Attorney-Approved Loan Agreement Template for the State of California

Form Specifications

| Fact Name | Description |

|---|---|

| Purpose | The California Loan Agreement form is used to outline the terms of a loan between a lender and a borrower. |

| Governing Law | The agreement is governed by California state laws, specifically the California Civil Code. |

| Parties Involved | The form includes sections for both the lender and borrower to provide their information. |

| Loan Amount | The form specifies the total amount of money being loaned. |

| Interest Rate | The agreement details the interest rate that will be applied to the loan. |

| Repayment Terms | It outlines how and when the borrower will repay the loan. |

| Default Consequences | The form explains the actions that may be taken if the borrower fails to repay the loan as agreed. |

Dos and Don'ts

When filling out the California Loan Agreement form, it is important to approach the task carefully. Below are some key do's and don'ts to keep in mind:

- Do read the entire form thoroughly before starting.

- Do provide accurate and complete information.

- Do double-check all figures and terms to avoid errors.

- Do sign and date the agreement in the designated areas.

- Don't leave any sections blank; fill in all required fields.

- Don't use abbreviations or unclear language.

- Don't rush through the process; take your time to ensure clarity.

By following these guidelines, you can help ensure that your Loan Agreement is completed correctly and effectively.

Create Popular Loan Agreement Forms for Different States

New York Promissory Note - Describes the process for making payments on the loan.

The California Dog Bill of Sale form is a legal document used to transfer ownership of a dog from one party to another. This form provides important details about the dog, including its breed, age, and any health information, ensuring both parties are protected in the transaction. For those seeking to understand and obtain this crucial document, it can be found at https://californiadocsonline.com/dog-bill-of-sale-form, helping to establish clear ownership and accountability.

Promissory Note Template Florida - This form can be customized to meet the needs of both the lender and borrower.

Promissory Note Texas - It serves to protect both the lender's and borrower's interests by clarifying the loan conditions.

Common mistakes

-

Failing to include all parties involved in the loan agreement. Make sure that every borrower and lender is listed.

-

Not providing accurate personal information. Double-check names, addresses, and contact details.

-

Omitting loan details such as the amount, interest rate, and repayment terms. Clarity in these areas is crucial.

-

Using unclear language or vague terms. Be specific about what is expected from each party.

-

Neglecting to include the purpose of the loan. This information can help clarify the agreement.

-

Forgetting to specify the repayment schedule. Outline when payments are due and how they should be made.

-

Not including a section for signatures. Ensure that all parties sign and date the agreement.

-

Ignoring state-specific requirements. Familiarize yourself with California laws regarding loan agreements.

-

Failing to keep a copy of the signed agreement. Always retain a copy for your records.

Documents used along the form

When entering into a loan agreement in California, several other forms and documents may be necessary to ensure a smooth transaction. These documents help clarify the terms of the loan, protect the interests of both parties, and comply with legal requirements. Here’s a list of common forms used alongside the California Loan Agreement.

- Promissory Note: This document outlines the borrower's promise to repay the loan, detailing the amount, interest rate, repayment schedule, and consequences of default.

- Loan Disclosure Statement: This statement provides borrowers with important information about the loan terms, including fees, interest rates, and payment schedules, ensuring transparency.

- Security Agreement: If the loan is secured by collateral, this agreement specifies the collateral and the lender's rights in case of default.

- Personal Guarantee: This document may be required when a business borrows money, where an individual agrees to be personally responsible for the loan if the business cannot repay it.

- Default Notice: If a borrower fails to meet the loan terms, this notice informs them of the default and the lender's intent to take action, such as initiating foreclosure.

- Loan Modification Agreement: If the terms of the original loan need to be changed, this document outlines the new terms and conditions agreed upon by both parties.

- Durable Power of Attorney: This document allows you to designate a trusted individual to make decisions on your behalf should you become incapacitated, ensuring your preferences are followed. You can find a template for this essential document at Forms Washington.

- Release of Liability: Upon repayment of the loan, this document releases the borrower from any further obligations, confirming that the loan has been satisfied.

- Payment Receipt: This simple document acknowledges the receipt of a loan payment, providing proof for both the lender and borrower.

These forms and documents play a crucial role in the loan process. They help protect both the lender and the borrower, ensuring that all parties are clear about their rights and responsibilities. It is always advisable to consult with a legal professional when drafting or reviewing these documents to ensure compliance with California laws.

