Attorney-Approved Prenuptial Agreement Template for the State of Florida

Form Specifications

| Fact Name | Description |

|---|---|

| Definition | A prenuptial agreement in Florida is a contract entered into by a couple before marriage, outlining the distribution of assets and financial responsibilities in the event of divorce or death. |

| Governing Law | Florida Statutes, Chapter 61 governs prenuptial agreements in the state, providing guidelines on their enforceability and requirements. |

| Voluntary Agreement | Both parties must enter into the agreement voluntarily. Coercion or undue influence can render the agreement invalid. |

| Full Disclosure | Each party is required to provide a fair and reasonable disclosure of their financial situation to ensure transparency and informed consent. |

| Written Requirement | In Florida, a prenuptial agreement must be in writing and signed by both parties to be legally enforceable. |

| Modification and Revocation | Couples can modify or revoke the agreement at any time, but such changes must also be in writing and signed by both parties. |

Dos and Don'ts

When filling out the Florida Prenuptial Agreement form, it is important to approach the process thoughtfully. Here are some guidelines to consider:

- Do be open and honest about your financial situation. Transparency is crucial for both parties.

- Don't rush the process. Take your time to ensure that all details are accurate and complete.

- Do seek legal advice. Consulting with a lawyer can help clarify any complex issues.

- Don't include vague language. Be specific about your assets and obligations to avoid misunderstandings.

- Do discuss your goals with your partner. Open communication can lead to a more mutually beneficial agreement.

- Don't forget to review the agreement periodically. Life circumstances change, and so may your needs.

- Do ensure both parties sign the document voluntarily. Coercion can invalidate the agreement.

Create Popular Prenuptial Agreement Forms for Different States

North Carolina Premarital Agreement - This type of agreement allows couples to acknowledge each other’s contributions.

The Washington Employment Verification form is a crucial document used by employers to confirm the employment status of their workers. This form serves as a reliable tool for both employers and employees, ensuring that accurate employment information is provided when needed. For those seeking a template to streamline this process, Forms Washington offers a practical solution. Understanding its purpose and proper usage is essential for navigating employment-related processes in Washington.

Ohio Premarital Agreement - Couples can use a prenup to agree upon how marital property will be classified and divided later on.

New Jersey Premarital Agreement - A prenuptial agreement can be revisited and updated as circumstances change, ensuring it remains relevant.

Common mistakes

-

Failing to Fully Disclose Assets: One of the most common mistakes is not providing a complete and accurate list of all assets. Transparency is crucial in a prenuptial agreement. Hiding or omitting significant assets can lead to legal disputes later on.

-

Not Considering Future Changes: Many individuals forget to account for potential future changes in their financial situation. A prenuptial agreement should be flexible enough to accommodate changes such as inheritance, business ventures, or other significant financial shifts.

-

Using Ambiguous Language: Clear and precise language is essential. Vague terms can create confusion and lead to misinterpretations. It's important to define key terms and conditions explicitly to avoid disputes in the future.

-

Neglecting to Seek Legal Advice: Some people attempt to fill out the form without consulting an attorney. Legal guidance can help ensure that the agreement is fair, enforceable, and compliant with Florida law. Without professional advice, individuals may overlook important legal considerations.

-

Forgetting to Update the Agreement: Life circumstances change, and so should prenuptial agreements. Failing to review and update the agreement after significant life events—like the birth of a child or a change in income—can render it outdated and less effective.

-

Not Having Both Parties Sign the Agreement: A prenuptial agreement is only valid if both parties sign it voluntarily. Some individuals mistakenly assume that a verbal agreement or a partially completed form suffices. Both parties must sign and date the document to ensure its enforceability.

Documents used along the form

A Florida Prenuptial Agreement is an important document that helps couples outline their financial rights and responsibilities before marriage. To ensure a comprehensive approach to planning, several other forms and documents are often used alongside the prenuptial agreement. Below is a list of these documents, each serving a unique purpose.

- Postnuptial Agreement: Similar to a prenuptial agreement, this document is created after the marriage has taken place. It allows couples to modify or clarify their financial arrangements and obligations.

- Financial Disclosure Statement: This document provides a complete overview of each party's financial situation, including assets, debts, and income. Transparency is crucial for a valid prenuptial agreement.

- Separation Agreement: If a couple decides to separate, this document outlines the terms of their separation, including asset division and support arrangements. It can be used as a basis for divorce proceedings.

- Motor Vehicle Bill of Sale: This legal document is crucial for recording the transfer of a vehicle from one person to another, ensuring that both parties have clarity on the transaction details and protecting their interests. For a comprehensive template, visit Formaid Org.

- Will: A will outlines how a person's assets will be distributed upon their death. Having a will can complement a prenuptial agreement by ensuring that both parties' wishes are respected after one spouse passes away.

