Valid Durable Power of Attorney Form

State-specific Durable Power of Attorney Documents

Form Specifications

| Fact Name | Description |

|---|---|

| Definition | A Durable Power of Attorney allows an individual to appoint someone else to make decisions on their behalf, even if they become incapacitated. |

| State-Specific Forms | Each state has its own version of the Durable Power of Attorney form. It is essential to use the correct form for the state where it will be executed. |

| Governing Laws | The laws governing Durable Power of Attorney vary by state. For instance, in California, it is governed by the California Probate Code Section 4400. |

| Durability | The term "durable" indicates that the authority granted remains in effect even if the principal becomes mentally incapacitated. |

| Revocation | A Durable Power of Attorney can be revoked at any time by the principal, as long as they are mentally competent to do so. |

Dos and Don'ts

When filling out a Durable Power of Attorney form, attention to detail is crucial. Here are five important guidelines to follow:

- Do ensure you understand the powers you are granting. Read the form carefully to know what authority you are giving to your agent.

- Do choose a trusted individual as your agent. This person will make significant decisions on your behalf.

- Do sign the document in the presence of a notary or witnesses, if required by your state. This adds an extra layer of validity.

- Don't leave any sections blank. Incomplete forms can lead to confusion and potential legal issues.

- Don't use vague language. Be specific about the powers you are granting to avoid misunderstandings later.

Create Popular Types of Durable Power of Attorney Documents

Notarized Minor Child Power of Attorney Child Guardianship - It serves as an assurance for both parents and caregivers about authority limits.

Common mistakes

-

Not Clearly Identifying the Agent: Individuals often fail to provide the full legal name of the agent they are appointing. This can lead to confusion and disputes later on.

-

Inadequate Description of Powers: Some people do not specify the powers they wish to grant to their agent. A vague description can limit the agent's ability to act effectively on behalf of the principal.

-

Forgetting to Sign and Date: A common mistake is neglecting to sign and date the document. Without a signature, the Durable Power of Attorney is not valid.

-

Not Considering Alternate Agents: Many individuals overlook the importance of naming an alternate agent. If the primary agent is unavailable or unwilling to act, this can create complications.

-

Failing to Review State-Specific Requirements: Each state has its own laws regarding Durable Power of Attorney forms. Ignoring these requirements can result in an invalid document.

Documents used along the form

When establishing a Durable Power of Attorney (DPOA), it is essential to consider additional documents that can complement this important legal tool. Each of these documents serves a unique purpose and can help ensure that your wishes are respected and your affairs are managed effectively. Below is a list of commonly used forms and documents that often accompany a Durable Power of Attorney.

- Healthcare Power of Attorney: This document allows an individual to designate someone to make medical decisions on their behalf if they become incapacitated. It ensures that healthcare choices align with the individual's preferences.

- Living Will: A living will outlines specific medical treatments an individual wishes to receive or avoid in case they are unable to communicate their desires. This document provides guidance to healthcare providers and loved ones during critical times.

- Revocation of Power of Attorney: This form is used to formally cancel a previously established power of attorney. It is crucial for individuals who wish to change their designated agent or revoke authority granted to someone else.

- Will: A will specifies how an individual's assets and affairs should be handled after their passing. It provides clear instructions for the distribution of property and can designate guardians for minor children.

- Trust Agreement: A trust agreement establishes a trust to hold and manage assets for the benefit of designated beneficiaries. It can help avoid probate and provide more control over how assets are distributed.

- Financial Power of Attorney: Similar to a DPOA, this document specifically grants authority to another person to manage financial matters, such as banking, investments, and property transactions, on behalf of the individual.

In conclusion, while a Durable Power of Attorney is a vital component of planning for the future, it is often beneficial to have these additional documents in place. Each one plays a significant role in ensuring that your wishes are honored and your affairs are handled according to your preferences. By considering these forms, individuals can create a comprehensive plan that provides peace of mind for themselves and their loved ones.

Misconceptions

Understanding the Durable Power of Attorney (DPOA) is crucial for effective estate planning. However, several misconceptions can lead to confusion. Here are five common misunderstandings about the DPOA:

- A DPOA only becomes effective when the principal is incapacitated. This is not entirely true. A Durable Power of Attorney can be set up to take effect immediately or at a future date specified by the principal. It remains in effect even if the principal becomes incapacitated.

