Attorney-Approved Promissory Note Template for the State of California

Form Specifications

| Fact Name | Description |

|---|---|

| Definition | A California promissory note is a written promise to pay a specified amount of money to a designated person or entity. |

| Governing Law | California Civil Code Sections 3300-3350 govern promissory notes in California. |

| Parties Involved | The note typically involves a borrower (maker) and a lender (payee). |

| Interest Rate | The interest rate can be fixed or variable, and it must be clearly stated in the note. |

| Payment Terms | Payment terms, including due dates and payment amounts, should be specified in the document. |

| Default Clause | A default clause outlines the consequences if the borrower fails to make payments. |

| Signatures | The note must be signed by the borrower to be legally binding. |

| Notarization | While notarization is not required, it can provide additional legal protection. |

| Transferability | Promissory notes can often be transferred to another party through endorsement. |

| Enforceability | To be enforceable, the note must contain all essential terms and be executed properly. |

Dos and Don'ts

When filling out the California Promissory Note form, it’s essential to follow certain guidelines to ensure accuracy and legality. Here’s a list of dos and don’ts to help you through the process.

- Do read the entire form carefully before starting.

- Do provide clear and accurate information regarding the borrower and lender.

- Do specify the loan amount in both numbers and words.

- Do include the interest rate, if applicable, and clarify whether it is fixed or variable.

- Do outline the repayment schedule, including due dates and payment amounts.

- Don't leave any sections blank; every part of the form must be completed.

- Don't use vague language; be specific about terms and conditions.

- Don't forget to sign and date the document; both parties must do this.

- Don't ignore state laws regarding interest rates and loan terms.

- Don't rush through the process; take your time to ensure everything is correct.

Create Popular Promissory Note Forms for Different States

Promissory Note Template Ohio - Borrowers should be aware of their rights under the terms set forth in the promissory note.

A California Hold Harmless Agreement is a legal document designed to protect one party from liability for certain actions or events. This form is commonly used in various situations, such as contracts and rental agreements, where one party agrees to assume the risk and hold another party harmless from any potential claims. For more information on how to properly complete this agreement, you can visit californiadocsonline.com/hold-harmless-agreement-form. Understanding this agreement is essential for anyone looking to navigate liability issues effectively in California.

Create Promissory Note - The formal structure of the Promissory Note instills confidence in the loan process.

Common mistakes

-

Incomplete Information: One of the most common mistakes is failing to provide all necessary details. Each section of the form must be filled out completely. This includes the names of the borrower and lender, the loan amount, and the repayment terms. Missing any information can lead to confusion or disputes later on.

-

Incorrect Loan Amount: Entering an incorrect loan amount can create significant issues. Borrowers should double-check the figures to ensure accuracy. A mistake in the amount can affect repayment schedules and the overall agreement.

-

Neglecting to Specify Interest Rates: If the loan includes interest, it is crucial to clearly state the interest rate. Leaving this blank or miscalculating it can lead to misunderstandings about how much will ultimately be owed.

-

Failure to Outline Payment Terms: Clearly defining the payment terms is essential. This includes specifying when payments are due, how often they should be made, and the method of payment. Vague terms can lead to disputes about when and how much is owed.

-

Not Including Default Terms: It is important to address what happens in the event of default. Many people overlook this, but including terms about late payments or defaults can protect both parties and clarify expectations.

-

Missing Signatures: A promissory note is not valid without the signatures of both the borrower and lender. Forgetting to sign can render the document unenforceable. Each party should ensure they have signed and dated the form.

-

Not Keeping Copies: After filling out the form, individuals often forget to keep copies for their records. Having a copy is essential for both parties to refer back to the terms of the agreement in the future.

Documents used along the form

When entering into a loan agreement in California, a Promissory Note is just one of several important documents that may be involved. Each of these documents serves a specific purpose and helps clarify the terms and responsibilities of the parties involved. Below is a list of other common forms and documents that are often used alongside a California Promissory Note.

- Loan Agreement: This document outlines the terms of the loan, including the amount borrowed, interest rate, repayment schedule, and any collateral involved. It provides a comprehensive overview of the agreement between the lender and borrower.

- Security Agreement: If the loan is secured by collateral, this document details the assets that back the loan. It specifies the rights of the lender in case the borrower defaults.

- Disclosure Statement: This form provides important information about the loan, such as fees, interest rates, and terms. It ensures that the borrower fully understands the financial implications of the loan.

- Personal Guarantee: In some cases, a third party may agree to guarantee the loan. This document makes that person legally responsible for the debt if the borrower fails to repay.

- Amortization Schedule: This schedule breaks down each payment over the life of the loan, showing how much goes toward interest and how much goes toward the principal. It helps borrowers understand their payment obligations.

