Attorney-Approved Quitclaim Deed Template for the State of Florida

Form Specifications

| Fact Name | Description |

|---|---|

| Definition | A quitclaim deed is a legal document used to transfer ownership of real estate from one party to another without any warranties. |

| Governing Law | In Florida, quitclaim deeds are governed by Chapter 689 of the Florida Statutes. |

| Purpose | This form is often used in situations such as transferring property between family members or clearing up title issues. |

| Consideration | A quitclaim deed does not require monetary consideration, but it is common to include a nominal amount. |

| Recording | To ensure the transfer is legally recognized, the deed must be recorded with the county clerk’s office where the property is located. |

| Limitations | Unlike warranty deeds, quitclaim deeds do not guarantee that the grantor has valid ownership of the property. |

| Tax Implications | Property transfers via quitclaim deeds may have tax implications, so consulting a tax professional is advisable. |

Dos and Don'ts

When filling out the Florida Quitclaim Deed form, it's important to follow certain guidelines to ensure the process goes smoothly. Here are some things you should and shouldn't do:

- Do provide accurate property information, including the legal description.

- Do ensure that all parties involved sign the form in front of a notary.

- Do double-check that the names of the grantor and grantee are spelled correctly.

- Do keep a copy of the completed deed for your records.

- Do file the deed with the appropriate county office after completion.

- Don't leave any sections of the form blank; fill in all required fields.

- Don't use outdated forms; make sure you have the latest version.

- Don't forget to check for any local requirements that may apply.

- Don't rush through the process; take your time to ensure accuracy.

- Don't ignore the importance of having the deed notarized.

Create Popular Quitclaim Deed Forms for Different States

How Do I File a Quit Claim Deed - A Quitclaim Deed can be beneficial in revising property ownership without a lengthy process.

Quitclaim Deed North Carolina - A Quitclaim Deed should be clearly understood by both parties before signing.

Quick Deed Meaning - A Quitclaim Deed is particularly useful when property is transferred through a court order.

Quitclaim Deed Form New Jersey - Perfect for scenarios where no money changes hands.

Common mistakes

-

Incorrect Names: One common mistake is entering the names of the grantor or grantee incorrectly. It is crucial to ensure that the names match exactly as they appear on legal documents.

-

Missing Signatures: The quitclaim deed must be signed by the grantor. Failing to include a signature can render the document invalid.

-

Inadequate Description of Property: A precise legal description of the property is essential. Vague or incomplete descriptions can lead to confusion or disputes later.

-

Improper Notarization: The deed must be notarized to be legally binding. Not having a notary public witness the signing can invalidate the document.

-

Omitting Consideration: The form requires a statement of consideration, which refers to what the grantee is giving in exchange for the property. Leaving this blank can create issues.

-

Failure to Record: After completing the quitclaim deed, it must be filed with the appropriate county office. Neglecting this step means the transfer of property may not be recognized legally.

Documents used along the form

When transferring property in Florida, the Quitclaim Deed is a common document used. However, it is often accompanied by other forms and documents that help clarify the transaction and ensure everything is in order. Below is a list of some important documents that may be needed alongside a Quitclaim Deed.

- Property Appraisal: This document provides an estimate of the property's value, which can be essential for both parties in understanding the worth of the property being transferred.

- Title Search Report: A title search identifies any liens, encumbrances, or claims against the property. This report ensures that the seller has the legal right to transfer ownership.

- Affidavit of Title: This sworn statement confirms that the seller is the rightful owner and provides information about the property's title history, ensuring transparency in the transaction.

- Transfer Tax Form: This form is required for reporting the transfer of property to the state. It may also involve the payment of transfer taxes based on the property's sale price.

- Closing Statement: This document outlines the final financial details of the transaction, including costs, fees, and the distribution of funds. It ensures both parties understand the financial aspects of the deal.

- Mortgage Release or Satisfaction: If the property has an existing mortgage, this document confirms that the mortgage has been paid off and releases the property from the lender's claim.

- Power of Attorney: If one party cannot be present for the transaction, a Power of Attorney allows another person to act on their behalf, ensuring the transfer can proceed smoothly.

- Notice of Intent to Transfer: This document informs interested parties, such as tenants or co-owners, about the upcoming property transfer, maintaining open communication and transparency.

Each of these documents plays a vital role in the property transfer process. By ensuring that all necessary forms are completed and submitted, both buyers and sellers can move forward with confidence, knowing their transaction is legally sound and properly documented.