- The agent can do anything they want with the principal's assets. While the agent does have significant authority, their power is not unlimited. The agent must act in the best interests of the principal and adhere to the terms outlined in the DPOA. Misusing this power can lead to legal consequences.

- A DPOA is only for financial matters. This misconception overlooks the fact that a Durable Power of Attorney can also cover health care decisions. A separate document, often called a healthcare proxy or medical power of attorney, can be designated for medical decisions, but a DPOA can encompass both areas.

- Once a DPOA is signed, it cannot be revoked. In reality, the principal retains the right to revoke the DPOA at any time, as long as they are competent. This can be done through a written notice to the agent and any relevant institutions.

- All DPOAs are the same. DPOAs can vary significantly based on state laws and the specific provisions included. It is essential to tailor the document to fit individual needs and ensure compliance with local regulations.

Clarifying these misconceptions can empower individuals to make informed decisions about their legal and financial affairs. Understanding the nuances of a Durable Power of Attorney is an essential step in effective estate planning.

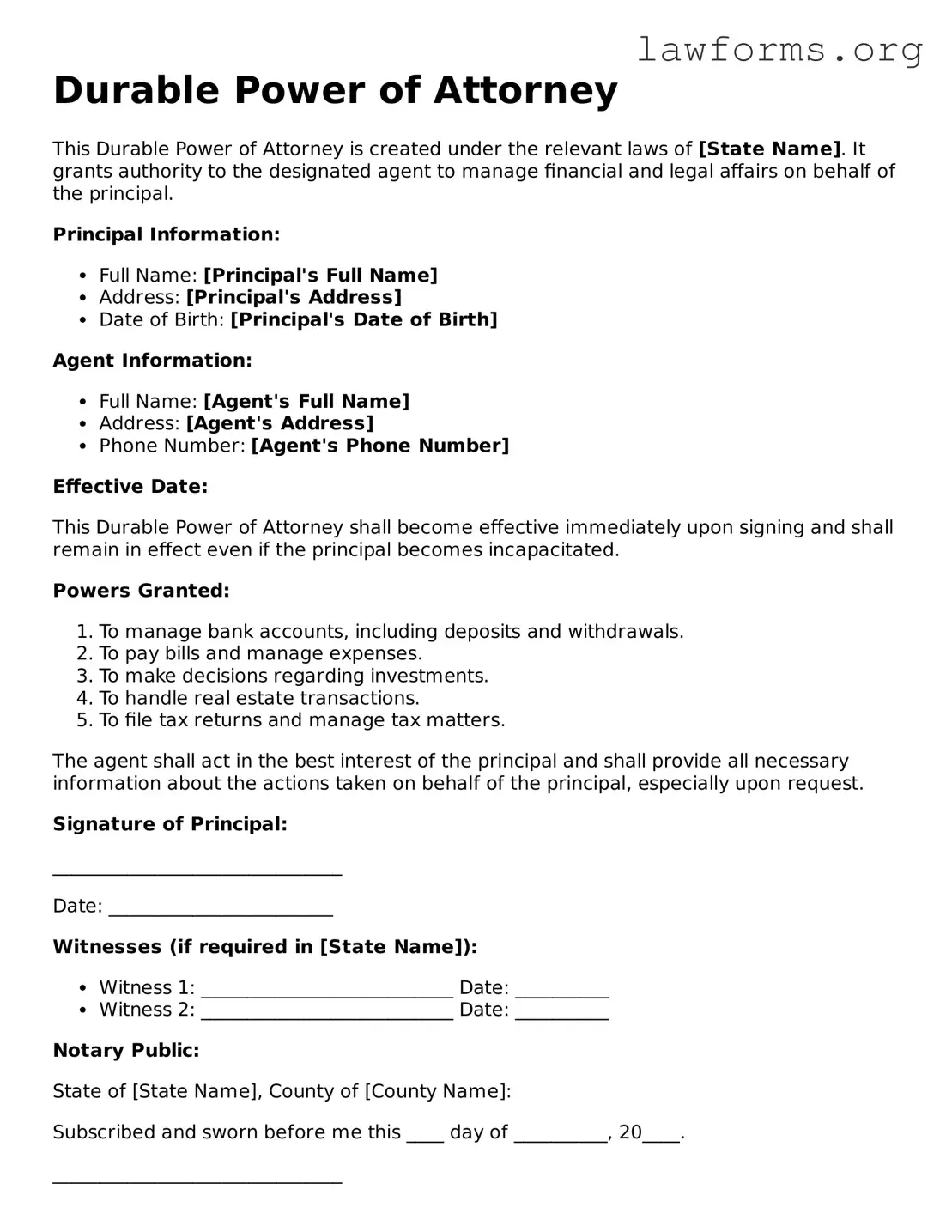

Preview - Durable Power of Attorney Form

Durable Power of Attorney

This Durable Power of Attorney is created under the relevant laws of [State Name]. It grants authority to the designated agent to manage financial and legal affairs on behalf of the principal.

