Attorney-Approved Real Estate Purchase Agreement Template for the State of Florida

Form Specifications

| Fact Name | Description |

|---|---|

| Governing Law | The Florida Real Estate Purchase Agreement is governed by Florida state law. |

| Purpose | This form outlines the terms and conditions for the purchase of real estate in Florida. |

| Parties Involved | The agreement includes the buyer and seller as the primary parties. |

| Property Description | A detailed description of the property being sold is required. |

| Purchase Price | The total purchase price must be clearly stated in the agreement. |

| Earnest Money | The agreement typically includes a provision for earnest money to be deposited. |

| Closing Date | A closing date must be specified, indicating when the transaction will be finalized. |

Dos and Don'ts

When filling out the Florida Real Estate Purchase Agreement form, it is essential to follow certain guidelines to ensure accuracy and compliance. Here’s a list of things you should and shouldn't do:

- Do read the entire agreement carefully before filling it out.

- Do provide accurate and complete information about the property.

- Do include all necessary contingencies to protect your interests.

- Do consult with a real estate attorney if you have questions.

- Don't rush through the form; take your time to ensure everything is correct.

- Don't leave any blanks unless instructed; every section should be filled out.

- Don't sign the agreement until you fully understand all terms and conditions.

Create Popular Real Estate Purchase Agreement Forms for Different States

How to Make a Purchase Agreement - Guides buyers and sellers on what to expect in the closing process.

North Carolina Offer to Purchase and Contract Pdf - The form may require additional forms, like a lead-based paint disclosure.

A prenuptial agreement form in Ohio is a legal document that couples complete before marriage to outline the division of assets and responsibilities in the event of divorce or separation. This agreement helps protect individual interests and provides clarity on financial matters. Understanding the importance of this form can lead to a more secure and transparent relationship, and for those interested in carrying out the process online, resources like Ohio PDF Forms can be invaluable.

Midland Title - Many Real Estate Purchase Agreements also include the method of payment, whether it’s cash, financing, or a combination.

Common mistakes

-

Not Including All Parties Involved: One common mistake is failing to list all buyers and sellers. Everyone involved in the transaction must be clearly identified to avoid confusion later.

-

Incorrect Property Description: Providing an inaccurate or incomplete description of the property can lead to legal issues. Make sure to include the correct address, parcel number, and any relevant details.

-

Overlooking Contingencies: Many buyers forget to include necessary contingencies, such as financing or inspection clauses. These protections are essential for ensuring that the deal can be canceled if certain conditions are not met.

-

Ignoring the Closing Date: Failing to specify a closing date can create uncertainty. It’s important to agree on a timeline that works for all parties involved.

-

Not Reviewing the Purchase Price: Double-checking the purchase price is crucial. Errors in this section can lead to disputes and misunderstandings later in the process.

-

Missing Signatures: All parties must sign the agreement for it to be legally binding. Forgetting a signature can invalidate the contract.

-

Neglecting to Include Earnest Money: Failing to specify the amount of earnest money can complicate negotiations. This deposit shows the seller that the buyer is serious about the purchase.

-

Not Consulting a Professional: Attempting to fill out the agreement without professional guidance can lead to mistakes. Consulting a real estate agent or attorney can help ensure the form is completed correctly.

Documents used along the form

When engaging in a real estate transaction in Florida, several key documents complement the Florida Real Estate Purchase Agreement. These forms help ensure clarity and protect the interests of all parties involved. Below is a list of commonly used documents.

- Seller's Disclosure Statement: This document requires the seller to disclose any known issues with the property, such as structural problems or environmental hazards. Transparency helps buyers make informed decisions.

- Lead-Based Paint Disclosure: Required for homes built before 1978, this form informs buyers about potential lead paint hazards. It is crucial for the safety of occupants, especially children.

- Title Commitment: This document outlines the terms of the title insurance policy. It confirms the seller's legal right to sell the property and identifies any liens or encumbrances.

- Closing Disclosure: Provided at least three days before closing, this form details the final loan terms and closing costs. It ensures that buyers understand their financial obligations.

- Property Appraisal Report: An appraisal assesses the property's market value. This report is often required by lenders to ensure that the loan amount aligns with the property's worth.

- Home Inspection Report: Conducted by a professional inspector, this report identifies any defects or necessary repairs in the home. It can influence the buyer's decision or negotiations.

- Mortgage Application: This form is submitted to lenders to request financing for the purchase. It includes personal financial information and details about the property.

- Domestic Violence Restraining Order Documents: If there are issues of domestic violence involved, it’s crucial to complete the necessary legal forms, such as the https://californiadocsonline.com/california-dv-260-form, to ensure that protections are in place for affected individuals.