Misconceptions

Understanding the California Loan Agreement form can be challenging, especially with the prevalence of misconceptions surrounding it. Here are five common misunderstandings and clarifications regarding this important document.

-

Misconception 1: The California Loan Agreement form is only for large loans.

This is not true. The form can be used for loans of various sizes, whether small or large. It provides a structured way to outline the terms of any loan, regardless of the amount.

-

Misconception 2: A verbal agreement is sufficient without a written form.

While verbal agreements can be legally binding, they often lead to misunderstandings. The California Loan Agreement form provides clarity and a record of the terms, which can be crucial in case of disputes.

-

Misconception 3: The form is only necessary for personal loans between friends and family.

This is incorrect. The California Loan Agreement form is beneficial for all types of loans, including business loans and loans between strangers. It helps establish trust and transparency in any lending relationship.

-

Misconception 4: Once signed, the terms of the loan cannot be changed.

While the agreement is binding, it is possible to amend the terms if both parties agree to the changes. Such amendments should be documented in writing to avoid future confusion.

-

Misconception 5: The form is too complicated to use without a lawyer.

Although legal advice can be helpful, the California Loan Agreement form is designed to be user-friendly. Many individuals can successfully complete it with a basic understanding of the terms involved.

By addressing these misconceptions, individuals can better navigate the California Loan Agreement form and ensure that their lending transactions are clear and legally sound.

