Attorney-Approved Durable Power of Attorney Template for the State of Florida

Form Specifications

| Fact Name | Details |

|---|---|

| Definition | A Durable Power of Attorney allows an individual to appoint someone else to manage their financial affairs if they become incapacitated. |

| Governing Law | The Florida Durable Power of Attorney is governed by Florida Statutes, Chapter 709. |

| Durability | This type of power of attorney remains effective even if the principal becomes incapacitated. |

| Principal | The person granting the authority is referred to as the principal. |

| Agent | The person appointed to act on behalf of the principal is known as the agent or attorney-in-fact. |

| Execution Requirements | The form must be signed by the principal in the presence of two witnesses and a notary public. |

| Revocation | The principal can revoke the Durable Power of Attorney at any time as long as they are competent. |

| Scope of Authority | The authority granted can be broad or limited, depending on the specific terms outlined in the document. |

| Springing vs. Immediate | This form can be immediate or springing, meaning it can take effect upon signing or only upon the principal's incapacity. |

| Legal Advice | While the form can be filled out without legal assistance, consulting an attorney is advisable to ensure it meets all legal requirements. |

Dos and Don'ts

When filling out the Florida Durable Power of Attorney form, it's essential to approach the process with care. Here are some important do's and don'ts to consider:

- Do ensure you understand the powers you are granting to your agent.

- Do choose a trustworthy individual as your agent.

- Do clearly specify any limitations or conditions on the powers granted.

- Do sign the form in the presence of a notary public.

- Do keep a copy of the signed document for your records.

- Don't use vague language that could lead to confusion about the powers granted.

- Don't forget to date the document when you sign it.

- Don't select an agent who may have conflicting interests.

- Don't overlook the importance of discussing your wishes with your agent.

Create Popular Durable Power of Attorney Forms for Different States

How to Do Power of Attorney - Provide clear guidelines to your agent to avoid confusion later.

When considering the importance of appointing an agent through a Washington Power of Attorney, resources like Forms Washington provide valuable templates and information to help individuals navigate this essential legal process smoothly.

Financial Power of Attorney New Jersey - This document can facilitate access to your bank accounts and other assets by your agent.

Common mistakes

-

Not specifying powers clearly: Individuals often fail to detail the specific powers they wish to grant to their agent. This can lead to confusion and disputes later on.

-

Choosing the wrong agent: Selecting an agent who is not trustworthy or lacks the necessary skills can result in mismanagement of financial or medical decisions.

-

Forgetting to sign and date: A common oversight is neglecting to sign and date the document. Without a signature, the power of attorney is not valid.

-

Not having witnesses: Florida law requires that the document be signed in the presence of two witnesses. Failing to have witnesses can invalidate the form.

-

Ignoring notarization: While notarization is not always required, it can add an extra layer of validity. Not considering this option may lead to complications.

-

Overlooking alternate agents: People sometimes forget to designate an alternate agent. If the primary agent is unable or unwilling to act, this can create a gap in decision-making.

-

Not reviewing the document regularly: Failing to review and update the durable power of attorney can lead to outdated information or changes in relationships that are not reflected in the document.

Documents used along the form

When considering a Florida Durable Power of Attorney, it is essential to understand that this document often works in conjunction with several other forms and legal documents. Each of these plays a vital role in ensuring that your wishes are honored and that your affairs are managed according to your preferences. Below is a list of commonly used documents alongside the Durable Power of Attorney.

- Advance Healthcare Directive: This document outlines your medical preferences in the event you become unable to communicate your wishes. It includes your choices regarding life-sustaining treatments and appoints a healthcare proxy to make decisions on your behalf.

- Living Will: A living will specifically addresses your desires concerning medical treatment at the end of life. It informs healthcare providers and family members about your wishes regarding life support and other critical care options.

- Last Will and Testament: This legal document expresses how you wish your assets to be distributed after your death. It can also name guardians for minor children and designate an executor to manage your estate.

- Trust Agreement: A trust agreement allows you to place your assets into a trust for the benefit of your chosen beneficiaries. This can help avoid probate and provide more control over how and when your assets are distributed.

- HIPAA Authorization: The Health Insurance Portability and Accountability Act (HIPAA) authorization allows designated individuals access to your medical records. This is crucial for ensuring that your healthcare proxy can make informed decisions about your medical care.