- Loan Modification Agreement: If the borrower needs to change the terms of the original loan, this document outlines the new terms and conditions agreed upon by both parties.

- Default Notice: Should the borrower fail to make payments, this notice is issued to inform them of the default and the potential consequences, including legal action.

- Release of Lien: Once the loan is paid off, this document is filed to remove any lien placed on the borrower's property as collateral for the loan.

- Motorcycle Bill of Sale: Completing a Motorcycle Bill of Sale provides clear documentation for the transfer of ownership and includes essential details such as the buyer and seller information, as well as specifics about the motorcycle itself. For a template, you can refer to Forms Washington.

- UCC Financing Statement: This document is filed to give public notice of the lender's interest in the borrower's collateral. It protects the lender's rights in the event of a default.

Each of these documents plays a vital role in the lending process. Understanding their purposes can help both lenders and borrowers navigate their financial agreements more effectively and ensure that all parties are protected throughout the duration of the loan.

Misconceptions

Understanding the California Promissory Note form is crucial for both lenders and borrowers. However, several misconceptions can lead to confusion and potential legal issues. Here are five common misconceptions:

-

All Promissory Notes are the Same:

Many people believe that all promissory notes are interchangeable. In reality, the terms and conditions can vary significantly. Each note should be tailored to the specific agreement between the parties involved.

-

Promissory Notes Do Not Need to Be Written:

Some assume that verbal agreements are sufficient for promissory notes. However, California law requires that promissory notes be in writing to be enforceable. A written document provides clarity and proof of the agreement.

-

Interest Rates Are Unlimited:

There is a misconception that lenders can charge any interest rate they choose. California has specific usury laws that limit the amount of interest that can be charged on loans, depending on the type of loan and the amount.

-

Promissory Notes Are Only for Large Loans:

Many think that promissory notes are only necessary for substantial loans. In truth, they can be used for any amount, regardless of size. Even small loans benefit from a formal agreement.

-

Signing a Promissory Note Is a Guarantee of Payment:

Some believe that signing a promissory note guarantees that the borrower will repay the loan. While it creates a legal obligation, it does not ensure payment. Borrowers may still default, and lenders should be prepared for this possibility.

By addressing these misconceptions, both lenders and borrowers can navigate the lending process more effectively and protect their interests.

