Attorney-Approved Quitclaim Deed Template for the State of California

Form Specifications

| Fact Name | Description |

|---|---|

| Definition | A Quitclaim Deed is a legal document used to transfer ownership of real property without any warranties or guarantees regarding the title. |

| Governing Law | The Quitclaim Deed in California is governed by the California Civil Code, specifically Sections 1091 and 1092. |

| Usage | This form is commonly used among family members, divorcing spouses, or in situations where the parties know each other well. |

| Consideration | While a Quitclaim Deed can be executed for no consideration, it is often accompanied by a nominal payment to formalize the transfer. |

| Filing Requirements | After signing, the Quitclaim Deed must be filed with the county recorder's office where the property is located to be legally effective. |

| Impact on Title | The Quitclaim Deed transfers whatever interest the grantor has in the property, but it does not guarantee that the title is free of claims or liens. |

Dos and Don'ts

When filling out the California Quitclaim Deed form, it’s important to follow certain guidelines to ensure accuracy and compliance. Here’s a list of things to do and avoid:

- Do provide the correct names of all parties involved in the transaction.

- Do include a complete legal description of the property being transferred.

- Do ensure that the form is signed in front of a notary public.

- Do check for any outstanding liens or encumbrances on the property.

- Don't leave any fields blank; all sections must be filled out completely.

- Don't use white-out or erase mistakes; instead, cross out errors neatly and initial them.

- Don't forget to include the date of the transfer.

- Don't submit the form without first making a copy for your records.

Create Popular Quitclaim Deed Forms for Different States

Quitclaim Deed Form New Jersey - Simple, effective, and straightforward property transfer method.

When considering future planning, it is crucial to be aware of the California Durable Power of Attorney form, a vital legal document that enables a principal to designate an agent for decision-making even in cases of incapacity. For more detailed information on this essential form, you can visit californiadocsonline.com/durable-power-of-attorney-form.

Florida Quit Claim Deed Rules - If you are gifting property to someone, a Quitclaim Deed is a common method to transfer ownership smoothly.

Common mistakes

-

Incorrect Names: One common mistake is failing to accurately list the names of the grantor (the person transferring the property) and the grantee (the person receiving the property). It’s essential to use the full legal names as they appear on official documents.

-

Missing Signatures: The form must be signed by the grantor. Sometimes, individuals forget to sign the document or assume that a witness is not necessary. In California, the signature of the grantor is crucial for the deed to be valid.

-

Improper Notarization: A quitclaim deed typically needs to be notarized. Failing to have the document notarized, or having it notarized incorrectly, can lead to complications when recording the deed.

-

Incorrect Property Description: The property description should be precise. Mistakes in the legal description, such as incorrect lot numbers or boundaries, can create confusion and lead to disputes in the future.

-

Omitting the Consideration: While a quitclaim deed does not require a monetary exchange, it is still important to indicate the consideration, even if it is just a nominal amount. Leaving this section blank can raise questions about the validity of the transfer.

-

Not Recording the Deed: After completing the quitclaim deed, individuals often forget to file it with the appropriate county recorder’s office. Recording the deed is essential to ensure that the transfer is legally recognized and to protect the rights of the new owner.

Documents used along the form

The California Quitclaim Deed form is a crucial document for transferring property ownership. However, several other forms and documents are often used in conjunction with it to ensure a smooth transaction. Below is a list of these essential documents, each serving a specific purpose in the property transfer process.

- Grant Deed: This document provides a guarantee that the property has not been sold to anyone else and that the seller has the right to transfer the property.

- Warranty Deed: A warranty deed offers the highest level of protection for the buyer, ensuring that the seller guarantees clear title to the property.

- Property Transfer Tax Form: This form is required by the county to report the transfer of property and assess any applicable taxes.

- Title Report: A title report outlines the ownership history of the property, revealing any liens or encumbrances that may affect the transfer.

- Mobile Home Bill of Sale: This legal document is essential for transferring ownership of a mobile home and includes pertinent details such as buyer and seller information, mobile home description, and sale price. For a comprehensive template, you can refer to Forms Washington.

- Affidavit of Death: This document is necessary when transferring property from a deceased owner, establishing the heir's right to the property.

- Preliminary Change of Ownership Report: This form is used to notify the county of a change in property ownership and is often required for tax purposes.

- Power of Attorney: This document allows one person to act on behalf of another in property transactions, often used when the owner cannot be present.

- Escrow Instructions: These instructions guide the escrow agent in handling the transaction, detailing the terms agreed upon by the buyer and seller.

- Homeowners Association (HOA) Documents: If the property is part of an HOA, these documents outline the rules, regulations, and fees associated with the community.

- Disclosure Statements: Sellers may be required to provide disclosures about the property's condition, including any known issues that could affect its value.

Using these forms and documents in conjunction with the California Quitclaim Deed helps ensure a clear and legally sound transfer of property ownership. It is advisable to consult with a legal professional to ensure all necessary paperwork is completed correctly.

