Attorney-Approved Promissory Note Template for the State of Florida

Form Specifications

| Fact Name | Description |

|---|---|

| Definition | A Florida Promissory Note is a written promise to pay a specified amount of money to a designated person or entity at a specified time. |

| Governing Law | The Florida Promissory Note is governed by Florida Statutes, particularly Chapter 673, which covers negotiable instruments. |

| Parties Involved | Typically, there are two parties involved: the borrower (maker) who promises to pay and the lender (payee) who receives the payment. |

| Interest Rates | The note can specify an interest rate, which may be fixed or variable, according to the agreement between the parties. |

| Payment Terms | Payment terms can vary. They may include a lump sum payment or installments over a specified period. |

| Default Consequences | If the borrower fails to make payments as agreed, the lender may have the right to take legal action to recover the owed amount. |

| Signature Requirement | The promissory note must be signed by the borrower to be legally binding. Witnesses or notarization may enhance its enforceability. |

Dos and Don'ts

When filling out the Florida Promissory Note form, it’s essential to approach the process with care. Here’s a helpful list of things you should and shouldn’t do to ensure accuracy and compliance.

- Do read the entire form carefully before starting to fill it out.

- Don’t leave any required fields blank; ensure all necessary information is provided.

- Do clearly print or type your information to avoid any misunderstandings.

- Don’t use abbreviations or slang; clarity is key in legal documents.

- Do double-check all figures and amounts for accuracy.

- Don’t sign the document until you are sure all information is correct.

- Do keep a copy of the completed form for your records.

- Don’t forget to consult with a legal professional if you have any questions about the terms.

Create Popular Promissory Note Forms for Different States

California Promissory Note Requirements - This form includes provisions for late payments and penalties if obligations are not met.

The Minnesota Motor Vehicle Bill of Sale form is a legal document that records the transfer of a vehicle from one person to another. It is an essential piece of paperwork that proves the sale and purchase transaction, providing details about the vehicle and the parties involved. This document safeguards both the seller's and the buyer's interests, ensuring a smooth transfer of ownership. For more information and to access a template, visit Formaid Org.

Texas Promissory Note - Some lenders may require notarization of a Promissory Note to enhance its enforceability.

Common mistakes

-

Incomplete Information: Many individuals fail to fill out all required fields. This can include missing names, addresses, or the loan amount. Leaving out any essential information can delay processing.

-

Incorrect Dates: Entering the wrong date can lead to confusion regarding the loan's start date or payment schedule. Ensure that the date reflects when the agreement is signed.

-

Improper Signatures: Some people forget to sign the document or have only one party sign when both are required. All necessary parties must sign to make the note legally binding.

-

Ambiguous Terms: Using vague language when describing the loan terms can create misunderstandings. Clearly outline the repayment schedule, interest rate, and any penalties for late payments.

-

Failure to Include Witnesses or Notary: Depending on the circumstances, some promissory notes may require a witness or notary signature. Neglecting this step can affect the enforceability of the document.

Documents used along the form

When entering into a loan agreement in Florida, a Promissory Note is often accompanied by several other documents to ensure clarity and legal protection for both parties involved. Here are some common forms that are frequently used alongside the Florida Promissory Note:

- Loan Agreement: This document outlines the terms of the loan, including the amount, interest rate, repayment schedule, and any collateral involved. It serves as a comprehensive guide to the responsibilities of both the lender and the borrower.

- Security Agreement: If the loan is secured by collateral, a Security Agreement details what assets are being pledged. It specifies the lender's rights in the event of default and provides clarity on how the collateral can be used or repossessed.

- Hold Harmless Agreement: This important legal document safeguards parties involved in various activities or events from liability claims. For more information, visit Forms Washington.

- Disclosure Statement: This document provides essential information about the loan terms, including fees, interest rates, and any potential penalties. It ensures that the borrower fully understands their obligations before signing the Promissory Note.

- Amortization Schedule: This schedule outlines the repayment plan over the life of the loan. It breaks down each payment into principal and interest, helping borrowers visualize their payment progress and total interest paid.

These documents work together to create a clear framework for the loan transaction, protecting the interests of both parties and facilitating a smoother borrowing process.

Misconceptions

When it comes to the Florida Promissory Note form, many people have misunderstandings that can lead to complications down the line. Clearing up these misconceptions can help individuals navigate their financial agreements with greater confidence.