- Power of Attorney: This document grants one spouse the authority to make financial or medical decisions on behalf of the other if they become incapacitated. It is essential for ensuring that decisions can be made quickly in emergencies.

- Living Trust: A living trust helps manage assets during a person’s lifetime and specifies how those assets should be distributed after death. It can work alongside a prenuptial agreement to provide additional protection for family assets.

These documents can enhance the clarity and effectiveness of a prenuptial agreement. Each serves a specific role in protecting the interests of both parties, ensuring that financial matters are addressed thoughtfully and thoroughly.

Misconceptions

Understanding prenuptial agreements can be challenging. Many people hold misconceptions about these legal documents. Here are six common misunderstandings regarding the Florida Prenuptial Agreement form:

-

Prenuptial agreements are only for the wealthy.

This is not true. Anyone can benefit from a prenuptial agreement, regardless of their financial status. It helps clarify financial rights and responsibilities.

-

Prenuptial agreements are only for divorce situations.

While they are often associated with divorce, prenuptial agreements can also provide clarity during the marriage. They can outline financial expectations and protect assets.

-

All prenuptial agreements are the same.

Each prenuptial agreement can be tailored to fit the unique needs of a couple. They can address various issues, including property division and debt responsibility.

-

Prenuptial agreements are not enforceable in court.

This misconception is false. When properly drafted and executed, prenuptial agreements are legally binding and enforceable in Florida courts.

-

You cannot change a prenuptial agreement once it is signed.

Couples can modify their prenuptial agreements at any time, as long as both parties agree to the changes and the modifications are documented properly.

-

Prenuptial agreements mean a couple is planning to get divorced.

This belief is misleading. A prenuptial agreement is a proactive step that can strengthen a marriage by promoting open communication about finances.

