Attorney-Approved Loan Agreement Template for the State of Florida

Form Specifications

| Fact Name | Description |

|---|---|

| Purpose | The Florida Loan Agreement form is used to outline the terms and conditions of a loan between a lender and a borrower. |

| Governing Law | This agreement is governed by the laws of the State of Florida, ensuring compliance with local regulations. |

| Parties Involved | The form requires identification of both the lender and the borrower, including their legal names and addresses. |

| Loan Amount | The specific amount being borrowed must be clearly stated in the agreement to avoid any misunderstandings. |

| Interest Rate | The form should specify the interest rate applicable to the loan, whether it is fixed or variable. |

| Repayment Terms | Details about the repayment schedule, including due dates and payment methods, are essential for clarity. |

| Default Clauses | The agreement outlines what constitutes a default and the potential consequences, protecting the lender's interests. |

Dos and Don'ts

When filling out the Florida Loan Agreement form, it is important to follow certain guidelines to ensure accuracy and compliance. Below is a list of things you should and shouldn't do:

- Do read the entire form carefully before starting to fill it out.

- Do provide accurate and complete information to avoid delays.

- Do double-check all figures and calculations for correctness.

- Do sign and date the form in the appropriate sections.

- Do keep a copy of the completed form for your records.

- Don't leave any required fields blank; fill in all necessary information.

- Don't use white-out or correction fluid on the form.

- Don't submit the form without reviewing it for errors.

- Don't forget to check for any additional documents that may need to be attached.

Create Popular Loan Agreement Forms for Different States

New York Promissory Note - States whether the loan can be refinanced in the future.

Filing the California LLC 12 form is not only a legal requirement but also a vital step in ensuring your business remains in good standing. To learn more about this essential document and the filing process, you can visit https://californiadocsonline.com/california-llc-12-form, where detailed information and resources are available to assist you in navigating your compliance obligations.

Promissory Note Template California - Disclosures required by law to protect the borrower are usually included.

Common mistakes

-

Incomplete Information: Many people fail to fill in all required fields. Missing information can delay the loan process or even lead to rejection.

-

Incorrect Loan Amount: Some borrowers mistakenly enter the wrong loan amount. Double-checking figures is crucial to avoid complications.

-

Wrong Interest Rate: Entering an incorrect interest rate can significantly impact monthly payments. Make sure to confirm the rate before submission.

-

Missing Signatures: Forgetting to sign the agreement is a common oversight. Always ensure that all required parties have signed the document.

-

Not Reading Terms: Some individuals skim through the terms and conditions. It's vital to understand what you’re agreeing to before signing.

-

Providing Inaccurate Personal Information: Errors in personal details, like your Social Security number or address, can lead to issues. Verify all personal data carefully.

-

Ignoring Additional Fees: Failing to account for processing or origination fees can lead to unexpected costs. Review the entire agreement for any hidden charges.

-

Not Keeping a Copy: Some borrowers forget to keep a copy of the signed agreement. Always retain a copy for your records to avoid confusion later on.

Documents used along the form

When entering into a loan agreement in Florida, several additional documents may be required to ensure clarity and protection for all parties involved. These documents help outline the terms of the loan and provide necessary legal backing. Below are some commonly used forms that accompany the Florida Loan Agreement.

- Promissory Note: This document serves as a written promise from the borrower to repay the loan under specified terms. It details the amount borrowed, interest rate, repayment schedule, and any penalties for late payments.

- Cease and Desist Letter: This legal document is essential for requesting the cessation of harmful actions and can provide a pathway to resolving disputes without litigation, as outlined by Forms Washington.

- Security Agreement: If the loan is secured by collateral, this agreement outlines the specific assets that back the loan. It provides the lender with rights to the collateral in case of default.

- Disclosure Statement: This document provides important information about the loan, including the total cost, interest rates, and any fees. It ensures that borrowers understand the terms before signing the loan agreement.

- Loan Application: Before a loan is approved, borrowers typically complete a loan application. This form collects personal and financial information to help the lender assess the borrower's creditworthiness.

These documents work together to create a comprehensive understanding of the loan process. By reviewing and completing each form carefully, both borrowers and lenders can protect their interests and establish a clear agreement moving forward.

Misconceptions

Understanding the Florida Loan Agreement form can be challenging due to various misconceptions. Here’s a list of common misunderstandings that people often have:

- All loan agreements are the same. Many believe that all loan agreements follow a standard template. In reality, each agreement can be tailored to the specific needs of the parties involved.

