Fill Out a Valid Cash Drawer Count Sheet Template

Form Specs

| Fact Name | Description |

|---|---|

| Purpose | The Cash Drawer Count Sheet is used to record the cash amount in a cash drawer at the end of a shift or business day. |

| Importance | This form helps in ensuring accurate cash management and accountability, reducing the risk of theft or errors. |

| Format | The sheet typically includes fields for date, time, total cash, and signatures of the person counting the cash. |

| Record Keeping | Businesses should retain completed Cash Drawer Count Sheets for a specified period, often required for auditing purposes. |

| State Regulations | Some states may have specific laws regarding cash handling and record-keeping, which can influence how this form is used. |

Dos and Don'ts

When filling out the Cash Drawer Count Sheet form, it is important to follow certain guidelines to ensure accuracy and clarity. Below is a list of things to do and things to avoid.

- Do double-check the cash amounts before recording them.

- Do use clear and legible handwriting to prevent misunderstandings.

- Do include the date and your name on the form.

- Do record any discrepancies immediately.

- Do keep the form in a secure location after completion.

- Don't leave any blank spaces on the form; fill in all required fields.

- Don't use correction fluid or tape on the form; it can create confusion.

- Don't rush through the process; take your time to ensure accuracy.

- Don't forget to sign the form if required.

- Don't ignore company policies regarding cash handling procedures.

Other PDF Documents

Miscellaneous Information - The form also covers payments for legal services received during the year.

In the context of vehicle transactions, having the correct paperwork is essential, which is why many individuals turn to resources such as Forms Washington to obtain a reliable Motor Vehicle Bill of Sale template that complies with state requirements and protects their transaction's legitimacy.

T47 Paralympics - The affidavit reflects the current usage of the residential property.

Common mistakes

-

Inaccurate Counting: Many individuals fail to accurately count the cash in the drawer. This can lead to discrepancies in the final totals.

-

Omitting Coins: Some people forget to include coins in their count. This oversight can significantly affect the overall cash balance.

-

Not Recording All Denominations: It is common for users to skip certain bill denominations when recording totals. Each denomination must be accounted for to ensure accuracy.

-

Failing to Double-Check: Rushing through the process without a second verification can lead to errors. A quick review can catch mistakes before submission.

-

Incorrectly Filling Out the Form: Some individuals may not follow the prescribed format when entering information. This can lead to confusion and delays in processing.

-

Neglecting to Sign and Date: Failing to sign and date the form can result in it being deemed incomplete. This step is crucial for record-keeping and accountability.

Documents used along the form

The Cash Drawer Count Sheet is an essential document for tracking cash flow in retail and service environments. To ensure accurate financial management, several other forms and documents are commonly used alongside it. Below is a list of these documents, each serving a unique purpose in the overall cash handling process.

- Daily Sales Report: This report summarizes the total sales made during a specific day. It helps in reconciling cash sales with the amount recorded in the cash drawer.

- Cash Deposit Slip: A cash deposit slip is used to document the amount of cash being deposited into the bank. This form ensures that the cash count matches what is being deposited.

- Petty Cash Log: This log tracks all petty cash transactions. It provides a record of small expenditures that do not go through the main cash drawer, helping maintain accurate financial records.

- Motorcycle Bill of Sale: This form is essential for documenting the purchase of a motorcycle in Minnesota, ensuring all transaction details are recorded and protecting the rights of both parties involved in the deal. For further information, you can refer to Formaid Org.

- Cash Register Tape: The cash register tape provides a printed record of sales transactions. It serves as a source document for verifying the cash drawer count against sales.

- Variance Report: A variance report highlights any discrepancies between expected cash amounts and actual cash counts. This document is crucial for identifying potential issues in cash handling practices.

Utilizing these forms in conjunction with the Cash Drawer Count Sheet can enhance financial accuracy and accountability. Proper documentation is key to maintaining trust and transparency in cash management processes.

Misconceptions

Understanding the Cash Drawer Count Sheet form is essential for accurate cash management. However, several misconceptions can lead to confusion. Here are four common misconceptions:

- It is only used for large businesses. Many believe that only large retailers need a Cash Drawer Count Sheet. In reality, any business that handles cash transactions can benefit from using this form, regardless of size.

- It is only necessary at the end of the day. Some think the Cash Drawer Count Sheet is only required for end-of-day cash reconciliation. However, it can be useful throughout the day to monitor cash flow and identify discrepancies early.