Misconceptions

Understanding the California Quitclaim Deed form is essential for anyone involved in property transactions. However, several misconceptions can lead to confusion. Here are eight common misunderstandings:

- Quitclaim Deeds Transfer Ownership Completely: Many believe that a quitclaim deed guarantees a full transfer of ownership. In reality, it transfers whatever interest the grantor has, which may be none at all.

- Quitclaim Deeds Are Only for Family Transfers: While often used among family members, quitclaim deeds can be used in various situations, including sales and transfers between unrelated parties.

- Quitclaim Deeds Eliminate Liens: Some think that using a quitclaim deed will remove any existing liens or debts on the property. This is not true; liens remain attached to the property regardless of the deed used.

- Quitclaim Deeds Are the Same as Warranty Deeds: A common misconception is that quitclaim deeds offer the same protections as warranty deeds. Unlike warranty deeds, quitclaim deeds do not guarantee the title's validity.

- Quitclaim Deeds Require Notarization: While notarization is recommended for legal purposes, it is not always a strict requirement for a quitclaim deed to be valid in California.

- Quitclaim Deeds Can Only Be Used for Real Estate: Some people think quitclaim deeds are limited to real estate transactions. However, they can also be used for other types of property transfers, such as vehicles or personal property.

- Quitclaim Deeds Are Irrevocable: A misconception exists that once a quitclaim deed is executed, it cannot be undone. In fact, the grantor can revoke the deed under certain conditions, such as mutual agreement.

- Using a Quitclaim Deed is Always Simple: While the process may seem straightforward, complications can arise, especially when dealing with multiple owners or unclear property titles. Legal advice is often beneficial.

Being aware of these misconceptions can help you navigate property transactions more effectively. Always consider seeking professional guidance to ensure a smooth process.

