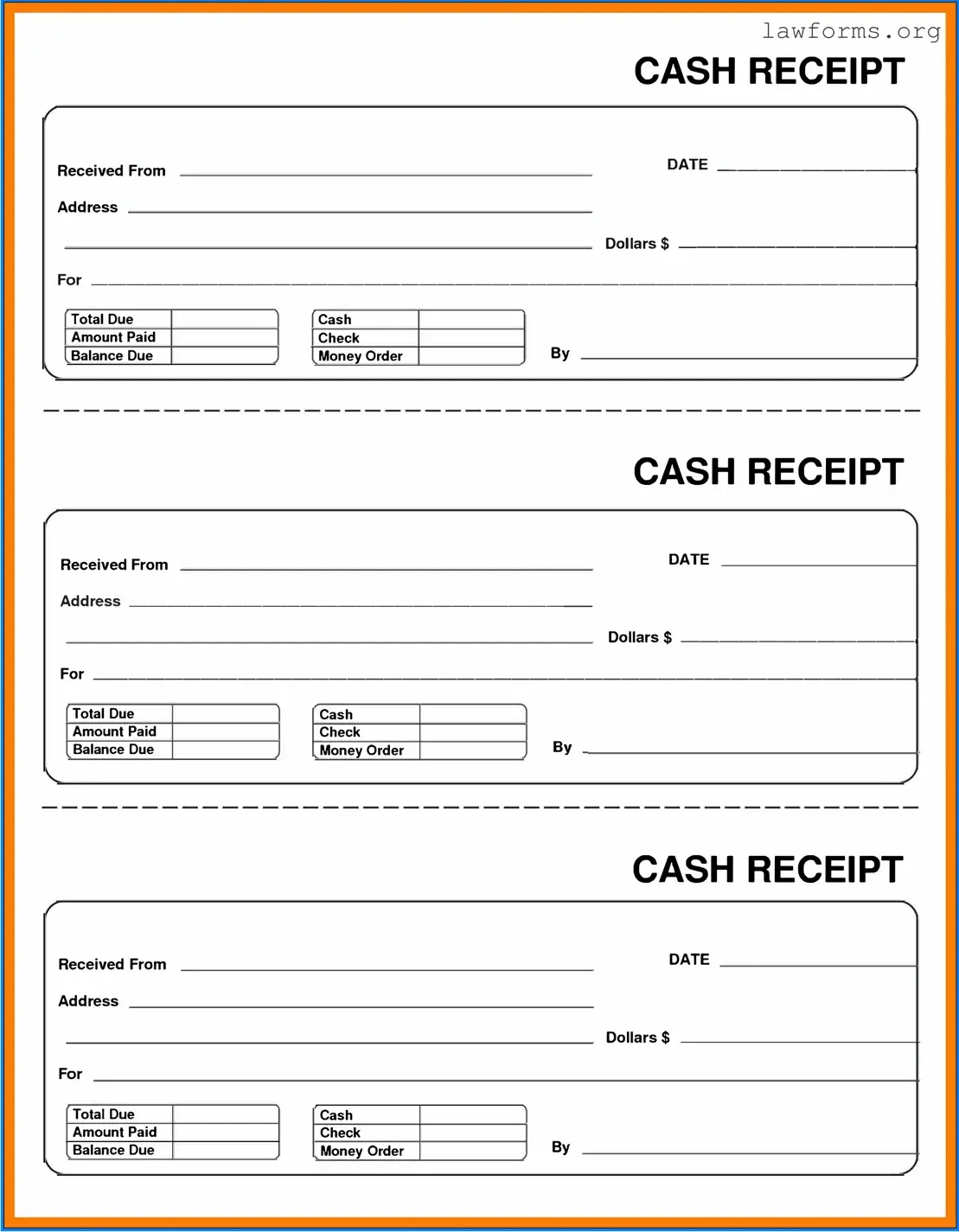

Fill Out a Valid Cash Receipt Template

Form Specs

| Fact Name | Description |

|---|---|

| Purpose | The Cash Receipt form is used to document the receipt of cash payments from customers or clients. |

