Attorney-Approved Deed in Lieu of Foreclosure Template for the State of Florida

Form Specifications

| Fact Name | Description |

|---|---|

| Definition | A deed in lieu of foreclosure is a legal document that allows a borrower to transfer ownership of their property to the lender to avoid foreclosure. |

| Governing Law | Florida Statutes, Chapter 697 governs deeds in lieu of foreclosure in Florida. |

| Eligibility | Homeowners must be in default on their mortgage to qualify for a deed in lieu of foreclosure. |

| Advantages | This option can help borrowers avoid the lengthy foreclosure process and may protect their credit score. |

| Disadvantages | Borrowers may still be liable for any remaining mortgage debt after the transfer, depending on the agreement with the lender. |

| Process | The borrower must negotiate with the lender, complete the deed, and submit it for recording with the county. |

| Alternatives | Other options include loan modification, short sale, or traditional foreclosure. |

Dos and Don'ts

When filling out the Florida Deed in Lieu of Foreclosure form, it's important to approach the process carefully. Here are some key things to do and avoid:

- Do ensure you fully understand the implications of signing the deed. This action transfers ownership of the property to the lender.

- Do gather all necessary documents, such as your mortgage agreement and any relevant financial statements.

- Do consult with a legal professional or housing counselor before proceeding. Their guidance can be invaluable.

- Do provide accurate information on the form. Incomplete or incorrect details can lead to delays.

- Do keep copies of everything you submit for your records. Documentation is crucial.

- Don't rush through the process. Take your time to review each section carefully.

- Don't sign the form without fully understanding what you are agreeing to. Once signed, it can be difficult to reverse.

- Don't ignore any potential tax consequences. Consult a tax advisor to understand how this might affect you.

- Don't assume that the lender will forgive any remaining debt after the transfer. Clarify this with them beforehand.

Create Popular Deed in Lieu of Foreclosure Forms for Different States

Sale in Lieu of Foreclosure - The borrower must agree to give up the property to the lender to finalize this arrangement.

The California DV-260 form is a confidential document used in cases of domestic violence. It helps law enforcement and the courts manage restraining orders effectively while keeping sensitive information private. Completing this form is an important step for those seeking protection, ensuring that their information is securely handled and communicated to the necessary authorities. For more information, you can visit californiadocsonline.com/california-dv-260-form/.

California Pre-foreclosure Property Transfer - An option for borrowers wishing to avoid the stigma associated with foreclosure proceedings.

Common mistakes

-

Incomplete Information: One common mistake is leaving out crucial details. Make sure to fill in all required fields, such as names, addresses, and property descriptions. Missing information can delay the process or lead to rejection.

-

Incorrect Property Description: Providing an inaccurate or vague description of the property can cause significant issues. Always ensure that the legal description matches the information in public records.

-

Not Notarizing the Document: Failing to have the deed notarized is a frequent error. A notary public must witness the signing to validate the document. Without notarization, the deed may not be legally binding.

-

Ignoring Lender Requirements: Each lender may have specific requirements for accepting a deed in lieu of foreclosure. Not adhering to these can result in the lender rejecting the deed. Always check with your lender for their specific guidelines.

-

Not Consulting a Legal Professional: Skipping the advice of a legal professional can lead to mistakes. Having an attorney review the document can help avoid pitfalls and ensure that your rights are protected throughout the process.

Documents used along the form

When dealing with a Deed in Lieu of Foreclosure in Florida, several other forms and documents may be necessary to ensure a smooth process. Each of these documents serves a specific purpose and helps clarify the responsibilities and agreements between the parties involved.

- Loan Modification Agreement: This document outlines any changes to the original loan terms. It may include adjustments to the interest rate, payment schedule, or loan amount, allowing the borrower to remain in their home under more manageable conditions.

- Notice of Default: This notice is sent to the borrower when they have failed to make mortgage payments. It formally notifies the borrower of their default status and outlines the steps they need to take to remedy the situation.

- Release of Mortgage: This document is executed when the lender agrees to release the mortgage lien on the property. It confirms that the borrower has fulfilled their obligations, often in conjunction with the Deed in Lieu of Foreclosure.

- Settlement Agreement: This agreement details the terms under which the borrower and lender agree to settle any outstanding debts or obligations. It may include provisions for the return of property or other compensation.

- Tractor Bill of Sale: This document is essential to formally verify the transfer of ownership for a tractor in Georgia, serving as a critical record for tax and registration purposes. For more information, you can visit https://georgiaform.com.

- Title Search Report: This report provides a comprehensive overview of the property’s title history. It identifies any liens, encumbrances, or claims against the property, ensuring that the Deed in Lieu of Foreclosure can be executed without issues.

These documents are integral to the process of executing a Deed in Lieu of Foreclosure. Each one plays a crucial role in protecting the interests of both the borrower and the lender, ensuring that all parties are clear on their rights and obligations.

