Fill Out a Valid Citibank Direct Deposit Template

Form Specs

| Fact Name | Description |

|---|---|

| Purpose | The Citibank Direct Deposit form allows customers to authorize automatic deposits into their bank accounts. |

| Eligibility | Any Citibank account holder can use the form to set up direct deposit for payroll, government benefits, or other recurring payments. |

| Required Information | Customers must provide their account number, routing number, and personal identification details to complete the form. |

| Submission Process | After filling out the form, customers should submit it to their employer or the organization making the deposits. |

| Processing Time | Direct deposit setup typically takes one to two pay cycles to become effective, depending on the employer's payroll schedule. |

| State-Specific Forms | Some states may have specific requirements for direct deposit forms, governed by state laws regarding payroll and banking. |

| Changes and Updates | To change or cancel direct deposit, customers must complete a new form and notify their employer promptly. |

| Security Measures | Citibank employs various security protocols to protect customers’ personal and financial information during the direct deposit process. |

| Contact Information | For assistance, customers can contact Citibank's customer service or visit their website for additional resources. |

Dos and Don'ts

When filling out the Citibank Direct Deposit form, it’s important to be careful and thorough. Here are some essential do's and don'ts to keep in mind:

- Do double-check your account number for accuracy.

- Do provide your employer with the correct routing number.

- Do sign the form where indicated.

- Do keep a copy of the completed form for your records.

- Don't leave any required fields blank.

- Don't use a temporary account number.

- Don't forget to notify your employer if your bank details change.

Other PDF Documents

Physical Exam Form for Healthcare Workers - Be ready to discuss lifestyle and dietary choices with your physician.

A California Hold Harmless Agreement is a legal document designed to protect one party from liability for certain actions or events. This form is commonly used in various situations, such as contracts and rental agreements, where one party agrees to assume the risk and hold another party harmless from any potential claims. For more information, you can refer to the californiadocsonline.com/hold-harmless-agreement-form. Understanding this agreement is essential for anyone looking to navigate liability issues effectively in California.

Cg 2010 - Liability for operations performed at designated locations is included.

Common mistakes

-

Incorrect Account Number: One common mistake is entering the wrong account number. This can lead to delays or misdirected deposits. Always double-check the number against your bank statements.

-

Wrong Routing Number: Each bank has a unique routing number. Using an incorrect routing number can prevent funds from reaching your account. Confirm the routing number with Citibank or through their official website.

-

Failure to Sign the Form: Some individuals forget to sign the direct deposit form. Without a signature, the bank may reject the request. Ensure that you sign and date the form before submission.

-

Not Updating Information: If you change accounts or banks, failing to update your direct deposit information can result in missed payments. Always notify your employer or payer of any changes promptly.

-

Omitting Required Information: Leaving out necessary details, such as your name or Social Security number, can lead to processing issues. Review the form to ensure all required fields are completed accurately.

Documents used along the form

When setting up direct deposit with Citibank, several other forms and documents may be required to ensure a smooth process. Each of these documents serves a specific purpose and helps facilitate the direct deposit arrangement. Below is a list of common forms you may encounter.

- Employment Verification Letter: This letter confirms your employment status and is often required by the bank to validate your identity and income.

- W-4 Form: This tax form provides information about your withholding allowances. It helps determine how much federal income tax should be withheld from your paycheck.

- Bank Statement: A recent bank statement may be needed to verify your existing bank account details and confirm that it is active and in good standing.

- Routing Number Verification: This document confirms the correct routing number for your bank. It ensures that your funds are deposited into the right account.

- Small Estate Affidavit: This document simplifies the collection of assets for heirs, avoiding formal probate processes, and can be conveniently accessed through the Small Estate Affidavit form.

- Pay Stub: A recent pay stub may be requested to verify your income and employment details. It serves as proof of earnings.

- Identification Documents: A government-issued ID, such as a driver's license or passport, is often required to verify your identity.

- Account Authorization Form: This form gives the bank permission to deposit funds directly into your account. It outlines the terms of the direct deposit arrangement.

- Tax Identification Number (TIN): Providing your TIN, which can be your Social Security number, may be necessary for tax reporting purposes.

- Termination Notice (if applicable): If you are switching banks or accounts, a termination notice from your previous bank may be required to cancel any existing direct deposit arrangements.