| Components | This form typically includes fields for the date, amount received, payer's name, and purpose of the payment. |

| Importance | It serves as an official record for both the payer and the recipient, helping to maintain accurate financial records. |

| Legal Compliance | In many states, maintaining proper records of cash transactions is required under state tax laws. |

| Format | The form can be printed or created digitally, depending on the organization's preferences and needs. |

| Retention Period | Organizations are generally advised to keep cash receipt records for a minimum of 3 to 7 years for auditing purposes. |

| State-Specific Laws | In California, for example, the governing law requires accurate record-keeping under the California Revenue and Taxation Code. |

| Security | To prevent fraud, it is essential to store cash receipts securely and limit access to authorized personnel only. |

Dos and Don'ts

When filling out the Cash Receipt form, it's important to follow certain guidelines to ensure accuracy and compliance. Here’s a list of things you should and shouldn't do:

- Do double-check all amounts before submitting the form.

- Do clearly write the date of the transaction.

- Do ensure that the payer's information is complete and accurate.

- Do use a pen to fill out the form to prevent alterations.

- Don't leave any fields blank; fill in all required information.

- Don't use correction fluid; it may cause confusion or errors.

Following these guidelines will help maintain the integrity of the Cash Receipt process.

Other PDF Documents

How to Make a Time Sheet in Excel - Allows employers to identify patterns in employee work hours.

Sample Profit and Loss Statement - Helps compare performance against industry standards.

The Minnesota Motorcycle Bill of Sale form is a crucial document that serves as proof of purchase for a motorcycle transaction in the state of Minnesota. It ensures that all details of the deal are formally recorded, safeguarding the rights of both the buyer and seller. For more information on this important document, you can visit Formaid Org. Without this document, the ownership transfer of a motorcycle cannot be officially recognized.

P60 Form - Each part of the P45 should be filled out according to specific employer instructions.

Common mistakes

-

Not including the date of the transaction. This is essential for record-keeping.

-

Failing to write down the amount received clearly. Ambiguous figures can lead to confusion.

-

Forgetting to specify the payment method, such as cash, check, or credit card. This information is crucial for tracking.

-

Neglecting to include the payer's name. Without this, it can be difficult to identify who made the payment.

-

Not providing a description of the transaction. A brief note helps clarify the purpose of the payment.

-

Using incorrect or inconsistent account numbers. This can lead to misallocation of funds.

-

Overlooking the need for signatures. Both the payer and the receiver should sign to validate the receipt.

-

Failing to keep a copy of the receipt for personal records. This is important for future reference and auditing.

-

Not double-checking for mathematical errors. Simple mistakes can cause discrepancies in financial records.

-

Leaving the form incomplete. Ensure all required fields are filled out to avoid issues later on.

Documents used along the form

When handling financial transactions, various forms and documents accompany the Cash Receipt form. These documents help maintain accurate records and ensure transparency in financial dealings. Below is a list of commonly used forms that may be relevant.

- Invoice: This document details the goods or services provided, along with the amount owed. It serves as a request for payment.

- Payment Voucher: This form is used to authorize payment. It often includes details about the transaction and the party receiving the funds.

- Deposit Slip: A deposit slip is used when depositing cash or checks into a bank account. It records the amount being deposited and the account details.

- Receipt Acknowledgment: This document confirms that a payment has been received. It may be signed by the recipient to acknowledge receipt.

- Sales Order: A sales order outlines the details of a sale, including items sold, quantities, and agreed prices. It serves as a confirmation of the transaction.

- Credit Memo: This document is issued to reduce the amount owed by a customer, often due to returns or discounts. It provides a record of the adjustment.

- Expense Report: An expense report lists expenses incurred by an employee on behalf of the company. It is used to request reimbursement.

- Mobile Home Bill of Sale Form: To ensure a proper transfer of ownership, refer to our detailed Mobile Home Bill of Sale documentation for clarity and legality in the process.

- Bank Statement: A bank statement summarizes all transactions in a bank account for a specific period. It helps reconcile cash receipts and payments.

