Attorney-Approved Power of Attorney Template for the State of Florida

Form Specifications

| Fact Name | Description |

|---|---|

| Definition | A Florida Power of Attorney is a legal document that allows one person to act on behalf of another in legal or financial matters. |

| Governing Law | The Florida Power of Attorney is governed by Chapter 709 of the Florida Statutes. |

| Durability | This form can be durable, meaning it remains effective even if the principal becomes incapacitated. |

| Types | There are different types of Power of Attorney forms, including limited, general, and healthcare powers of attorney. |

| Signing Requirements | The principal must sign the document in the presence of two witnesses and a notary public. |

| Revocation | A Power of Attorney can be revoked at any time by the principal as long as they are mentally competent. |

| Agent's Authority | The agent's authority can be broad or limited, depending on how the document is drafted. |

| Healthcare Decisions | A separate document is typically required for healthcare decisions, although some Power of Attorney forms can include healthcare provisions. |

Dos and Don'ts

When filling out the Florida Power of Attorney form, it's essential to follow certain guidelines to ensure that the document is valid and effective. Here are nine important dos and don'ts to consider:

- Do clearly identify the principal and the agent in the document.

- Do specify the powers granted to the agent in detail.

- Do sign the document in the presence of a notary public.

- Do ensure that the form complies with Florida state laws.

- Do keep a copy of the signed document for your records.

- Don't use vague language that could lead to confusion about the powers granted.

- Don't forget to discuss your intentions with your chosen agent beforehand.

- Don't sign the document without understanding its implications.

- Don't assume that the form is valid if it hasn't been properly notarized.

By adhering to these guidelines, you can create a Power of Attorney that accurately reflects your wishes and provides clear authority to your agent.

Create Popular Power of Attorney Forms for Different States

How to Get Power of Attorney in North Carolina - Offers peace of mind by ensuring someone can act if needed.

California Poa - Use this form to avoid complications in managing affairs.

New Jersey Power of Attorney - A Power of Attorney typically covers financial transactions, healthcare decisions, and legal actions.

Common mistakes

-

Not Specifying Powers Clearly: Many individuals fail to clearly define the powers granted to the agent. This can lead to confusion and disputes later. It's important to outline specific powers, such as financial decisions or healthcare choices, to avoid ambiguity.

-

Neglecting to Sign and Date: A common mistake is not signing and dating the form. Without a signature, the document is not valid. Ensure that all required parties sign the document in the appropriate places.

-

Forgetting to Have Witnesses or Notarization: Florida law requires that the Power of Attorney be signed in the presence of two witnesses or notarized. Failing to meet this requirement can invalidate the document.

-

Not Reviewing the Document Regularly: Life circumstances change. Failing to review and update the Power of Attorney can lead to outdated information. Regular reviews ensure that the document reflects current wishes and relationships.

Documents used along the form

When creating a Florida Power of Attorney (POA), it’s important to understand that several other documents often accompany it. These additional forms can help clarify intentions, ensure proper management of affairs, and provide necessary legal protections. Below is a list of some commonly used documents alongside the Florida Power of Attorney form.

- Advance Healthcare Directive: This document outlines an individual’s preferences regarding medical treatment and end-of-life care. It allows a person to express their wishes if they become unable to communicate them due to illness or injury.

- Living Will: A living will is a specific type of advance directive that details what medical treatments a person does or does not want in case they are terminally ill or in a persistent vegetative state.

- Durable Power of Attorney: Similar to a standard POA, a durable power of attorney remains in effect even if the principal becomes incapacitated. This ensures that financial and legal matters can still be managed without interruption.

- Financial Power of Attorney: This document specifically grants authority to handle financial matters, such as managing bank accounts, paying bills, and making investment decisions on behalf of the principal.

- HIPAA Authorization: This form allows designated individuals to access a person's medical records and health information. It ensures that healthcare providers can share information with the appointed agents under the POA.

- Articles of Incorporation: To establish a corporation in New York, it is essential to complete the Articles of Incorporation form, which outlines necessary information required by the state. For more details, visit Formaid Org.

- Revocation of Power of Attorney: If a principal decides to cancel a previously established POA, this document formally revokes the authority granted to the agent, ensuring that no further actions can be taken on their behalf.

