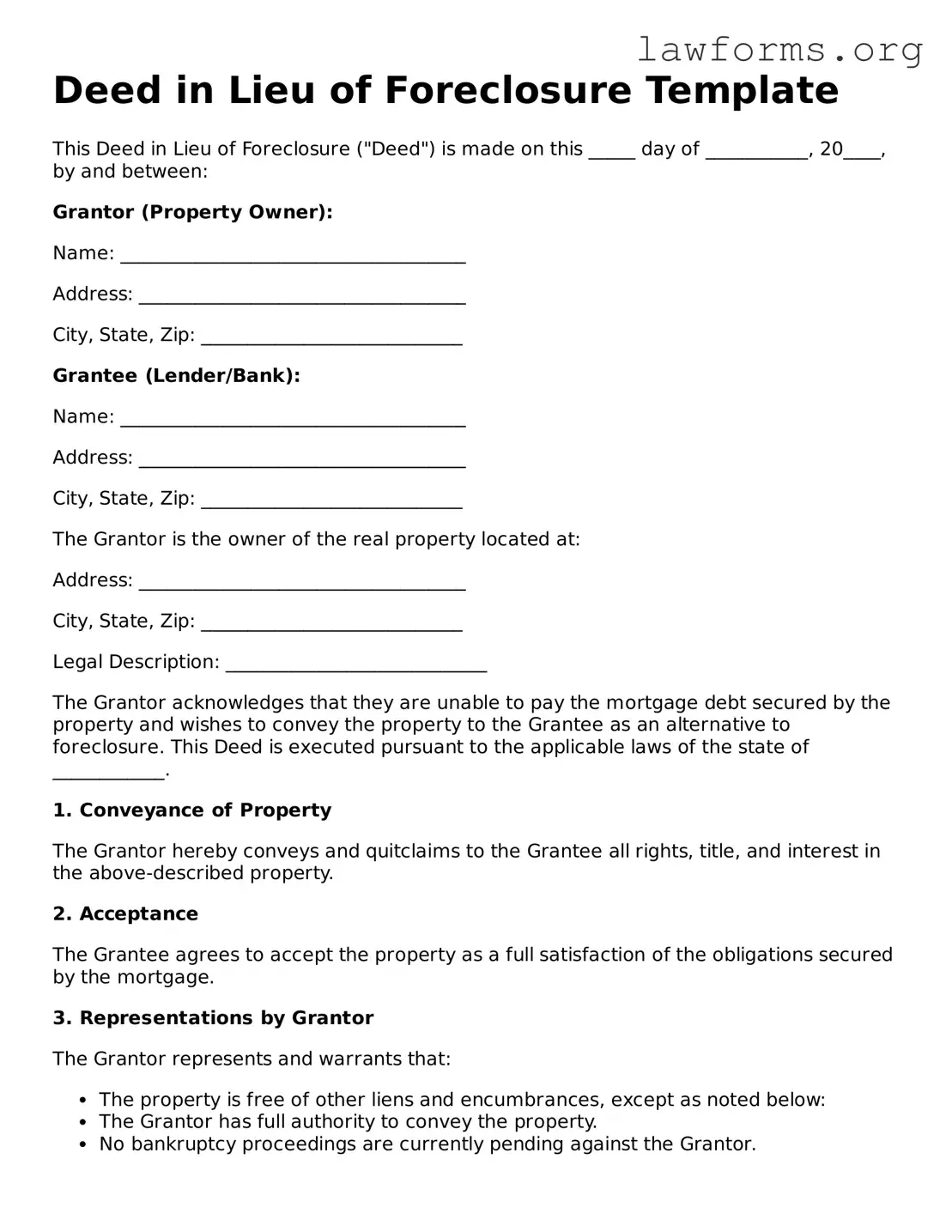

Deed in Lieu of Foreclosure Template

This Deed in Lieu of Foreclosure ("Deed") is made on this _____ day of ___________, 20____, by and between:

Grantor (Property Owner):

Name: _____________________________________

Address: ___________________________________

City, State, Zip: ____________________________

Grantee (Lender/Bank):

Name: _____________________________________

Address: ___________________________________

City, State, Zip: ____________________________

The Grantor is the owner of the real property located at:

Address: ___________________________________

City, State, Zip: ____________________________

Legal Description: ____________________________

The Grantor acknowledges that they are unable to pay the mortgage debt secured by the property and wishes to convey the property to the Grantee as an alternative to foreclosure. This Deed is executed pursuant to the applicable laws of the state of ____________.

1. Conveyance of Property

The Grantor hereby conveys and quitclaims to the Grantee all rights, title, and interest in the above-described property.

2. Acceptance

The Grantee agrees to accept the property as a full satisfaction of the obligations secured by the mortgage.

3. Representations by Grantor

The Grantor represents and warrants that:

- The property is free of other liens and encumbrances, except as noted below:

- The Grantor has full authority to convey the property.

- No bankruptcy proceedings are currently pending against the Grantor.

4. Miscellaneous

This Deed shall be binding upon and inure to the benefit of the parties and their respective successors and assigns. If any provision of this Deed is determined to be unenforceable, the remaining provisions shall remain in effect.

5. Governing Law

This Deed shall be governed by, and construed in accordance with, the laws of the state of ____________.

Signatures

Grantor: _____________________________________ (Signature)

Date: ________________________________________

Grantee: _____________________________________ (Signature)

Date: ________________________________________

Witness: _____________________________________ (Signature)

Date: ________________________________________

Notary Public: ________________________________

My Commission Expires: ______________________