Misconceptions

Understanding the Florida Deed in Lieu of Foreclosure can be challenging. Many people have misconceptions about this legal process. Here are seven common misunderstandings:

-

It eliminates all debts associated with the property.

A deed in lieu of foreclosure only transfers ownership of the property to the lender. It does not automatically cancel any remaining debts, such as personal loans or second mortgages.

-

It is the same as a foreclosure.

While both processes result in the loss of the home, a deed in lieu is generally less damaging to a homeowner's credit score than a foreclosure. It allows for a more amicable resolution.

-

All lenders accept deeds in lieu.

Not all lenders are willing to accept a deed in lieu of foreclosure. Each lender has its own policies, and some may prefer to proceed with a foreclosure.

-

It can be completed quickly without any paperwork.

While a deed in lieu can be faster than foreclosure, it still requires legal documentation and approval from the lender. Homeowners must be prepared for a process that includes various forms and potential negotiations.

-

It allows homeowners to stay in their homes longer.

A deed in lieu of foreclosure usually requires homeowners to vacate the property. Unlike a foreclosure, where homeowners may have some time to stay, a deed in lieu often involves a quicker move-out timeline.

-

It is only for homeowners in financial distress.

While many people consider this option during financial hardship, it can also be a strategic decision for homeowners looking to avoid the lengthy foreclosure process.

-

Homeowners can negotiate favorable terms.

While some negotiation may be possible, lenders typically have strict guidelines. Homeowners may not have as much leverage as they think when seeking favorable terms.

Understanding these misconceptions can help homeowners make informed decisions regarding their options when facing financial difficulties.

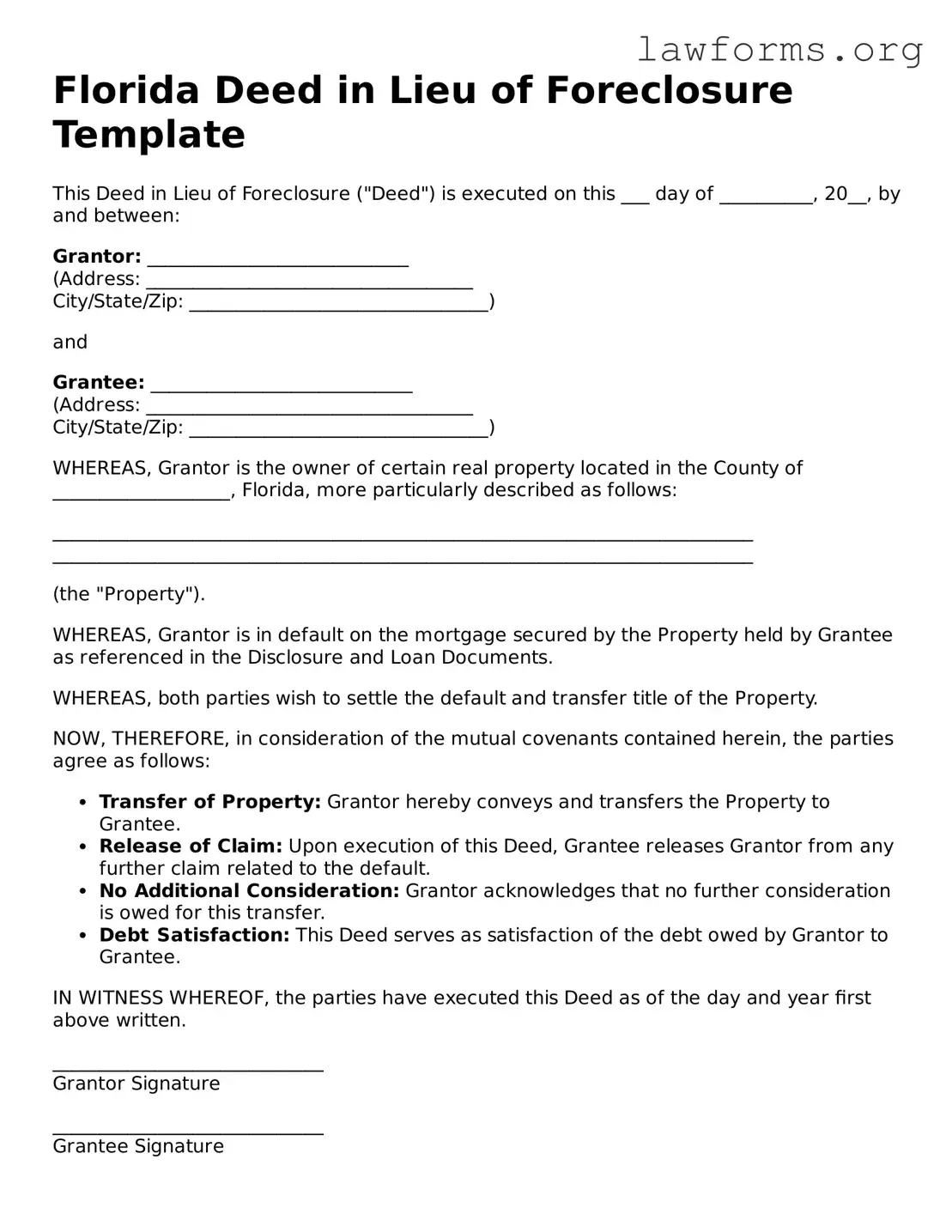

Preview - Florida Deed in Lieu of Foreclosure Form

Florida Deed in Lieu of Foreclosure Template

This Deed in Lieu of Foreclosure ("Deed") is executed on this ___ day of __________, 20__, by and between:

Grantor: ____________________________

(Address: ___________________________________

City/State/Zip: ________________________________)

and

Grantee: ____________________________

(Address: ___________________________________

City/State/Zip: ________________________________)

WHEREAS, Grantor is the owner of certain real property located in the County of ___________________, Florida, more particularly described as follows:

___________________________________________________________________________

___________________________________________________________________________

(the "Property").

WHEREAS, Grantor is in default on the mortgage secured by the Property held by Grantee as referenced in the Disclosure and Loan Documents.

WHEREAS, both parties wish to settle the default and transfer title of the Property.

NOW, THEREFORE, in consideration of the mutual covenants contained herein, the parties agree as follows:

- Transfer of Property: Grantor hereby conveys and transfers the Property to Grantee.

- Release of Claim: Upon execution of this Deed, Grantee releases Grantor from any further claim related to the default.

- No Additional Consideration: Grantor acknowledges that no further consideration is owed for this transfer.

- Debt Satisfaction: This Deed serves as satisfaction of the debt owed by Grantor to Grantee.

IN WITNESS WHEREOF, the parties have executed this Deed as of the day and year first above written.

_____________________________

Grantor Signature

_____________________________

Grantee Signature

WITNESSES:

_____________________________

Witness Signature

_____________________________

Witness Signature

STATE OF FLORIDA

COUNTY OF ___________________

Before me, a Notary Public, personally appeared ____________________, who is known to me or has produced _____________________ as identification and who acknowledged that he/she executed the foregoing Deed in Lieu of Foreclosure for the purposes therein contained.

Witness my hand and official seal this ___ day of __________, 20__.

_____________________________

Notary Public Name

My Commission Expires: ____________

Key takeaways

Filling out and using the Florida Deed in Lieu of Foreclosure form can be a crucial step for homeowners facing foreclosure. Here are some key takeaways to consider:

- Understand the Purpose: A Deed in Lieu of Foreclosure allows you to transfer ownership of your property to the lender to avoid foreclosure proceedings.

- Eligibility Requirements: Not all homeowners qualify. Lenders typically require that you are in default on your mortgage and have no other liens on the property.

- Consult with a Professional: It's advisable to seek legal or financial advice before proceeding. An expert can help clarify your options and the implications of the deed.

- Complete the Form Accurately: Ensure that all information is filled out correctly. Mistakes can delay the process or lead to complications.

- Negotiate with Your Lender: Before submitting the deed, discuss potential terms with your lender. They may agree to forgive some of the debt or provide other concessions.

- Document Everything: Keep copies of all correspondence and documents related to the deed. This can protect you in case of disputes later.

- Understand Tax Implications: Transferring your property may have tax consequences. Consult a tax professional to understand how this may affect you.

Similar forms

The Deed in Lieu of Foreclosure is a significant document in the realm of real estate, particularly when it comes to avoiding the lengthy foreclosure process. It shares similarities with several other documents, each serving a unique purpose in property transactions. Here are four documents that are similar to the Deed in Lieu of Foreclosure:

- Short Sale Agreement: This document allows a homeowner to sell their property for less than the amount owed on the mortgage. Like a Deed in Lieu, it helps the homeowner avoid foreclosure, but it involves selling the home rather than transferring ownership directly to the lender.

- Mortgage Modification Agreement: This agreement modifies the terms of an existing mortgage to make it more affordable for the borrower. While a Deed in Lieu transfers ownership to the lender, a mortgage modification keeps the homeowner in their property, offering a chance to catch up on payments.

- Prenuptial Agreement: This legally binding form outlines the financial responsibilities and asset division for couples before marriage. It serves to prevent misunderstandings in the event of a divorce or separation, safeguarding individual interests. For more information, you can explore Ohio PDF Forms.

- Forbearance Agreement: A forbearance agreement temporarily pauses or reduces mortgage payments for a specific period. Similar to a Deed in Lieu, it aims to help the borrower avoid foreclosure, but it does not involve giving up ownership of the property.

- Loan Assumption Agreement: This document allows a buyer to take over the seller's mortgage, assuming responsibility for the payments. It can prevent foreclosure by enabling a sale, much like a Deed in Lieu, but it involves a third party purchasing the property rather than the lender taking ownership.

Understanding these documents can empower homeowners facing financial difficulties to make informed decisions. Each option presents unique advantages and implications, so it's crucial to consider your specific situation before proceeding.