Attorney-Approved Transfer-on-Death Deed Template for the State of California

Form Specifications

| Fact Name | Description |

|---|---|

| Definition | A Transfer-on-Death (TOD) Deed allows property owners in California to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | The California Transfer-on-Death Deed is governed by California Probate Code Sections 5600-5693. |

| Eligibility | Only real property, such as land and buildings, can be transferred using a TOD Deed in California. |

| Beneficiary Designation | Property owners can designate one or more beneficiaries to receive the property upon their death. |

| Revocation | A TOD Deed can be revoked or changed at any time by the property owner during their lifetime. |

| Filing Requirements | The completed TOD Deed must be recorded with the county recorder's office where the property is located to be effective. |

| Tax Implications | Transferring property through a TOD Deed does not trigger immediate tax consequences for the beneficiaries. |

| Survivorship | If multiple beneficiaries are named and one predeceases the property owner, the share of the deceased beneficiary typically passes to the surviving beneficiaries. |

| Limitations | Transfer-on-Death Deeds cannot be used for properties held in a trust or for certain types of property interests, such as community property. |

Dos and Don'ts

When filling out the California Transfer-on-Death Deed form, it's important to follow certain guidelines to ensure the document is valid and effective. Here are some dos and don'ts to keep in mind:

- Do make sure you understand the purpose of the Transfer-on-Death Deed. It allows you to transfer property to someone after your death without going through probate.

- Do provide accurate information about the property. Include the correct legal description to avoid confusion.

- Do include the names and addresses of the beneficiaries clearly. This helps ensure that the right people receive the property.

- Do sign the form in front of a notary public. This step is crucial for the deed to be legally recognized.

- Don't forget to record the deed with the county recorder's office. This action is necessary to make the transfer effective.

- Don't use vague language when describing the property or the beneficiaries. Clarity is essential to avoid disputes later.

- Don't overlook state-specific requirements. California has specific rules that must be followed for the deed to be valid.

Create Popular Transfer-on-Death Deed Forms for Different States

Transfer on Death Deed Form Ohio - Property owners should periodically review their Transfer-on-Death Deed to ensure it aligns with their wishes and circumstances.

To ensure clarity and avoid misunderstandings during the divorce process, it is critical to utilize the Washington Divorce Settlement Agreement form, which comprehensively details the necessary terms between the parties. For those looking for a reliable template to facilitate this process, Forms Washington offers a valuable resource that can help streamline the completion of the agreement.

Problems With Transfer on Death Deeds Ohio - The property ownership remains unchanged until the owner dies, maintaining their rights during their lifetime.

How to Transfer Deed of House - Make sure to communicate your intentions with the named beneficiaries.

Transfer on Death Deed Florida Form - A Transfer-on-Death Deed may be particularly beneficial for individuals who have specific heirs in mind and want to avoid family strife.

Common mistakes

-

Incomplete Information: One common mistake is failing to provide all necessary details. The form requires specific information about the property, such as the legal description and the address. Omitting any of these details can lead to confusion or even invalidate the deed.

-

Incorrect Signatures: The signatures of the property owner and any witnesses must be correctly placed on the form. Failing to sign in the appropriate areas or using the wrong names can render the deed ineffective.

-

Not Notarizing the Deed: While California does not require notarization for a Transfer-on-Death Deed, it is highly recommended. Without a notary, the deed may face challenges during the transfer process, especially if the validity is questioned later.

-

Improper Recording: After completing the form, it must be recorded with the county recorder's office. Many individuals forget this crucial step. Without proper recording, the transfer may not be recognized, leaving the property in limbo.

-

Failure to Update: Life circumstances change, and so do property ownership and beneficiary designations. Neglecting to update the Transfer-on-Death Deed after significant life events, such as marriage, divorce, or the death of a beneficiary, can lead to unintended consequences.

Documents used along the form

When considering the use of a California Transfer-on-Death Deed, it is essential to understand that several other forms and documents may be involved in the process. Each of these documents plays a vital role in ensuring that the transfer of property occurs smoothly and in accordance with the law. Below is a list of commonly used forms that may accompany the Transfer-on-Death Deed.

- Grant Deed: This document is used to transfer ownership of real property from one party to another. It provides a clear record of the transfer and is often required to establish legal ownership.

- Revocable Living Trust: A revocable living trust allows individuals to manage their assets during their lifetime and specify how those assets will be distributed upon death. This document can work in conjunction with a Transfer-on-Death Deed to provide additional estate planning benefits.

- Affidavit of Death: This is a sworn statement that confirms the death of an individual. It may be necessary to present this document when transferring property to the designated beneficiaries after the owner’s death.

- Will: A will outlines how a person's assets should be distributed after their death. While a Transfer-on-Death Deed supersedes a will for the property it covers, having a will is still important for other assets.

