Attorney-Approved Power of Attorney Template for the State of California

Form Specifications

| Fact Name | Details |

|---|---|

| Definition | A Power of Attorney (POA) is a legal document that allows one person to act on behalf of another in legal or financial matters. |

| California Statute | The California Power of Attorney is governed by the California Probate Code, specifically sections 4000-4545. |

| Types of POA | California recognizes several types of POA, including General, Limited, Durable, and Medical Power of Attorney. |

| Durable POA | A Durable Power of Attorney remains effective even if the principal becomes incapacitated. |

| Agent Responsibilities | The agent, or attorney-in-fact, must act in the best interest of the principal and follow their instructions. |

| Revocation | The principal can revoke a Power of Attorney at any time, provided they are mentally competent. |

| Signing Requirements | The California POA must be signed by the principal and witnessed by at least one person or notarized. |

| Healthcare Decisions | A Medical Power of Attorney allows the agent to make healthcare decisions on behalf of the principal if they are unable to do so. |

| Limitations | Certain actions, such as changing a will or trust, cannot be delegated through a Power of Attorney. |

Dos and Don'ts

When filling out the California Power of Attorney form, it’s essential to follow specific guidelines to ensure everything is done correctly. Here’s a list of things to do and avoid.

- Do read the entire form carefully before starting.

- Do clearly state the powers you are granting.

- Do use clear and concise language.

- Do sign and date the form in the presence of a notary public.

- Don't leave any sections blank unless instructed.

- Don't use vague terms that could lead to confusion.

- Don't forget to inform the person you are appointing about their responsibilities.

- Don't assume that verbal agreements are sufficient; always have it in writing.

Create Popular Power of Attorney Forms for Different States

Printable Power of Attorney Form Texas - The agent's powers can include managing bank accounts, property, and investments.

How to Get Power of Attorney in North Carolina - Can be an important part of managing family affairs during crises.

General Power of Attorney Form Florida - This document gives legal authority to another person to act for you.

Common mistakes

-

Not specifying the type of Power of Attorney: Individuals often overlook the importance of indicating whether they are creating a general or limited Power of Attorney. A general Power of Attorney grants broad authority, while a limited one restricts the agent’s powers to specific tasks.

-

Failing to date the document: It is crucial to include the date when the Power of Attorney is signed. Without a date, it may lead to confusion about when the authority begins or whether the document is valid.

-

Not naming a successor agent: In some cases, people forget to designate a successor agent. If the primary agent is unable or unwilling to act, having a backup ensures that someone can step in to manage affairs.

-

Using vague language: Clarity is key when filling out the form. Ambiguous terms can lead to misunderstandings about what the agent is authorized to do. Specificity helps avoid potential disputes.

-

Neglecting to have witnesses or notarization: California law requires that a Power of Attorney be either witnessed or notarized. Skipping this step can render the document invalid.

-

Not discussing the document with the agent: It is essential to have a conversation with the chosen agent about their responsibilities. This ensures they understand their role and are willing to accept it.

-

Overlooking state-specific requirements: Each state has its own rules regarding Power of Attorney forms. Failing to adhere to California’s specific requirements can lead to complications.

-

Forgetting to revoke previous Powers of Attorney: If an individual has previously created a Power of Attorney, they must formally revoke it before establishing a new one. This prevents conflicting authorities.

Documents used along the form

When creating a Power of Attorney in California, several other documents may be beneficial to ensure comprehensive legal coverage and clarity of intent. Below is a list of commonly used forms that often accompany the Power of Attorney.

- Advance Healthcare Directive: This document allows individuals to outline their healthcare preferences and appoint someone to make medical decisions on their behalf if they become unable to do so.

- Durable Power of Attorney: Similar to a standard Power of Attorney, this version remains effective even if the principal becomes incapacitated, providing ongoing authority to the designated agent.

- Financial Power of Attorney: This specific form grants authority to manage financial matters, such as banking, investments, and property transactions, distinct from healthcare decisions.

- Living Will: A living will details an individual's wishes regarding end-of-life medical treatment, specifying the types of interventions they do or do not want.

- Trust Document: This legal document establishes a trust, allowing a designated trustee to manage assets for the benefit of specified beneficiaries, often used in estate planning.

- HIPAA Authorization: This form allows individuals to designate who can access their medical records and health information, ensuring that the appointed agent has the necessary information to make informed decisions.

Using these documents in conjunction with a Power of Attorney can help ensure that all aspects of a person's wishes are respected and legally upheld. It is always advisable to consult with a legal professional to tailor these documents to specific needs and circumstances.

Misconceptions

Understanding the California Power of Attorney form is essential for anyone considering its use. However, several misconceptions can cloud the process. Here are seven common misunderstandings:

- It only applies to financial matters. Many believe that a Power of Attorney is only for financial decisions. In reality, it can also cover health care decisions, depending on the type of Power of Attorney you choose.