- Purchase Agreement Addendum: This document modifies the original purchase agreement, adding specific terms or conditions that were not included in the initial contract.

Understanding these documents is essential for a smooth transaction. Each plays a vital role in protecting the interests of buyers and sellers alike. By being informed, parties can navigate the process with confidence.

Misconceptions

Understanding the Florida Real Estate Purchase Agreement is essential for anyone involved in a property transaction in the state. However, several misconceptions can lead to confusion. Here are four common misconceptions:

- It is a standard form that requires no customization. Many people believe that the Florida Real Estate Purchase Agreement is a one-size-fits-all document. In reality, while it contains standard clauses, each transaction has unique elements that may require adjustments to meet specific needs.

- Signing the agreement is the final step in the buying process. Some individuals think that once they sign the agreement, the deal is complete. However, this is just the beginning. The agreement typically includes contingencies that must be satisfied before the sale can be finalized.

- Only buyers need to understand the agreement. There is a common belief that only the buyer should worry about the terms of the purchase agreement. In truth, sellers must also understand the document, as it outlines their rights and obligations as well.

- All terms are negotiable. While many aspects of the agreement can be negotiated, some terms, such as legal requirements and state regulations, are non-negotiable. It is important to recognize which elements can be altered and which cannot.

By addressing these misconceptions, individuals can navigate the Florida Real Estate Purchase Agreement with greater clarity and confidence.

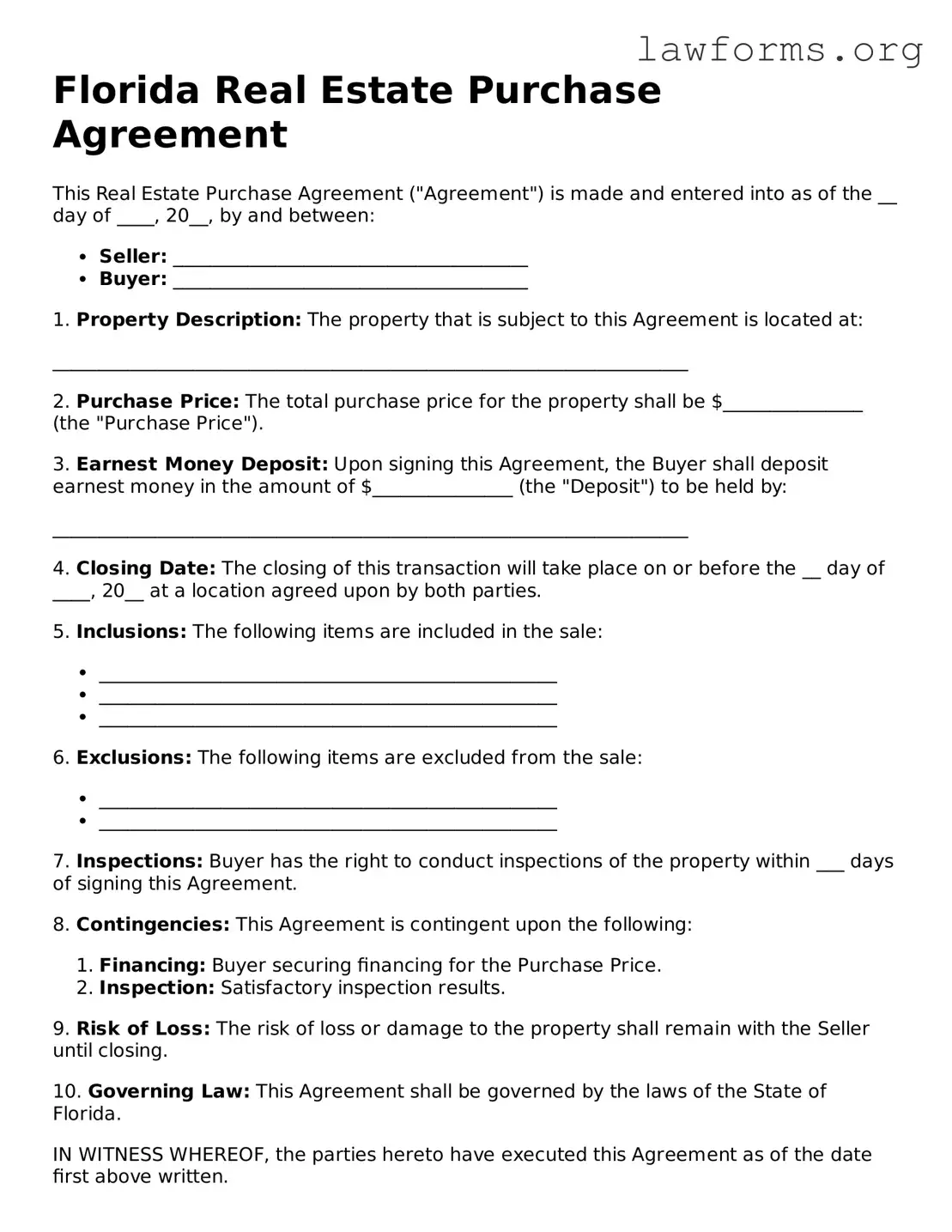

Preview - Florida Real Estate Purchase Agreement Form

Florida Real Estate Purchase Agreement

This Real Estate Purchase Agreement ("Agreement") is made and entered into as of the __ day of ____, 20__, by and between:

- Seller: ______________________________________

- Buyer: ______________________________________

1. Property Description: The property that is subject to this Agreement is located at:

____________________________________________________________________

2. Purchase Price: The total purchase price for the property shall be $_______________ (the "Purchase Price").

3. Earnest Money Deposit: Upon signing this Agreement, the Buyer shall deposit earnest money in the amount of $_______________ (the "Deposit") to be held by:

____________________________________________________________________

4. Closing Date: The closing of this transaction will take place on or before the __ day of ____, 20__ at a location agreed upon by both parties.

5. Inclusions: The following items are included in the sale:

- _________________________________________________

- _________________________________________________

- _________________________________________________

6. Exclusions: The following items are excluded from the sale:

- _________________________________________________

- _________________________________________________

7. Inspections: Buyer has the right to conduct inspections of the property within ___ days of signing this Agreement.

8. Contingencies: This Agreement is contingent upon the following:

- Financing: Buyer securing financing for the Purchase Price.

- Inspection: Satisfactory inspection results.

9. Risk of Loss: The risk of loss or damage to the property shall remain with the Seller until closing.

10. Governing Law: This Agreement shall be governed by the laws of the State of Florida.

IN WITNESS WHEREOF, the parties hereto have executed this Agreement as of the date first above written.

______________________________ ______________________________

Seller Signature Buyer Signature

Date: ________________________ Date: ________________________

Key takeaways

When engaging in a real estate transaction in Florida, understanding the Real Estate Purchase Agreement form is crucial. Here are nine key takeaways to consider:

- Parties Involved: Clearly identify the buyer and seller. This includes full legal names and contact information to avoid any confusion.

- Property Description: Provide a detailed description of the property. Include the address, parcel number, and any relevant details that distinguish the property.

- Purchase Price: Clearly state the agreed-upon purchase price. This should be prominently displayed to ensure both parties are aligned.

- Earnest Money Deposit: Specify the amount of the earnest money deposit. This shows the buyer's commitment and should be held in a trust account.

- Financing Contingency: If applicable, outline any financing contingencies. This includes details on loan approval and the timeline for securing financing.

- Inspection Period: Include a specified period for property inspections. This allows the buyer to assess the property’s condition before finalizing the purchase.

- Closing Date: Define the closing date. This is when the transaction is finalized and ownership is transferred, so clarity is essential.

- Disclosures: Be aware of required disclosures. Sellers must inform buyers of any known issues with the property, such as structural problems or environmental hazards.

- Default and Remedies: Understand the consequences of default. The agreement should outline what happens if either party fails to meet their obligations.

By paying close attention to these elements, both buyers and sellers can navigate the Florida Real Estate Purchase Agreement with greater confidence and clarity.

Similar forms

- Lease Agreement: This document outlines the terms under which a tenant can occupy a property. Similar to a purchase agreement, it details the rights and responsibilities of both parties, including payment terms and duration of occupancy.

- Option to Purchase Agreement: This agreement grants a potential buyer the right to purchase a property at a predetermined price within a specific timeframe. It shares similarities with the purchase agreement by specifying terms and conditions for the transaction.

- Sales Contract: A sales contract is used for various types of sales, including real estate. Like the purchase agreement, it outlines the terms of the sale, including price, payment method, and contingencies.

- Escrow Agreement: This document establishes an arrangement where a third party holds funds or documents until certain conditions are met. It complements the purchase agreement by ensuring that all parties fulfill their obligations before the transaction is completed.

- Disclosure Statement: Often required in real estate transactions, this document informs buyers of any known issues with the property. It is similar to the purchase agreement in that it aims to protect the interests of the buyer by providing essential information.

- Tractor Bill of Sale: This form is essential for confirming the transfer of ownership of a tractor in Georgia, providing a legal record of the sale. For more information, visit georgiaform.com.

- Title Report: A title report provides details about the ownership history of a property and any liens or encumbrances. It is closely related to the purchase agreement, as it helps ensure that the buyer receives clear title to the property.

- Home Inspection Report: This report assesses the condition of a property before purchase. It is similar to the purchase agreement in that it can include contingencies based on the findings of the inspection, allowing buyers to make informed decisions.