Attorney-Approved Operating Agreement Template for the State of Florida

Form Specifications

| Fact Name | Description |

|---|---|

| Definition | The Florida Operating Agreement is a document that outlines the management structure and operating procedures of a limited liability company (LLC) in Florida. |

| Governing Law | The agreement is governed by the Florida Limited Liability Company Act, found in Chapter 605 of the Florida Statutes. |

| Purpose | It serves to define the rights and responsibilities of members and managers, ensuring clarity in operations. |

| Flexibility | Florida law allows LLCs significant flexibility in drafting their operating agreements, accommodating various business needs. |

| Not Mandatory | While an operating agreement is not legally required in Florida, it is highly recommended to avoid disputes among members. |

| Member Contributions | The agreement typically includes details about member contributions, including cash, property, and services. |

| Management Structure | It can establish whether the LLC will be member-managed or manager-managed, impacting decision-making processes. |

| Dispute Resolution | Many agreements include provisions for resolving disputes, which can help prevent costly litigation. |

| Amendments | Members can outline procedures for amending the operating agreement, ensuring it remains relevant as the business evolves. |

| Record Keeping | Maintaining a copy of the operating agreement is essential for compliance and reference, especially during audits or legal proceedings. |

Dos and Don'ts

When filling out the Florida Operating Agreement form, it is important to follow certain guidelines to ensure accuracy and compliance. Here is a list of things you should and shouldn't do:

- Do read the entire form carefully before starting.

- Do provide accurate information about all members and their roles.

- Do specify the management structure clearly.

- Do include provisions for profit and loss distribution.

- Don't leave any sections blank unless they are optional.

- Don't use vague language that could lead to misunderstandings.

- Don't forget to sign and date the agreement.

- Don't overlook the importance of having the document reviewed by a legal professional.

Create Popular Operating Agreement Forms for Different States

Create an Operating Agreement - An Operating Agreement presents a formal framework that supports the business's vision.

For those looking to create a Motor Vehicle Bill of Sale, it is recommended to use templates that simplify the process and ensure all necessary information is included. One such resource is available at Formaid Org, which provides a comprehensive template to help both buyers and sellers accurately document the vehicle transfer and adhere to legal requirements.

Is an Operating Agreement Required for an Llc - The document may provide details on how to wind down the LLC if necessary.

Ohio Llc Operating Agreement Pdf - This form can clarify the power dynamics in decision-making processes.

Common mistakes

-

Not Including All Members: One common mistake is failing to list all members of the LLC. Each member's name and address should be clearly stated in the agreement. Omitting a member can lead to disputes later on.

-

Neglecting to Define Roles: Another frequent error is not clearly defining the roles and responsibilities of each member. This can create confusion about who is in charge of what, leading to potential conflicts.

-

Ignoring Voting Rights: Some people forget to specify voting rights within the agreement. It's important to outline how decisions will be made and how much voting power each member has to avoid future disagreements.

-

Inadequate Profit Distribution: Failing to detail how profits and losses will be distributed among members is a mistake that can cause tension. The agreement should clearly state the method of distribution to ensure transparency.

-

Not Addressing Dispute Resolution: Many overlook the importance of including a dispute resolution clause. This clause can provide a clear process for resolving conflicts, which can save time and resources in the long run.

-

Forgetting to Update the Agreement: Finally, some individuals neglect to update the Operating Agreement as changes occur. Whether members leave, new members join, or roles shift, keeping the agreement current is crucial for effective management.

Documents used along the form

When forming a limited liability company (LLC) in Florida, an Operating Agreement is a crucial document that outlines the management structure and operating procedures of the company. However, several other forms and documents are often utilized alongside the Operating Agreement to ensure compliance and clarity in business operations. Below is a list of commonly used documents.

- Articles of Organization: This document is filed with the Florida Division of Corporations to officially create the LLC. It includes essential information such as the company name, principal office address, and registered agent details.

- Bylaws: While not required for LLCs, bylaws can serve as an internal guide for the company’s operations and governance. They outline the roles of members and managers, meeting protocols, and voting procedures.

- Power of Attorney for a Child Form: If you need to appoint someone to make decisions on behalf of your child, check out the comprehensive Power of Attorney for a Child resources for detailed guidance.

- Member Consent Form: This form is used to document the agreement among members regarding specific decisions or actions taken by the LLC. It provides a written record of unanimous consent for significant business matters.

- Initial Member Capital Contributions: This document details the financial contributions made by each member at the formation of the LLC. It establishes ownership percentages and capital accounts for each member.

- Operating Procedures: This document outlines the day-to-day operations of the LLC, including roles, responsibilities, and processes for managing business activities.

- Membership Certificates: These certificates serve as proof of ownership for each member in the LLC. They can be issued to signify a member's stake in the company.