- Tax Form: Various tax forms may be needed to report income or sales, depending on the nature of the transaction and applicable laws.

These documents play important roles in the financial processes of a business. They help ensure that all transactions are recorded accurately and that both parties have a clear understanding of their financial obligations.

Misconceptions

Understanding the Cash Receipt form is essential for effective financial management. However, several misconceptions can lead to confusion. Here are five common misunderstandings:

-

Cash Receipt forms are only for cash transactions.

Many people believe that these forms are exclusively for cash payments. In reality, they can also document credit card transactions, checks, and other forms of payment. The purpose is to provide a record of any received funds.

-

Cash Receipt forms are not necessary for small transactions.

Some assume that small amounts do not require documentation. However, maintaining accurate records for all transactions, regardless of size, is crucial for financial accountability and reporting.

-

Once a Cash Receipt form is filled out, it cannot be modified.

This misconception suggests that errors cannot be corrected. In fact, adjustments can be made if necessary, but they should be documented properly to maintain a clear audit trail.

-

Cash Receipt forms are only used by accountants.

While accountants often handle these forms, they are valuable for anyone managing finances, including business owners and administrative staff. Understanding how to use them can enhance financial oversight.

-

Cash Receipt forms are not important for tax purposes.

Some believe that these forms have no relevance when it comes to taxes. However, they serve as essential documentation that can support income reporting and provide evidence of transactions during audits.

By clearing up these misconceptions, individuals and businesses can better utilize Cash Receipt forms to enhance their financial practices.

Preview - Cash Receipt Form

CASH RECEIPT

Received From |

|

� |

|||

Address |

|

|

Dollars$ |

||

|

|

|

|

||

|

� |

||||

Total Due

Amount Paid

Balance Due

Cash

Check

Money Order

By

CASH RECEIPT

Received From |

|

|

|

|

|

|

|

|

|

DATE |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

||||||

Address ________________________ |

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

Dollars$ |

+ |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Due |

|

|

|

|

|

Cash |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

Amount Paid |

|

|

|

|

|

Check |

|

|

By |

|

|

|

|

|

|

Balance Due |

|

|

|

|

|

Money Order |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CASH RECEIPT

Received From |

|

DATE |

|||

Address |

|

|

|

||

|

|

|

|

Dollars$ |

|

For |

|

|

|

||

Total Due

Amount Paid

Balance Due

Cash

Check

Money Order

By

Key takeaways

Here are some important points to remember when filling out and using the Cash Receipt form:

- Always include the date on the form. This helps keep accurate records.

- Clearly write the name of the person or business making the payment. This ensures proper identification.

- Specify the amount received. Double-check the figures to avoid mistakes.

- Indicate the purpose of the payment. This provides context for the transaction.

- Keep a copy of the completed Cash Receipt form for your records. This is important for future reference.

- Use the form consistently for all cash transactions. Consistency helps maintain organized financial records.

Similar forms

- Invoice: Both the Cash Receipt form and an invoice serve as records of transactions. An invoice requests payment for goods or services, while a Cash Receipt form confirms that payment has been received.

- Sales Receipt: A sales receipt, like a Cash Receipt form, documents a completed sale. It provides proof of payment and details about the transaction, including date, amount, and items purchased.

- Mobile Home Bill of Sale: This document is vital for transferring ownership of a mobile home, detailing information about the buyer and seller, the mobile home itself, and the sale price. For a useful template, visit Forms Washington.

- Payment Voucher: A payment voucher authorizes a payment to be made, similar to how a Cash Receipt form acknowledges that payment has occurred. Both documents are essential for financial record-keeping.

- Deposit Slip: A deposit slip is used to deposit cash or checks into a bank account, similar to how a Cash Receipt form records incoming funds. Both documents track the flow of money into an organization.

- Credit Memo: A credit memo adjusts a customer’s account balance, much like a Cash Receipt form confirms the receipt of funds. Both documents help maintain accurate financial records.

- Transaction Log: A transaction log records all financial activities, including cash receipts. Like the Cash Receipt form, it provides a detailed account of money received and helps in tracking overall financial health.