Valid Corrective Deed Form

Form Specifications

| Fact Name | Description |

|---|---|

| Purpose | A Corrective Deed is used to correct errors in a previously recorded deed, ensuring that the property records accurately reflect ownership. |

| Common Errors | Errors that may be corrected include misspellings of names, incorrect legal descriptions of the property, or mistakes in the grantor or grantee details. |

| Governing Law | The laws governing Corrective Deeds vary by state. In many states, the relevant statutes can be found in property or real estate law sections. |

| Filing Requirements | To file a Corrective Deed, it typically must be signed by the original grantor and may require notarization, depending on state laws. |

| Impact on Title | Once recorded, a Corrective Deed updates the title records, helping to prevent future disputes regarding property ownership. |

Dos and Don'ts

When filling out the Corrective Deed form, it is essential to follow specific guidelines to ensure accuracy and compliance. Below is a list of things you should and shouldn't do:

- Do: Carefully read all instructions provided with the form.

- Do: Use clear and legible handwriting or type the information.

- Do: Double-check all names and addresses for accuracy.

- Do: Sign and date the form in the appropriate sections.

- Do: Keep a copy of the completed form for your records.

- Don't: Leave any required fields blank.

- Don't: Use correction fluid or tape on the form.

Following these guidelines will help ensure that your Corrective Deed form is processed smoothly and efficiently.

Create Popular Types of Corrective Deed Documents

What Is a Gift Deed in Real Estate - Gift Deeds may help in minimizing probate complexities upon death.

When considering the transfer of property in Florida, utilizing a Florida Quitclaim Deed form can serve as an effective method, especially among acquaintances or family members, as it allows for a direct conveyance of property rights. For further information and access to templates, you can visit https://toptemplates.info, where you can find valuable resources to guide you through the process.

Free Lady Bird Deed Form - This deed is especially valuable for individuals with real estate assets they want to gift to their children.

Common mistakes

-

Incorrect Names: One of the most common mistakes is misspelling names or using incorrect legal names. Ensure that the names of all parties involved match exactly with their official identification documents.

-

Missing Signatures: Forgetting to sign the form can lead to delays. All required parties must sign the Corrective Deed for it to be valid.

-

Improper Notarization: Not having the document properly notarized is another frequent error. A notary public must witness the signatures to verify their authenticity.

-

Incorrect Property Description: Failing to accurately describe the property can cause confusion or legal issues. Include the correct address, lot number, and any other identifying information.

-

Omitting Relevant Details: Important details about the correction may be left out. Be sure to explain the reason for the correction clearly and concisely.

-

Using the Wrong Form: Sometimes individuals mistakenly use a different form instead of the Corrective Deed. Double-check to ensure you have the correct document for your needs.

-

Not Consulting a Professional: Skipping professional advice can lead to errors. Consulting with a real estate attorney or a qualified professional can help avoid pitfalls.

Documents used along the form

When dealing with property transactions, the Corrective Deed form plays a crucial role in rectifying errors in previously recorded deeds. However, it is often accompanied by other important documents that help ensure clarity and legal compliance. Here are some forms and documents commonly used alongside the Corrective Deed:

- Original Deed: This is the initial document that outlines the transfer of property ownership. It contains vital information such as the names of the grantor and grantee, property description, and any conditions or restrictions associated with the property.

- Affidavit of Correction: This sworn statement is used to confirm the intent to correct a mistake in the original deed. It provides a legal basis for the corrections made in the Corrective Deed and may include details about the nature of the errors.

- Quitclaim Deed: This type of deed is often used to transfer interest in a property without guaranteeing a clear title. It can be useful for informal transfers, such as between family members. For more information, visit https://legalpdfdocs.com/georgia-quitclaim-deed-template.

- Title Search Report: This document summarizes the history of ownership and any liens or encumbrances on the property. It is essential for ensuring that the property title is clear and can help identify any issues that may need to be addressed during the corrective process.

- Property Description Addendum: If the property description in the original deed was incomplete or inaccurate, this addendum provides the necessary details to clarify the boundaries and characteristics of the property being transferred.

Understanding these accompanying documents can significantly enhance your grasp of property transactions. Each plays a vital role in ensuring that corrections are made accurately and that all parties involved are protected throughout the process.