- Annual Report: This document must be filed annually with the Florida Division of Corporations to maintain the LLC’s active status. It updates the state on the company’s current information.

- Tax Identification Number (EIN): An Employer Identification Number is required for tax purposes. This document is obtained from the IRS and is necessary for opening a business bank account and filing taxes.

- Business License: Depending on the nature of the business, a local or state business license may be required. This document ensures that the LLC is authorized to operate legally within its jurisdiction.

These documents, when used in conjunction with the Florida Operating Agreement, help establish a solid foundation for the LLC's operations and legal standing. Properly preparing and maintaining these forms can prevent misunderstandings and disputes among members, ensuring a smoother business experience.

Misconceptions

Many people have misunderstandings about the Florida Operating Agreement form. Here are five common misconceptions:

- It's only for large businesses. Many believe that only big companies need an operating agreement. In reality, even small businesses and startups benefit from having one. It helps clarify roles and responsibilities among members.

- It’s a legal requirement in Florida. Some think that having an operating agreement is mandatory by law. While it is not required, having one is highly recommended. It can prevent disputes and provide clear guidelines for the business.

- It’s a one-time document. A common belief is that once an operating agreement is created, it never needs to change. However, as businesses grow and evolve, the agreement should be updated to reflect new circumstances or member changes.

- All operating agreements are the same. Many assume that all operating agreements follow a standard template. In truth, each agreement should be tailored to fit the specific needs and goals of the business and its members.

- It only covers financial aspects. Some people think that an operating agreement is solely about money. In fact, it addresses a variety of topics, including decision-making processes, member roles, and what happens if a member wants to leave.