Misconceptions

Understanding the Florida Quitclaim Deed is crucial for anyone involved in real estate transactions. However, several misconceptions can lead to confusion. Here are six common myths:

- A Quitclaim Deed Transfers Ownership Completely. Many believe that a quitclaim deed transfers full ownership of a property. While it does transfer whatever interest the grantor has, it does not guarantee that the grantor has any ownership at all.

- Quitclaim Deeds Are Only for Transfers Between Family Members. This is not true. While quitclaim deeds are often used in family transactions, they can be used in any situation where property interests need to be transferred, regardless of the relationship between the parties.

- Quitclaim Deeds Provide Title Insurance. Some think that using a quitclaim deed automatically comes with title insurance. In reality, a quitclaim deed does not provide any warranties or guarantees regarding the title. Buyers should seek title insurance separately.

- Using a Quitclaim Deed Is Complicated. Many people assume that the process is overly complex. In fact, completing a quitclaim deed is relatively straightforward, requiring only the correct form and signatures.

- Quitclaim Deeds Are Irrevocable. There is a misconception that once a quitclaim deed is executed, it cannot be undone. In reality, the parties involved can agree to reverse the transaction, but this may require additional legal documentation.

- All Quitclaim Deeds Are the Same. Not all quitclaim deeds are identical. Variations exist based on specific circumstances and state laws. It's essential to use the correct form for Florida to ensure compliance with local regulations.

Being aware of these misconceptions can help individuals make informed decisions regarding property transactions in Florida. Always consult a professional when in doubt.