- Property Tax Exemption Forms: Depending on the circumstances, beneficiaries may need to file forms to claim property tax exemptions. This can help minimize the tax burden on the heirs after the transfer of property.

- Firearm Application: For individuals seeking to obtain a Firearm Control Card in Illinois, completing the necessary application form is crucial. For more information, visit https://formsillinois.com.

- Change of Ownership Statement: This document is often required by the county assessor's office to record the change in ownership of property. It helps ensure that property taxes are assessed correctly following the transfer.

Each of these documents serves a specific purpose in the property transfer process. It is advisable to review them carefully and consult with a legal professional to ensure all necessary forms are completed accurately and submitted on time. This careful approach can help prevent potential complications in the future.

Misconceptions

Understanding the California Transfer-on-Death Deed form can be challenging. Here are seven common misconceptions that people often have about this legal document:

-

It automatically transfers property upon death.

Many believe that the deed instantly transfers property to the designated beneficiary as soon as the owner passes away. In reality, the transfer occurs only after the owner's death and when the deed has been properly recorded.

-

It replaces a will.

Some think that a Transfer-on-Death Deed serves as a substitute for a will. However, it is a separate legal instrument. A will can address various aspects of an estate, while the deed specifically pertains to the transfer of real property.

-

It can only be used for residential properties.

There is a belief that this deed is limited to residential properties. In fact, it can be used for any real property, including commercial properties, as long as it meets the legal requirements.

-

Beneficiaries can access the property before the owner's death.

Some individuals think that beneficiaries can take possession of the property while the owner is still alive. This is incorrect; beneficiaries have no rights to the property until the owner has passed and the deed is executed.

-

It eliminates the need for probate.

While a Transfer-on-Death Deed can help avoid probate for the property it covers, it does not eliminate the need for probate for other assets or debts that the deceased may have.

-

It requires the beneficiary's consent.

Many assume that the beneficiary must agree to the deed before it is executed. This is not true; the owner can create the deed without the beneficiary's knowledge or consent.

-

It is irrevocable once signed.

There is a misconception that once the deed is signed, it cannot be changed. In reality, the owner can revoke or modify the deed at any time before their death, as long as the proper procedures are followed.

Clarifying these misconceptions can help individuals make informed decisions regarding their estate planning in California.

