Attorney-Approved Lady Bird Deed Template for the State of Florida

Form Specifications

| Fact Name | Description |

|---|---|

| Definition | The Florida Lady Bird Deed allows property owners to transfer their property to beneficiaries while retaining control during their lifetime. |

| Governing Law | This deed is governed by Florida Statutes, specifically Section 689.05. |

| Retained Control | Property owners can sell, mortgage, or change the deed without the beneficiaries' consent. |

| Beneficiary Rights | Beneficiaries receive the property automatically upon the owner's death, avoiding probate. |

| Tax Implications | The property retains its tax basis, which can benefit beneficiaries when they inherit it. |

| Revocability | The Lady Bird Deed can be revoked or modified at any time by the property owner. |

| Use of Name | The term "Lady Bird Deed" is derived from former First Lady Lady Bird Johnson, who popularized this type of deed. |

| Eligibility | Any individual who owns property in Florida can create a Lady Bird Deed. |

| Limitations | It cannot be used for certain types of property, such as properties held in a trust. |

| Creation Requirements | The deed must be executed, notarized, and recorded in the county where the property is located. |

Dos and Don'ts

When filling out the Florida Lady Bird Deed form, it is important to follow certain guidelines to ensure accuracy and legality. Here is a list of things you should and shouldn't do:

- Do ensure that you understand the purpose of the Lady Bird Deed. It allows for the transfer of property while retaining certain rights.

- Do clearly identify the property being transferred. Include the legal description to avoid confusion.

- Do list all beneficiaries accurately. Ensure their names are spelled correctly and match official documents.

- Do sign the deed in front of a notary public. This step is crucial for the deed's validity.

- Don't leave any sections blank. Incomplete forms can lead to legal issues later.

- Don't forget to record the deed with the county clerk’s office. This step is necessary for public notice.

- Don't use vague language. Be specific about your intentions and the rights retained.

Create Popular Lady Bird Deed Forms for Different States

Lady Bird Deed South Carolina - Using this deed is often a wise move for anyone wanting to safeguard their family's future.

When engaging in a vehicle transaction, it's essential to utilize the proper documentation to ensure clarity and legality in the process. One valuable resource for obtaining the necessary forms is Forms Washington, which provides templates that simplify the completion of the Washington Motor Vehicle Bill of Sale. This document plays a vital role in confirming the transfer of ownership, thus contributing to the overall efficiency of the sale.

Common mistakes

-

Failing to include all required information. When filling out the Lady Bird Deed form, it's essential to provide complete details about the property and the parties involved. Missing information can lead to legal complications.

-

Not clearly identifying the property. The property description must be precise. Vague descriptions can create confusion and may result in disputes later.

-

Using incorrect names. Ensure that the names of all parties are spelled correctly and match their legal documents. Errors in names can invalidate the deed.

-

Overlooking witness signatures. In Florida, a Lady Bird Deed must be signed in front of two witnesses. Forgetting this step can render the deed unenforceable.

-

Not notarizing the deed. After signing, the deed must be notarized to be valid. Failing to have it notarized can lead to issues with property transfer.

-

Ignoring state-specific requirements. Each state has its own rules regarding property deeds. Make sure to follow Florida's specific guidelines to avoid problems.

-

Neglecting to record the deed. After completing the form, it must be filed with the county clerk's office. If not recorded, the deed may not be recognized in legal matters.

-

Assuming the deed is irrevocable. While a Lady Bird Deed offers certain benefits, it can still be revoked. Understanding the implications is crucial for future planning.

Documents used along the form

A Florida Lady Bird Deed is a useful tool for transferring property while retaining certain rights. When preparing this deed, several other forms and documents may also be necessary to ensure a smooth process. Below is a list of some common documents that are often used alongside the Lady Bird Deed.

- Warranty Deed: This document transfers ownership of real property from one party to another, guaranteeing that the title is clear of any liens or claims.

- Motorcycle Bill of Sale: To complete the sale of a motorcycle in Illinois, both the buyer and seller must fill out the formsillinois.com/, which captures the necessary details of the transaction.

- Power of Attorney: This form allows someone to act on behalf of another person in legal matters, including property transactions.

- Life Estate Deed: Similar to a Lady Bird Deed, this document grants someone the right to use and benefit from a property during their lifetime, with the remainder going to another party after their death.

- Quit Claim Deed: This deed transfers any interest the grantor has in a property without guaranteeing that the title is clear. It is often used to clear up title issues.

- Affidavit of Heirship: This sworn statement identifies heirs of a deceased person, which can help in transferring property without going through probate.

- Property Tax Exemption Application: This form may be necessary to apply for tax exemptions available to certain property owners, such as those who are elderly or disabled.

- Homestead Declaration: This document can protect a primary residence from creditors and may provide property tax benefits for homeowners in Florida.