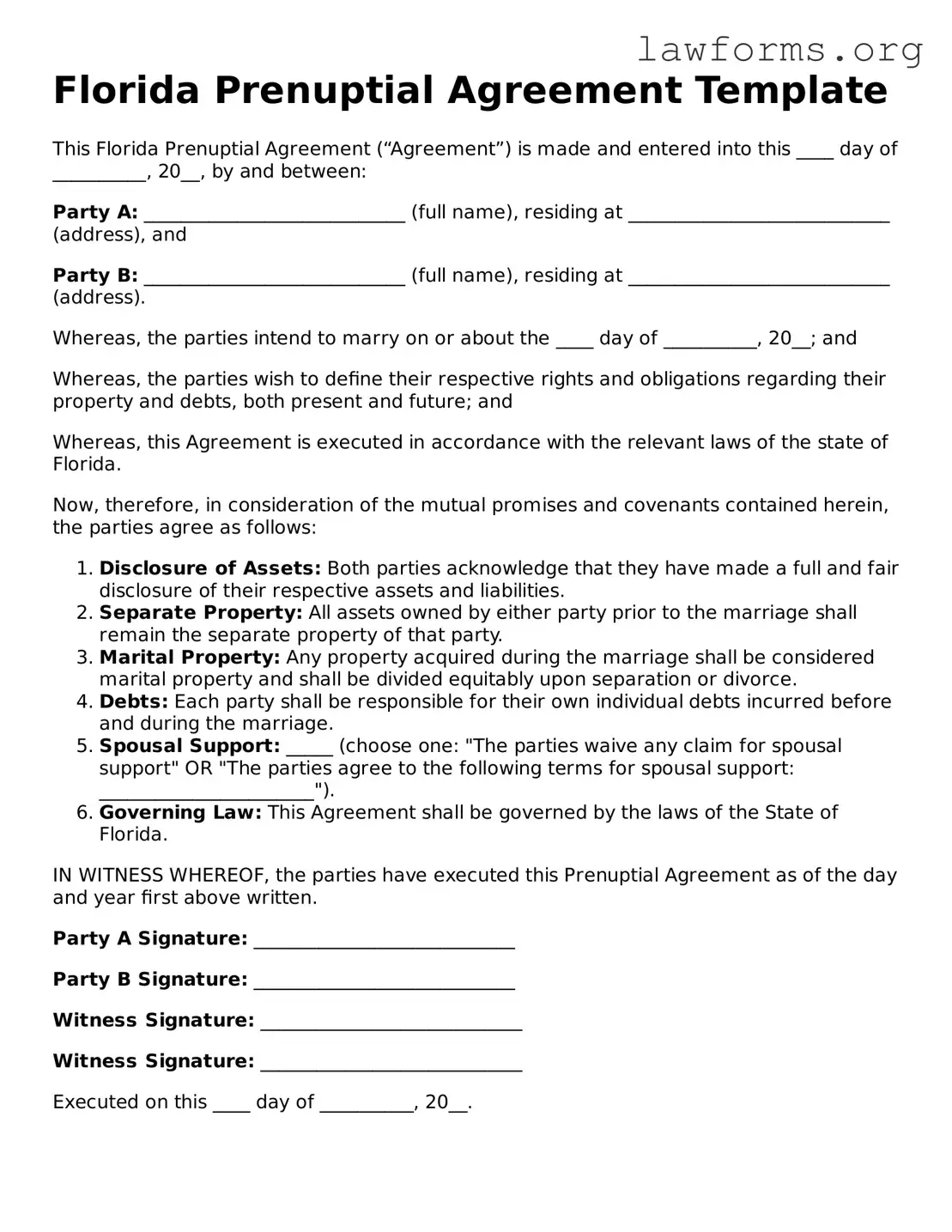

Preview - Florida Prenuptial Agreement Form

Florida Prenuptial Agreement Template

This Florida Prenuptial Agreement (“Agreement”) is made and entered into this ____ day of __________, 20__, by and between:

Party A: ____________________________ (full name), residing at ____________________________ (address), and

Party B: ____________________________ (full name), residing at ____________________________ (address).

Whereas, the parties intend to marry on or about the ____ day of __________, 20__; and

Whereas, the parties wish to define their respective rights and obligations regarding their property and debts, both present and future; and

Whereas, this Agreement is executed in accordance with the relevant laws of the state of Florida.

Now, therefore, in consideration of the mutual promises and covenants contained herein, the parties agree as follows:

- Disclosure of Assets: Both parties acknowledge that they have made a full and fair disclosure of their respective assets and liabilities.

- Separate Property: All assets owned by either party prior to the marriage shall remain the separate property of that party.

- Marital Property: Any property acquired during the marriage shall be considered marital property and shall be divided equitably upon separation or divorce.

- Debts: Each party shall be responsible for their own individual debts incurred before and during the marriage.

- Spousal Support: _____ (choose one: "The parties waive any claim for spousal support" OR "The parties agree to the following terms for spousal support: _______________________").

- Governing Law: This Agreement shall be governed by the laws of the State of Florida.

IN WITNESS WHEREOF, the parties have executed this Prenuptial Agreement as of the day and year first above written.

Party A Signature: ____________________________

Party B Signature: ____________________________

Witness Signature: ____________________________

Witness Signature: ____________________________

Executed on this ____ day of __________, 20__.

Key takeaways

When considering a Florida Prenuptial Agreement, it is essential to understand the key aspects involved in filling out and using the form. Here are some important takeaways:

- Understand the Purpose: A prenuptial agreement outlines how assets and debts will be managed during the marriage and in the event of a divorce.

- Full Disclosure: Both parties must fully disclose their financial situations. This includes income, assets, and debts to ensure fairness.

- Legal Requirements: The agreement must be in writing and signed by both parties. Oral agreements are not enforceable.

- Consider Timing: It is advisable to complete the agreement well before the wedding date to avoid any claims of coercion.

- Seek Legal Advice: Each party should consult with their own attorney to ensure their rights are protected and the agreement is valid.

- Review Regularly: Life circumstances change, so it's wise to review and possibly update the agreement periodically.

- Understand Enforceability: Courts may not enforce certain provisions, especially those that are deemed unfair or unconscionable.

By keeping these points in mind, individuals can better navigate the process of creating a prenuptial agreement in Florida.

Similar forms

Postnuptial Agreement: Similar to a prenuptial agreement, a postnuptial agreement is created after a couple gets married. It outlines the distribution of assets and responsibilities, ensuring both parties understand their rights and obligations during the marriage or in the event of a divorce.

- Horse Bill of Sale Form: When navigating the sale or purchase of horses, use the complete Horse Bill of Sale documentation guide to ensure all transactions are properly recorded and legally sound.

Separation Agreement: This document comes into play when a couple decides to live apart. A separation agreement details how assets, debts, and responsibilities will be managed during the separation period, much like a prenuptial agreement does before marriage.

Divorce Settlement Agreement: When a marriage ends, a divorce settlement agreement outlines how assets and debts will be divided. While a prenuptial agreement sets the stage for asset division, the divorce settlement finalizes those terms based on the couple's circumstances at the time of divorce.

Living Together Agreement: For couples who are cohabitating without marrying, a living together agreement serves a similar purpose. It clarifies the rights and responsibilities of each partner regarding shared property and finances, akin to a prenuptial agreement.

Will: Although not directly comparable, a will serves a similar function in terms of planning for the future. It outlines how a person's assets will be distributed upon their death, just as a prenuptial agreement addresses asset distribution in the event of divorce.