Attorney-Approved Transfer-on-Death Deed Template for the State of Florida

Form Specifications

| Fact Name | Description |

|---|---|

| What It Is | A Transfer-on-Death Deed allows property owners in Florida to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | The use of Transfer-on-Death Deeds in Florida is governed by Florida Statutes, specifically Section 732.4015. |

| Benefits | This deed simplifies the transfer process, avoids probate costs, and allows for a straightforward transfer of property to heirs. |

| Requirements | The deed must be signed, notarized, and recorded in the county where the property is located to be valid. |

Dos and Don'ts

When filling out the Florida Transfer-on-Death Deed form, there are several important considerations to keep in mind. Below is a list of things you should and shouldn't do to ensure the process goes smoothly.

- Do ensure that you are eligible to use the Transfer-on-Death Deed by confirming that the property is not subject to any liens or encumbrances.

- Don't forget to include the legal description of the property. This is crucial for identifying the specific property being transferred.

- Do clearly state the name of the beneficiary. Make sure that the name is spelled correctly to avoid any confusion later.

- Don't overlook the requirement for signatures. Both the property owner and a witness must sign the deed for it to be valid.

- Do consider having the deed notarized. While not always required, notarization can add an extra layer of authenticity.

- Don't use vague language. Be as clear and specific as possible to avoid potential disputes in the future.

- Do file the completed deed with the county clerk's office where the property is located. This step is essential for the deed to take effect.

- Don't forget to keep a copy of the deed for your records. Having a copy can be helpful for future reference.

- Do review the deed thoroughly before submission. Double-check all information for accuracy to prevent any issues.

- Don't rush the process. Take your time to ensure that every detail is correct and that you understand the implications of the deed.

Create Popular Transfer-on-Death Deed Forms for Different States

Transfer on Death - Using a Transfer-on-Death Deed can help avoid family disputes by clearly outlining who receives the property after death.

Tod Deed California - A Transfer-on-Death Deed allows property owners to transfer real estate to beneficiaries upon their passing without going through probate.

How to Transfer Deed of House - Specific wording in the deed is crucial to ensure clarity for all parties.

The importance of having an Operating Agreement for LLCs in Ohio cannot be overstated, as it provides clarity on various aspects of the business, including decision-making processes and the roles of members. By ensuring that all parties understand their obligations, the agreement helps prevent misunderstandings and disputes. For those looking to create or update their agreement, a good resource can be found at Ohio PDF Forms, which offers essential tools for forming these important documents.

Where Can I Get a Tod Form - This deed provides peace of mind knowing your property will go directly to your chosen beneficiaries.

Common mistakes

-

Inaccurate Property Description: Failing to provide a clear and precise description of the property can lead to significant issues. Ensure that the legal description matches what is recorded in public records. This includes the correct parcel number and any relevant details that identify the property.

-

Incorrect Signatures: The deed must be signed by the owner(s) of the property. If the signatures are missing or if someone who is not an owner signs the document, it will be deemed invalid. All owners must sign the deed in front of a notary.

-

Failure to Record the Deed: After completing the form, it must be recorded with the county clerk’s office. Neglecting this step means that the deed may not be enforceable upon the owner’s death. Recording establishes the legal validity of the transfer.

-

Not Understanding Beneficiary Designations: Choosing the wrong beneficiaries or failing to name them can create confusion or disputes among heirs. It is crucial to clearly identify who will receive the property and ensure that their information is accurate.

Documents used along the form

When considering the Florida Transfer-on-Death Deed, several other documents may be relevant to ensure a smooth transfer of property and clarity in estate planning. Below is a list of forms and documents commonly used in conjunction with the Transfer-on-Death Deed.

- Last Will and Testament: This document outlines how a person wishes their assets to be distributed after their death. It may include provisions for guardianship of minor children.

- Durable Power of Attorney: This form allows someone to make financial decisions on behalf of another person if they become incapacitated.

- Health Care Proxy: This document designates an individual to make medical decisions for someone who is unable to do so themselves.

- Living Will: This legal document expresses a person's wishes regarding medical treatment and end-of-life care.

- Affidavit of Heirship: This form helps establish the rightful heirs to a deceased person's estate, particularly when no will exists.

- Quitclaim Deed: This document is used to transfer ownership of property without guaranteeing that the title is clear, often used between family members.

- Property Tax Exemption Application: This application allows property owners to apply for tax exemptions, which can affect the estate's financial standing.

- Estate Inventory Form: This document lists all assets and liabilities of the deceased, providing a clear picture of the estate's value.

