Fill Out a Valid Employee Advance Template

Form Specs

| Fact Name | Description |

|---|---|

| Purpose | The Employee Advance form is used to request an advance on salary or wages from the employer. |

| Eligibility | Typically, only employees who have been with the company for a certain period can request an advance. |

| Repayment Terms | Advances are usually repaid through deductions from future paychecks, often within a specified timeframe. |

| Approval Process | Requests for advances must be approved by a supervisor or human resources department. |

| Documentation | Employees may need to provide documentation or justification for the request, depending on company policy. |

| State-Specific Laws | In some states, such as California, specific laws govern wage advances and deductions from paychecks. |

| Tax Implications | Employee advances may have tax implications, and employees should consult with a tax professional. |

| Confidentiality | Requests for advances are generally treated as confidential and should not be disclosed without consent. |

| Form Availability | The Employee Advance form is usually available through the company's human resources department or intranet. |

Dos and Don'ts

When filling out the Employee Advance form, it’s important to follow certain guidelines to ensure a smooth process. Here are five things you should and shouldn't do:

- Do double-check all the information you provide for accuracy.

- Do submit your form in a timely manner to avoid delays.

- Do keep a copy of the completed form for your records.

- Don't leave any required fields blank; this can cause processing issues.

- Don't forget to include any necessary supporting documentation.

Other PDF Documents

Chick-fil-a Hiring Near Me - Interact with diverse individuals and create lasting connections.

T47 Paralympics - This form assists in verifying property boundaries and encroachments.

In addition to understanding the importance of the Ohio Trailer Bill of Sale, you may find it helpful to access the necessary forms online for convenience. For example, you can visit Ohio PDF Forms to easily obtain this document and ensure a smooth transfer of ownership.

Does an Advanced Directive Need to Be Notarized - You can share copies of your completed directive with family and health care providers.

Common mistakes

-

Failing to provide accurate personal information. This includes your full name, employee ID, and department. Inaccuracies can lead to delays in processing.

-

Not specifying the purpose of the advance. Clearly state why you need the funds. A vague description can result in denial.

-

Overlooking the required signatures. Ensure that all necessary parties, including your supervisor, have signed the form. Missing signatures will halt the approval process.

-

Requesting an amount that exceeds company policy limits. Familiarize yourself with the maximum allowable advance before submitting your request.

-

Neglecting to attach supporting documentation. If your advance is for travel, include itineraries or invoices. Lack of documentation can lead to questions about your request.

-

Using outdated forms. Always check for the most current version of the Employee Advance form. Using an old form can cause confusion and delays.

-

Submitting the form after the deadline. Adhere to submission timelines to ensure your request is considered in a timely manner.

-

Not keeping a copy of the submitted form. Retain a copy for your records. This will help if there are any discrepancies later.

-

Ignoring the repayment terms. Understand the repayment process and timeline to avoid future complications.

-

Failing to follow up on the status of the request. After submission, check in to ensure that your form is being processed. This proactive approach can prevent unnecessary delays.

Documents used along the form

The Employee Advance form is a crucial document used by employers to provide financial assistance to employees before their regular paychecks. Alongside this form, several other documents are often utilized to ensure proper processing and compliance with company policies. Below is a list of related forms and documents commonly associated with the Employee Advance form.

- Employee Reimbursement Form: This document allows employees to request reimbursement for expenses incurred while performing job-related duties. It typically requires receipts and a description of the expenses.

- Payroll Deduction Authorization Form: Employees use this form to authorize the company to deduct repayments of advances or other amounts from their future paychecks.

- Expense Report: This form summarizes all expenses an employee has incurred during a specific period, providing details necessary for reimbursement or advance justification.

- California Judicial Council Form: This standardized document is crucial for streamlining legal processes and is required for various court filings. For more information, visit https://californiadocsonline.com/california-judicial-council-form/.

- Employment Agreement: This document outlines the terms of employment, including salary, benefits, and any conditions regarding advances or reimbursements.

- Tax Withholding Form (W-4): Employees complete this form to indicate their tax withholding preferences, which may be relevant when processing advances and deductions.

- Direct Deposit Authorization Form: This form allows employees to authorize direct deposit of their paychecks, including any advances received.

- Leave of Absence Request Form: Employees may need this form if they are requesting time off, which could impact their financial situation and need for an advance.

- Performance Review Form: This document may be referenced when evaluating an employee’s eligibility for advances, based on their performance and tenure.

- Termination Checklist: This form is used when an employee leaves the company, ensuring all financial matters, including any outstanding advances, are settled.

Each of these documents plays a significant role in the overall process of managing employee finances and ensuring compliance with company policies. Proper use of these forms helps maintain clear communication between employers and employees regarding financial matters.