- A verbal agreement is sufficient. Some think that a verbal agreement is enough to secure a loan. However, having a written agreement is crucial for legal protection and clarity.

- Only banks can issue loans. It is a common belief that only traditional banks can provide loans. In fact, many private lenders and credit unions also offer loan agreements.

- Loan agreements are only for large sums of money. Many assume that loan agreements are only necessary for significant amounts. However, even small loans should be documented to avoid misunderstandings.

- Once signed, a loan agreement cannot be changed. Some people think that a loan agreement is set in stone once signed. In truth, parties can negotiate changes if both agree.

- Loan agreements are only for personal loans. Many believe these agreements are solely for personal loans. They can also apply to business loans and other financial arrangements.

- Interest rates are fixed in all agreements. There is a misconception that all loan agreements have fixed interest rates. In reality, rates can be variable and should be clearly stated in the agreement.

- Loan agreements are only necessary for secured loans. Some think that only secured loans require an agreement. However, unsecured loans also benefit from having a formal document.

- The lender is always responsible for drafting the agreement. Many assume that lenders must draft the agreement. Borrowers can also request modifications or even draft their own terms.

- Signing the agreement means you understand all terms. Just because a borrower signs the agreement does not mean they fully understand all terms. It’s essential to read and ask questions before signing.

Being aware of these misconceptions can help individuals navigate the loan process more effectively and ensure they are well-informed when entering into a loan agreement.

