Fill Out a Valid Childcare Receipt Template

Form Specs

| Fact Name | Description |

|---|---|

| Date of Service | The form requires the date when the childcare services were provided. This helps in tracking the specific time frame for which payment was made. |

| Amount Paid | The form includes a section to specify the amount paid for the childcare services. This is crucial for both the provider and the parent for financial records. |

| Recipient Information | Parents or guardians must provide their name on the receipt. This ensures that the payment is linked to the correct individual and child. |

| Child's Name | It is essential to list the names of the child or children receiving care. This clarifies which services were provided to which child. |

| Service Period | The form requires the start and end dates of the childcare services. This information is vital for understanding the duration of care provided. |

| Provider's Signature | The childcare provider must sign the receipt. This signature serves as proof that the services were rendered and payment was received. |

Dos and Don'ts

When filling out the Childcare Receipt form, attention to detail is crucial. Here’s a list of things you should and shouldn’t do to ensure the form is completed correctly.

- Do write clearly and legibly. Your handwriting should be easy to read to avoid any confusion.

- Do include the full name of the child or children receiving care. This ensures accurate record-keeping.

- Do specify the dates of service clearly. This helps both you and the provider track the care period.

- Do double-check the amount entered. Mistakes in the amount can lead to misunderstandings.

- Don't leave any fields blank. Every section of the form should be filled out to avoid delays.

- Don't use abbreviations or nicknames for names. Always use the full legal names of the children.

- Don't forget to obtain the provider's signature. This is essential for the receipt to be valid.

Other PDF Documents

Erc Forms - The report synthesizes data to better reflect the current real estate environment.

Understanding the importance of liability protection, many organizations choose to implement a Hold Harmless Agreement, as seen with resources like Forms Washington, which provides essential templates for this legal document. By utilizing such agreements, parties engaged in activities or events can ensure they are safeguarded against unforeseen claims or damages that might arise, fostering a safer and more responsible environment.

Employer's Quarterly Federal Tax Return - Employers use this form to calculate their liability for federal unemployment taxes as well.

Basketball Evaluation Form Pdf - Evaluate the player's attitude towards coaching and improvement.

Common mistakes

-

Failing to complete the date: Many people forget to fill in the date on the receipt. This information is crucial for record-keeping and tax purposes.

-

Incorrect amount entered: Double-check the amount paid for childcare services. Errors in this section can lead to confusion during tax filing.

-

Omitting the name of the payer: Ensure that the name of the person making the payment is clearly written. This helps identify who the receipt belongs to.

-

Not listing the child's name: It's essential to include the name(s) of the child or children receiving care. This provides clarity for both the provider and the payer.

-

Missing service dates: Fill in the start and end dates for the childcare services. Without these dates, the receipt lacks important context.

-

Provider's signature not included: The provider must sign the receipt. A missing signature can invalidate the receipt and cause issues later.

Documents used along the form

When utilizing the Childcare Receipt form, several other documents may accompany it to ensure comprehensive record-keeping and clarity in transactions. Each document serves a specific purpose, contributing to the overall management of childcare services.

- Childcare Agreement: This document outlines the terms and conditions of the childcare services provided. It includes details such as hours of operation, fees, and responsibilities of both the provider and the parent.

- Mobile Home Bill of Sale: This form is crucial for documenting the sale and transfer of ownership of a mobile home in Illinois. For more details on how to fill out this form, visit https://formsillinois.com/.

- Enrollment Form: The enrollment form collects essential information about the child, including medical history, emergency contacts, and any special needs. This information is crucial for the provider to ensure the child's safety and well-being.

- Payment Agreement: This document specifies the payment schedule and methods accepted for childcare services. It may also detail any late fees or penalties for missed payments, providing clarity for both parties.

- Tax Information Form: This form is necessary for tax purposes, allowing parents to report childcare expenses. It includes the provider's tax identification number and may also request the parent's information for tax deduction eligibility.

- Attendance Record: The attendance record tracks the days and hours the child attends childcare. This document is useful for both billing purposes and ensuring compliance with any regulatory requirements.

- Incident Report: In the event of an accident or unusual occurrence, an incident report documents the details. This report is vital for transparency and can be used to address any concerns that may arise.

