Attorney-Approved Deed Template for the State of Florida

Form Specifications

| Fact Name | Details |

|---|---|

| Definition | A Florida Deed is a legal document that transfers ownership of real property from one party to another. |

| Types of Deeds | Common types include Warranty Deeds, Quitclaim Deeds, and Special Warranty Deeds. |

| Governing Law | Florida Statutes, Chapter 689 governs the transfer of real property through deeds. |

| Recording Requirement | To be effective against third parties, a deed must be recorded in the county where the property is located. |

| Signature Requirement | The deed must be signed by the grantor (the person transferring the property) and may require witnesses. |

Dos and Don'ts

When filling out the Florida Deed form, certain practices can help ensure accuracy and compliance. Here’s a list of things to do and avoid:

- Do: Clearly write the names of all parties involved in the transaction.

- Do: Include the correct legal description of the property.

- Do: Sign the deed in front of a notary public.

- Do: Ensure that all required information is complete and accurate.

- Do: Check for any specific county requirements for recording the deed.

- Do: Keep a copy of the completed deed for your records.

- Don't: Leave any sections of the form blank.

- Don't: Use abbreviations or informal names for the parties involved.

- Don't: Forget to date the deed.

- Don't: Submit the deed without proper notarization.

- Don't: Assume that all counties have the same requirements for recording.

- Don't: Rely solely on verbal agreements; everything must be in writing.

Create Popular Deed Forms for Different States

Deed Form New York - May require notarization to be legally valid.

Sample Deed - Reviewing all terms in a deed carefully can prevent future property disputes.

When engaging in real estate transactions, it is crucial to utilize the appropriate documents, such as the Property Deed, to formalize the transfer of ownership and ensure a smooth process. These documents not only protect the interests of both parties involved but also adhere to state-specific regulations that govern property transfers.

Grant Deed in California - Deeds may also contain easements or rights-of-way as part of the transfer.

Common mistakes

Filling out a Florida Deed form can seem straightforward, but many individuals make common mistakes that can lead to complications down the line. Here are eight mistakes to avoid:

-

Incorrect Grantee Information: One of the most frequent errors is misspelling the name of the grantee (the person receiving the property). Ensure that the name matches exactly as it appears on identification documents.

-

Failure to Include a Legal Description: A proper legal description of the property is essential. Omitting this information can create confusion about which property is being transferred.

-

Not Using the Correct Type of Deed: Different types of deeds serve different purposes. Be sure to select the appropriate deed type, such as a warranty deed or quitclaim deed, based on your specific needs.

-

Omitting Signatures: All required parties must sign the deed. Forgetting to obtain a signature can invalidate the document and delay the transfer process.

-

Improper Witness Requirements: Florida law requires that deeds be witnessed. Failing to have the correct number of witnesses can lead to issues with the deed's validity.

-

Not Notarizing the Document: A deed must be notarized to be legally binding. Skipping this step can result in complications when trying to record the deed.

-

Incorrectly Filling Out the Date: The date on the deed is crucial. Make sure it accurately reflects when the deed was executed to avoid any legal disputes.

-

Ignoring Local Recording Requirements: Each county in Florida may have specific requirements for recording a deed. Be aware of these local rules to ensure proper filing.

By paying attention to these common pitfalls, individuals can navigate the process of completing a Florida Deed form more effectively. Taking the time to review and ensure accuracy will save time and prevent legal issues in the future.

Documents used along the form

When transferring property in Florida, several forms and documents may accompany the Florida Deed form to ensure a smooth transaction. Each of these documents serves a specific purpose and helps clarify the terms of the transfer. Below is a list of commonly used forms that may be required in conjunction with a Florida Deed.

- Property Transfer Tax Form: This form is used to report the transfer of real estate and calculate any applicable documentary stamp taxes. It is essential for compliance with Florida tax regulations.

- Affidavit of No Florida Income Tax Due: This affidavit certifies that the seller does not owe any Florida income taxes related to the property sale, which can be important for tax purposes.

- Title Insurance Policy: A title insurance policy protects the buyer against potential disputes over property ownership and ensures that the title is clear of liens or encumbrances.

- Closing Statement (HUD-1): This document outlines the financial details of the transaction, including costs, fees, and the final amounts due at closing. It provides transparency for both parties involved.

- Bill of Sale: If personal property is included in the transaction, a bill of sale may be necessary to formally transfer ownership of those items from the seller to the buyer.

- Power of Attorney: In cases where one party cannot be present for the signing, a power of attorney allows another individual to act on their behalf, ensuring that the transaction can proceed smoothly.