- Misconception 1: A Promissory Note is the same as a loan agreement.

- Misconception 2: A Promissory Note does not require signatures.

- Misconception 3: The terms of a Promissory Note are not negotiable.

- Misconception 4: A Promissory Note is only for large loans.

- Misconception 5: A Promissory Note does not need to be notarized.

While both documents relate to borrowing money, a Promissory Note is a simpler document that outlines the borrower's promise to repay a specific amount. A loan agreement, on the other hand, often includes more detailed terms and conditions, such as collateral and repayment schedules.

Many believe that a Promissory Note can be valid without signatures. In reality, both the borrower and lender must sign the document for it to be legally binding. This signature serves as proof of agreement and intent.

Some people think that once a Promissory Note is drafted, the terms are set in stone. However, the terms can be negotiated before signing. This flexibility allows both parties to agree on interest rates, repayment schedules, and other important details.

Another common belief is that Promissory Notes are only necessary for significant amounts of money. In truth, they can be used for any loan amount, big or small. Whether it's a few hundred dollars or thousands, having a written record is beneficial.

While notarization is not always required for a Promissory Note to be valid, having it notarized adds an extra layer of security. It can help prevent disputes by providing evidence that the parties involved willingly entered into the agreement.

Preview - Florida Promissory Note Form

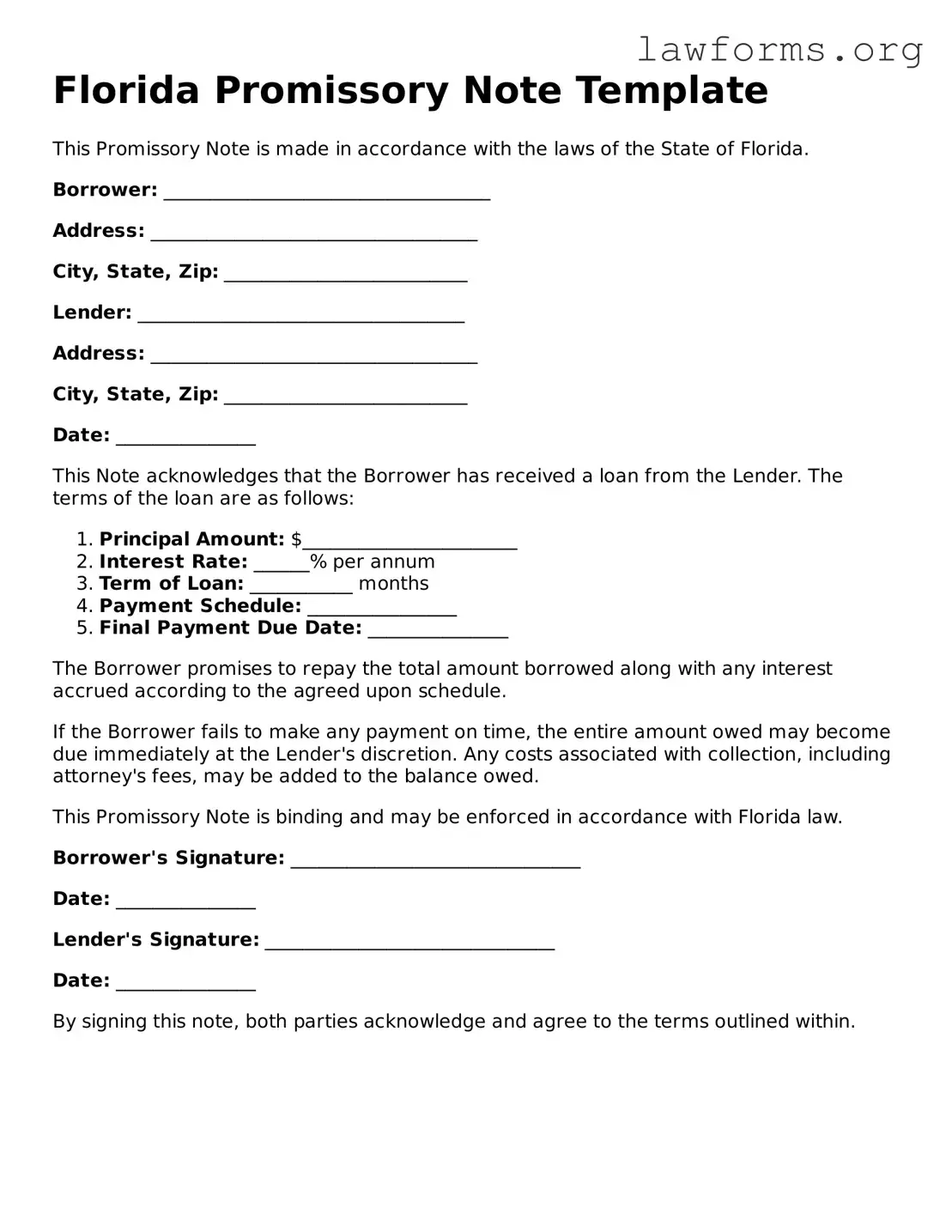

Florida Promissory Note Template

This Promissory Note is made in accordance with the laws of the State of Florida.

Borrower: ___________________________________

Address: ___________________________________

City, State, Zip: __________________________

Lender: ___________________________________

Address: ___________________________________

City, State, Zip: __________________________

Date: _______________

This Note acknowledges that the Borrower has received a loan from the Lender. The terms of the loan are as follows:

- Principal Amount: $_______________________

- Interest Rate: ______% per annum

- Term of Loan: ___________ months

- Payment Schedule: ________________

- Final Payment Due Date: _______________

The Borrower promises to repay the total amount borrowed along with any interest accrued according to the agreed upon schedule.

If the Borrower fails to make any payment on time, the entire amount owed may become due immediately at the Lender's discretion. Any costs associated with collection, including attorney's fees, may be added to the balance owed.

This Promissory Note is binding and may be enforced in accordance with Florida law.

Borrower's Signature: _______________________________

Date: _______________

Lender's Signature: _______________________________

Date: _______________