- Property Management Agreement: This agreement outlines the responsibilities and authority granted to an agent regarding the management of real estate or other properties owned by the principal.

- Trust Documents: If a trust is established, these documents detail how assets will be managed and distributed. They can work in conjunction with a POA to ensure comprehensive management of a person's financial affairs.

Understanding these documents is crucial for anyone considering a Power of Attorney in Florida. Each serves a unique purpose and can significantly impact how personal and financial matters are handled. Always consult with a qualified professional to ensure that all necessary forms are completed correctly and reflect your wishes accurately.

Misconceptions

-

Misconception 1: A Power of Attorney is only for financial matters.

Many people believe that a Power of Attorney (POA) is solely designed to handle financial affairs. While it is true that a POA can grant authority over financial matters, it can also cover health care decisions, property management, and other personal affairs. This flexibility allows individuals to tailor the document to their specific needs.

-

Misconception 2: A Power of Attorney is permanent and cannot be revoked.

This misconception stems from a misunderstanding of the nature of the document. In reality, a POA can be revoked at any time, as long as the principal (the person granting authority) is mentally competent. Properly notifying the agent and any relevant institutions of the revocation is essential to ensure that the changes are recognized.

-

Misconception 3: A Power of Attorney is only necessary for the elderly or those with health issues.

While it is common for older adults to establish a POA, younger individuals can benefit from having one as well. Life can be unpredictable, and having a POA in place ensures that someone can make decisions on your behalf in case of an emergency, regardless of age or health status.

-

Misconception 4: A Power of Attorney gives the agent unlimited power.

This is not entirely accurate. The authority granted to an agent can be limited and specified in the POA document. The principal can outline exactly what powers are given, whether for specific tasks or broader authority. This ensures that the agent acts within the boundaries set by the principal.