Misconceptions

Understanding the Employee Advance form is essential for both employees and employers. However, there are several misconceptions that can lead to confusion. Here’s a list of common misunderstandings:

-

Only full-time employees can use the form.

This is not true. Part-time employees may also be eligible to request advances, depending on company policy.

-

Employee advances are loans that must be paid back immediately.

While advances do need to be repaid, the repayment terms can vary. They are often deducted from future paychecks over time.

-

All requests for advances are automatically approved.

This is a misconception. Each request is reviewed based on specific criteria and may be denied if it does not meet company guidelines.

-

There is a limit to how many times an employee can request an advance.

Limits may exist, but they vary by company policy. Some organizations may allow multiple requests, while others may restrict them.

-

The Employee Advance form is the same as a reimbursement form.

These forms serve different purposes. An advance is money given ahead of time, while reimbursement is for expenses already incurred.

-

Submitting the form guarantees that the advance will be processed quickly.

Processing times can differ based on the organization’s workflow. It’s best to submit requests as early as possible.

-

All advances are for the same amount.

Advances can vary significantly based on individual needs and company policy. Employees should specify the amount they are requesting.

-

Employees must provide a reason for requesting an advance.

While some companies may require a reason, others may not. Check with your HR department for specific requirements.

-

Using the Employee Advance form affects credit scores.

This is a common concern, but employee advances are internal transactions and do not impact credit ratings.

-

Once the form is submitted, there’s no way to make changes.

In many cases, employees can contact HR to amend their request if necessary, as long as it’s before approval.

By addressing these misconceptions, employees can better navigate the process of requesting advances and ensure they understand their rights and responsibilities.

