Valid Employee Loan Agreement Form

Form Specifications

| Fact Name | Description |

|---|---|

| Purpose | An Employee Loan Agreement outlines the terms under which an employer provides a loan to an employee. |

| Repayment Terms | The agreement specifies how and when the employee must repay the loan, including interest rates and payment schedules. |

| Governing Law | The agreement is typically governed by state law, which varies by location. For example, in California, it would be governed by California Civil Code. |

| Confidentiality | Both parties may agree to keep the terms of the loan confidential, protecting sensitive financial information. |

| Default Conditions | The agreement outlines what happens if the employee fails to repay the loan, including potential legal actions. |

| Signatures Required | Both the employer and employee must sign the agreement for it to be legally binding. |

Dos and Don'ts

When filling out the Employee Loan Agreement form, there are important guidelines to follow. Below is a list of things you should and shouldn't do.

- Do read the entire agreement carefully before signing.

- Do provide accurate personal information, including your name and address.

- Do specify the loan amount clearly.

- Do understand the repayment terms and conditions.

- Don't leave any required fields blank.

- Don't rush through the form; take your time to ensure accuracy.

- Don't sign the agreement without fully understanding your obligations.

- Don't ignore any questions or clarifications that arise during the process.

Common mistakes

-

Inaccurate Personal Information: One common mistake is providing incorrect personal details. This includes misspelling names, entering wrong addresses, or using outdated contact information. Double-checking this information can prevent future complications.

-

Missing Signatures: A frequent oversight is failing to sign the document. Both the employee and the employer must provide their signatures for the agreement to be valid. Without these signatures, the agreement may not hold up in a dispute.

-

Neglecting Loan Terms: It's essential to clearly outline the loan terms, including the amount borrowed, interest rates, and repayment schedule. Leaving these sections blank or vague can lead to misunderstandings later on.

-

Ignoring State Regulations: Different states have specific laws governing employee loans. Not being aware of these regulations can result in non-compliance. Researching local laws before completing the form is crucial to ensure that the agreement is enforceable.

Documents used along the form

When processing an Employee Loan Agreement, several other forms and documents may be necessary to ensure clarity and compliance. Each of these documents serves a specific purpose in the loan process, helping both the employer and employee understand their rights and responsibilities. Below is a list of commonly used forms and documents that accompany the Employee Loan Agreement.

- Loan Application Form: This form collects essential information from the employee, including personal details, employment status, and the amount requested. It serves as the initial step in the loan process.

- Promissory Note: This document outlines the terms of the loan, including the repayment schedule, interest rate, and consequences of default. It acts as a formal promise from the employee to repay the borrowed amount.

- Repayment Schedule: A detailed timeline indicating when payments are due. This schedule helps both parties keep track of payment dates and amounts, ensuring transparency in the repayment process.

- Loan Disclosure Statement: This document provides essential information about the loan, including fees, interest rates, and other important terms. It ensures that the employee fully understands the financial implications of the loan.

- Texas Loan Agreement Form: This document governs the borrowing terms between parties in Texas. To ensure a comprehensive understanding of your loan conditions, All Texas Forms can be accessed for required documentation.

- Authorization for Payroll Deduction: This form allows the employer to deduct loan payments directly from the employee's paycheck. It streamlines the repayment process and ensures timely payments.

- Employment Verification Form: This form confirms the employee's current employment status and income level. It is often required by lenders to assess the employee's ability to repay the loan.

- Loan Agreement Addendum: If any changes need to be made to the original loan agreement, this addendum documents those modifications. It ensures that all parties are aware of and agree to the changes.

- Termination of Loan Agreement: This document is used to formally end the loan agreement, either upon full repayment or in the event of default. It provides a clear record of the loan's conclusion.

These forms and documents play a crucial role in the employee loan process, helping to protect the interests of both the employer and employee. Properly managing these documents ensures a smooth and efficient loan experience.

Misconceptions

Understanding the Employee Loan Agreement form is essential for both employers and employees. However, several misconceptions can lead to confusion and mismanagement. Here’s a list of ten common misconceptions about the Employee Loan Agreement form, along with clarifications to help you navigate this important document.

- All loans to employees are automatically forgiven. Many believe that loans given to employees do not need to be repaid. In reality, unless explicitly stated in the agreement, these loans typically require repayment.

- Interest rates on employee loans are always low. Some assume that loans to employees must have low or no interest rates. However, the interest rate can vary based on company policy and federal regulations.

