Attorney-Approved Articles of Incorporation Template for the State of Florida

Form Specifications

| Fact Name | Description |

|---|---|

| Governing Law | The Florida Articles of Incorporation are governed by the Florida Business Corporation Act, specifically Chapter 607 of the Florida Statutes. |

| Filing Requirement | To officially incorporate in Florida, the Articles of Incorporation must be filed with the Florida Department of State, Division of Corporations. |

| Required Information | The form requires essential details such as the corporation's name, principal office address, and the name and address of the registered agent. |

| Filing Fee | The standard filing fee for the Articles of Incorporation in Florida is $70, with additional fees for optional services. |

Dos and Don'ts

When filling out the Florida Articles of Incorporation form, it's important to be careful and thorough. Here are some key do's and don'ts to keep in mind:

- Do provide accurate and complete information about your business.

- Do include the name of your corporation as it will appear on official documents.

- Don't forget to designate a registered agent who can receive legal documents on behalf of the corporation.

- Don't submit the form without reviewing it for errors or omissions.

Create Popular Articles of Incorporation Forms for Different States

Articles of Incorporation Texas - The Articles are submitted to the Secretary of State for filing.

Starting an Llc in California - Document that establishes a corporation as a legal entity.

Corporate Form - Ensure transparency in corporate activities and finances.

Llc Filing Ohio - Multiple individuals may serve as incorporators and sign this form.

Common mistakes

-

Incorrect Entity Name: Choosing a name that is already in use or does not comply with Florida naming requirements can lead to rejection. Ensure that the name is unique and includes the appropriate designator, such as “Corporation” or “Inc.”

-

Missing Registered Agent Information: Failing to provide the name and address of a registered agent can cause delays. The registered agent must be available during business hours to receive legal documents.

-

Inaccurate Purpose Statement: Writing a vague or overly broad purpose statement can result in confusion. Be clear and concise about the specific business activities your corporation will engage in.

-

Omitting Incorporator Details: Forgetting to include the names and addresses of the incorporators can lead to the application being incomplete. All incorporators must be listed, as they are responsible for filing the Articles.

-

Incorrect Number of Shares: Specifying an incorrect number of authorized shares or failing to state the par value can complicate matters. Make sure to accurately reflect the structure of your corporation’s stock.

-

Not Including Effective Date: Neglecting to specify an effective date can result in the Articles being processed later than intended. If you want your corporation to start on a specific date, make sure to include that information.

-

Improper Signatures: Submitting the form without proper signatures can lead to rejection. Ensure that all required parties sign the document where indicated.

-

Failure to Review for Accuracy: Not double-checking the form for errors or typos can lead to delays. Take the time to review all entries carefully before submission to avoid unnecessary complications.

Documents used along the form

When forming a corporation in Florida, several other forms and documents are typically required in addition to the Florida Articles of Incorporation. Each document serves a specific purpose in ensuring compliance with state regulations and facilitating the smooth operation of the business.

- Bylaws: This document outlines the internal rules and procedures for the corporation. Bylaws govern the management structure, the responsibilities of directors and officers, and the procedures for holding meetings and making decisions.

- Trailer Bill of Sale: The Washington Trailer Bill of Sale form is essential for transferring ownership of a trailer. This legal document includes vital details and serves as proof of the transaction. For more information, you can refer to Forms Washington.

- Initial Report: Some states require an initial report to be filed shortly after incorporation. This document typically includes basic information about the corporation, such as its address, officers, and registered agent.

- Employer Identification Number (EIN): Obtaining an EIN from the IRS is essential for tax purposes. This unique number identifies the corporation for federal tax filings and is often required for opening a business bank account.

- Business License: Depending on the type of business and location, a business license may be necessary. This document permits the corporation to operate legally within a specific jurisdiction and may require periodic renewal.

Incorporating a business involves careful consideration of various documents. Each plays a crucial role in establishing a legally compliant and functional organization in Florida.