Misconceptions

Understanding the Corrective Deed form can be tricky, and several misconceptions often arise. Here are seven common misunderstandings about this important document:

- Corrective Deeds are only for mistakes made by the seller. Many believe that only sellers can use a Corrective Deed to fix errors. In reality, anyone involved in the transaction can request a corrective deed if there are mistakes in the property description or names.

- A Corrective Deed is the same as a Quitclaim Deed. While both documents transfer property interests, they serve different purposes. A Corrective Deed specifically addresses and corrects errors, whereas a Quitclaim Deed simply transfers whatever interest the grantor has without addressing any mistakes.

- All errors can be fixed with a Corrective Deed. Not every error qualifies for correction through this form. For example, issues related to liens or encumbrances typically require different legal solutions.

- You need to go to court to use a Corrective Deed. This is not true. Most corrections can be made by simply completing and recording the Corrective Deed with the appropriate county office without the need for court intervention.

- Once a Corrective Deed is filed, it cannot be challenged. While it is designed to correct mistakes, a Corrective Deed can still be contested if someone believes it was executed improperly or if the underlying issues were not adequately resolved.

- Corrective Deeds are only for residential properties. This misconception overlooks the fact that Corrective Deeds can be used for any type of property, including commercial and industrial real estate.

- Filing a Corrective Deed is a lengthy process. Many think that the process takes a long time, but it can often be completed relatively quickly, especially if all necessary information is readily available and the deed is properly prepared.

By clarifying these misconceptions, property owners and buyers can better understand the Corrective Deed and its role in real estate transactions.