- Employee loans are not subject to tax implications. It's a common belief that employee loans are tax-free. In fact, if the loan is not repaid, it may be considered taxable income.

- All employees are eligible for loans. Many think that every employee can receive a loan. Eligibility often depends on company policy, tenure, and financial need.

- A verbal agreement is sufficient. Some believe that a handshake or verbal promise is enough. In reality, a written agreement is crucial for legal protection and clarity.

- Loan agreements are the same as employment contracts. There is a misconception that these two documents are interchangeable. They serve different purposes and should be treated as separate entities.

- Employees can borrow any amount they want. Many think there are no limits to how much they can borrow. Most companies set specific limits based on their policies and financial considerations.

- Loan repayments are flexible and can be changed at any time. Some believe that repayment terms can be adjusted informally. Changes typically require a formal agreement to avoid misunderstandings.

- Employee loans do not affect credit scores. A common myth is that these loans are off the record. However, if not managed properly, they can impact an employee's credit rating.

- Once signed, the loan agreement cannot be modified. Many think that loan agreements are set in stone. In fact, agreements can often be amended if both parties consent to the changes.

By understanding these misconceptions, both employees and employers can approach the Employee Loan Agreement form with clarity and confidence. Proper communication and documentation are key to ensuring a positive experience for all parties involved.

