Attorney-Approved Operating Agreement Template for the State of California

Form Specifications

| Fact Name | Description |

|---|---|

| Definition | The California Operating Agreement is a document that outlines the management structure and operating procedures of a Limited Liability Company (LLC). |

| Governing Law | This agreement is governed by the California Corporations Code, specifically Sections 17300 to 17360. |

| Purpose | The primary purpose of the Operating Agreement is to establish the rights and responsibilities of the members and managers of the LLC. |

| Member Roles | The agreement specifies the roles of each member, including their voting rights and profit-sharing arrangements. |

| Flexibility | California law allows for significant flexibility in how the Operating Agreement is structured, enabling customization to meet the needs of the LLC. |

| Not Mandatory | While not legally required, having an Operating Agreement is highly recommended to prevent disputes among members. |

| Amendments | The Operating Agreement can be amended as needed, provided that the process for amendments is clearly outlined in the document. |

| Dispute Resolution | Many Operating Agreements include provisions for resolving disputes, which can help avoid lengthy and costly litigation. |

| Confidentiality | Confidentiality clauses may be included to protect sensitive information shared among members. |

| Termination | The agreement should outline the process for dissolving the LLC and distributing its assets upon termination. |

Dos and Don'ts

When filling out the California Operating Agreement form, it’s essential to approach the task with care. Here are five important dos and don’ts to keep in mind:

- Do read the instructions carefully before starting. Understanding the requirements will help you complete the form correctly.

- Do provide accurate information. Double-check names, addresses, and dates to avoid any mistakes.

- Do include all necessary signatures. Ensure that all members sign where required to validate the agreement.

- Don't leave any required fields blank. Incomplete forms can lead to delays or rejections.

- Don't rush through the process. Take your time to review the entire document before submission.

Create Popular Operating Agreement Forms for Different States

Operating Agreement Llc Florida Template - The Operating Agreement may also outline the procedures for member departures.

The California Homeschool Letter of Intent form is a crucial document that parents need to submit to officially declare their intention to homeschool their children. To ensure compliance with state laws regarding homeschooling, parents can find detailed guidance on completing this form at californiadocsonline.com/homeschool-letter-of-intent-form/, which can help them navigate the homeschooling process smoothly.

Create an Operating Agreement - An Operating Agreement can help in resolving conflicts by providing a clear course of action.

Common mistakes

-

Not specifying the management structure: Many individuals overlook the importance of detailing whether the LLC will be member-managed or manager-managed. This decision affects how the business operates and who has authority over daily decisions.

-

Failing to include member contributions: It's crucial to outline each member's initial contributions, whether in cash, property, or services. Omitting this information can lead to disputes later on.

-

Ignoring profit and loss distribution: Some people forget to clarify how profits and losses will be shared among members. This can create confusion and conflict if not addressed upfront.

-

Not addressing buyout provisions: It's wise to include terms for how a member can exit the LLC or how their share will be handled in case of death or disability. Without this, the remaining members may face difficulties.

-

Leaving out dispute resolution methods: Many fail to specify how disputes among members will be resolved. Having a clear process can save time and resources in the event of disagreements.

-

Overlooking state-specific requirements: Each state has its own regulations regarding operating agreements. Not adhering to California's specific requirements can render the agreement less effective.

-

Neglecting to update the agreement: As the business evolves, so should the operating agreement. Failing to revise it when significant changes occur can lead to outdated practices and misunderstandings.

Documents used along the form

When forming a Limited Liability Company (LLC) in California, the Operating Agreement is a crucial document. However, several other forms and documents may also be necessary to ensure compliance and proper governance of the LLC. Here are five important documents often used alongside the California Operating Agreement.

- Articles of Organization: This is the foundational document filed with the California Secretary of State to officially create the LLC. It includes essential details like the LLC's name, address, and the name of the registered agent.

- Power of Attorney Form: This legal document allows the principal to appoint an agent to make decisions on their behalf. Understanding its specifics is crucial to ensure one's wishes are respected. For comprehensive templates, visit Forms Washington.

- Employer Identification Number (EIN): Obtaining an EIN from the IRS is necessary for tax purposes. This unique number is required for opening a business bank account, hiring employees, and filing taxes.

- Membership Certificates: These certificates serve as proof of ownership for members of the LLC. They detail the percentage of ownership each member holds and can be useful for internal records and external verification.

- Operating Procedures: While the Operating Agreement outlines the structure and management of the LLC, a document detailing specific operating procedures can help clarify day-to-day operations, decision-making processes, and member responsibilities.

- Meeting Minutes: Keeping records of meetings is essential for maintaining transparency and accountability within the LLC. Meeting minutes document discussions, decisions, and actions taken during meetings, providing a historical record for future reference.