Misconceptions

There are several misconceptions about the Florida Articles of Incorporation form. Understanding these can help ensure a smoother process for establishing a corporation in Florida.

- Misconception 1: The Articles of Incorporation are optional.

- Misconception 2: Any document can serve as the Articles of Incorporation.

- Misconception 3: You can file the Articles of Incorporation at any time.

- Misconception 4: The process is quick and easy, with no need for professional help.

- Misconception 5: You do not need to include the corporation’s purpose in the Articles of Incorporation.

- Misconception 6: Once filed, the Articles of Incorporation cannot be changed.

- Misconception 7: The Articles of Incorporation are the only requirement for starting a corporation.

This is incorrect. Filing the Articles of Incorporation is a necessary step to legally establish a corporation in Florida.

Only the official form provided by the state can be used. It must meet specific requirements outlined by Florida law.

While there is no strict deadline, it is advisable to file as soon as possible to avoid delays in business operations.

While it may seem straightforward, mistakes can lead to delays. Consulting with a professional can be beneficial.

Florida law requires a brief statement of the corporation's purpose, so this information must be included.

Amendments can be made to the Articles of Incorporation after filing, but this requires additional paperwork and fees.

In addition to the Articles, other steps such as obtaining licenses and permits may be necessary depending on the business type.

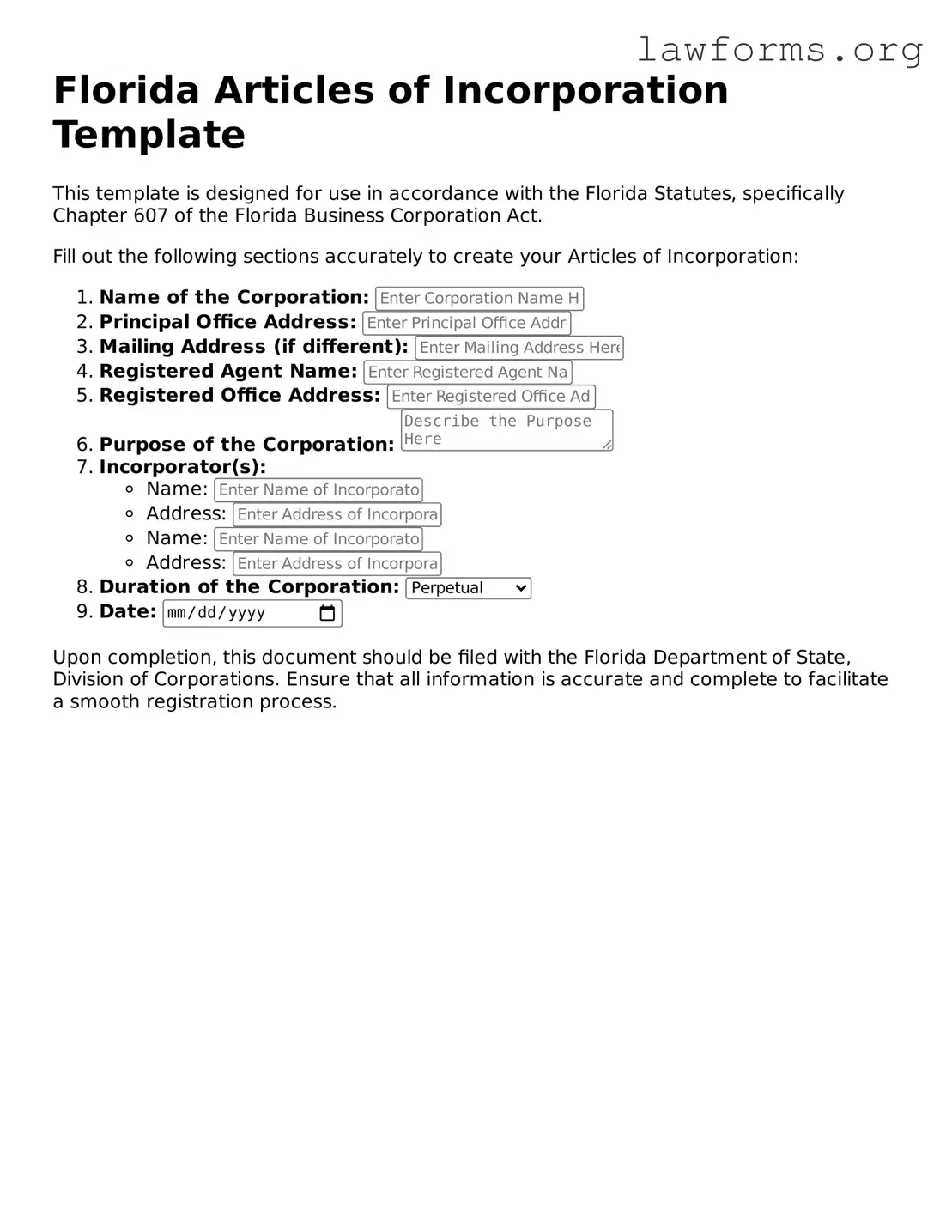

Preview - Florida Articles of Incorporation Form

Florida Articles of Incorporation Template

This template is designed for use in accordance with the Florida Statutes, specifically Chapter 607 of the Florida Business Corporation Act.

Fill out the following sections accurately to create your Articles of Incorporation:

- Name of the Corporation:

- Principal Office Address:

- Mailing Address (if different):

- Registered Agent Name:

- Registered Office Address:

- Purpose of the Corporation:

- Incorporator(s):

- Name:

- Address:

- Name:

- Address:

- Duration of the Corporation:

- Date:

Upon completion, this document should be filed with the Florida Department of State, Division of Corporations. Ensure that all information is accurate and complete to facilitate a smooth registration process.

Key takeaways

Filling out the Florida Articles of Incorporation form is a crucial step in establishing a corporation in the state. Here are some key takeaways to keep in mind:

- The form requires you to provide the name of the corporation, which must be unique and not similar to existing entities in Florida.