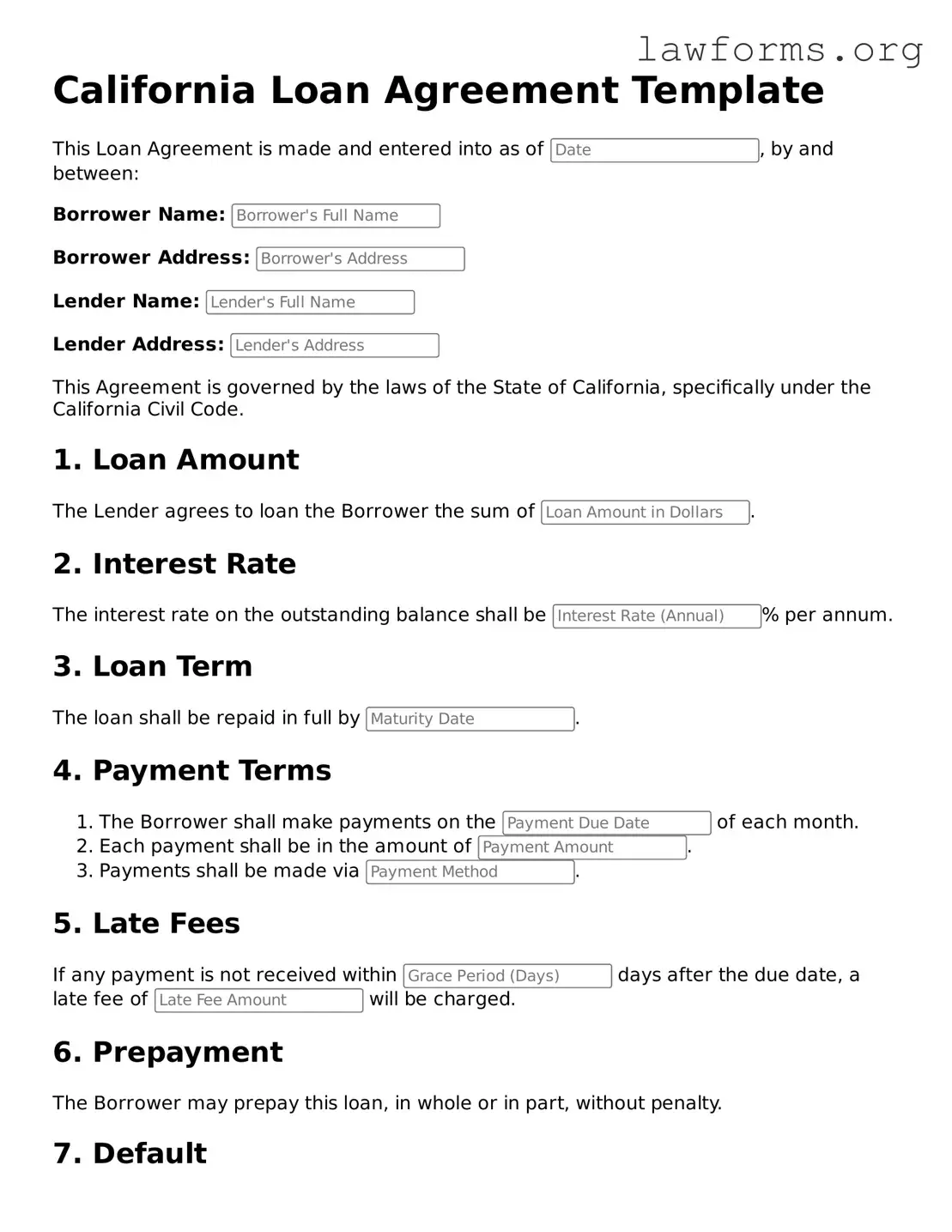

Preview - California Loan Agreement Form

California Loan Agreement Template

This Loan Agreement is made and entered into as of , by and between:

Borrower Name:

Borrower Address:

Lender Name:

Lender Address:

This Agreement is governed by the laws of the State of California, specifically under the California Civil Code.

1. Loan Amount

The Lender agrees to loan the Borrower the sum of .

2. Interest Rate

The interest rate on the outstanding balance shall be % per annum.

3. Loan Term

The loan shall be repaid in full by .

4. Payment Terms

- The Borrower shall make payments on the of each month.

- Each payment shall be in the amount of .

- Payments shall be made via .

5. Late Fees

If any payment is not received within days after the due date, a late fee of will be charged.

6. Prepayment

The Borrower may prepay this loan, in whole or in part, without penalty.

7. Default

- In the event of default, the Lender may demand immediate payment of the entire outstanding balance.

- Default may occur if the Borrower fails to make any payment when due.

8. Governing Law

This Agreement shall be governed by the laws of the State of California.

9. Entire Agreement

This Agreement constitutes the entire understanding between the parties and supersedes all prior discussions or agreements.

10. Signatures

IN WITNESS WHEREOF, the parties hereto have executed this Loan Agreement as of the date first written above.

Borrower's Signature: _______________________ Date:

Lender's Signature: _______________________ Date:

Key takeaways

When filling out and using the California Loan Agreement form, consider the following key takeaways:

- Understand the Purpose: The Loan Agreement outlines the terms and conditions of the loan between the lender and the borrower.

- Complete All Sections: Ensure every section of the form is filled out accurately to avoid any misunderstandings later.

- Specify Loan Amount: Clearly state the total amount being loaned to prevent disputes over the loan's value.

- Detail Interest Rates: Include the interest rate and specify whether it is fixed or variable.

- Outline Payment Terms: Clearly define the repayment schedule, including due dates and amounts.

- Include Late Fees: Specify any penalties for late payments to ensure both parties are aware of the consequences.

- Signatures Required: Both the lender and borrower must sign the agreement for it to be legally binding.

- Keep Copies: Each party should retain a signed copy of the agreement for their records.

- Consult a Professional: If uncertain about any terms, seek legal advice to ensure clarity and compliance with California law.

Similar forms

Promissory Note: This document outlines the borrower's promise to repay the loan. It includes the loan amount, interest rate, and repayment schedule, similar to the Loan Agreement.

Mortgage Agreement: This document secures the loan with property collateral. Like the Loan Agreement, it details the terms of the loan and the consequences of default.

Security Agreement: This agreement provides collateral for the loan. It is similar to the Loan Agreement in that it specifies the obligations of the borrower and lender.

Lease Agreement: While primarily for renting property, it contains terms and conditions similar to those found in a Loan Agreement, particularly regarding payment schedules and penalties for late payments.

Credit Agreement: This document governs the terms of credit extended by a lender. It shares similarities with the Loan Agreement in defining the terms of borrowing and repayment.

Unclaimed Property Reporting: The Illinois Unclaimed Property Reporting form is essential for businesses to declare unclaimed assets, and you can find more information and the form at https://formsillinois.com/.

Partnership Agreement: In a business context, this document outlines the responsibilities of partners, similar to how a Loan Agreement specifies the roles of the borrower and lender.

Installment Sale Agreement: This is a contract for purchasing goods over time. Like the Loan Agreement, it details payment terms and conditions for the buyer.

Personal Loan Agreement: This is a straightforward agreement between individuals for personal loans. It mirrors the Loan Agreement by including terms of repayment, interest rates, and borrower obligations.