These documents work together to create a solid foundation for your LLC, ensuring that all legal and operational aspects are addressed. Properly managing these forms will help streamline your business operations and maintain compliance with state regulations.

Misconceptions

Many people have misunderstandings about the California Operating Agreement form. Here are six common misconceptions:

-

It's only necessary for large businesses.

Many believe that only big companies need an Operating Agreement. In reality, even small businesses and LLCs benefit from having this document in place.

-

It is a legally required document.

While it is not mandatory to have an Operating Agreement in California, it is highly recommended. This document helps clarify the management and ownership structure of the business.

-

It must be filed with the state.

Some think that the Operating Agreement needs to be submitted to the state. However, this document is kept privately within the business and does not require state filing.

-

All members must sign the agreement.

There is a belief that every member must sign the Operating Agreement. While it is good practice for all members to agree, it is not a strict requirement.

-

It cannot be changed once created.

Many assume that once the Operating Agreement is established, it cannot be modified. In fact, it can be amended as the business evolves or as members agree.

-

It only covers financial matters.

Some think the Operating Agreement is solely about finances. However, it also addresses management roles, decision-making processes, and member responsibilities.

Preview - California Operating Agreement Form

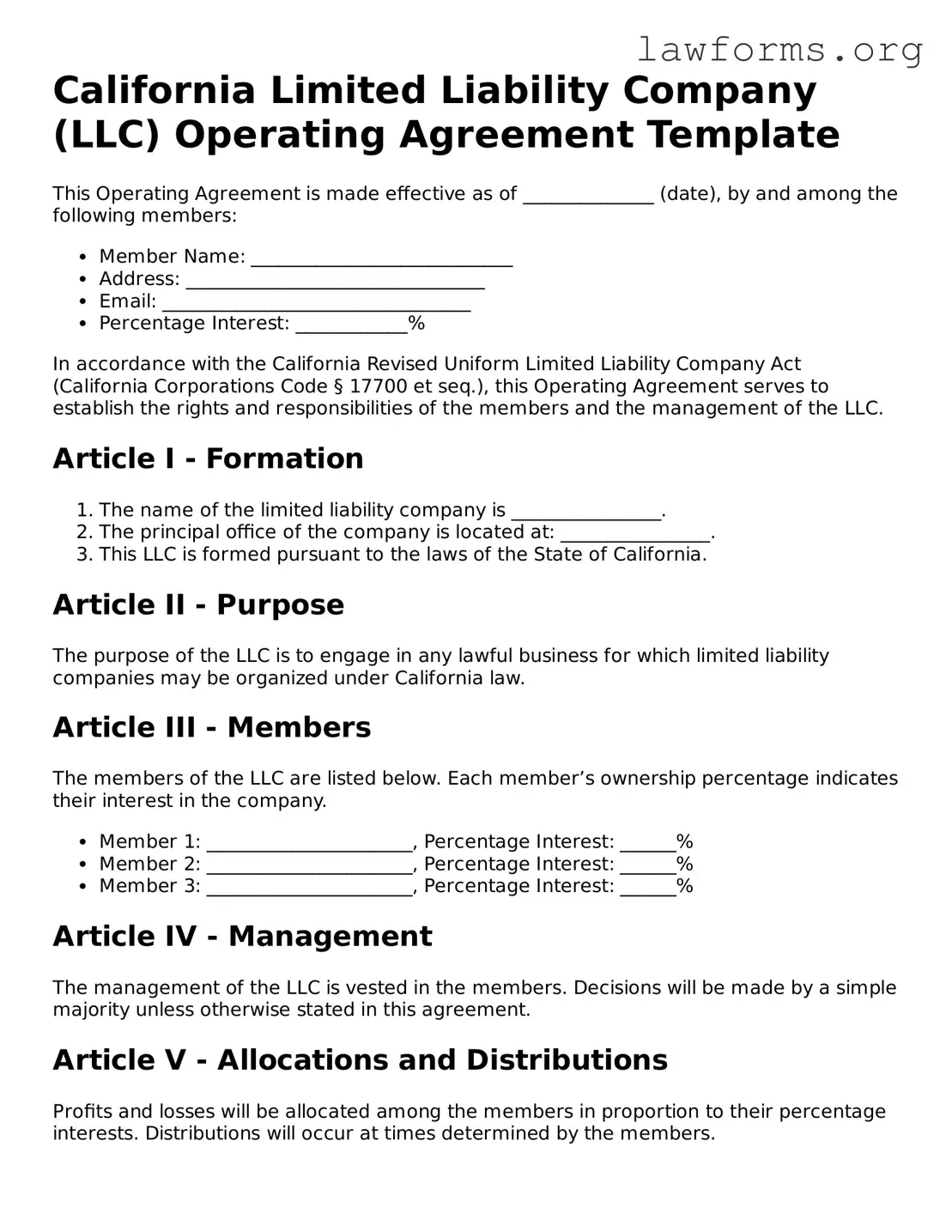

California Limited Liability Company (LLC) Operating Agreement Template

This Operating Agreement is made effective as of ______________ (date), by and among the following members:

- Member Name: ____________________________

- Address: ________________________________

- Email: _________________________________

- Percentage Interest: ____________%

In accordance with the California Revised Uniform Limited Liability Company Act (California Corporations Code § 17700 et seq.), this Operating Agreement serves to establish the rights and responsibilities of the members and the management of the LLC.