- It is a complicated process. There is a misconception that filling out the Cash Drawer Count Sheet is overly complicated. In truth, the process is straightforward and can be easily integrated into daily operations with a little practice.

- It is not important for accounting. Some may underestimate the importance of the Cash Drawer Count Sheet for accounting purposes. This form provides vital information for financial records, helping to ensure accuracy in reporting and audits.

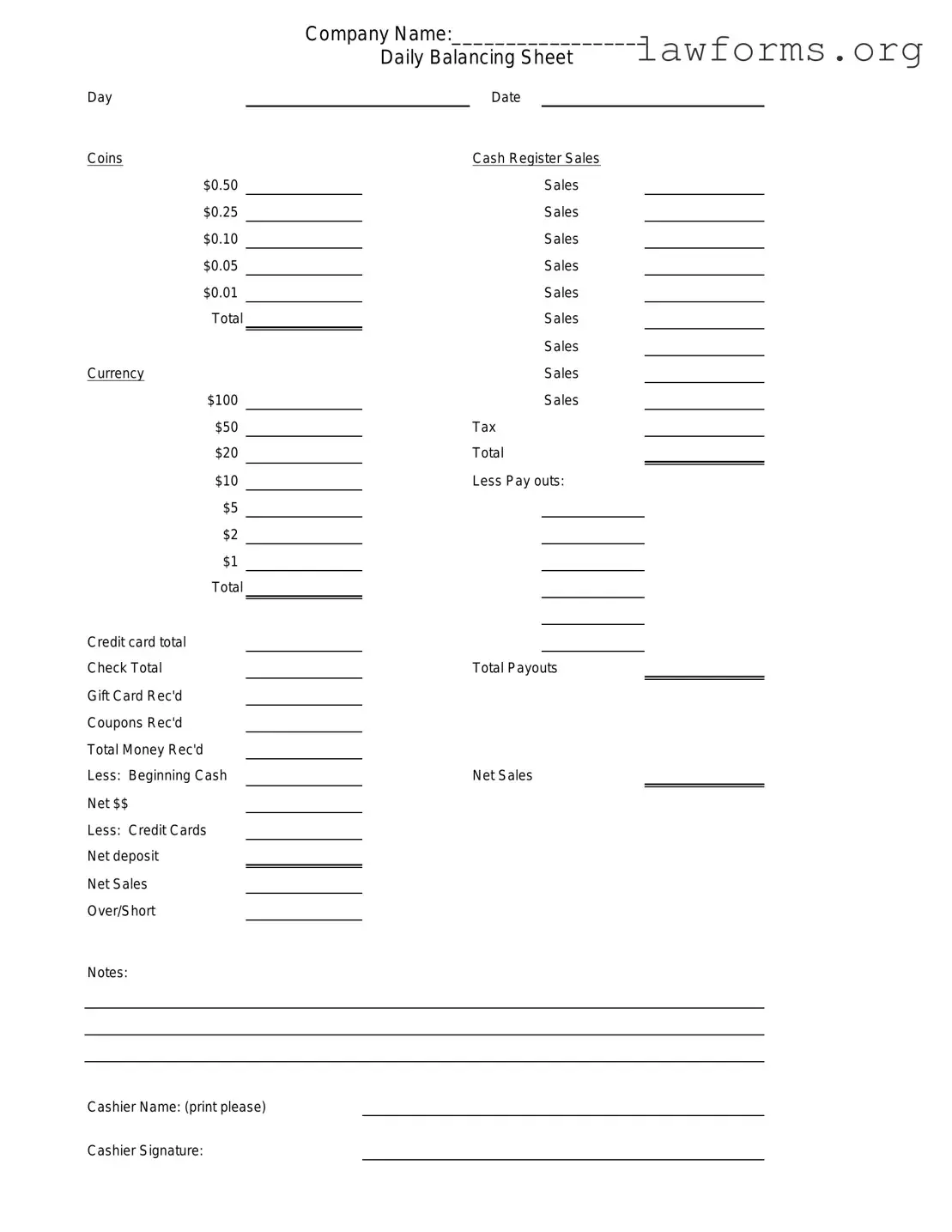

Preview - Cash Drawer Count Sheet Form

|

Company Name:__________________ |

|||||

|

|

Daily Balancing Sheet |

||||

Day |

|

|

Date |

|

||

Coins |

|

|

Cash Register Sales |

|||

$0.50 |

|

|

|

Sales |

|

|

$0.25 |

|

|

|

Sales |

|

|

$0.10 |

|

|

|

Sales |

|

|

$0.05 |

|

|

|

Sales |

|

|

$0.01 |

|

|

|

Sales |

|

|

Total |

|

|

|

Sales |

|

|

|

|

|

|

Sales |

|

|

Currency |

|

|

|

Sales |

|

|

$100 |

|

|

|

Sales |

|

|

$50 |

|

|

Tax |

|

||

$20 |

|

|

Total |

|

||

$10 |

|

|

Less Pay outs: |

|||

$5 |

|

|

|

|

|

|

$2 |

|

|

|

|

|

|

$1 |

|

|

|

|

|

|

Total |

|

|

|

|

|

|

Credit card total |

|

|

|

|

|

|

|

|

|

|

|

|

|

Check Total |

|

|

Total Payouts |

|||

Gift Card Rec'd |

|

|

|

|

|

|

Coupons Rec'd |

|

|

|

|

|

|

Total Money Rec'd |

|

|

|

|

|

|

Less: Beginning Cash |

|

|

Net Sales |

|||

Net $$ |

|

|

|

|

|

|

Less: Credit Cards |

|

|

|

|

|

|

Net deposit |

|

|

|

|

|

|

Net Sales |

|

|

|

|

|

|

|

|

|

|

|

|

|

Over/Short |

|

|

|

|

|

|

Notes: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cashier Name: (print please)

Cashier Signature:

Key takeaways

When managing cash in a retail environment, using a Cash Drawer Count Sheet can streamline the process and enhance accuracy. Here are some key takeaways to consider:

- Accuracy is Essential: Ensure that all cash amounts are recorded accurately. Double-check your figures to avoid discrepancies.

- Consistent Use: Regularly use the Cash Drawer Count Sheet at the beginning and end of each shift. This creates a routine that helps maintain accountability.

- Document Everything: Record not just cash, but also any checks, credit card transactions, or other forms of payment. This provides a complete picture of your drawer's contents.

- Monitor Trends: Keep an eye on the data over time. Analyzing patterns can help identify discrepancies and improve overall cash management.