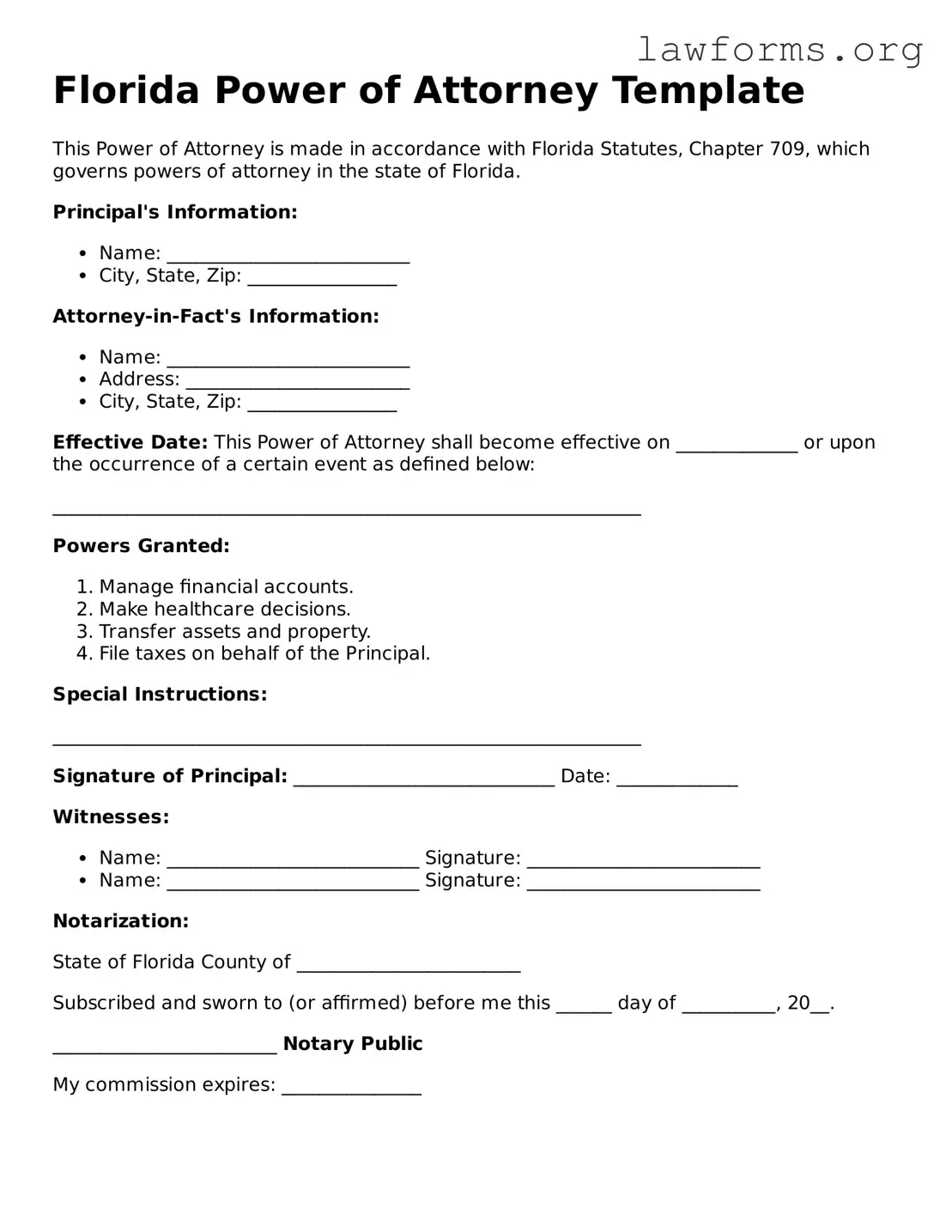

Preview - Florida Power of Attorney Form

Florida Power of Attorney Template

This Power of Attorney is made in accordance with Florida Statutes, Chapter 709, which governs powers of attorney in the state of Florida.

Principal's Information:

- Name: __________________________

- City, State, Zip: ________________

Attorney-in-Fact's Information:

- Name: __________________________

- Address: ________________________

- City, State, Zip: ________________

Effective Date: This Power of Attorney shall become effective on _____________ or upon the occurrence of a certain event as defined below:

_______________________________________________________________

Powers Granted:

- Manage financial accounts.

- Make healthcare decisions.

- Transfer assets and property.

- File taxes on behalf of the Principal.

Special Instructions:

_______________________________________________________________

Signature of Principal: ____________________________ Date: _____________

Witnesses:

- Name: ___________________________ Signature: _________________________

- Name: ___________________________ Signature: _________________________

Notarization:

State of Florida County of ________________________

Subscribed and sworn to (or affirmed) before me this ______ day of __________, 20__.

________________________ Notary Public

My commission expires: _______________

Key takeaways

Filling out and utilizing a Power of Attorney form in Florida is an important task that requires careful consideration. Here are some key takeaways to keep in mind:

- Understand the Purpose: A Power of Attorney allows you to designate someone to act on your behalf in financial or legal matters. This can be crucial if you become incapacitated or unable to make decisions.

- Choose Your Agent Wisely: The person you designate as your agent should be trustworthy and capable. This individual will have significant control over your affairs, so select someone who understands your wishes.

- Specify Powers Clearly: The form allows you to specify what powers you are granting to your agent. Be clear about the scope of authority, whether it’s limited to certain tasks or broad in nature.

- Revocation is Possible: If you change your mind, you can revoke the Power of Attorney at any time, as long as you are competent. Make sure to inform your agent and any relevant institutions about the revocation.

Taking these points into account can help ensure that your Power of Attorney serves your needs effectively and protects your interests.

Similar forms

-

Living Will: A living will is a document that outlines your preferences regarding medical treatment in case you become unable to communicate your wishes. Like a Power of Attorney, it allows you to express your desires about health care decisions, but it specifically focuses on end-of-life care rather than appointing someone to make decisions on your behalf.

-

Healthcare Proxy: A healthcare proxy, similar to a Power of Attorney, designates a person to make medical decisions for you if you are unable to do so. While a Power of Attorney can cover a broad range of financial and legal matters, a healthcare proxy is specifically tailored for health-related decisions.

-

Will: A will is a legal document that outlines how your assets should be distributed after your death. Although it serves a different purpose than a Power of Attorney, both documents require careful consideration and planning. They ensure that your wishes are respected, whether in life or after death.

-

Trust: A trust is a legal arrangement where a trustee manages assets on behalf of beneficiaries. Like a Power of Attorney, a trust can help manage your affairs, but it typically focuses on asset distribution and management rather than decision-making authority during your lifetime.