- It must be notarized to be valid. While notarization can add an extra layer of authenticity, not all Power of Attorney forms require notarization. Some may only need witnesses, depending on the circumstances.

- Once signed, it cannot be changed. This is not true. A Power of Attorney can be revoked or modified at any time, as long as the person who created it is mentally competent.

- It gives unlimited power to the agent. A Power of Attorney does not mean the agent can do whatever they want. The document can specify the powers granted, and limits can be placed on what the agent can do.

- It becomes effective only when the principal is incapacitated. Some people think that a Power of Attorney only kicks in when the principal can no longer make decisions. However, it can be set up to take effect immediately or upon a specific event.

- It is only for elderly individuals. Many assume that only older adults need a Power of Attorney. In truth, anyone can benefit from having one, especially those with significant assets or health concerns.

- It automatically ends upon death. While it is true that a Power of Attorney ceases to be effective once the principal dies, it does not mean that the agent has no role afterward. The agent may have responsibilities related to the estate, but they will need to follow different legal procedures.

By addressing these misconceptions, individuals can make informed decisions about their legal needs and the use of a Power of Attorney in California.

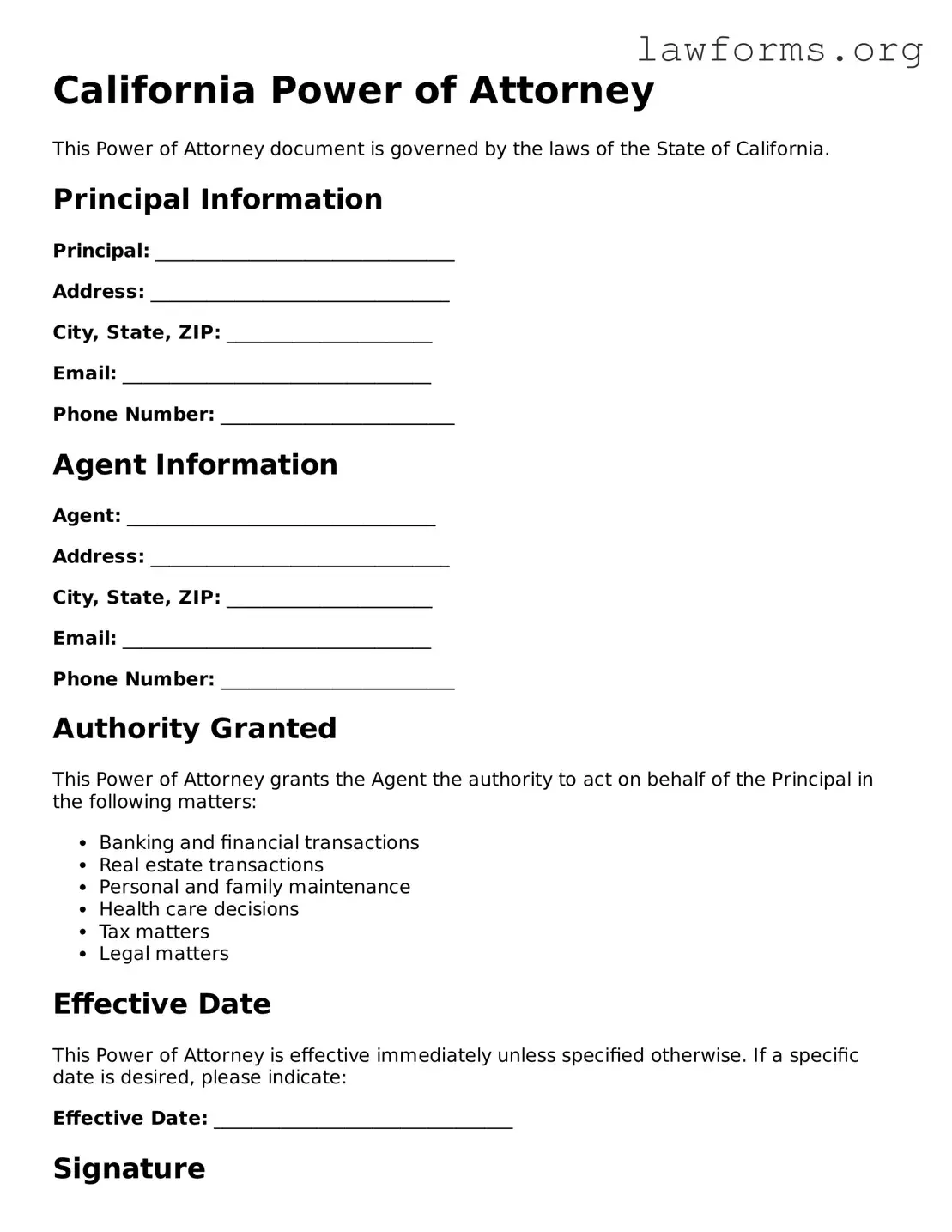

Preview - California Power of Attorney Form

California Power of Attorney

This Power of Attorney document is governed by the laws of the State of California.