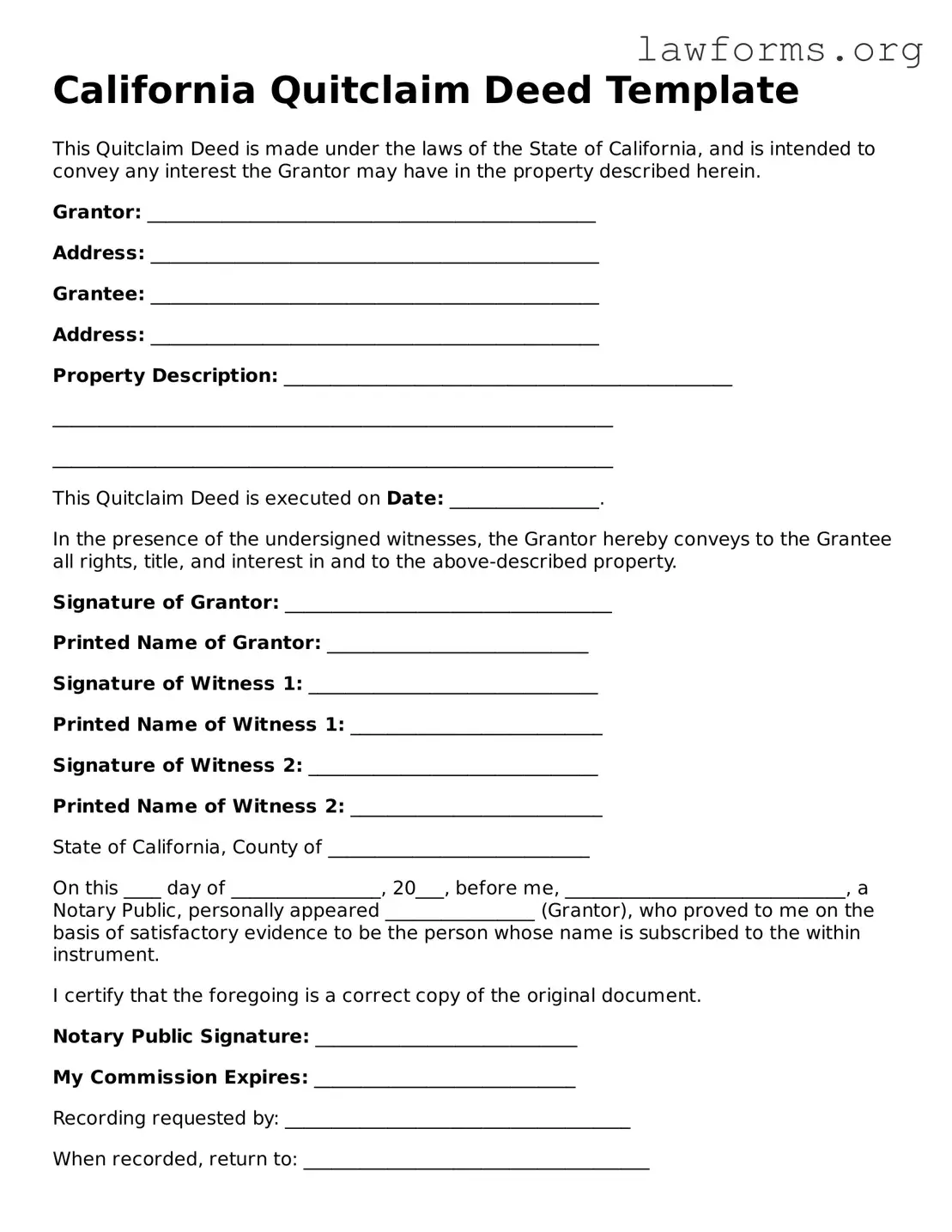

Preview - California Quitclaim Deed Form

California Quitclaim Deed Template

This Quitclaim Deed is made under the laws of the State of California, and is intended to convey any interest the Grantor may have in the property described herein.

Grantor: ________________________________________________

Address: ________________________________________________

Grantee: ________________________________________________

Address: ________________________________________________

Property Description: ________________________________________________

____________________________________________________________

____________________________________________________________

This Quitclaim Deed is executed on Date: ________________.

In the presence of the undersigned witnesses, the Grantor hereby conveys to the Grantee all rights, title, and interest in and to the above-described property.

Signature of Grantor: ___________________________________

Printed Name of Grantor: ____________________________

Signature of Witness 1: _______________________________

Printed Name of Witness 1: ___________________________

Signature of Witness 2: _______________________________

Printed Name of Witness 2: ___________________________

State of California, County of ____________________________

On this ____ day of ________________, 20___, before me, ______________________________, a Notary Public, personally appeared ________________ (Grantor), who proved to me on the basis of satisfactory evidence to be the person whose name is subscribed to the within instrument.

I certify that the foregoing is a correct copy of the original document.

Notary Public Signature: ____________________________

My Commission Expires: ____________________________

Recording requested by: _____________________________________

When recorded, return to: _____________________________________

Key takeaways

When filling out and using the California Quitclaim Deed form, it is essential to understand the key components and implications of the document. Here are seven important takeaways:

- Purpose of the Quitclaim Deed: This form is primarily used to transfer ownership of real estate from one party to another without any warranties. It effectively conveys whatever interest the grantor has in the property.

- Identification of Parties: Clearly identify both the grantor (the person transferring the property) and the grantee (the person receiving the property). Full names and addresses should be included to avoid any confusion.

- Property Description: Provide a detailed description of the property being transferred. This includes the address and legal description, which can typically be found in previous property documents.

- Signatures Required: The deed must be signed by the grantor. If the grantor is a business entity, an authorized representative must sign on behalf of the entity.

- Notarization: The signature of the grantor must be notarized. This step is crucial as it adds an extra layer of authenticity to the document.

- Recording the Deed: After completing the form, it is important to file it with the county recorder's office where the property is located. This step ensures that the transfer of ownership is legally recognized.

- Tax Implications: Be aware of potential tax consequences associated with the transfer. Consulting with a tax professional can help clarify any obligations that may arise from the transaction.

Understanding these key points can facilitate a smoother process when using the California Quitclaim Deed form. Proper attention to detail will help ensure that the transfer of property rights is executed effectively and legally.

Similar forms

- Warranty Deed: Like a quitclaim deed, a warranty deed transfers ownership of property. However, it provides a guarantee that the seller holds clear title to the property and has the right to sell it. This added assurance can be crucial for buyers.

- Grant Deed: A grant deed also conveys property ownership, similar to a quitclaim deed. The key difference is that a grant deed includes implied warranties that the property is free from encumbrances, except those disclosed.

- Deed of Trust: This document secures a loan with real estate as collateral. While it doesn’t transfer ownership outright like a quitclaim deed, it establishes a legal claim to the property until the loan is repaid.

- Mobile Home Bill of Sale: This document is crucial for the sale and transfer of ownership of a mobile home in Illinois. It ensures all transaction details are recorded, providing proof of purchase and necessary documentation. For more information, visit https://formsillinois.com.

- Lease Agreement: A lease agreement allows one party to use a property owned by another for a specified time. Although it doesn’t transfer ownership, it grants rights to use the property, much like a quitclaim deed transfers ownership rights.

- Bill of Sale: This document transfers ownership of personal property. While a quitclaim deed is specific to real estate, both documents serve to officially change ownership from one party to another.

- Life Estate Deed: A life estate deed allows a person to live in a property for their lifetime while transferring ownership to another party upon their death. It shares similarities with a quitclaim deed in that it involves a transfer of property rights.

- Affidavit of Heirship: This document is used to establish the heirs of a deceased person’s estate, similar to a quitclaim deed in that it can help clarify property ownership without going through probate.

- Power of Attorney: While not a deed, a power of attorney allows one person to act on behalf of another in legal matters, including property transactions. It can facilitate the transfer of property rights, akin to what a quitclaim deed accomplishes.