of their assets after passing. However, it shares similarities with several other important documents. Here’s a look at ten documents that resemble a Last Will and Testament:

- Living Will: This document outlines your healthcare preferences if you become unable to communicate your wishes. Like a will, it reflects your intentions regarding your personal affairs, but it focuses specifically on medical decisions.

- Trust: A trust allows you to manage your assets during your lifetime and specifies how they should be distributed after your death. Both documents ensure your wishes are honored, but a trust can also help avoid probate.

- Non-disclosure Agreement: For individuals and businesses looking to protect sensitive information, the Illinois Non-disclosure Agreement form is essential. It serves to restrict the sharing of proprietary data. To get started on securing your confidential information, visit formsillinois.com/.

- Power of Attorney: This document grants someone the authority to make decisions on your behalf if you are incapacitated. It is similar to a will in that it designates a trusted individual to manage your affairs, but it is primarily focused on financial and legal matters.

- Healthcare Proxy: A healthcare proxy allows you to appoint someone to make medical decisions for you if you are unable to do so. Both this document and a will involve appointing someone to act on your behalf in critical situations.

- Letter of Instruction: This informal document provides guidance to your loved ones about your wishes and preferences. While a will is legally binding, a letter of instruction can complement it by providing personal insights and additional information.

- Beneficiary Designations: Many financial accounts allow you to name beneficiaries who will receive assets upon your death. Like a will, these designations ensure your assets go to the intended recipients, but they operate outside the probate process.

- Codicil: A codicil is an amendment to an existing will. It allows you to make changes without creating an entirely new document, similar to how a will can be updated to reflect changes in your life.

- Joint Tenancy Agreements: This type of property ownership allows two or more people to own an asset together. When one owner passes away, the property automatically transfers to the surviving owner, similar to how a will distributes assets after death.

- Distribution Agreement: Often used in family situations, this document outlines how assets should be divided among heirs. It functions similarly to a will, as it specifies the distribution of property, but it may not always be legally binding.

- Funeral Instructions: This document provides specific wishes regarding your funeral and burial arrangements. While a will handles asset distribution, funeral instructions focus on how you want your final arrangements to be made.

Understanding these documents can help you create a comprehensive plan for your future and ensure your wishes are respected. Each document serves a unique purpose, but they all share the common goal of providing clarity and direction for your loved ones during difficult times.