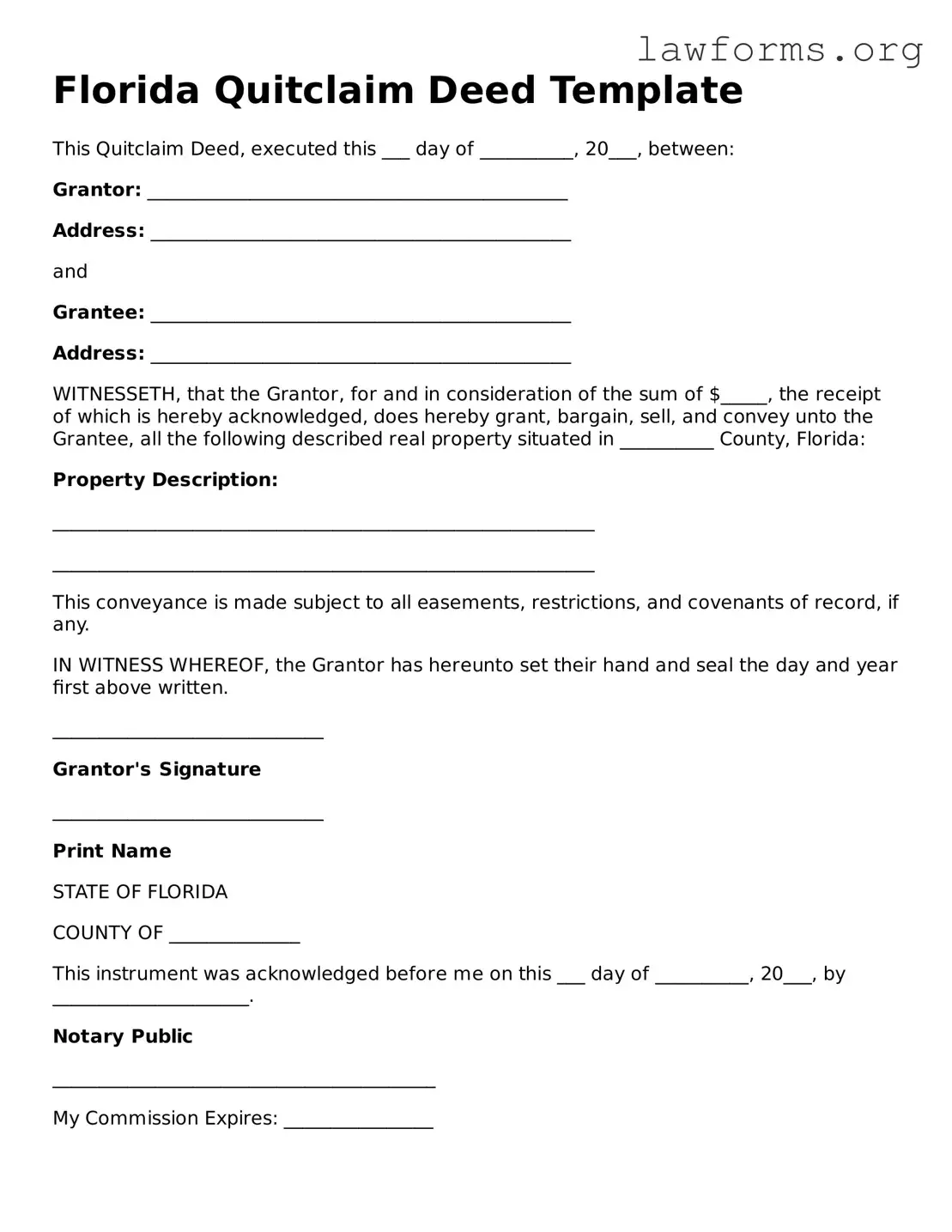

Preview - Florida Quitclaim Deed Form

Florida Quitclaim Deed Template

This Quitclaim Deed, executed this ___ day of __________, 20___, between:

Grantor: _____________________________________________

Address: _____________________________________________

and

Grantee: _____________________________________________

Address: _____________________________________________

WITNESSETH, that the Grantor, for and in consideration of the sum of $_____, the receipt of which is hereby acknowledged, does hereby grant, bargain, sell, and convey unto the Grantee, all the following described real property situated in __________ County, Florida:

Property Description:

__________________________________________________________

__________________________________________________________

This conveyance is made subject to all easements, restrictions, and covenants of record, if any.

IN WITNESS WHEREOF, the Grantor has hereunto set their hand and seal the day and year first above written.

_____________________________

Grantor's Signature

_____________________________

Print Name

STATE OF FLORIDA

COUNTY OF ______________

This instrument was acknowledged before me on this ___ day of __________, 20___, by _____________________.

Notary Public

_________________________________________

My Commission Expires: ________________

Key takeaways

When filling out and using the Florida Quitclaim Deed form, there are several important aspects to keep in mind. These takeaways will help ensure a smooth process and proper handling of the deed.

- Understanding the Purpose: A Quitclaim Deed is primarily used to transfer ownership of property from one party to another without guaranteeing that the title is clear. It is often used among family members or in divorce settlements.

- Completing the Form: All required fields must be filled out accurately. This includes the names of both the grantor (the person transferring the property) and the grantee (the person receiving the property), as well as a description of the property.

- Notarization Requirement: The Quitclaim Deed must be signed in the presence of a notary public. This step is crucial, as it verifies the identities of the parties involved and ensures that the document is legally binding.

- Filing with the County: After the deed is completed and notarized, it should be filed with the appropriate county clerk’s office. This action officially records the transfer of ownership and protects the rights of the new owner.

- Consulting with Professionals: It may be beneficial to seek advice from a real estate attorney or a professional familiar with property laws in Florida. They can provide guidance and ensure that all legal requirements are met.

Similar forms

- Warranty Deed: Similar to a quitclaim deed, a warranty deed transfers property ownership. However, it provides a guarantee that the seller holds clear title to the property and has the right to sell it. This assurance protects the buyer against any future claims on the property.

- Grant Deed: A grant deed also conveys ownership of real estate. Like a quitclaim deed, it transfers title without warranty. However, it guarantees that the seller has not sold the property to anyone else and that there are no undisclosed encumbrances.

- Deed of Trust: This document secures a loan by transferring the title of the property to a trustee until the borrower repays the debt. While it serves a different purpose than a quitclaim deed, both involve the transfer of property rights.

- Real Estate Purchase Agreement: A real estate purchase agreement outlines the terms of a property sale. Although it does not transfer ownership like a quitclaim deed, it is essential in initiating the process of property transfer, detailing the rights and obligations of both parties.

- Articles of Incorporation: The New York Articles of Incorporation is essential for corporations in the state, setting the framework for legal recognition and protection of personal assets. For guidance on this process, refer to Formaid Org.

- Life Estate Deed: A life estate deed allows an individual to retain ownership of a property during their lifetime, while transferring future ownership to another party. It shares similarities with a quitclaim deed in that it involves the transfer of property rights, but it also includes specific conditions regarding the life tenant's rights.