- Title Search Report: A title search is conducted to ensure that the property title is clear of any encumbrances, providing peace of mind before the transfer.

Using these documents in conjunction with the Florida Lady Bird Deed can help facilitate a more efficient property transfer process. Always consider consulting with a legal professional to ensure all necessary forms are completed accurately and appropriately for your situation.

Misconceptions

The Florida Lady Bird Deed is a unique estate planning tool, yet several misconceptions surround its use. Understanding these misconceptions can help individuals make informed decisions about their property and estate planning. Below are five common misunderstandings about the Lady Bird Deed.

- It Automatically Avoids Probate: Many people believe that a Lady Bird Deed completely eliminates the probate process. While it does allow for a smoother transfer of property upon death, it does not prevent all assets from going through probate. Other assets not covered by the deed may still require probate.

- Only Married Couples Can Use It: Some think that only married couples can benefit from a Lady Bird Deed. In reality, anyone who owns property can utilize this deed, whether single, married, or part of a domestic partnership.

- It Is the Same as a Traditional Transfer on Death Deed: A common misconception is that a Lady Bird Deed functions exactly like a traditional transfer on death deed. While both allow for property transfer upon death, the Lady Bird Deed provides additional benefits, such as retaining the right to sell or mortgage the property during the grantor's lifetime.

- It Is Only for Florida Residents: Some believe that the Lady Bird Deed is exclusive to Florida residents. Although it is named after a Texas First Lady, the deed is primarily used in Florida. However, similar deeds may exist in other states, tailored to local laws.

- It Is Too Complicated to Understand: Many people think that the Lady Bird Deed is a complex legal document. In truth, while it has specific legal language, the concept is straightforward. With proper guidance, anyone can grasp its purpose and benefits.

By addressing these misconceptions, individuals can better navigate their estate planning options and make choices that align with their goals.