By signing this note, both parties acknowledge and agree to the terms outlined within.

Key takeaways

When filling out and using the Florida Promissory Note form, it is essential to keep several key points in mind to ensure clarity and enforceability. Below are important takeaways to consider:

- Accurate Information: Ensure that all names, addresses, and financial details are filled in accurately. Any discrepancies can lead to confusion or legal issues down the line.

- Clear Terms: The terms of the loan, including interest rates, payment schedules, and due dates, should be explicitly stated. This clarity helps both parties understand their obligations.

- Signatures Required: Both the borrower and the lender must sign the document. Without signatures, the note may not be considered valid or enforceable.

- Record Keeping: Keep a copy of the completed promissory note for your records. This document serves as proof of the agreement and can be crucial in case of disputes.

By adhering to these guidelines, individuals can navigate the process of creating a promissory note with confidence and security.

Similar forms

A Promissory Note is a financial document that outlines a borrower's promise to repay a loan under specified terms. Several other documents serve similar purposes or share characteristics with a Promissory Note. Here are six such documents:

- Loan Agreement: This document details the terms and conditions of a loan, including the amount, interest rate, and repayment schedule. Like a Promissory Note, it establishes a legal obligation for the borrower to repay the lender.

- Mortgage: A mortgage is a specific type of loan agreement used to finance real estate purchases. It includes a promise to repay the loan, similar to a Promissory Note, but also involves the property as collateral for the loan.

- Installment Agreement: This document outlines a repayment plan for a debt, often used for larger purchases. It specifies the payment amounts and schedule, akin to the structured repayment terms found in a Promissory Note.

- Durable Power of Attorney: A Durable Power of Attorney form is crucial for appointing an agent to make decisions on behalf of the principal, especially when they become incapacitated. For more details, you can visit californiadocsonline.com/durable-power-of-attorney-form/.

- Personal Guarantee: A personal guarantee is a promise made by an individual to repay a loan if the primary borrower defaults. This document shares the essence of a Promissory Note by creating a legal obligation for repayment.

- Commercial Lease Agreement: In a commercial lease, the tenant agrees to pay rent over a specified term. While it primarily pertains to rental payments, it can function similarly to a Promissory Note by establishing a commitment to make payments on time.

- Debt Acknowledgment Letter: This letter serves as a written acknowledgment of a debt owed, including the amount and repayment terms. It parallels a Promissory Note by confirming the borrower's obligation to repay the lender.