These documents, when used in conjunction with the Childcare Receipt form, help establish a clear and organized framework for managing childcare services. Proper documentation not only facilitates smooth operations but also enhances communication between providers and parents.

Misconceptions

There are several misconceptions surrounding the Childcare Receipt form. Understanding these can help clarify its purpose and usage.

- Misconception 1: The form is only necessary for tax purposes.

- Misconception 2: Only licensed childcare providers can issue this receipt.

- Misconception 3: The form must be filled out in a specific way.

- Misconception 4: Parents do not need to keep a copy of the receipt.

- Misconception 5: The form does not require a signature.

- Misconception 6: The receipt is only valid for a single transaction.

While the Childcare Receipt form can be used for tax deductions, it serves a broader purpose. It acts as a record of payment for services rendered, which can be important for both parents and childcare providers.

Any individual or organization providing childcare services can issue this receipt. It is not limited to licensed providers, though proper documentation is recommended for accountability.

There is flexibility in how the form is completed, as long as all necessary information is included. Essential details such as the date, amount, and names of the children should be provided.

It is advisable for parents to retain a copy of the receipt for their records. This can help in tracking childcare expenses and providing proof of payment if needed.

A signature from the childcare provider is a key component of the form. It verifies that the service was provided and that payment was received.

The form can be used multiple times for different transactions. Each receipt should be filled out for each payment period, allowing for accurate record-keeping.

