Attorney-Approved Real Estate Purchase Agreement Template for the State of California

Form Specifications

| Fact Name | Description |

|---|---|

| Governing Law | The California Real Estate Purchase Agreement is governed by California state law. |

| Purpose | This form is used to outline the terms and conditions of a real estate transaction in California. |

| Parties Involved | The agreement involves a buyer and a seller, each with defined roles and responsibilities. |

| Property Description | A detailed description of the property being sold must be included in the agreement. |

| Purchase Price | The purchase price is clearly stated and may include deposit amounts and financing details. |

| Contingencies | Common contingencies include financing, inspections, and the sale of the buyer’s current home. |

| Closing Date | The agreement specifies a closing date, marking when the ownership transfer occurs. |

| Disclosures | California law requires sellers to disclose specific information about the property’s condition. |

| Signatures | Both parties must sign the agreement to make it legally binding. |

| Amendments | Any changes to the agreement must be documented in writing and signed by both parties. |

Dos and Don'ts

When filling out the California Real Estate Purchase Agreement form, it’s essential to approach the process with care. Here’s a list of things to do and avoid:

- Do read the entire agreement carefully before filling it out.

- Do ensure all parties involved are clearly identified, including full names and contact information.

- Do provide accurate property details, including the address and legal description.

- Do specify the purchase price and any contingencies clearly.

- Do include any necessary disclosures required by California law.

- Don't leave any sections blank; incomplete information can lead to issues later.

- Don't use abbreviations or shorthand that might confuse the reader.

- Don't rush through the process; take your time to ensure accuracy.

- Don't forget to sign and date the agreement; unsigned documents are not valid.

By following these guidelines, you can help ensure that your Real Estate Purchase Agreement is filled out correctly and effectively. Proper attention to detail can prevent misunderstandings and legal complications down the line.

Create Popular Real Estate Purchase Agreement Forms for Different States

North Carolina Offer to Purchase and Contract Pdf - It usually specifies the governing laws applicable to the sale.

If you're looking to navigate your marital separation effectively, our guide on the “Texas Marital Separation Agreement” provides valuable insight into the necessary steps and considerations. This resource ensures that both parties understand their rights and obligations throughout the process. For a complete understanding, you can access the document through this informative Marital Separation Agreement form.

Texas Real Estate Commision - Is often accompanied by a title search to confirm ownership and property liens.

Common mistakes

-

Inaccurate Property Description: One common mistake is failing to provide a precise description of the property being purchased. This can lead to confusion and disputes later. Buyers should ensure that the property address, legal description, and any relevant details are clearly stated.

-

Missing Contingencies: Another frequent error involves neglecting to include necessary contingencies. Contingencies protect buyers by allowing them to back out of the agreement under specific circumstances, such as failing to secure financing or issues arising from a home inspection. Omitting these can leave buyers vulnerable.

-

Incorrect Dates: Entering incorrect dates can create significant issues. Buyers must pay attention to critical timelines, such as the offer date, acceptance date, and closing date. Miscommunication regarding these dates can lead to delays or even the loss of the property.

-

Failure to Understand Terms: Many individuals do not fully understand the terms and conditions of the agreement. This lack of comprehension can result in unintended consequences. It is essential for buyers to read the entire document carefully and seek clarification on any points that are unclear.

Documents used along the form

When engaging in a real estate transaction in California, several forms and documents accompany the Real Estate Purchase Agreement (RPA). These documents help clarify the terms of the sale, protect the interests of both buyers and sellers, and ensure compliance with state laws. Below is a list of commonly used forms that are often associated with the RPA.

- Disclosure Statement: This document informs buyers about the property's condition, any known issues, and other relevant information that may affect their decision to purchase.

- Preliminary Title Report: Issued by a title company, this report outlines the property's title history, including any liens or encumbrances that may exist.

- Home Inspection Report: Conducted by a licensed inspector, this report provides a detailed assessment of the property's physical condition, identifying any repairs needed.

- Contingency Addendum: This form outlines specific conditions that must be met for the sale to proceed, such as financing or satisfactory inspections.

- Counter Offer: If the seller does not accept the initial offer, they may issue a counter offer, proposing different terms for the buyer to consider.

- Durable Power of Attorney: This legal document allows the principal to appoint an agent for decision-making, remaining effective even if incapacitated, ensuring that their financial and legal matters are handled according to their wishes. For more information, visit https://californiadocsonline.com/durable-power-of-attorney-form/.

- Closing Statement: This document summarizes the financial aspects of the transaction, detailing all costs and credits involved in the closing process.