- North Carolina Motor Vehicle Bill of Sale: This document records the transfer of ownership of a motor vehicle, serving as proof of purchase. For more information, click to open.

- Homeowner Association (HOA) Documents: If the property is part of an HOA, relevant documents such as rules, regulations, and financial statements may need to be reviewed and provided to the buyer.

- Notice of Sale: This document is often required to inform relevant parties about the sale, ensuring that all stakeholders are aware of the property transfer.

Understanding these documents and their purposes can significantly enhance the property transfer process in Florida. Each form plays a vital role in ensuring that both buyers and sellers are protected and informed throughout the transaction.

Misconceptions

- All deeds are the same. Many people think that all deeds are interchangeable. In reality, different types of deeds serve different purposes. For instance, a warranty deed offers more protection to the buyer than a quitclaim deed.

- A deed must be notarized to be valid. While notarization is often required, it is not always necessary for a deed to be legally valid in Florida. Some deeds can be valid without a notary, depending on specific circumstances.

- Once a deed is signed, it cannot be changed. This is not true. Deeds can be modified or revoked, but the process can be complicated. It's important to follow the legal steps to ensure any changes are valid.

- Deeds are only for transferring property ownership. While the primary purpose of a deed is to transfer ownership, deeds can also be used for other purposes, such as creating life estates or placing property in a trust.

- All deeds must be recorded. Though recording a deed is a good practice to protect ownership rights, it is not a legal requirement in Florida. However, failing to record a deed can lead to complications in proving ownership later.

- Anyone can create a deed. While it is possible for individuals to draft their own deeds, it is advisable to seek legal assistance. A poorly drafted deed can lead to disputes or issues with property rights.

- The Florida Deed form is the same for all counties. This is a misconception. While the basic elements are similar, some counties may have specific requirements or variations in their deed forms. Always check local regulations.

