Attorney-Approved Prenuptial Agreement Template for the State of California

Form Specifications

| Fact Name | Details |

|---|---|

| Definition | A prenuptial agreement is a contract between two individuals before marriage that outlines the division of assets and responsibilities in the event of a divorce. |

| Governing Law | California Family Code Sections 1600-1617 govern prenuptial agreements in California. |

| Voluntary Agreement | Both parties must enter into the agreement voluntarily, without any pressure or coercion. |

| Full Disclosure | Each party is required to fully disclose their assets and liabilities for the agreement to be valid. |

| Written Requirement | The agreement must be in writing. Oral prenuptial agreements are not enforceable in California. |

| Notarization | While notarization is not mandatory, having the agreement notarized can strengthen its validity. |

| Legal Representation | It is advisable for both parties to have independent legal representation to ensure fairness and understanding. |

| Enforceability | The agreement can be challenged in court if it is deemed unfair or if one party did not understand its terms. |

| Modification | Prenuptial agreements can be modified after marriage, but any changes must be in writing and signed by both parties. |

Dos and Don'ts

When filling out the California Prenuptial Agreement form, it’s important to approach the process with care. Here are some key things to keep in mind:

- Do be honest about your financial situation. Transparency is crucial for the agreement to be valid.

- Do consult with a legal professional. They can help ensure that your rights are protected and that the agreement complies with California law.

- Do discuss the terms openly with your partner. Mutual understanding can prevent future conflicts.

- Do keep copies of the signed agreement. Having documentation is important for future reference.

- Don't rush the process. Take your time to consider all aspects of the agreement.

- Don't hide assets or debts. Full disclosure is necessary for the agreement to hold up in court.

- Don't use vague language. Be clear and specific about the terms to avoid misunderstandings.

- Don't forget to review the agreement periodically. Life changes, and so might your financial situation.

Create Popular Prenuptial Agreement Forms for Different States

North Carolina Premarital Agreement - The agreement may need to be renewed or revisited in the event of major life changes.

When navigating the complexities of a horse transaction, having a well-prepared document is vital. For an effective exchange, you may find this thorough Horse Bill of Sale template particularly useful in ensuring all necessary details are recorded.

New York Premarital Agreement - A prudent step for couples regardless of wealth level.

New Jersey Premarital Agreement - A prenuptial agreement can minimize the potential for financial arguments during the marriage.

Common mistakes

-

Not fully understanding the purpose of the agreement. Many individuals fill out the form without realizing that a prenuptial agreement is meant to protect assets and clarify financial responsibilities. Understanding this can help in accurately completing the form.

-

Failing to disclose all assets and debts. It’s crucial to list all assets and liabilities. Omitting significant items can lead to disputes later. Transparency is key to ensuring that both parties feel secure.

-

Using vague or ambiguous language. Clear and precise language is essential. Ambiguities can create confusion and lead to legal challenges in the future. Each term should be defined and understood by both parties.

-

Not considering future changes. Life circumstances can change, such as income fluctuations or the birth of children. Failing to address how these changes will be managed in the agreement can lead to complications later.

-

Neglecting to consult with legal professionals. While it may seem straightforward, having legal guidance can prevent mistakes. An attorney can provide insights that help ensure the agreement is enforceable and fair.

-

Rushing the process. Taking time to carefully review and discuss the agreement is important. Hurrying through the completion can lead to oversights and regrets down the line.

Documents used along the form

A California Prenuptial Agreement is a legal document that outlines the division of assets and responsibilities in the event of a divorce. Several other forms and documents may accompany this agreement to ensure a comprehensive understanding of the couple's financial and legal obligations. Below is a list of some commonly used documents.

- Financial Disclosure Statement: This document requires both parties to provide a complete overview of their financial situation, including income, debts, and assets. Transparency is essential for a fair agreement.

- Postnuptial Agreement: Similar to a prenuptial agreement, this document is created after marriage. It outlines the division of assets and responsibilities, often used when circumstances change significantly.

- Minnesota Motor Vehicle Bill of Sale: This form is vital for documenting the transfer of vehicle ownership and is available through Formaid Org, offering clarity and legal protection for both buyers and sellers.

- Separation Agreement: In the event of a separation, this document details how the couple will handle their assets, debts, and responsibilities while living apart. It can be a precursor to divorce proceedings.

- Property Settlement Agreement: This agreement is typically created during divorce proceedings. It specifies how marital property will be divided between the spouses.

- Will: A will outlines how an individual's assets will be distributed upon their death. Couples may choose to update their wills in conjunction with a prenuptial agreement to reflect their shared financial goals.

- Trust Documents: These documents establish a trust to manage assets during and after marriage. They can provide additional protection for assets and ensure they are distributed according to the couple's wishes.