- California Civil Form: For those dealing with estate issues in California, the californiadocsonline.com/california-civil-form/ is essential for initiating civil cases, helping the court to effectively categorize and manage cases.

- Probate Petition: This form initiates the legal process of settling a deceased person's estate, ensuring that debts are paid and assets are distributed according to the will or state law.

Using these documents in conjunction with the Florida Transfer-on-Death Deed can help clarify intentions and facilitate the transfer of property. Each document plays a crucial role in ensuring that wishes are honored and that the estate is managed effectively.

Misconceptions

Understanding the Florida Transfer-on-Death Deed (TOD) form can be challenging due to common misconceptions. Here are six prevalent misunderstandings about this legal document:

-

The TOD deed avoids probate entirely.

While the TOD deed allows for the direct transfer of property to beneficiaries upon the owner's death, it does not eliminate probate for all assets. Other assets may still require probate proceedings.

-

Only married couples can use a TOD deed.

This is incorrect. Any individual who owns property in Florida can execute a TOD deed, regardless of marital status.

-

A TOD deed must be notarized and witnessed.

In Florida, a TOD deed must be signed by the owner and recorded with the county clerk, but it does not require notarization or witnesses to be valid.

-

Beneficiaries have immediate rights to the property.

Beneficiaries do not gain rights to the property until the owner's death. Until that time, the owner retains full control over the property.

-

A TOD deed can be revoked only through a formal process.

In Florida, the owner can revoke a TOD deed at any time by executing a new deed or by recording a written revocation. This process is straightforward and does not require court intervention.

-

The TOD deed is the same as a will.

Although both documents deal with the transfer of property, a TOD deed specifically transfers property outside of probate, while a will goes through the probate process.