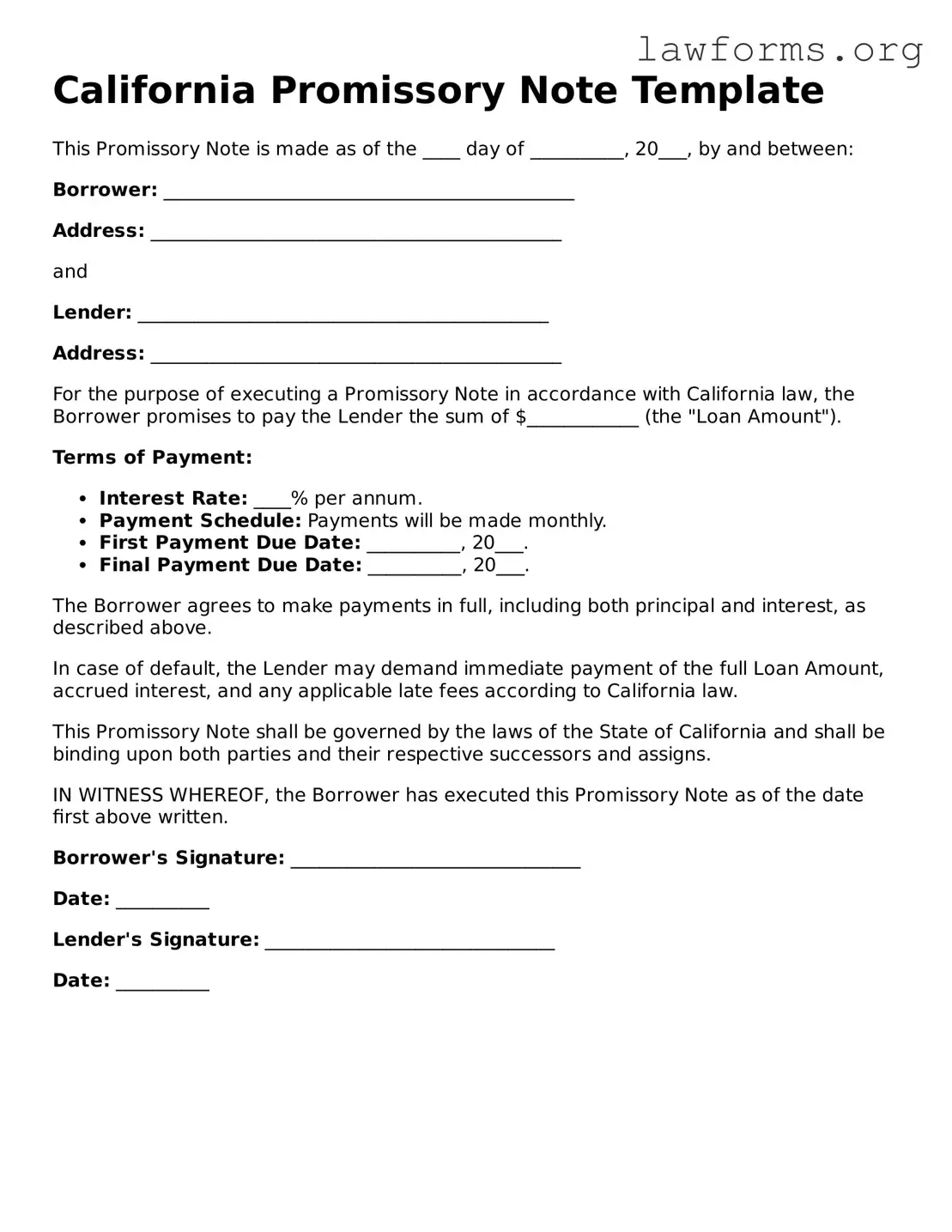

Preview - California Promissory Note Form

California Promissory Note Template

This Promissory Note is made as of the ____ day of __________, 20___, by and between:

Borrower: ____________________________________________

Address: ____________________________________________

and

Lender: ____________________________________________

Address: ____________________________________________

For the purpose of executing a Promissory Note in accordance with California law, the Borrower promises to pay the Lender the sum of $____________ (the "Loan Amount").

Terms of Payment:

- Interest Rate: ____% per annum.

- Payment Schedule: Payments will be made monthly.

- First Payment Due Date: __________, 20___.

- Final Payment Due Date: __________, 20___.

The Borrower agrees to make payments in full, including both principal and interest, as described above.

In case of default, the Lender may demand immediate payment of the full Loan Amount, accrued interest, and any applicable late fees according to California law.

This Promissory Note shall be governed by the laws of the State of California and shall be binding upon both parties and their respective successors and assigns.

IN WITNESS WHEREOF, the Borrower has executed this Promissory Note as of the date first above written.

Borrower's Signature: _______________________________

Date: __________

Lender's Signature: _______________________________

Date: __________

Key takeaways

Ensure that all parties involved in the loan are clearly identified. This includes the borrower and the lender.

Clearly state the loan amount. The exact figure should be written in both numbers and words to avoid confusion.

Include the interest rate, if applicable. Specify whether it is fixed or variable and detail how it will be calculated.

Outline the repayment terms. Specify the payment schedule, including due dates and the total duration of the loan.

Make sure to sign and date the document. Both the borrower and lender must provide their signatures for the agreement to be valid.

Similar forms

- Loan Agreement: This document outlines the terms of a loan, including the amount borrowed, interest rate, and repayment schedule. Like a promissory note, it serves as a commitment to repay a specific sum of money.

- Mortgage: A mortgage is a type of loan secured by real property. It includes a promissory note as part of the agreement, ensuring that the borrower will repay the loan while detailing the collateral involved.

- Installment Agreement: Similar to a promissory note, this document specifies a payment plan for the borrower. It breaks down the total amount owed into smaller, manageable payments over time.

- Security Agreement: This document provides collateral for a loan. It often accompanies a promissory note, ensuring that the lender has rights to the collateral if the borrower defaults.

- Personal Guarantee: A personal guarantee is a promise made by an individual to repay a debt if the primary borrower defaults. It reinforces the commitment found in a promissory note.

- Debt Settlement Agreement: This document outlines the terms under which a debtor agrees to pay a reduced amount to settle a debt. It serves a similar purpose to a promissory note by establishing a repayment plan.

- Loan Modification Agreement: This document modifies the terms of an existing loan. It may adjust the interest rate or payment schedule while retaining the original promissory note's core commitment.

- Non-disclosure Agreement: This agreement is essential for protecting sensitive information exchanged during negotiations or business operations. By using a Non-disclosure Agreement, parties can ensure confidentiality and prevent unauthorized disclosures of proprietary information, making it a crucial step for businesses operating in Illinois. For more information, visit formsillinois.com/.

- Lease Agreement: While primarily for renting property, some lease agreements include provisions for payment similar to a promissory note, detailing the obligations of the tenant to pay rent.

- Bill of Sale: This document transfers ownership of personal property. It can include payment terms, acting similarly to a promissory note when payments are made over time.

- Credit Agreement: This document outlines the terms under which credit is extended. It includes details about repayment, interest, and other obligations, much like a promissory note.