These documents, when used alongside a California Prenuptial Agreement, help clarify the financial and legal landscape of a marriage. Properly executed, they can provide peace of mind and reduce potential conflicts in the future.

Misconceptions

Many people have misconceptions about prenuptial agreements, especially in California. Understanding the truth behind these beliefs can help couples make informed decisions. Here are eight common misconceptions:

- Prenuptial agreements are only for the wealthy. This is a common myth. Anyone can benefit from a prenuptial agreement, regardless of their financial situation. It can help clarify financial responsibilities and protect individual assets.

- Prenuptial agreements are only for divorce. While they can outline terms for divorce, these agreements also address issues like financial management during the marriage and can protect both parties' interests.

- Prenuptial agreements are not legally binding. When drafted correctly and signed by both parties, these agreements are legally enforceable in California. It's essential to follow the proper legal procedures to ensure validity.

- Only one partner needs a lawyer. For a prenuptial agreement to be fair and enforceable, both parties should have independent legal representation. This helps ensure that both sides understand their rights and obligations.

- Prenuptial agreements can cover anything. While they can address many financial matters, certain topics, like child custody and support, cannot be included in a prenuptial agreement. Courts will not enforce provisions that violate public policy.

- Prenuptial agreements are a sign of distrust. Many couples view these agreements as a proactive approach to financial planning. They can foster open communication about finances, which is crucial for a healthy relationship.

- Prenuptial agreements are permanent. These agreements can be modified or revoked if both parties agree. Life circumstances change, and it's possible to update the agreement to reflect new realities.

- Prenuptial agreements are only for first marriages. Individuals entering a second or subsequent marriage often find prenuptial agreements particularly beneficial. They can help protect children from previous relationships and ensure fair distribution of assets.

By debunking these misconceptions, couples can better understand the role of prenuptial agreements in their lives. Open discussions about finances can lead to stronger partnerships.