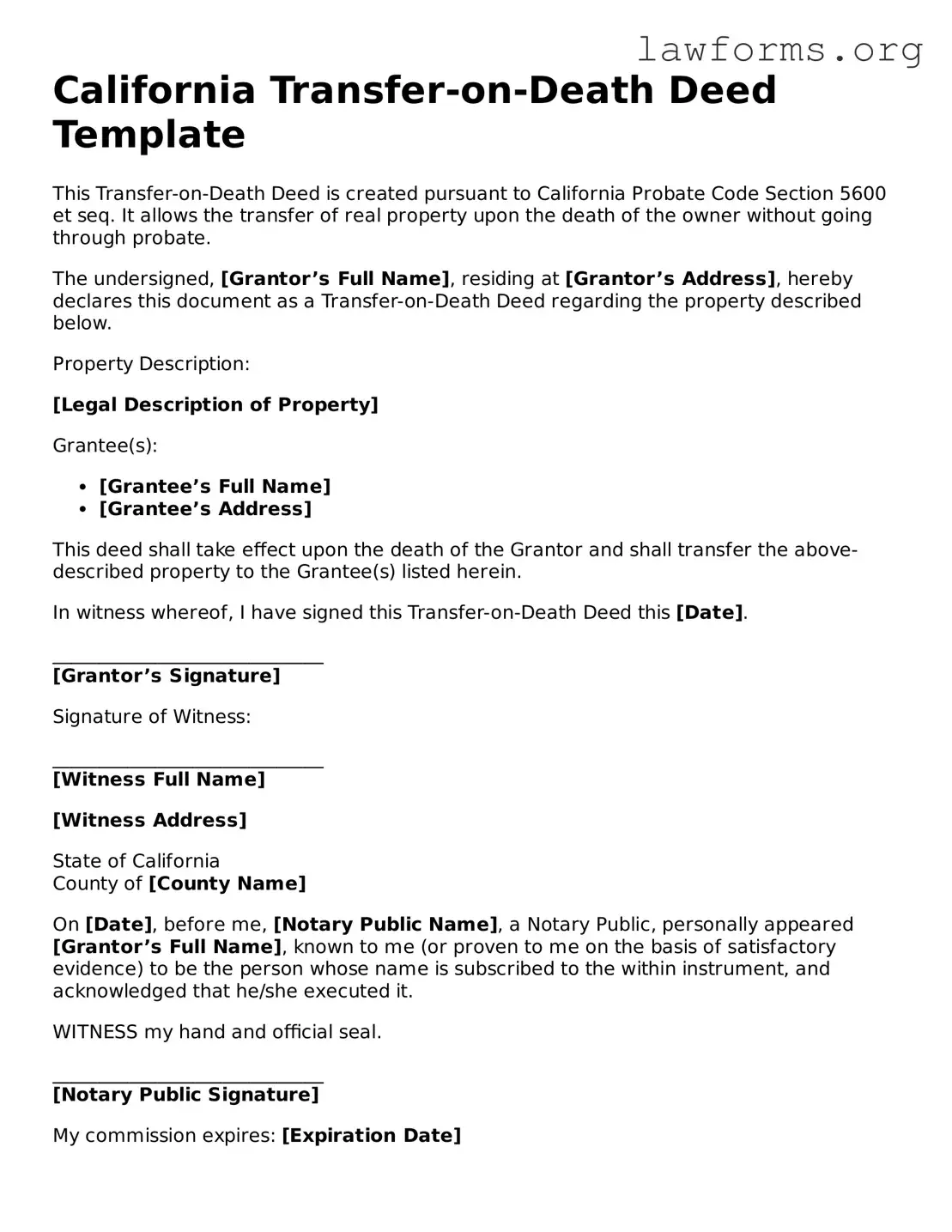

Preview - California Transfer-on-Death Deed Form

California Transfer-on-Death Deed Template

This Transfer-on-Death Deed is created pursuant to California Probate Code Section 5600 et seq. It allows the transfer of real property upon the death of the owner without going through probate.

The undersigned, [Grantor’s Full Name], residing at [Grantor’s Address], hereby declares this document as a Transfer-on-Death Deed regarding the property described below.

Property Description:

[Legal Description of Property]

Grantee(s):

- [Grantee’s Full Name]

- [Grantee’s Address]

This deed shall take effect upon the death of the Grantor and shall transfer the above-described property to the Grantee(s) listed herein.

In witness whereof, I have signed this Transfer-on-Death Deed this [Date].

_____________________________

[Grantor’s Signature]

Signature of Witness:

_____________________________

[Witness Full Name]

[Witness Address]

State of California

County of [County Name]

On [Date], before me, [Notary Public Name], a Notary Public, personally appeared [Grantor’s Full Name], known to me (or proven to me on the basis of satisfactory evidence) to be the person whose name is subscribed to the within instrument, and acknowledged that he/she executed it.

WITNESS my hand and official seal.

_____________________________

[Notary Public Signature]

My commission expires: [Expiration Date]

Key takeaways

When considering the California Transfer-on-Death Deed (TODD), it’s important to understand several key points to ensure proper use and execution. Below are seven essential takeaways.

- Purpose of the TODD: The Transfer-on-Death Deed allows property owners to transfer real estate to beneficiaries without going through probate, simplifying the process of inheritance.

- Eligibility: Only individuals who own real property in California can utilize this deed. It is not available for entities like corporations or partnerships.

- Form Requirements: The TODD must be in writing, signed by the property owner, and must clearly identify the beneficiaries and the property being transferred.

- Recording the Deed: To be effective, the completed TODD must be recorded with the county recorder's office where the property is located. This step is crucial for the deed to take effect upon the owner’s death.

- Revocation: Property owners can revoke the TODD at any time before their death. This can be done by recording a new deed or a revocation form, ensuring that the original TODD is no longer valid.

- Tax Implications: While the TODD helps avoid probate, it does not eliminate potential tax implications. Beneficiaries may still be responsible for property taxes and capital gains taxes upon the transfer.

- Legal Assistance: Although the form is designed to be straightforward, consulting with a legal professional is advisable to ensure that all details are correctly handled and to address any specific concerns.

Understanding these points can help property owners make informed decisions about using the Transfer-on-Death Deed in California.

Similar forms

- Will: A will outlines how a person's assets should be distributed after their death. Like a Transfer-on-Death Deed, it allows for the transfer of property but requires probate, which can be a lengthy process.

- Living Trust: A living trust holds assets during a person's lifetime and specifies how they should be distributed upon death. Similar to a Transfer-on-Death Deed, it avoids probate and allows for a smoother transfer of property.

- Beneficiary Designation: This document is often used for financial accounts and insurance policies. It allows individuals to name beneficiaries who will receive assets upon their death, much like how a Transfer-on-Death Deed designates heirs for real estate.

- Firearm Bill of Sale Form: For those engaging in firearm transactions, refer to our comprehensive Firearm Bill of Sale template to ensure compliance with state laws and proper documentation.

- Joint Tenancy: In a joint tenancy arrangement, two or more people own property together. When one owner dies, their share automatically passes to the surviving owner(s). This is similar to a Transfer-on-Death Deed in that it facilitates a direct transfer of ownership without going through probate.