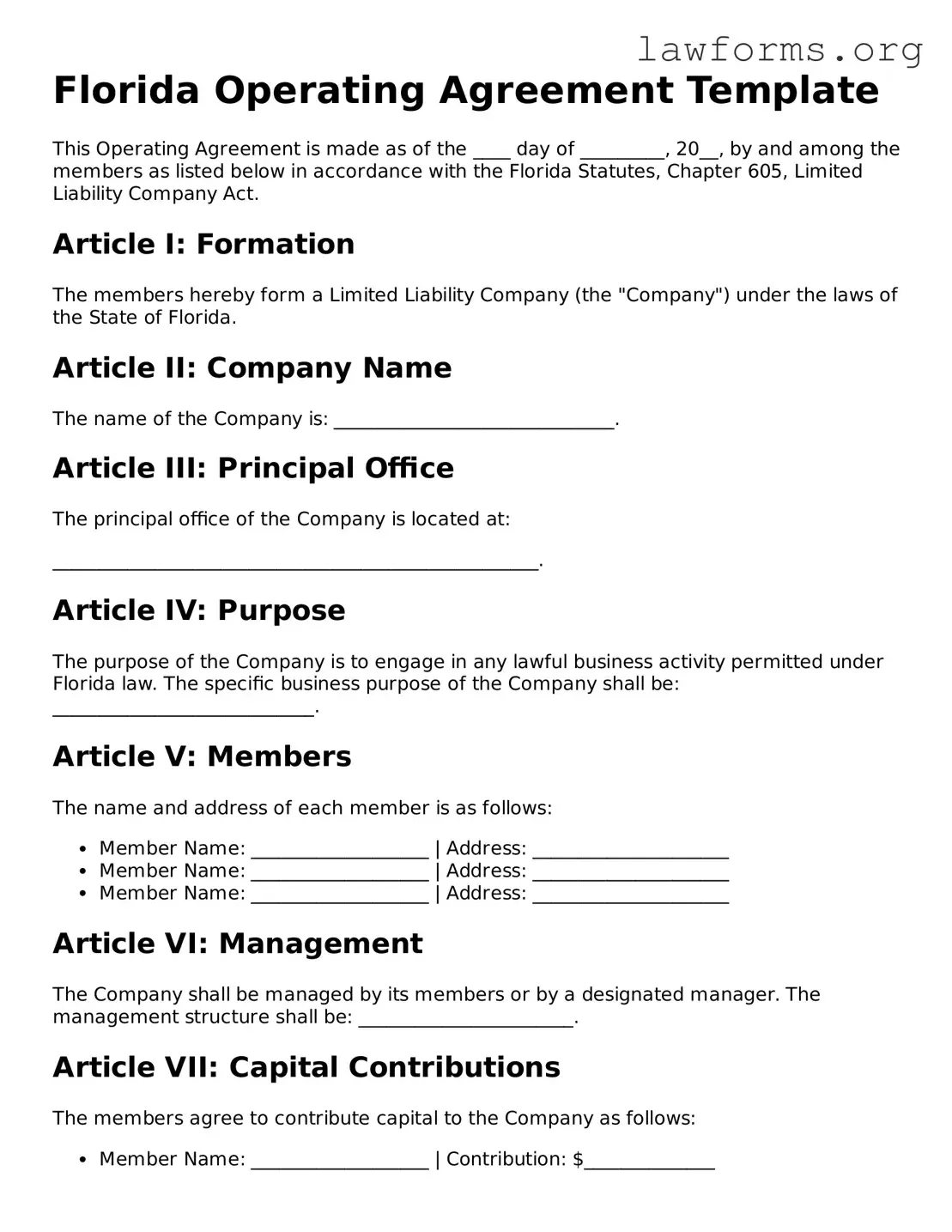

Preview - Florida Operating Agreement Form

Florida Operating Agreement Template

This Operating Agreement is made as of the ____ day of _________, 20__, by and among the members as listed below in accordance with the Florida Statutes, Chapter 605, Limited Liability Company Act.

Article I: Formation

The members hereby form a Limited Liability Company (the "Company") under the laws of the State of Florida.

Article II: Company Name

The name of the Company is: ______________________________.

Article III: Principal Office

The principal office of the Company is located at:

____________________________________________________.

Article IV: Purpose

The purpose of the Company is to engage in any lawful business activity permitted under Florida law. The specific business purpose of the Company shall be: ____________________________.

Article V: Members

The name and address of each member is as follows:

- Member Name: ___________________ | Address: _____________________

- Member Name: ___________________ | Address: _____________________

- Member Name: ___________________ | Address: _____________________

Article VI: Management

The Company shall be managed by its members or by a designated manager. The management structure shall be: _______________________.

Article VII: Capital Contributions

The members agree to contribute capital to the Company as follows:

- Member Name: ___________________ | Contribution: $______________

- Member Name: ___________________ | Contribution: $______________

- Member Name: ___________________ | Contribution: $______________

Article VIII: Profits and Losses

Profits and losses of the Company shall be allocated to the members in proportion to their respective contributions.

Article IX: Distributions

Distributions shall be made to members at such times and in such amounts as determined by the members. The schedule for distributions shall be established as: _______________________.

Article X: Amendments

This Operating Agreement may be amended only by a written agreement signed by the members.

Article XI: Governing Law

This Operating Agreement shall be governed by and construed in accordance with the laws of the State of Florida.

Article XII: Signatures

IN WITNESS WHEREOF, the members have executed this Operating Agreement as of the date first above written.

- ___________________________ (Member Signature)

- ___________________________ (Member Signature)

- ___________________________ (Member Signature)

End of Agreement

Key takeaways

When filling out and using the Florida Operating Agreement form, there are several important points to keep in mind. These takeaways will help ensure that you create a clear and effective document for your business.

- Understand the Purpose: The Operating Agreement serves as a foundational document for your LLC. It outlines the management structure and the rights and responsibilities of the members.

- Customize the Agreement: Each business is unique. Tailor the Operating Agreement to reflect your specific needs, including profit distribution, decision-making processes, and member roles.

- Include Essential Clauses: Make sure to incorporate key clauses such as how to handle member departures, dispute resolution procedures, and amendments to the agreement.

- Review State Requirements: Florida has specific legal requirements for LLCs. Ensure your Operating Agreement complies with state laws to avoid potential issues in the future.

- Regular Updates: As your business evolves, so should your Operating Agreement. Regularly review and update the document to reflect any changes in membership or business operations.

Similar forms

The Operating Agreement is a crucial document for LLCs, but it shares similarities with several other important documents. Here’s a look at five documents that have comparable functions or purposes:

- Bylaws: Just like an Operating Agreement outlines the internal workings of an LLC, bylaws serve a similar role for corporations. They define the rules for governance, including how meetings are conducted and how decisions are made.

- Partnership Agreement: This document is essential for partnerships, detailing the roles, responsibilities, and profit-sharing arrangements among partners. Like an Operating Agreement, it helps prevent disputes by setting clear expectations from the outset.

- Shareholder Agreement: In corporations, a shareholder agreement governs the relationship between shareholders. It addresses issues such as voting rights and the transfer of shares, paralleling how an Operating Agreement manages member relationships in an LLC.

- Joint Venture Agreement: When two or more parties collaborate on a specific project, a joint venture agreement outlines each party's contributions, responsibilities, and profit-sharing. This is similar to how an Operating Agreement delineates the roles of LLC members.

- Power of Attorney: A legal document that allows one person to act on another's behalf, similar in importance to the Operating Agreement; for more information, check Forms Washington.

- Employment Agreement: While primarily focused on the employer-employee relationship, an employment agreement can specify terms of employment, duties, and compensation. This mirrors how an Operating Agreement details member roles and responsibilities within the LLC.

Understanding these documents can help you navigate the complexities of business structures and ensure that all parties are on the same page.