- Secure Storage: Store completed Cash Drawer Count Sheets in a secure location. This protects sensitive information and ensures it is accessible for future reference.

- Training is Key: Train all employees who handle cash on how to properly fill out the form. This reduces errors and fosters a culture of responsibility.

- Review Regularly: Periodically review your Cash Drawer Count Sheets for any unusual patterns or errors. This proactive approach can prevent larger issues down the line.

By following these takeaways, you can improve cash handling processes and enhance financial accountability within your business.

Similar forms

- Daily Sales Report: Like the Cash Drawer Count Sheet, this document summarizes the daily financial activities of a business. It records total sales and helps in reconciling cash at the end of the day.

- Bank Deposit Slip: This document is used to deposit cash and checks into a bank account. It includes details similar to the Cash Drawer Count Sheet, such as total amounts and denominations.

- Petty Cash Log: This log tracks small cash transactions. It shares the same purpose of maintaining accurate financial records, ensuring transparency in cash handling.

Mobile Home Bill of Sale Form: Ensure a smooth transaction with the essential Mobile Home Bill of Sale documentation for transferring ownership legally.

- Cash Register Tape: This tape provides a printout of sales transactions. It is similar in that it captures the cash flow and helps verify the amounts recorded on the Cash Drawer Count Sheet.

- Inventory Count Sheet: While focused on physical goods, this sheet also tracks quantities and values. Both documents aim to ensure accuracy in financial reporting.

- Expense Report: This report details expenditures, similar to how the Cash Drawer Count Sheet details cash inflow and outflow. Both are essential for financial accountability.

- Sales Invoice: An invoice outlines a transaction between a buyer and seller. It includes amounts due, which can be compared to cash collected, similar to the Cash Drawer Count Sheet.

- Credit Card Transaction Log: This log records credit card payments. Like the Cash Drawer Count Sheet, it helps in reconciling total sales and cash on hand.

- Financial Statement: This document provides an overview of a business's financial health. It summarizes data from various sources, including cash transactions reflected in the Cash Drawer Count Sheet.