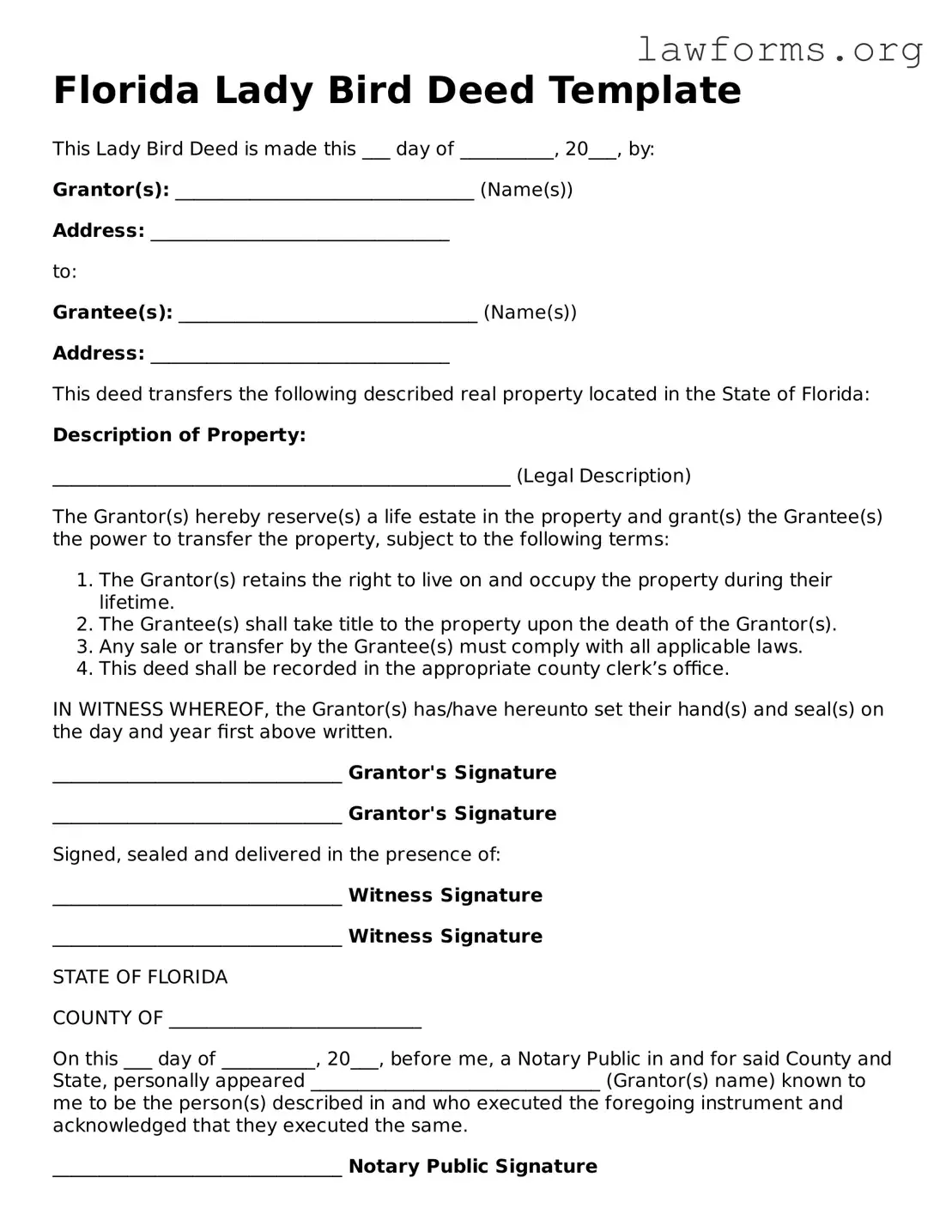

Preview - Florida Lady Bird Deed Form

Florida Lady Bird Deed Template

This Lady Bird Deed is made this ___ day of __________, 20___, by:

Grantor(s): ________________________________ (Name(s))

Address: ________________________________

to:

Grantee(s): ________________________________ (Name(s))

Address: ________________________________

This deed transfers the following described real property located in the State of Florida:

Description of Property:

_________________________________________________ (Legal Description)

The Grantor(s) hereby reserve(s) a life estate in the property and grant(s) the Grantee(s) the power to transfer the property, subject to the following terms:

- The Grantor(s) retains the right to live on and occupy the property during their lifetime.

- The Grantee(s) shall take title to the property upon the death of the Grantor(s).

- Any sale or transfer by the Grantee(s) must comply with all applicable laws.

- This deed shall be recorded in the appropriate county clerk’s office.

IN WITNESS WHEREOF, the Grantor(s) has/have hereunto set their hand(s) and seal(s) on the day and year first above written.

_______________________________ Grantor's Signature

_______________________________ Grantor's Signature

Signed, sealed and delivered in the presence of:

_______________________________ Witness Signature

_______________________________ Witness Signature

STATE OF FLORIDA

COUNTY OF ___________________________

On this ___ day of __________, 20___, before me, a Notary Public in and for said County and State, personally appeared _______________________________ (Grantor(s) name) known to me to be the person(s) described in and who executed the foregoing instrument and acknowledged that they executed the same.

_______________________________ Notary Public Signature

My Commission Expires: _______________

Key takeaways

When considering the Florida Lady Bird Deed form, keep these key takeaways in mind:

- The Lady Bird Deed allows property owners to transfer their property to beneficiaries while retaining control during their lifetime.

- This type of deed helps avoid probate, simplifying the transfer process after the owner’s death.

- It is essential to include a clear description of the property and the names of the beneficiaries on the form.

- Consulting with a legal professional is advisable to ensure the deed complies with Florida laws and meets your specific needs.

- Once completed, the deed must be signed, notarized, and recorded in the county where the property is located to be effective.

Understanding these points can help you navigate the process more smoothly.

Similar forms

The Lady Bird Deed is a unique estate planning tool that allows property owners to transfer their real estate to beneficiaries while retaining certain rights during their lifetime. However, there are several other documents that serve similar purposes or share characteristics with the Lady Bird Deed. Here’s a look at seven of them:

- Transfer on Death Deed (TODD): This document allows property owners to designate beneficiaries who will automatically receive the property upon the owner’s death, similar to the Lady Bird Deed's transfer upon death feature.

- Life Estate Deed: A life estate deed grants ownership of a property to one party for their lifetime, with the remainder going to another party after their death. Like the Lady Bird Deed, it allows for a transfer of ownership but includes a life interest.

- Will: A will outlines how a person's assets, including real estate, should be distributed after their death. While a will does not avoid probate, it serves a similar purpose in directing property transfer.

- Non-compete Agreement: To safeguard your business interests, consider this essential Non-compete Agreement form that prevents former employees from competing within specified parameters.

- Revocable Living Trust: This trust allows individuals to place their assets, including real estate, into a trust during their lifetime. The assets can be managed and transferred without going through probate, akin to the benefits of a Lady Bird Deed.

- Joint Tenancy with Right of Survivorship: In this arrangement, two or more people hold title to a property. When one owner dies, their share automatically passes to the surviving owner(s), similar to the automatic transfer feature of a Lady Bird Deed.

- Durable Power of Attorney: While not directly a property transfer document, a durable power of attorney allows someone to manage a person's financial affairs, including real estate, if they become incapacitated, paralleling the Lady Bird Deed’s focus on retaining control during life.

- Beneficiary Designation for Real Estate: Some states allow property owners to name beneficiaries directly on the deed. This designation ensures that the property passes to the named individuals upon the owner's death, much like the Lady Bird Deed.

Each of these documents has its own specific features and implications, but they all share the common goal of facilitating property transfer and management in a way that aligns with the owner’s wishes.