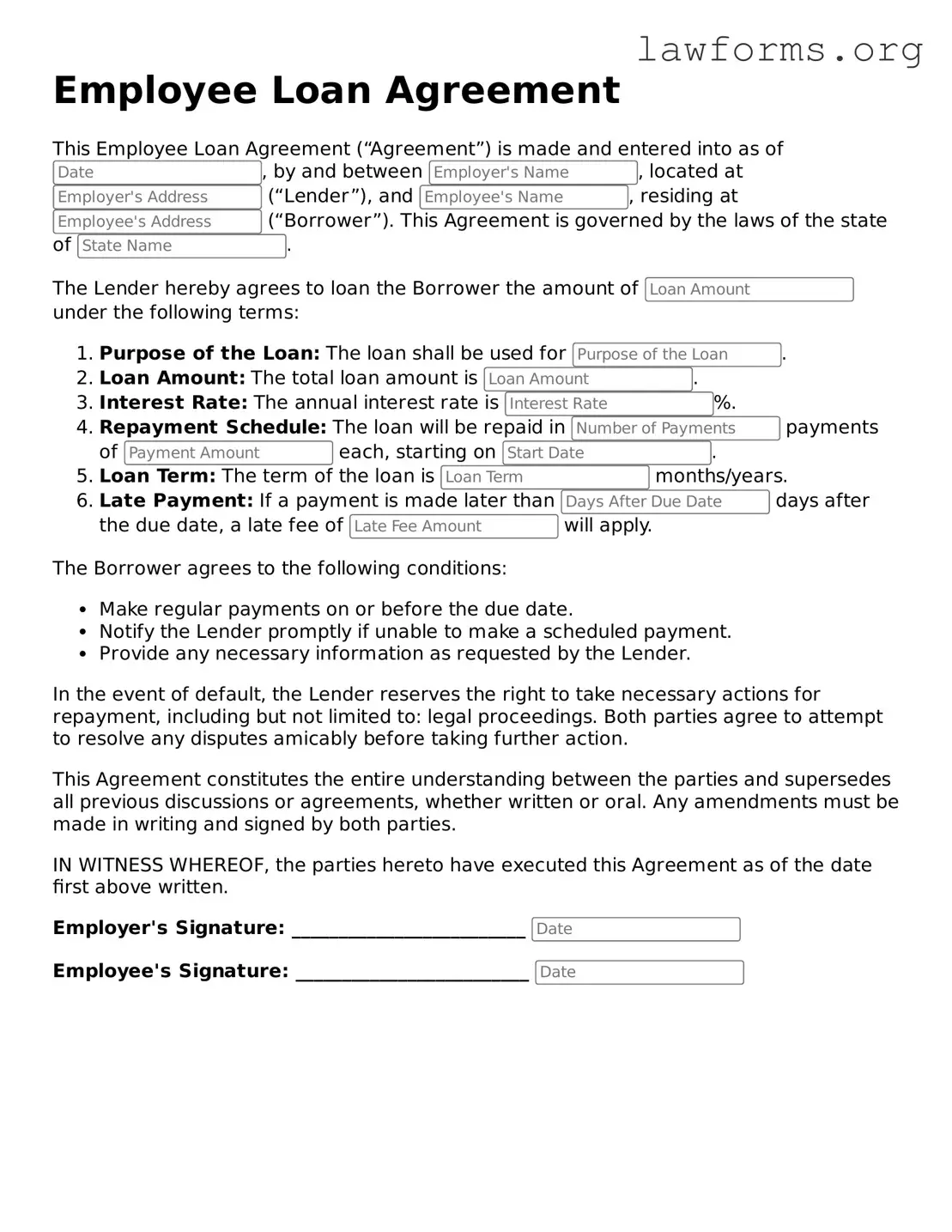

Preview - Employee Loan Agreement Form

Employee Loan Agreement

This Employee Loan Agreement (“Agreement”) is made and entered into as of , by and between , located at (“Lender”), and , residing at (“Borrower”). This Agreement is governed by the laws of the state of .

The Lender hereby agrees to loan the Borrower the amount of under the following terms:

- Purpose of the Loan: The loan shall be used for .

- Loan Amount: The total loan amount is .

- Interest Rate: The annual interest rate is %.

- Repayment Schedule: The loan will be repaid in payments of each, starting on .

- Loan Term: The term of the loan is months/years.

- Late Payment: If a payment is made later than days after the due date, a late fee of will apply.

The Borrower agrees to the following conditions:

- Make regular payments on or before the due date.

- Notify the Lender promptly if unable to make a scheduled payment.

- Provide any necessary information as requested by the Lender.

In the event of default, the Lender reserves the right to take necessary actions for repayment, including but not limited to: legal proceedings. Both parties agree to attempt to resolve any disputes amicably before taking further action.

This Agreement constitutes the entire understanding between the parties and supersedes all previous discussions or agreements, whether written or oral. Any amendments must be made in writing and signed by both parties.

IN WITNESS WHEREOF, the parties hereto have executed this Agreement as of the date first above written.

Employer's Signature: _________________________

Employee's Signature: _________________________

Key takeaways

When filling out and using the Employee Loan Agreement form, consider these key takeaways:

- Clear Terms and Conditions: Ensure the agreement outlines the loan amount, interest rate, repayment schedule, and any penalties for late payments. This clarity helps both parties understand their obligations.

- Documentation Requirements: Include any necessary documentation, such as proof of income or employment verification, to support the loan application. This step strengthens the agreement's validity.

- Signatures and Dates: Both the employee and employer must sign and date the agreement. This formalizes the contract and indicates mutual consent to the terms.

- Retention of Records: Keep a copy of the signed agreement for your records. This can be useful for future reference and ensures compliance with the agreed-upon terms.

Similar forms

- Promissory Note: This document outlines a borrower's promise to repay a loan under specified terms. Like the Employee Loan Agreement, it includes details about the loan amount, interest rate, and repayment schedule.

- Loan Agreement: Similar to the Employee Loan Agreement, this document sets forth the terms and conditions of a loan between a lender and a borrower, including payment terms and consequences for default.

Loan Agreement Form: A Loan Agreement form is crucial for documenting the terms agreed upon between a borrower and a lender, including specifics such as the loan amount and repayment schedule. For a detailed template, you can refer to https://smarttemplates.net/fillable-loan-agreement.

- Personal Loan Agreement: This agreement is between individuals rather than an employer and employee. It shares the same structure, detailing loan amounts, interest rates, and repayment terms.

- Mortgage Agreement: This document secures a loan with real property. While it involves different collateral, it similarly outlines loan terms, payment schedules, and borrower obligations.

- Business Loan Agreement: This is used when a business borrows money. It parallels the Employee Loan Agreement by detailing loan terms, including interest rates and repayment plans, but is tailored for business needs.

- Credit Agreement: This document governs the terms of credit extended to a borrower. Like the Employee Loan Agreement, it specifies repayment terms and interest rates, focusing on the borrower's obligations.

- Debt Settlement Agreement: This outlines terms for settling a debt for less than the full amount owed. It shares similarities in terms of documenting obligations and agreements between parties.

- Installment Loan Agreement: This type of agreement allows borrowers to repay a loan in installments over time. It mirrors the Employee Loan Agreement in structure and detail regarding payment schedules.

- Loan Modification Agreement: This document alters the terms of an existing loan. It is similar to the Employee Loan Agreement in that it requires both parties to agree on new terms for repayment.