Gathering these documents ahead of time can streamline the direct deposit setup process with Citibank. Ensure that all information is accurate to avoid any delays in receiving your funds.

Misconceptions

Many individuals have questions about the Citibank Direct Deposit form, leading to various misconceptions. Understanding these can help clarify the process and ensure a smoother experience. Here are five common misconceptions:

-

Direct deposit is only for payroll. Many people believe that direct deposit is exclusively for receiving salaries. In reality, you can use direct deposit for various types of payments, including government benefits, tax refunds, and other recurring payments.

-

Setting up direct deposit is complicated. Some think that the process is overly complicated or time-consuming. However, filling out the Citibank Direct Deposit form is straightforward. You typically need to provide your account number and routing number, which can be found on your checks or online banking portal.

-

Direct deposit is not secure. There is a misconception that direct deposit is less secure than receiving paper checks. In fact, direct deposit is often more secure. Funds are transferred electronically, reducing the risk of theft or loss associated with physical checks.

-

Once set up, direct deposit cannot be changed. Some people worry that they will be stuck with the same direct deposit arrangement forever. This is not true. You can change your direct deposit information at any time by submitting a new Citibank Direct Deposit form.

-

Direct deposit means I won't receive a pay stub. Many believe that opting for direct deposit means they will not receive any documentation of their earnings. However, employers are still required to provide pay stubs, which can be sent electronically or through the mail, regardless of how you receive your payment.

By addressing these misconceptions, individuals can better navigate the direct deposit process and take advantage of its benefits.