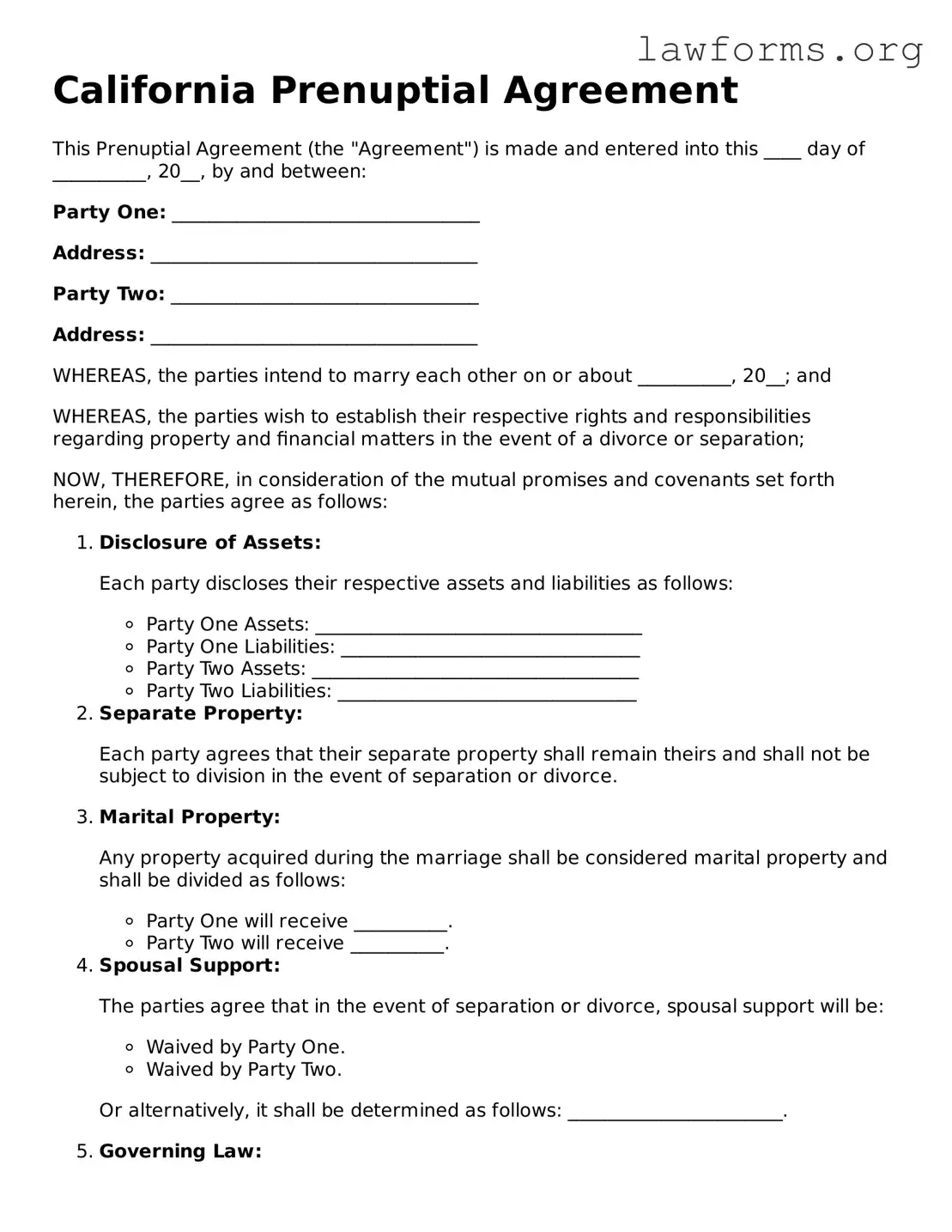

Preview - California Prenuptial Agreement Form

California Prenuptial Agreement

This Prenuptial Agreement (the "Agreement") is made and entered into this ____ day of __________, 20__, by and between:

Party One: _________________________________

Address: ___________________________________

Party Two: _________________________________

Address: ___________________________________

WHEREAS, the parties intend to marry each other on or about __________, 20__; and

WHEREAS, the parties wish to establish their respective rights and responsibilities regarding property and financial matters in the event of a divorce or separation;

NOW, THEREFORE, in consideration of the mutual promises and covenants set forth herein, the parties agree as follows:

- Disclosure of Assets:

Each party discloses their respective assets and liabilities as follows:

- Party One Assets: ___________________________________

- Party One Liabilities: ________________________________

- Party Two Assets: ___________________________________

- Party Two Liabilities: ________________________________

- Separate Property:

Each party agrees that their separate property shall remain theirs and shall not be subject to division in the event of separation or divorce.

- Marital Property:

Any property acquired during the marriage shall be considered marital property and shall be divided as follows:

- Party One will receive __________.

- Party Two will receive __________.

- Spousal Support:

The parties agree that in the event of separation or divorce, spousal support will be:

- Waived by Party One.

- Waived by Party Two.

Or alternatively, it shall be determined as follows: _______________________.

- Governing Law:

This Agreement shall be governed by, and construed in accordance with, the laws of the State of California.

- Amendment:

This Agreement may only be amended in writing and signed by both parties.

- Severability:

If any provision of this Agreement is found to be invalid or unenforceable, the remaining provisions shall remain in effect.

IN WITNESS WHEREOF, the parties hereto have executed this California Prenuptial Agreement on the date first above written.

_______________________________

Party One

_______________________________

Party Two

_______________________________

Date

Key takeaways

When considering a prenuptial agreement in California, it's important to understand the key aspects involved in filling out and using the form. Here are some essential takeaways:

- Understand the Purpose: A prenuptial agreement helps clarify financial rights and responsibilities before marriage.

- Full Disclosure: Both parties must provide complete and honest information about their finances. This includes assets, debts, and income.

- Legal Requirements: The agreement must be in writing and signed by both parties to be enforceable.

- Consider Timing: It's best to finalize the agreement well before the wedding date to avoid any claims of coercion.

- Seek Legal Advice: Consulting with an attorney can help ensure that the agreement is fair and compliant with California law.

- Review Regularly: Life changes, such as having children or changes in income, may necessitate updates to the agreement.

- Be Open and Honest: Communication is key. Discussing the agreement openly can strengthen your relationship.

Similar forms

- Postnuptial Agreement: Similar to a prenuptial agreement, this document is created after marriage. It outlines how assets and debts will be handled in case of divorce or separation.

- Separation Agreement: This document is used when a couple decides to live apart. It details the division of property, debts, and child custody arrangements.

- Divorce Settlement Agreement: After a divorce, this agreement finalizes the terms of the divorce, including asset division, alimony, and child support.

- Co-habitation Agreement: For couples living together without marriage, this document sets out the rights and responsibilities regarding property and finances.

- Durable Power of Attorney: A Durable Power of Attorney allows a designated person to make decisions on your behalf when you are unable to do so. This document is crucial for maintaining control over your financial and medical matters. For a template, you can refer to Forms Washington.

- Living Will: While not directly related to marriage, a living will outlines healthcare preferences. It can be important for couples to ensure their wishes are respected.

- Power of Attorney: This document allows one person to make legal decisions on behalf of another. It can be crucial in marriage for financial and healthcare decisions.

- Will: A will specifies how a person's assets will be distributed after death. Couples often create or update wills to reflect their shared lives.

- Trust Agreement: This document establishes a trust to manage assets for beneficiaries. Couples may use trusts for estate planning and asset protection.

- Financial Disclosure Statement: This is often required in divorce proceedings. It provides a clear picture of each party's financial situation.

- Child Custody Agreement: This outlines the arrangements for child custody and support, crucial for couples with children, especially during separation or divorce.