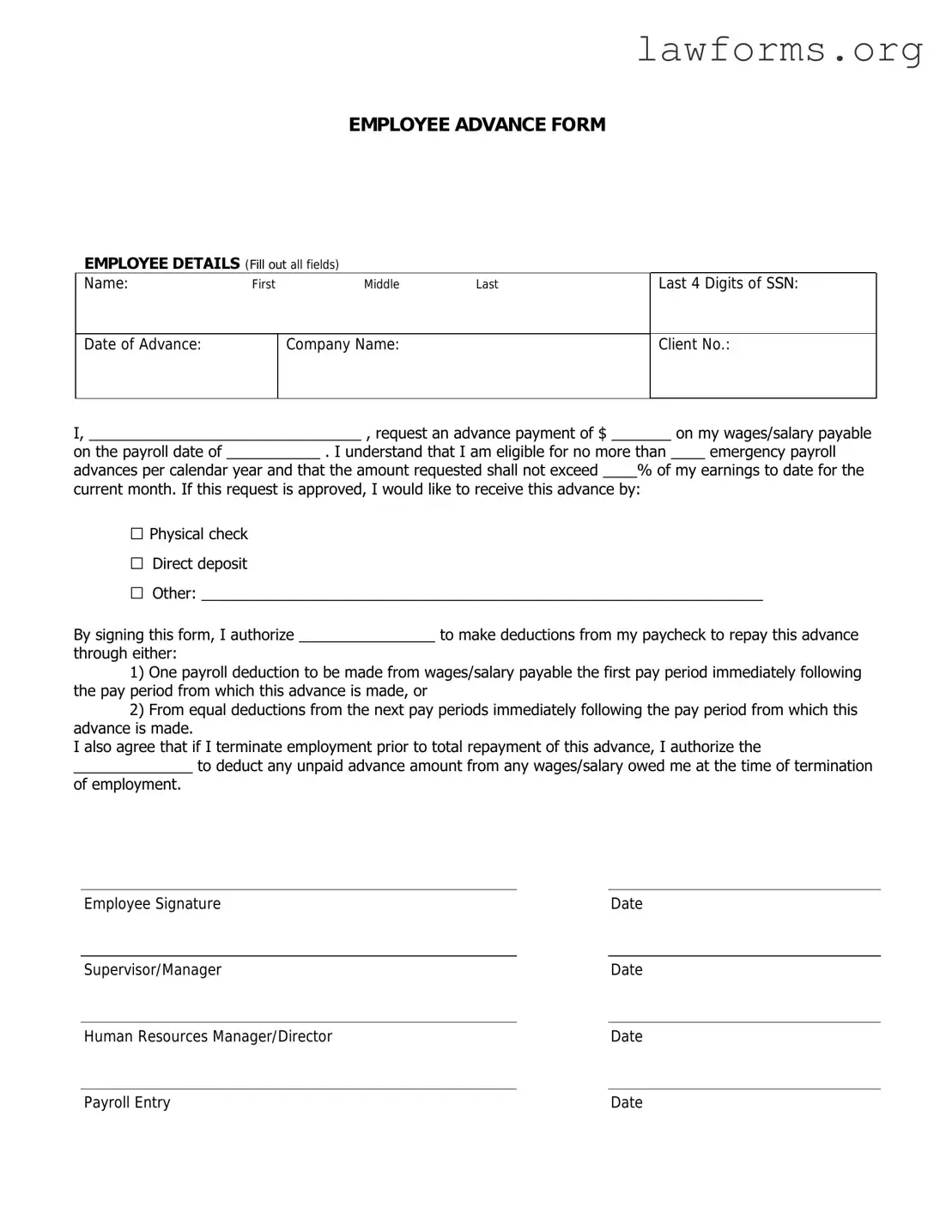

Preview - Employee Advance Form

EMPLOYEE ADVANCE FORM

EMPLOYEE DETAILS (Fill out all fields)

Name: |

First |

Middle |

Last |

|

|

|

|

Date of Advance: |

|

Company Name: |

|

|

|

|

|

Last 4 Digits of SSN:

Client No.:

I, ________________________________ , request an advance payment of $ _______ on my wages/salary payable

on the payroll date of ___________ . I understand that I am eligible for no more than ____ emergency payroll

advances per calendar year and that the amount requested shall not exceed ____% of my earnings to date for the

current month. If this request is approved, I would like to receive this advance by:

□Physical check

□Direct deposit

□Other: __________________________________________________________________

By signing this form, I authorize ________________ to make deductions from my paycheck to repay this advance

through either:

1)One payroll deduction to be made from wages/salary payable the first pay period immediately following the pay period from which this advance is made, or

2)From equal deductions from the next pay periods immediately following the pay period from which this advance is made.

I also agree that if I terminate employment prior to total repayment of this advance, I authorize the

______________ to deduct any unpaid advance amount from any wages/salary owed me at the time of termination of employment.

Employee Signature |

|

Date |

|

|

|

Supervisor/Manager |

|

Date |

|

|

|

Human Resources Manager/Director |

|

Date |

Payroll Entry |

Date |

Key takeaways

When it comes to filling out and using the Employee Advance form, there are several important points to keep in mind. Understanding these can help ensure a smooth process for both employees and employers.

- Be Clear and Concise: When filling out the form, provide clear and concise information. This helps avoid confusion and speeds up the approval process.

- Include All Necessary Details: Make sure to include all relevant details, such as the amount requested and the purpose of the advance. This information is crucial for approval.

- Check Company Policy: Familiarize yourself with your company’s policy regarding advances. Different organizations may have varying rules and limits.

- Submit on Time: Timeliness is key. Ensure that you submit the form well in advance of when you need the funds to allow for processing time.

- Keep Copies: Always keep a copy of the submitted form for your records. This can be helpful for future reference or in case of any discrepancies.

- Follow Up: After submission, follow up with your supervisor or HR to confirm that your request is being processed. This helps ensure nothing falls through the cracks.

By keeping these takeaways in mind, you can navigate the Employee Advance form process with greater ease and confidence.

Similar forms

The Employee Advance form serves as a critical tool in the workplace, allowing employees to request funds before their regular paychecks. Several other documents share similarities with the Employee Advance form, each serving a specific purpose within the realm of employee financial management. Here are six documents that are similar to the Employee Advance form:

- Expense Reimbursement Form: Like the Employee Advance form, this document allows employees to request funds. However, it is typically used to reimburse employees for expenses they have already incurred while performing their job duties.

- Payroll Advance Agreement: This document outlines the terms under which an employee can receive an advance on their paycheck. Similar to the Employee Advance form, it specifies the amount and repayment conditions.

- Loan Application Form: Employees may use this form to apply for a loan from their employer. It shares the same purpose of providing financial assistance but usually involves more formal terms and conditions.

- Petty Cash Request Form: This document is used to request small amounts of cash for minor expenses. Like the Employee Advance form, it facilitates access to funds, but it is generally for immediate, smaller transactions.

- Travel Advance Request Form: Employees traveling for work may use this form to request funds for travel-related expenses. It is similar to the Employee Advance form in that it provides preemptive financial support for specific purposes.

- Corporation Formation Documentation: This essential paperwork is necessary for anyone looking to establish a business entity in Florida. It includes the critical Florida Articles of Incorporation form, which can be found here: https://floridadocuments.net/fillable-articles-of-incorporation-form/.

- Salary Deduction Authorization Form: This form allows employees to authorize deductions from their salary for various reasons, including repayment of an advance. It connects to the Employee Advance form by detailing how repayment will be managed.

Understanding these documents can help employees navigate their financial options within the workplace effectively.