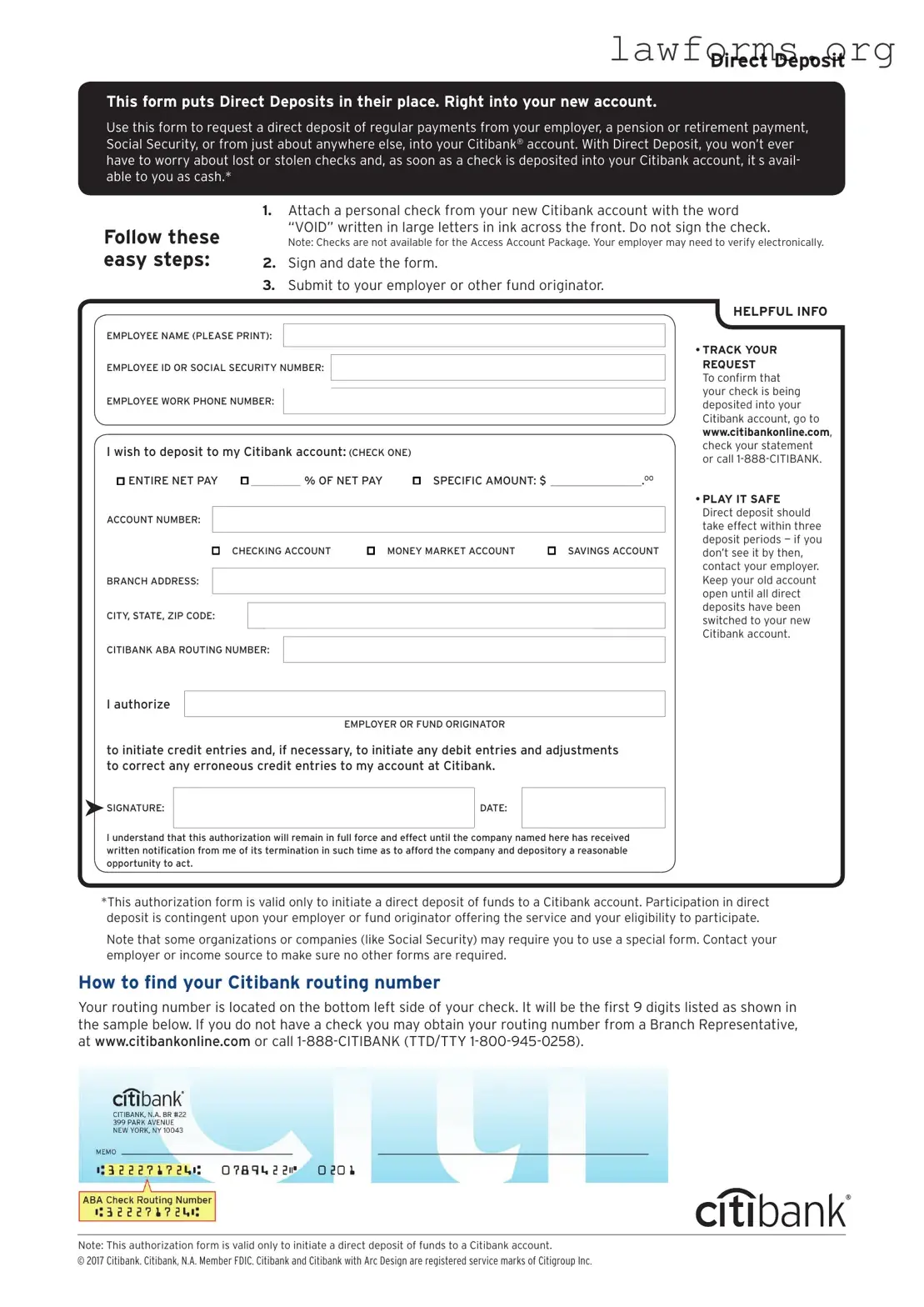

Preview - Citibank Direct Deposit Form

Direct Deposit

This form puts Direct Deposits in their place. Right into your new account.

Use this form to request a direct deposit of regular payments from your employer, a pension or retirement payment, Social Security, or from just about anywhere else, into your Citibank® account. With Direct Deposit, you won’t ever have to worry about lost or stolen checks and, as soon as a check is deposited into your Citibank account, it’s avail- able to you as cash.*

Follow these easy steps:

1.Attach a personal check from your new Citibank account with the word

“VOID” written in large letters in ink across the front. Do not sign the check.

Note: Checks are not available for the Access Account Package. Your employer may need to verify electronically.

2.Sign and date the form.

3.Submit to your employer or other fund originator.

HELPFUL INFO

EMPLOYEE NAME (PLEASE PRINT):

• TRACK YOUR

EMPLOYEE ID OR SOCIAL SECURITY NUMBER:

EMPLOYEE WORK PHONE NUMBER:

I wish to deposit to my Citibank account: (CHECK ONE)

ENTIRE NET PAY ı__________ % OF NET PAY |

ı SPECIFIC AMOUNT: $ ________________.OO |

ACCOUNT NUMBER:

ı CHECKING ACCOUNT |

ı MONEY MARKET ACCOUNT |

ı SAVINGS ACCOUNT |

BRANCH ADDRESS:

CITY, STATE, ZIP CODE:

CITIBANK ABA ROUTING NUMBER:

REQUEST

To confirm that your check is being deposited into your Citibank account, go to www.citibankonline.com, check your statement or call

•PLAY IT SAFE Direct deposit should take effect within three deposit periods — if you don’t see it by then, contact your employer. Keep your old account open until all direct deposits have been switched to your new Citibank account.

I authorize

EMPLOYER OR FUND ORIGINATOR

to initiate credit entries and, if necessary, to initiate any debit entries and adjustments to correct any erroneous credit entries to my account at Citibank.

SIGNATURE:

SIGNATURE:

DATE:

I understand that this authorization will remain in full force and effect until the company named here has received written notification from me of its termination in such time as to afford the company and depository a reasonable opportunity to act.

*This authorization form is valid only to initiate a direct deposit of funds to a Citibank account. Participation in direct deposit is contingent upon your employer or fund originator offering the service and your eligibility to participate.

Note that some organizations or companies (like Social Security) may require you to use a special form. Contact your employer or income source to make sure no other forms are required.