Principal Information

Principal: ________________________________

Address: ________________________________

City, State, ZIP: ______________________

Email: _________________________________

Phone Number: _________________________

Agent Information

Agent: _________________________________

Address: ________________________________

City, State, ZIP: ______________________

Email: _________________________________

Phone Number: _________________________

Authority Granted

This Power of Attorney grants the Agent the authority to act on behalf of the Principal in the following matters:

- Banking and financial transactions

- Real estate transactions

- Personal and family maintenance

- Health care decisions

- Tax matters

- Legal matters

Effective Date

This Power of Attorney is effective immediately unless specified otherwise. If a specific date is desired, please indicate:

Effective Date: ________________________________

Signature

By signing below, the Principal affirms that they are of sound mind and voluntarily grant the authority outlined in this document.

Principal's Signature: ________________________________

Date: ________________________________

Witnesses

This document must be signed in the presence of two witnesses.

Witness 1 Name: ________________________________

Witness 1 Signature: ________________________________

Date: ________________________________

Witness 2 Name: ________________________________

Witness 2 Signature: ________________________________

Date: ________________________________

Notary Acknowledgment

State of California, County of ______________________

On this ____ day of _____________, 20__, before me, a Notary Public, personally appeared _______________________ (Principal), known to me to be the person whose name is subscribed to the within instrument, and acknowledged that they executed the same.

Notary Public Signature: ________________________________

My Commission Expires: ________________________________

Key takeaways

Filling out and using a Power of Attorney (POA) form in California is an important process that allows you to designate someone to make decisions on your behalf. Here are key takeaways to keep in mind:

- Understand the Types of POA: California recognizes different types of POA, including durable, medical, and limited. Each serves a distinct purpose.

- Choose Your Agent Wisely: Your agent should be someone you trust completely, as they will have significant control over your financial or medical decisions.

- Complete the Form Accurately: Ensure all sections of the form are filled out completely and accurately to avoid any issues later on.

- Sign and Date the Document: Both you and your agent must sign and date the form. Witnesses may also be required, depending on the type of POA.

- Notarization May Be Required: While not always necessary, having the document notarized can add an extra layer of validation.

- Communicate with Your Agent: Discuss your wishes and preferences with your agent to ensure they understand your intentions.

- Keep Copies Accessible: After completing the form, keep copies in a safe place and provide copies to your agent and relevant institutions.

- Review Regularly: Life circumstances change. Review your POA periodically to ensure it still reflects your wishes.

- Understand Revocation: You have the right to revoke the POA at any time, as long as you are mentally competent to do so.

Being informed about the Power of Attorney process can help you make sound decisions and ensure your wishes are honored when it matters most.

Similar forms

The Power of Attorney (POA) form is a legal document that grants someone the authority to act on another person's behalf. There are several other documents that share similarities with the Power of Attorney. Here’s a list of eight such documents, along with explanations of how they are alike:

- Living Will: Like a Power of Attorney, a living will allows individuals to express their wishes regarding medical treatment. It specifically addresses healthcare decisions when a person cannot communicate their preferences.

- Healthcare Proxy: This document designates someone to make healthcare decisions for an individual if they are unable to do so themselves. Similar to a POA, it empowers another person to act on behalf of the individual in medical matters.

- Durable Power of Attorney: A durable POA is a specific type of Power of Attorney that remains effective even if the person who created it becomes incapacitated. It serves a similar purpose but emphasizes continuity in authority.

- Financial Power of Attorney: This document is a specific type of POA that grants authority over financial matters. It is similar in function but focuses solely on financial decisions rather than broader legal actions.

- Trust Agreement: A trust agreement allows a person to transfer assets to a trustee for the benefit of others. While it serves a different purpose, both documents involve delegating authority to manage affairs on behalf of another.

- Will: A will outlines how a person’s assets should be distributed after their death. While it does not grant authority during a person’s lifetime, it does reflect a similar intention to designate control over personal matters.

- Guardianship Documents: These documents appoint someone to care for a minor or an incapacitated adult. Like a POA, they involve designating someone to make decisions on behalf of another person.

- Trailer Bill of Sale: The Forms Washington provides a template for the Trailer Bill of Sale, which is essential for legally transferring ownership of a trailer, ensuring all necessary details are documented to comply with state requirements.

- Affidavit: An affidavit is a sworn statement used to confirm certain facts. While it does not grant authority, it can be used in conjunction with a POA to affirm the legitimacy of the authority being exercised.

Each of these documents serves a unique purpose but shares the common theme of delegating authority or expressing wishes regarding personal affairs. Understanding these similarities can help individuals make informed decisions about their legal options.