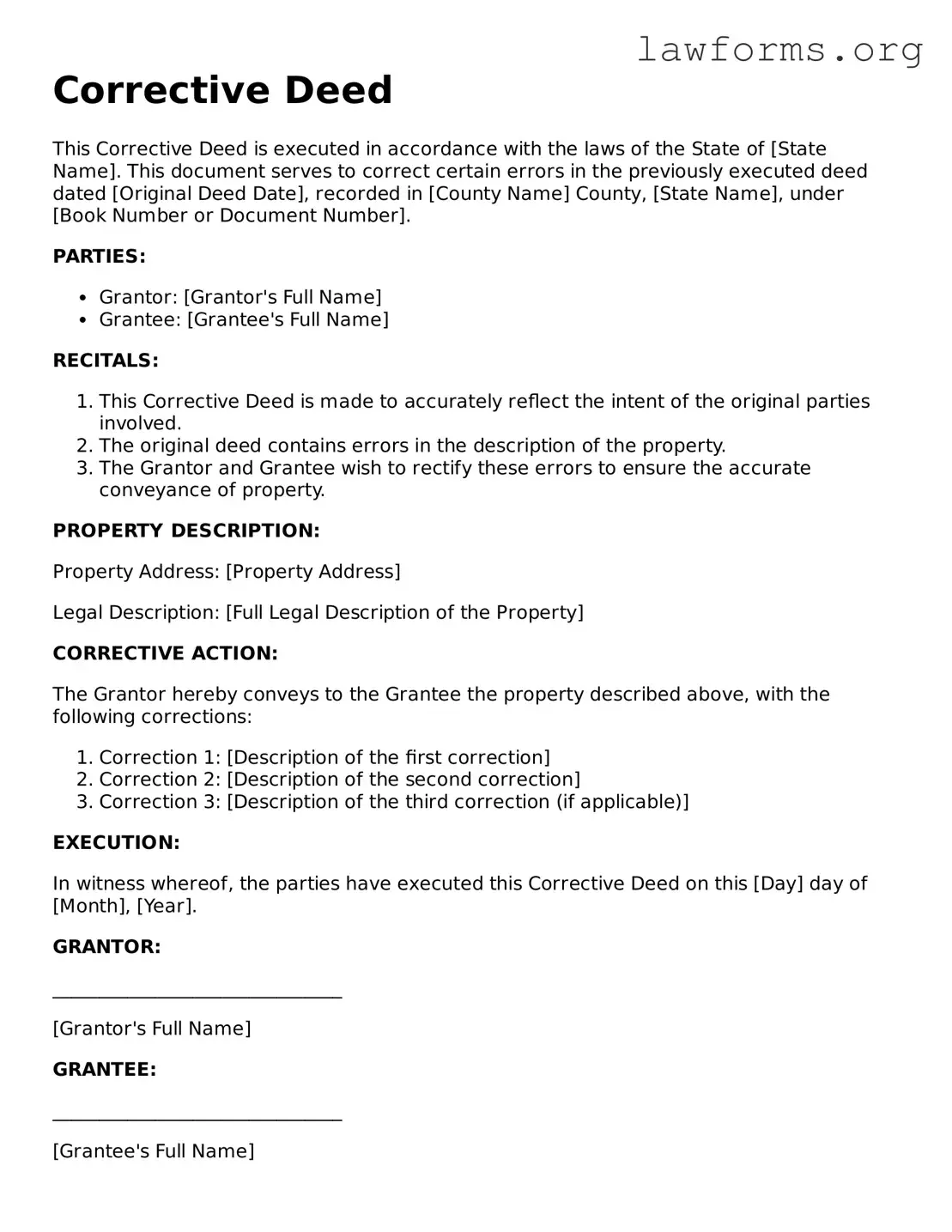

Preview - Corrective Deed Form

Corrective Deed

This Corrective Deed is executed in accordance with the laws of the State of [State Name]. This document serves to correct certain errors in the previously executed deed dated [Original Deed Date], recorded in [County Name] County, [State Name], under [Book Number or Document Number].

PARTIES:

- Grantor: [Grantor's Full Name]

- Grantee: [Grantee's Full Name]

RECITALS:

- This Corrective Deed is made to accurately reflect the intent of the original parties involved.

- The original deed contains errors in the description of the property.

- The Grantor and Grantee wish to rectify these errors to ensure the accurate conveyance of property.

PROPERTY DESCRIPTION:

Property Address: [Property Address]

Legal Description: [Full Legal Description of the Property]

CORRECTIVE ACTION:

The Grantor hereby conveys to the Grantee the property described above, with the following corrections:

- Correction 1: [Description of the first correction]

- Correction 2: [Description of the second correction]

- Correction 3: [Description of the third correction (if applicable)]

EXECUTION:

In witness whereof, the parties have executed this Corrective Deed on this [Day] day of [Month], [Year].

GRANTOR:

_______________________________

[Grantor's Full Name]

GRANTEE:

_______________________________

[Grantee's Full Name]

NOTARY PUBLIC:

State of [State Name], County of [County Name]

Subscribed and sworn to before me this [Day] day of [Month], [Year].

_______________________________

Notary Public

My Commission Expires: [Expiration Date]

Key takeaways

When filling out and using the Corrective Deed form, it is important to keep the following key takeaways in mind:

- Ensure all information is accurate and complete to avoid future complications.

- Use clear and concise language to describe the corrections being made.

- Double-check the names and legal descriptions of the properties involved.

- Obtain the necessary signatures from all parties involved in the deed.

- File the Corrective Deed with the appropriate local government office to make it official.

- Keep a copy of the Corrective Deed for your records after it has been filed.

Similar forms

The Corrective Deed form is a legal document used to amend or correct errors in a previously recorded deed. It serves to clarify the intent of the parties involved and ensure that the public record accurately reflects the ownership of property. Here are four documents that share similarities with the Corrective Deed form:

- Quitclaim Deed: This document transfers ownership interest in a property without guaranteeing that the title is clear. Like the Corrective Deed, it can be used to correct issues related to property ownership, but it does not provide the same level of assurance regarding the title.

- Warranty Deed: A Warranty Deed guarantees that the grantor holds clear title to the property and has the right to sell it. While it serves a different primary purpose, both documents can be used to rectify ownership discrepancies and ensure that the title is properly conveyed.

- Georgia Deed Form: This document, essential for the transfer of property ownership in Georgia, ensures the details of the transaction are clearly outlined. It’s similar to the Corrective Deed in its aim to clarify property ownership. For more information, refer to Georgia Documents.

- Deed of Trust: This document is used in real estate transactions to secure a loan with the property as collateral. Although its main function is different, it can also be amended to correct errors, similar to how a Corrective Deed is utilized to fix inaccuracies in property records.

- Affidavit of Heirship: This document is used to establish the heirs of a deceased property owner. It can clarify ownership issues, much like a Corrective Deed, by providing evidence of rightful ownership when the title is unclear due to the previous owner's passing.