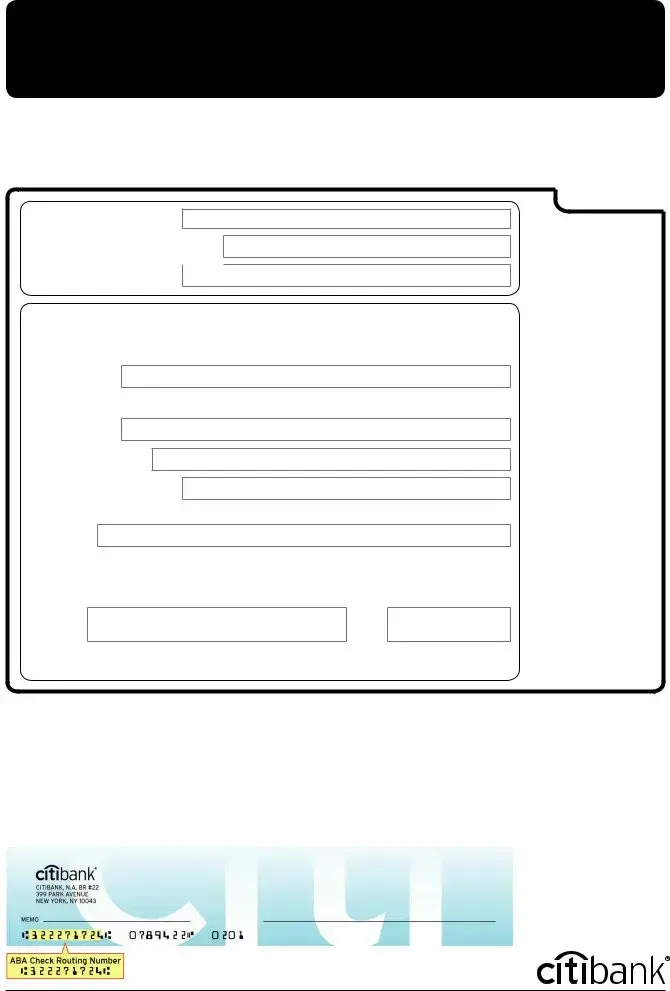

How to find your Citibank routing number

Your routing number is located on the bottom left side of your check. It will be the first 9 digits listed as shown in the sample below. If you do not have a check you may obtain your routing number from a Branch Representative, at www.citibankonline.com or call

Note: This authorization form is valid only to initiate a direct deposit of funds to a Citibank account.

© 2017 Citibank. Citibank, N.A. Member FDIC. Citibank and Citibank with Arc Design are registered service marks of Citigroup Inc.

Key takeaways

When filling out the Citibank Direct Deposit form, there are several important points to keep in mind to ensure a smooth process. Here are key takeaways:

- Accurate Information: Double-check that all personal information, such as your name, address, and Social Security number, is accurate. Mistakes can lead to delays in processing.

- Bank Account Details: Provide the correct bank account number and routing number. These numbers are crucial for directing your funds to the right place.

- Signature Requirement: Don’t forget to sign the form. Your signature authorizes the deposit and verifies that you agree to the terms.

- Employer Notification: After completing the form, submit it to your employer or payroll department. They need this information to set up direct deposits.

- Keep a Copy: Always keep a copy of the filled-out form for your records. This can help resolve any issues that might arise later.

- Review Regularly: Once set up, periodically review your bank statements to ensure that deposits are being made correctly. If discrepancies occur, address them promptly.

By following these takeaways, you can navigate the process of setting up direct deposit with confidence and ease.

Similar forms

- Payroll Authorization Form: This document allows employees to authorize their employer to deposit their salary directly into their bank account, similar to the Citibank Direct Deposit form.

- Bank Account Information Form: This form collects the necessary bank account details for transactions, paralleling the information required on the Citibank Direct Deposit form.

- Automatic Payment Authorization Form: Used for recurring payments, this form shares a similar purpose of facilitating direct transactions between a bank and an account holder.

- Tax Refund Direct Deposit Form: This document allows taxpayers to choose direct deposit for their tax refunds, mirroring the direct deposit mechanism of the Citibank form.

- Social Security Direct Deposit Form: This form enables recipients of Social Security benefits to receive payments directly into their bank accounts, akin to the Citibank Direct Deposit process.

Non-disclosure Agreement: This form is crucial for protecting sensitive information between parties. It ensures confidentiality and prevents unauthorized disclosure of important data. For a comprehensive template, refer to Forms Washington.

- Vendor Payment Authorization Form: Businesses use this form to set up direct payments to vendors, reflecting the same principles as the Citibank Direct Deposit form.

- Retirement Plan Distribution Form: This document allows individuals to receive retirement benefits via direct deposit, similar to the direct deposit functionality of the Citibank form.

- Insurance Premium Payment Authorization Form: This form permits automatic deductions for insurance premiums, aligning with the direct deposit concept.

- Loan Payment Authorization Form: Borrowers use this document to authorize automatic loan payments from their bank account, which is similar in nature to the Citibank Direct Deposit form.

- Commission Payment Authorization Form: This form allows sales representatives to receive their commissions directly in their bank accounts, paralleling the direct deposit process.