Understanding these documents can empower you to make informed decisions about your future. Each serves a unique purpose and collectively ensures that your legal and healthcare preferences are respected. Consulting with a legal professional can provide further clarity on how these documents work together to protect your interests.

Misconceptions

Understanding the Florida Durable Power of Attorney form can be challenging. Here are six common misconceptions that people often have about this important legal document:

- It only applies to financial matters. Many believe that a Durable Power of Attorney is limited to financial decisions. In reality, it can also cover health care decisions if specified in the document.

- It becomes effective only when the principal is incapacitated. Some think that the Durable Power of Attorney only takes effect when the principal is unable to make decisions. However, it can be set up to be effective immediately upon signing, depending on the principal’s wishes.

- All powers are automatically granted. People often assume that the agent has unlimited authority. In fact, the principal can specify which powers are granted and can limit them as needed.

- It is permanent and cannot be revoked. Many individuals believe that once a Durable Power of Attorney is established, it cannot be changed. In truth, the principal can revoke or modify the document at any time as long as they are competent.

- It is only necessary for the elderly. Some think that only older individuals need a Durable Power of Attorney. However, anyone over the age of 18 can benefit from having this document in place, as unexpected situations can arise at any age.

- Agents must act in the principal’s best interest at all times. While agents are expected to act ethically, some believe that this is legally enforceable. It’s important to select a trustworthy agent, as the document does not provide ongoing oversight of the agent’s actions.

Being informed about these misconceptions can help individuals make better decisions regarding their legal planning in Florida.