- It is essential to include the principal office address, which will serve as the official location of the corporation.

- Designate a registered agent who will be responsible for receiving legal documents on behalf of the corporation.

- Specify the purpose of the corporation. While a general statement is acceptable, clarity can help in future operations.

- Indicate the number of shares the corporation is authorized to issue. This is important for potential investors and shareholders.

- Include the names and addresses of the incorporators, who are the individuals responsible for filing the Articles.

- After completing the form, it must be filed with the Florida Division of Corporations along with the required filing fee to officially establish the corporation.

Understanding these elements can streamline the incorporation process and set a solid foundation for your business in Florida.

Similar forms

- Bylaws: Bylaws serve as the internal rules governing the management of a corporation. While the Articles of Incorporation establish the corporation's existence, the bylaws outline how it will operate day-to-day.

- Operating Agreement: This document is crucial for LLCs, detailing the management structure and operational procedures. Similar to Articles of Incorporation, it formalizes the entity's framework but is specific to limited liability companies.

- Partnership Agreement: This agreement outlines the terms of a partnership, including roles and responsibilities. Like the Articles of Incorporation, it is foundational for the entity's structure and governance.

- Certificate of Formation: Used primarily in LLCs, this document is akin to Articles of Incorporation in that it officially creates the business entity and provides basic information about it.

- Business License: A business license grants permission to operate legally within a jurisdiction. While it does not establish the entity, it is a necessary step that follows the incorporation process.

- Shareholder Agreement: This document outlines the rights and obligations of shareholders in a corporation. Similar to Articles of Incorporation, it helps define the governance structure and protect shareholder interests.

- Annual Report: Corporations are often required to file annual reports, which provide updated information about the business. This document reflects ongoing compliance and maintains the entity's good standing, similar to the initial filing of Articles of Incorporation.

- Tax Registration Forms: These forms, which include applications for an Employer Identification Number (EIN), are essential for tax purposes. They complement the Articles of Incorporation by ensuring the corporation is recognized by tax authorities.