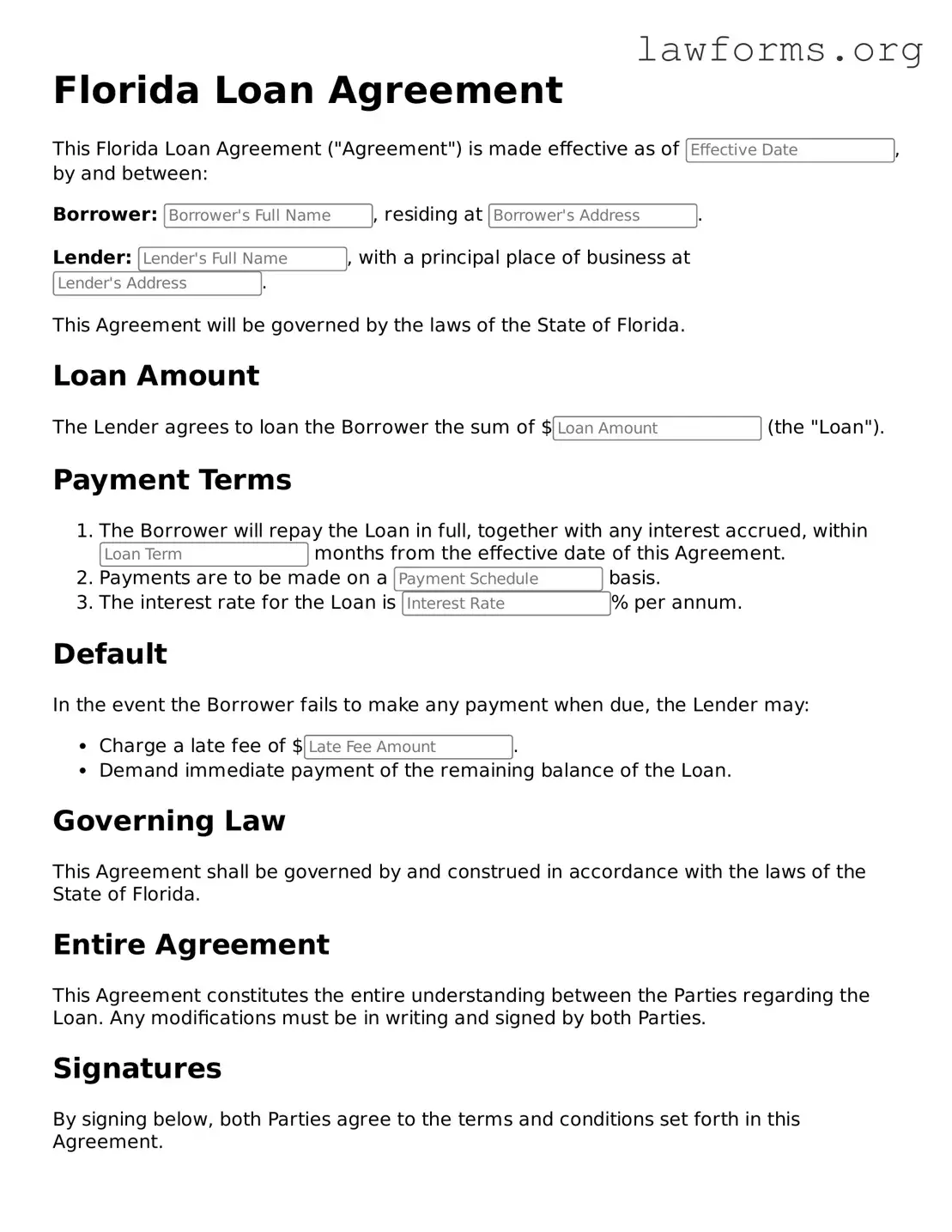

Preview - Florida Loan Agreement Form

Florida Loan Agreement

This Florida Loan Agreement ("Agreement") is made effective as of , by and between:

Borrower: , residing at .

Lender: , with a principal place of business at .

This Agreement will be governed by the laws of the State of Florida.

Loan Amount

The Lender agrees to loan the Borrower the sum of $ (the "Loan").

Payment Terms

- The Borrower will repay the Loan in full, together with any interest accrued, within months from the effective date of this Agreement.

- Payments are to be made on a basis.

- The interest rate for the Loan is % per annum.

Default

In the event the Borrower fails to make any payment when due, the Lender may:

- Charge a late fee of $.

- Demand immediate payment of the remaining balance of the Loan.

Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State of Florida.

Entire Agreement

This Agreement constitutes the entire understanding between the Parties regarding the Loan. Any modifications must be in writing and signed by both Parties.

Signatures

By signing below, both Parties agree to the terms and conditions set forth in this Agreement.

Borrower's Signature: _______________________ Date: ______________

Lender's Signature: _______________________ Date: ______________

Key takeaways

When dealing with a Florida Loan Agreement form, it is crucial to understand the key elements involved. Here are seven important takeaways:

- Understand the Parties Involved: Clearly identify the lender and borrower. Full names and addresses should be included to avoid confusion.

- Specify the Loan Amount: Clearly state the total amount of money being borrowed. This figure must be accurate and easy to locate within the document.

- Outline the Interest Rate: Indicate the interest rate applicable to the loan. This can be fixed or variable, but it must be explicitly stated.

- Detail the Repayment Terms: Include the repayment schedule. Specify when payments are due, the frequency of payments, and the total duration of the loan.

- Include Default Provisions: Clearly outline what constitutes a default. This can include late payments or failure to adhere to the agreement.

- Address Governing Law: State that the agreement is governed by the laws of Florida. This is important for legal enforcement and interpretation.

- Signatures Are Essential: Ensure that both parties sign the agreement. Without signatures, the document may not be legally binding.

By focusing on these elements, individuals can create a comprehensive and effective Loan Agreement that protects both parties involved.

Similar forms

The Loan Agreement form shares similarities with several other important documents. Each of these documents serves a specific purpose in financial transactions and legal agreements. Below are eight documents that are similar to a Loan Agreement:

- Promissory Note: This document outlines the borrower's promise to repay a loan, detailing the amount, interest rate, and repayment schedule.

- Mortgage Agreement: This is a specific type of loan agreement secured by real estate, ensuring the lender can claim the property if the borrower defaults.

- Lease Agreement: Similar to a loan agreement, this document outlines the terms under which one party rents property from another, including payment terms and duration.

Do Not Resuscitate Order: Essential for those facing terminal illnesses, the comprehensive Do Not Resuscitate Order form guidelines provide clarity on medical directives and patient preferences.

- Credit Agreement: This document establishes the terms of a credit facility, including the amount of credit extended and the repayment terms, similar to a loan agreement.

- Security Agreement: This document provides the lender with a security interest in the borrower's assets, similar to how a loan agreement outlines obligations and rights.

- Personal Guarantee: This document involves an individual agreeing to repay a loan if the primary borrower defaults, similar in obligation to a loan agreement.

- Debt Settlement Agreement: This document outlines the terms under which a debtor agrees to pay a reduced amount to settle a debt, akin to renegotiating a loan agreement.

- Forbearance Agreement: This document allows a borrower to pause or reduce payments temporarily, similar to provisions that may be included in a loan agreement for hardship situations.