- Loan Estimate: Provided by the lender, this form gives buyers an estimate of the mortgage terms and costs associated with their loan.

- Final Walk-Through Checklist: Buyers typically complete this checklist shortly before closing to ensure the property is in the agreed-upon condition.

Understanding these documents can empower buyers and sellers, helping them navigate the complexities of real estate transactions in California. Each form serves a specific purpose, contributing to a smoother process and clearer communication between parties involved.

Misconceptions

Understanding the California Real Estate Purchase Agreement (RPA) is crucial for anyone involved in a property transaction. However, several misconceptions can lead to confusion and potential issues. Here are seven common misconceptions:

- It is a legally binding contract immediately upon signing. Many believe that the agreement becomes enforceable as soon as both parties sign. In reality, it may be contingent upon certain conditions, such as inspections or financing.

- All real estate agents are qualified to fill out the RPA. While agents are trained, not all have the same level of expertise. Ensure your agent has specific experience with the RPA and understands its nuances.

- Once submitted, changes cannot be made. Some think that any modifications after submission are impossible. However, parties can negotiate changes before the agreement is finalized.

- The RPA is the same for every property type. This form is often perceived as a one-size-fits-all document. Different property types may require additional clauses or modifications to address unique circumstances.

- It covers all aspects of the transaction. Many assume that the RPA includes every detail of the sale. However, it primarily outlines the terms of the sale and may not address all issues, such as disclosures or warranties.

- Signing the RPA means the buyer must proceed with the purchase. Buyers often think they are locked into the transaction upon signing. In fact, there are typically contingencies that allow buyers to back out under certain conditions.

- The seller is obligated to accept the first offer. Some believe that once an offer is made, the seller must accept it. Sellers have the right to reject or counter any offer, regardless of how attractive it may seem.

Awareness of these misconceptions can empower buyers and sellers, ensuring a smoother transaction process. Always seek professional guidance to navigate the complexities of real estate agreements.