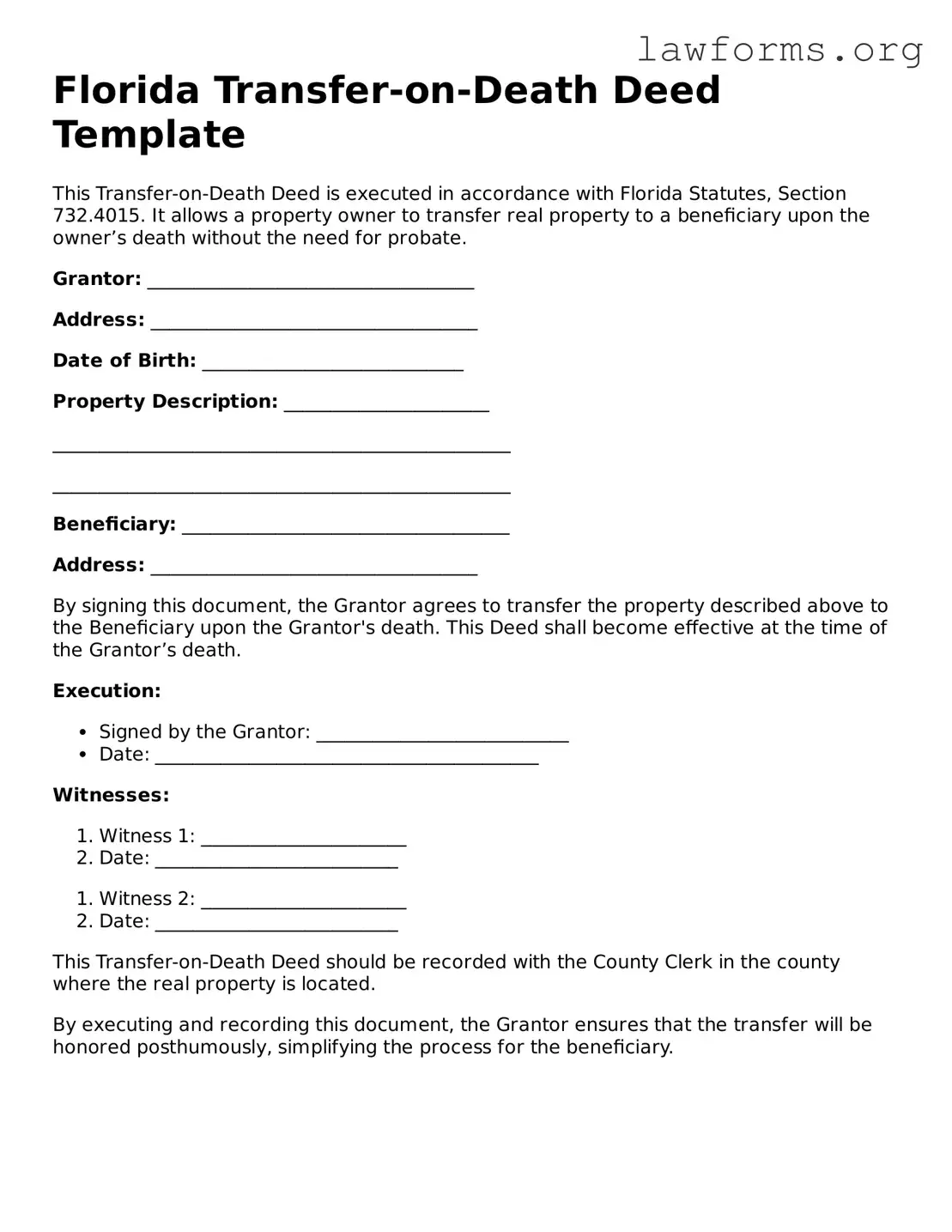

Preview - Florida Transfer-on-Death Deed Form

Florida Transfer-on-Death Deed Template

This Transfer-on-Death Deed is executed in accordance with Florida Statutes, Section 732.4015. It allows a property owner to transfer real property to a beneficiary upon the owner’s death without the need for probate.

Grantor: ___________________________________

Address: ___________________________________

Date of Birth: ____________________________

Property Description: ______________________

_________________________________________________

_________________________________________________

Beneficiary: ___________________________________

Address: ___________________________________

By signing this document, the Grantor agrees to transfer the property described above to the Beneficiary upon the Grantor's death. This Deed shall become effective at the time of the Grantor’s death.

Execution:

- Signed by the Grantor: ___________________________

- Date: _________________________________________

Witnesses:

- Witness 1: ______________________

- Date: __________________________

- Witness 2: ______________________

- Date: __________________________

This Transfer-on-Death Deed should be recorded with the County Clerk in the county where the real property is located.

By executing and recording this document, the Grantor ensures that the transfer will be honored posthumously, simplifying the process for the beneficiary.

Key takeaways

Understanding the Florida Transfer-on-Death Deed form is essential for effective estate planning. This deed allows property owners to transfer their real estate to beneficiaries upon their death without the need for probate. Here are some key takeaways to consider:

- The Transfer-on-Death Deed must be executed in writing and signed by the property owner.

- It is crucial to name the beneficiaries clearly to avoid confusion later.

- This deed does not transfer ownership until the property owner passes away, allowing for full control during their lifetime.

- To be valid, the deed must be recorded in the county where the property is located.

- Beneficiaries can be individuals or entities, such as trusts or organizations.

- It is advisable to consult with a legal professional to ensure compliance with all requirements and to address any specific circumstances.

- Revocation of the deed is possible; however, it must be done in writing and recorded to be effective.

Similar forms

- Last Will and Testament: A document that outlines how a person's assets should be distributed after their death. Like a Transfer-on-Death Deed, it allows for the transfer of property, but it must go through probate, which can be time-consuming and costly.

- Living Trust: A legal arrangement where a person places their assets into a trust during their lifetime. Similar to a Transfer-on-Death Deed, a living trust allows for the direct transfer of property upon death, avoiding probate, but it requires more management and oversight.

- Beneficiary Designation: Commonly used for financial accounts and insurance policies, this document allows individuals to name beneficiaries who will receive assets upon their death. Like the Transfer-on-Death Deed, it bypasses probate, ensuring quicker access to funds for beneficiaries.

- Joint Tenancy with Right of Survivorship: This property ownership arrangement allows co-owners to inherit the property automatically upon the death of one owner. Similar to a Transfer-on-Death Deed, it facilitates a seamless transfer without the need for probate.

- Payable-on-Death (POD) Accounts: These bank accounts allow the account holder to designate a beneficiary who will receive the funds upon their death. Like the Transfer-on-Death Deed, POD accounts provide a straightforward way to transfer assets directly to beneficiaries without probate.

- Transfer-on-Death Registration for Securities: This allows individuals to designate a beneficiary for their stocks and bonds. Similar to the Transfer-on-Death Deed, it ensures that the assets transfer directly to the named individual upon death, avoiding the probate process.

- Boat Bill of Sale Form: To securely transfer boat ownership, ensure you reference this thorough Boat Bill of Sale form guide to meet all legal requirements.

- Life Estate Deed: This deed allows a person to retain the right to live in a property during their lifetime, with the property passing directly to a named beneficiary upon death. Like the Transfer-on-Death Deed, it facilitates a direct transfer while allowing the original owner to maintain control during their lifetime.