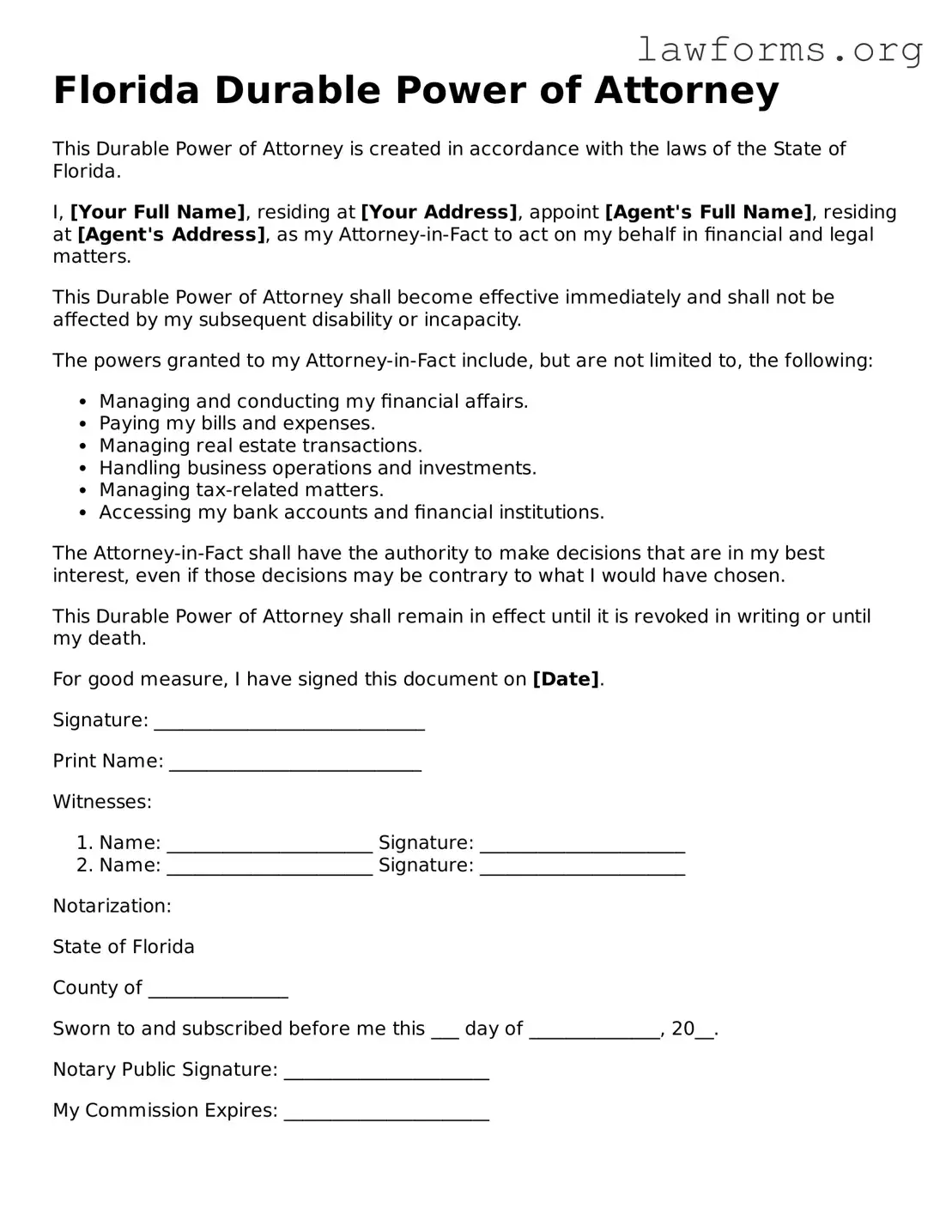

Preview - Florida Durable Power of Attorney Form

Florida Durable Power of Attorney

This Durable Power of Attorney is created in accordance with the laws of the State of Florida.

I, [Your Full Name], residing at [Your Address], appoint [Agent's Full Name], residing at [Agent's Address], as my Attorney-in-Fact to act on my behalf in financial and legal matters.

This Durable Power of Attorney shall become effective immediately and shall not be affected by my subsequent disability or incapacity.

The powers granted to my Attorney-in-Fact include, but are not limited to, the following:

- Managing and conducting my financial affairs.

- Paying my bills and expenses.

- Managing real estate transactions.

- Handling business operations and investments.

- Managing tax-related matters.

- Accessing my bank accounts and financial institutions.

The Attorney-in-Fact shall have the authority to make decisions that are in my best interest, even if those decisions may be contrary to what I would have chosen.

This Durable Power of Attorney shall remain in effect until it is revoked in writing or until my death.

For good measure, I have signed this document on [Date].

Signature: _____________________________

Print Name: ___________________________

Witnesses:

- Name: ______________________ Signature: ______________________

- Name: ______________________ Signature: ______________________

Notarization:

State of Florida

County of _______________

Sworn to and subscribed before me this ___ day of ______________, 20__.

Notary Public Signature: ______________________

My Commission Expires: ______________________

Key takeaways

Ensure the form is completed in its entirety. Missing information can lead to complications later.

Choose a trusted individual as your agent. This person will have the authority to make decisions on your behalf.

Specify the powers granted to your agent clearly. Be precise about what decisions they can make.

Consider having the document notarized. While not always required, notarization can strengthen the validity of the form.

Keep a copy of the completed form in a safe place. Make sure your agent knows where to find it.

Review the document periodically. Changes in your life circumstances may require updates to the powers granted.

Understand that the Durable Power of Attorney remains effective even if you become incapacitated. This is a key feature that distinguishes it from other types of power of attorney.

Similar forms

- General Power of Attorney: This document allows someone to act on your behalf in a broad range of matters, similar to a Durable Power of Attorney, but it becomes invalid if you become incapacitated.

- Medical Power of Attorney: This form specifically grants someone the authority to make healthcare decisions for you if you are unable to do so yourself, focusing on medical matters.

- Living Will: While not the same as a Power of Attorney, a Living Will outlines your wishes regarding medical treatment, especially at the end of life, complementing the Medical Power of Attorney.

- Financial Power of Attorney: This document gives someone the power to manage your financial affairs, similar to a Durable Power of Attorney, but often limited to financial matters only.

- Healthcare Proxy: This is another term for a Medical Power of Attorney, allowing someone to make health-related decisions on your behalf when you cannot.

- Trust Agreement: A Trust can manage your assets and designate someone to handle them, similar to a Durable Power of Attorney, but it often involves more complex estate planning.

- Will: A Will outlines how your assets should be distributed after your death. It does not grant authority while you are alive, unlike a Durable Power of Attorney.

- Advance Healthcare Directive: This combines a Living Will and Medical Power of Attorney, giving instructions for medical care and designating someone to make decisions for you.

- Guardianship Papers: These documents establish a legal guardian for someone unable to care for themselves, similar in purpose to a Durable Power of Attorney but focused on personal care.

- Asset Management Agreement: This document allows a designated person to manage your assets, similar to a Durable Power of Attorney, but typically focuses on investment and asset management specifically.