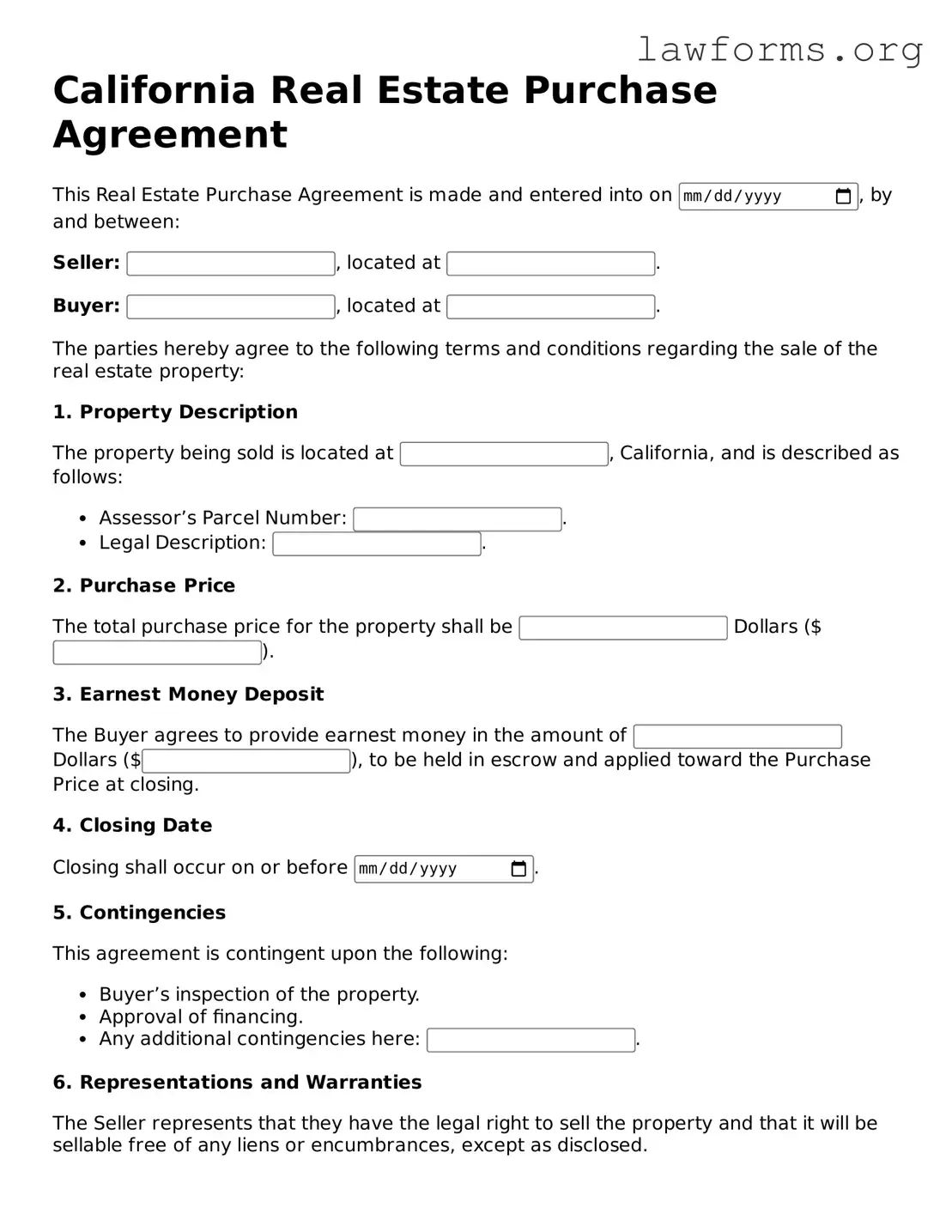

Preview - California Real Estate Purchase Agreement Form

California Real Estate Purchase Agreement

This Real Estate Purchase Agreement is made and entered into on , by and between:

Seller: , located at .

Buyer: , located at .

The parties hereby agree to the following terms and conditions regarding the sale of the real estate property:

1. Property Description

The property being sold is located at , California, and is described as follows:

- Assessor’s Parcel Number: .

- Legal Description: .

2. Purchase Price

The total purchase price for the property shall be Dollars ($).

3. Earnest Money Deposit

The Buyer agrees to provide earnest money in the amount of Dollars ($), to be held in escrow and applied toward the Purchase Price at closing.

4. Closing Date

Closing shall occur on or before .

5. Contingencies

This agreement is contingent upon the following:

- Buyer’s inspection of the property.

- Approval of financing.

- Any additional contingencies here: .

6. Representations and Warranties

The Seller represents that they have the legal right to sell the property and that it will be sellable free of any liens or encumbrances, except as disclosed.

7. Governing Law

This agreement shall be governed by the laws of the State of California.

8. Signatures

IN WITNESS WHEREOF, the parties hereto have executed this Real Estate Purchase Agreement on the date first above written:

__________________________

(Seller)

__________________________

(Buyer)

Key takeaways

When it comes to navigating the California Real Estate Purchase Agreement, understanding its nuances is crucial for both buyers and sellers. Here are some key takeaways to keep in mind:

- Clarity is Key: Ensure all terms are clearly defined. Ambiguities can lead to misunderstandings down the line, so take the time to specify details like purchase price, contingencies, and timelines.

- Contingencies Matter: Include any necessary contingencies that protect your interests. Common contingencies involve financing, inspections, and the sale of another property. These can provide a safety net if circumstances change.

- Understand Your Rights: Familiarize yourself with your rights and obligations under the agreement. This knowledge empowers you to make informed decisions and helps prevent potential disputes.

- Seek Professional Guidance: Consider enlisting the help of a real estate agent or attorney. Their expertise can provide valuable insights, ensuring that the agreement meets legal standards and aligns with your goals.

Similar forms

- Lease Agreement: A lease agreement outlines the terms under which a tenant rents property from a landlord. Like a real estate purchase agreement, it specifies the parties involved, property details, payment terms, and duration of the agreement.

- Option to Purchase Agreement: This document grants a buyer the right, but not the obligation, to purchase a property within a specified timeframe. Similar to a purchase agreement, it includes terms of sale and conditions that must be met before the purchase can occur.

- Hold Harmless Agreement: This legal document protects one party from liability during specific activities or events, similar to other agreements that outline responsibilities and expectations, such as the Forms Washington template that provides clarity on risks involved.

- Sale Agreement: A sale agreement is a broader term that can refer to the sale of various types of property, including real estate. It shares similarities with a real estate purchase agreement by detailing the buyer and seller, property description, and sale price.

- Escrow Agreement: An escrow agreement involves a third party holding funds or documents until specific conditions are met. This document complements a real estate purchase agreement by ensuring that both parties fulfill their obligations before the transaction is finalized.

- Disclosure Statement: A disclosure statement provides essential information about the property, such as its condition and any known issues. It is similar to a real estate purchase agreement in that it aims to protect the buyer by ensuring transparency about the property being sold.