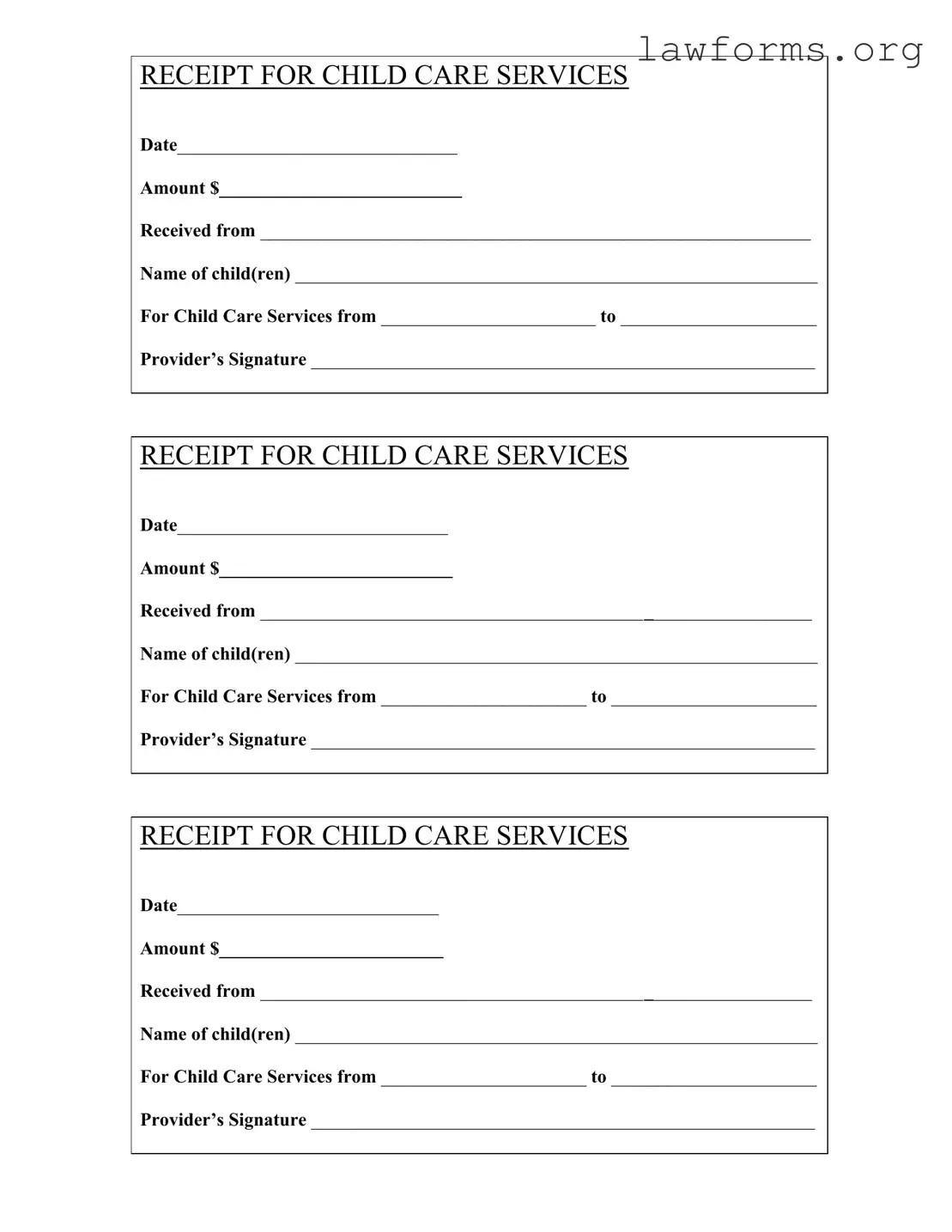

Preview - Childcare Receipt Form

RECEIPT FOR CHILD CARE SERVICES

Date______________________________

Amount $__________________________

Received from ___________________________________________________________

Name of child(ren) ________________________________________________________

For Child Care Services from _______________________ to _____________________

Provider’s Signature ______________________________________________________

RECEIPT FOR CHILD CARE SERVICES

Date_____________________________

Amount $_________________________

Received from ___________________________________________________________

Name of child(ren) ________________________________________________________

For Child Care Services from ______________________ to ______________________

Provider’s Signature ______________________________________________________

RECEIPT FOR CHILD CARE SERVICES

Date____________________________

Amount $________________________

Received from ___________________________________________________________

Name of child(ren) ________________________________________________________

For Child Care Services from ______________________ to ______________________

Provider’s Signature ______________________________________________________

Key takeaways

Filling out and using the Childcare Receipt form can be straightforward if you keep a few key points in mind. Here are some essential takeaways to ensure the process goes smoothly:

- Complete All Fields: Make sure to fill in every section of the form, including the date, amount, and names of the children. Incomplete forms may lead to confusion or disputes later.

- Use Clear Writing: Write legibly when filling out the form. If the information is difficult to read, it may create issues when you need to refer back to it.

- Keep Copies: Always keep a copy of the completed receipt for your records. This can be useful for tax purposes or if any questions arise in the future.

- Provider's Signature: Ensure that the childcare provider signs the form. This signature confirms that the services were rendered and the payment was received.

- Document the Service Period: Clearly indicate the dates for which the childcare services were provided. This helps in tracking the duration of care and is important for any financial records.

- Payment Amount: Clearly state the total amount paid for the childcare services. This amount should match any agreements made prior to the service.

- Understand Tax Implications: Be aware that childcare receipts can sometimes be used for tax deductions. Keeping accurate records can help maximize potential benefits.

- Communicate with Your Provider: If you have any questions about the receipt or the services provided, don’t hesitate to reach out to your childcare provider for clarification.

By following these guidelines, you can ensure that filling out and using the Childcare Receipt form is a simple and effective process.

Similar forms

Invoice: An invoice details services rendered and includes payment information. Like the Childcare Receipt, it specifies the date, amount due, and services provided.

Payment Receipt: This document confirms that a payment has been made. Similar to the Childcare Receipt, it includes the date, amount, and recipient's information.

Tuition Receipt: A tuition receipt is issued by educational institutions for payments made. It shares similarities with the Childcare Receipt in that it also lists the date, amount, and purpose of payment.

Service Agreement: This document outlines the terms of service between a provider and a client. It is similar in that it includes service dates and may reference payment details, though it is more comprehensive.

Deposit Receipt: A deposit receipt acknowledges a sum of money paid upfront. Like the Childcare Receipt, it includes the date and amount but focuses on initial payments rather than full service payments.

- Marital Separation Agreement Form: For couples navigating the separation process, the essential Marital Separation Agreement considerations help clarify rights and obligations before finalizing any divorce proceedings.

Contract for Services: This is a formal agreement that defines the relationship between the service provider and the client. It is similar in detailing the services provided and the payment schedule, though it is more formal and comprehensive.

Tax Receipt: A tax receipt is provided for tax-deductible payments. It shares the same fundamental elements as the Childcare Receipt, including date and amount, but is specifically designed for tax purposes.