Principal Information:

- Full Name: [Principal's Full Name]

- Address: [Principal's Address]

- Date of Birth: [Principal's Date of Birth]

Agent Information:

- Full Name: [Agent's Full Name]

- Address: [Agent's Address]

- Phone Number: [Agent's Phone Number]

Effective Date:

This Durable Power of Attorney shall become effective immediately upon signing and shall remain in effect even if the principal becomes incapacitated.

Powers Granted:

- To manage bank accounts, including deposits and withdrawals.

- To pay bills and manage expenses.

- To make decisions regarding investments.

- To handle real estate transactions.

- To file tax returns and manage tax matters.

The agent shall act in the best interest of the principal and shall provide all necessary information about the actions taken on behalf of the principal, especially upon request.

Signature of Principal:

_______________________________

Date: ________________________

Witnesses (if required in [State Name]):

- Witness 1: ___________________________ Date: __________

- Witness 2: ___________________________ Date: __________

Notary Public:

State of [State Name], County of [County Name]:

Subscribed and sworn before me this ____ day of __________, 20____.

_______________________________

Notary Public Signature

My Commission Expires: ____________

Key takeaways

When considering a Durable Power of Attorney (DPOA), it's important to understand its implications and uses. Here are some key takeaways:

- Definition: A Durable Power of Attorney allows someone to make decisions on your behalf if you become unable to do so.

- Durability: The term "durable" means the authority remains effective even if you become incapacitated.

- Choosing an Agent: Select someone you trust to act in your best interests. This person is often referred to as your agent or attorney-in-fact.

- Scope of Authority: You can specify what decisions your agent can make, including financial, medical, or legal matters.

- State Requirements: Each state has its own rules regarding DPOAs. Ensure the form complies with your state’s laws.

- Revocation: You can revoke a DPOA at any time as long as you are mentally competent. This should be done in writing.

- Signing the Document: The DPOA must be signed and dated by you, and some states require witnesses or notarization.

- Sharing the Document: Provide copies of the DPOA to your agent, healthcare providers, and financial institutions to ensure they are aware of your wishes.

- Review Regularly: Life circumstances change. Regularly review and update your DPOA to reflect your current situation and preferences.

Similar forms

- General Power of Attorney: Like the Durable Power of Attorney, this document allows someone to act on behalf of another person in a wide range of financial and legal matters. However, it becomes invalid if the principal becomes incapacitated.

- Healthcare Power of Attorney: This document specifically grants someone the authority to make medical decisions on behalf of another person if they are unable to do so. It focuses solely on health-related matters, unlike the Durable Power of Attorney, which can cover broader financial issues.

- Trailer Bill of Sale: The Forms Washington provides templates for the Trailer Bill of Sale, ensuring that all necessary details are accurately documented for a successful ownership transfer.

- Living Will: A Living Will outlines a person's wishes regarding medical treatment in situations where they are unable to communicate their preferences. While it does not appoint an agent, it works in conjunction with a Healthcare Power of Attorney.

- Financial Power of Attorney: Similar to a Durable Power of Attorney, this document allows someone to manage financial affairs. However, it may not remain valid if the principal becomes incapacitated, depending on how it is structured.

- Revocable Trust: A Revocable Trust allows a person to manage their assets during their lifetime and dictate how those assets will be distributed after death. It provides some similar benefits to a Durable Power of Attorney in terms of asset management.

- Advance Healthcare Directive: This document combines a Healthcare Power of Attorney and a Living Will. It allows a person to outline their healthcare preferences and appoint someone to make decisions on their behalf.

- Guardian or Conservatorship Documents: These legal documents appoint someone to manage the affairs of an individual who is unable to do so due to incapacity. While they serve a similar purpose, they are often court-appointed rather than chosen by the individual.

- Will: A Will outlines how a person's assets will be distributed after their death. While it does not grant authority during a person’s lifetime, it is essential for estate planning, much like the Durable Power of Attorney is crucial for managing affairs during life.