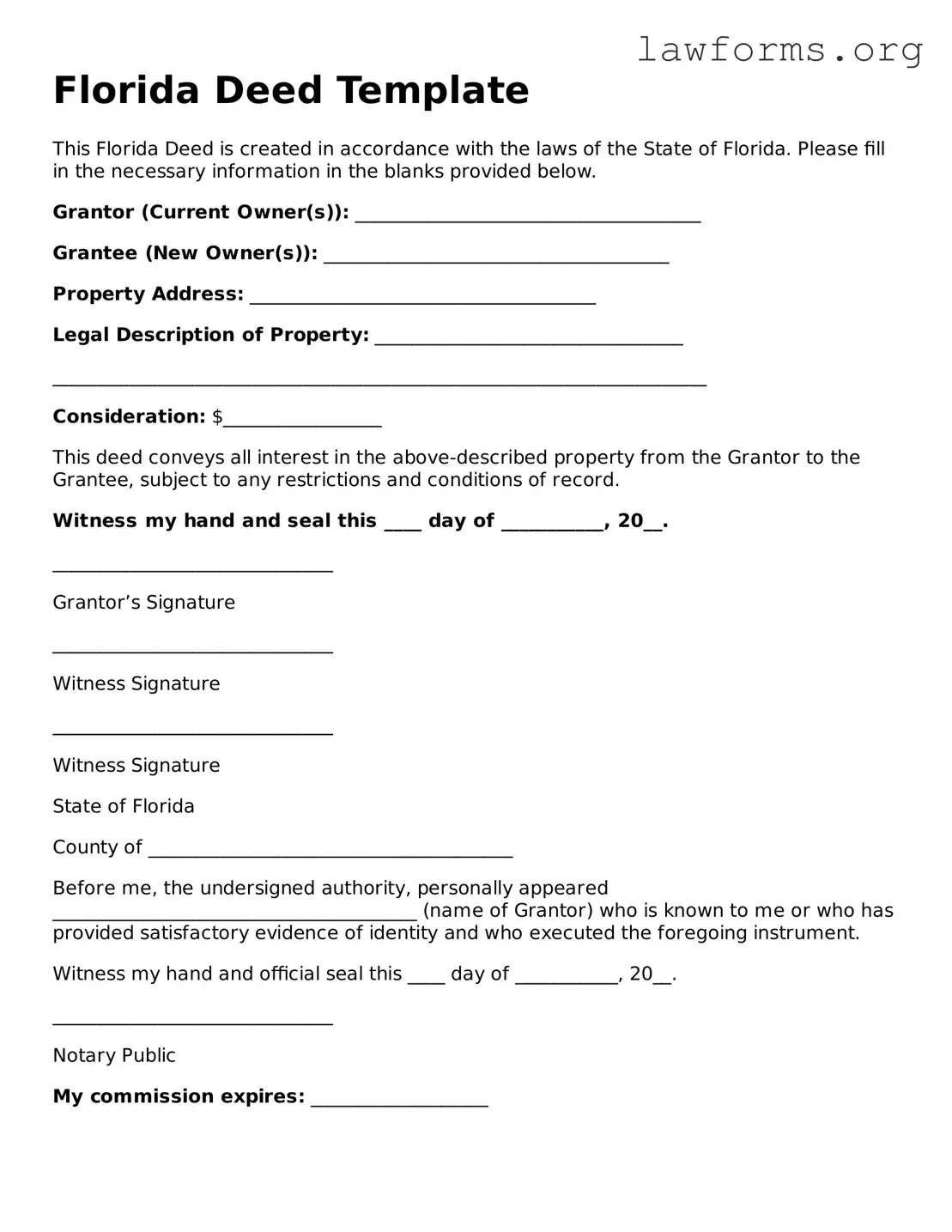

Preview - Florida Deed Form

Florida Deed Template

This Florida Deed is created in accordance with the laws of the State of Florida. Please fill in the necessary information in the blanks provided below.

Grantor (Current Owner(s)): _____________________________________

Grantee (New Owner(s)): _____________________________________

Property Address: _____________________________________

Legal Description of Property: _________________________________

______________________________________________________________________

Consideration: $_________________

This deed conveys all interest in the above-described property from the Grantor to the Grantee, subject to any restrictions and conditions of record.

Witness my hand and seal this ____ day of ___________, 20__.

______________________________

Grantor’s Signature

______________________________

Witness Signature

______________________________

Witness Signature

State of Florida

County of _______________________________________

Before me, the undersigned authority, personally appeared _______________________________________ (name of Grantor) who is known to me or who has provided satisfactory evidence of identity and who executed the foregoing instrument.

Witness my hand and official seal this ____ day of ___________, 20__.

______________________________

Notary Public

My commission expires: ___________________

Key takeaways

Filling out and using the Florida Deed form requires careful attention to detail. Here are some key takeaways to keep in mind:

- Ensure that all parties involved are correctly identified, including their full legal names and addresses.

- Specify the type of deed being used, such as a warranty deed or quitclaim deed, as this affects the rights conveyed.

- Clearly describe the property being transferred, including the legal description, which is essential for clarity and accuracy.

- Include the date of the transaction, as this establishes when the transfer takes effect.

- Signatures of both the grantor (the person transferring the property) and the grantee (the person receiving the property) must be included.

- Consider having the deed notarized, as this adds an extra layer of authenticity and may be required for recording.

- File the completed deed with the appropriate county clerk's office to ensure the transfer is legally recognized.

- Keep a copy of the filed deed for your records, as it serves as proof of ownership and can be important for future transactions.

Similar forms

The Deed form is a crucial legal document used to convey property rights. However, it shares similarities with several other important documents in real estate and legal transactions. Below are six documents that are comparable to the Deed form, along with explanations of their similarities.

- Title Insurance Policy: Like a Deed, a Title Insurance Policy is essential in real estate transactions. It provides protection against potential defects in the title, ensuring that the buyer receives clear ownership of the property.

- Bill of Sale: A Bill of Sale serves a similar purpose to a Deed, as it transfers ownership of personal property. Both documents are used to formalize the transfer of ownership and provide legal evidence of that transfer.

- Lease Agreement: A Lease Agreement outlines the terms under which one party can use another party's property. While a Deed transfers ownership, a Lease Agreement grants temporary rights, highlighting the importance of both in property rights management.

- Mortgage Agreement: A Mortgage Agreement is linked to a Deed in that it secures a loan with the property as collateral. Both documents are vital in real estate transactions, as they establish rights and obligations concerning property ownership and financing.

- Residential Lease Agreement: The Ohio Residential Lease Agreement is a legally binding document that outlines the terms and conditions between a landlord and a tenant for renting residential property in Ohio. For more information, visit Ohio PDF Forms.

- Power of Attorney: A Power of Attorney allows one person to act on behalf of another in legal matters, including property transactions. Similar to a Deed, it is a formal document that grants authority and can facilitate the transfer of property rights.

- Trust Agreement: A Trust Agreement can hold property on behalf of beneficiaries. While a Deed transfers ownership directly, a Trust Agreement manages property interests, illustrating the various ways property rights can be structured and conveyed.