Article I - Formation

- The name of the limited liability company is ________________.

- The principal office of the company is located at: ________________.

- This LLC is formed pursuant to the laws of the State of California.

Article II - Purpose

The purpose of the LLC is to engage in any lawful business for which limited liability companies may be organized under California law.

Article III - Members

The members of the LLC are listed below. Each member’s ownership percentage indicates their interest in the company.

- Member 1: ______________________, Percentage Interest: ______%

- Member 2: ______________________, Percentage Interest: ______%

- Member 3: ______________________, Percentage Interest: ______%

Article IV - Management

The management of the LLC is vested in the members. Decisions will be made by a simple majority unless otherwise stated in this agreement.

Article V - Allocations and Distributions

Profits and losses will be allocated among the members in proportion to their percentage interests. Distributions will occur at times determined by the members.

Article VI - Books and Records

The LLC shall maintain complete and accurate books and records of its business and affairs. Members have the right to access these records as permitted by California law.

Article VII - Indemnification

The LLC shall indemnify to the fullest extent permitted by law any member or manager from any loss, liability, or damage arising from their actions on behalf of the LLC.

Article VIII - Amendments

This Operating Agreement may only be amended or modified by a written agreement signed by all members.

Article IX - Governing Law

This Operating Agreement shall be governed by and construed in accordance with the laws of the State of California.

IN WITNESS WHEREOF, the members have executed this Operating Agreement effective as of the date first written above.

- _____________________________ (Member’s Signature)

- _____________________________ (Member’s Signature)

- _____________________________ (Member’s Signature)

Date: ________________

Key takeaways

When it comes to managing a business in California, an Operating Agreement is an essential document for LLCs. Here are some key takeaways to keep in mind:

- Clarity of Roles: The Operating Agreement clearly defines the roles and responsibilities of each member. This helps prevent misunderstandings and ensures everyone knows their duties.

- Flexibility: Unlike some states, California allows LLCs to customize their Operating Agreements. You can tailor the terms to fit your specific business needs.

- Ownership Structure: The agreement outlines how ownership interests are divided among members. This is crucial for determining profit sharing and decision-making authority.

- Dispute Resolution: Including a section on how disputes will be resolved can save time and money. It provides a clear process for addressing conflicts that may arise.

- Legal Protection: Having an Operating Agreement in place can provide legal protection for the business and its members. It demonstrates that the LLC is a separate entity, which can help shield personal assets from business liabilities.

By understanding these key points, you can effectively navigate the process of filling out and utilizing the California Operating Agreement form. This document is not just a formality; it is a vital tool for your business's success.

Similar forms

- Bylaws: Bylaws serve as the internal rules for a corporation. Similar to an Operating Agreement, they outline the governance structure, including roles of officers and procedures for meetings.

- Partnership Agreement: This document outlines the terms of a partnership. Like an Operating Agreement, it details the responsibilities, profit-sharing, and decision-making processes among partners.

- Shareholder Agreement: A Shareholder Agreement governs the relationship between shareholders. It parallels an Operating Agreement by specifying rights, obligations, and procedures for the transfer of shares.

- LLC Membership Agreement: This document is specific to limited liability companies. It functions similarly to an Operating Agreement by defining the roles and responsibilities of members within the LLC.

- Joint Venture Agreement: A Joint Venture Agreement outlines the terms of a temporary partnership for a specific project. It shares similarities with an Operating Agreement in terms of governance and profit-sharing arrangements.

- Power of Attorney: This legal document allows a principal to designate an agent to make decisions on their behalf, especially in health care or financial matters. Those interested can https://formsillinois.com/ to fill out the necessary form.

- Franchise Agreement: This agreement details the relationship between a franchisor and franchisee. Like an Operating Agreement, it establishes operational guidelines and responsibilities for both parties.

- Operating Procedures Manual: This manual provides detailed instructions for daily operations. It complements an Operating Agreement by offering practical guidance on implementing the governance structure.

- Employment Agreement: An Employment Agreement outlines the terms of employment for staff. It is similar to an Operating Agreement in that it specifies roles, responsibilities, and compensation structures.

- Indemnification Agreement: This document protects individuals from liability. It shares a common goal with an Operating Agreement by safeguarding the interests of members and managers within the business structure.