Fill Out a Valid Free And Invoice Pdf Template

Form Specs

| Fact Name | Description |

|---|---|

| Form Purpose | The Free and Invoice PDF form is designed to provide a clear, professional template for invoicing clients. |

| File Format | This form is typically available in PDF format, ensuring compatibility across various devices and platforms. |

| Customization | Users can customize the form with their business logo and contact information, enhancing brand visibility. |

| State-Specific Regulations | Different states may have specific requirements for invoicing. For example, California requires inclusion of tax identification numbers. |

| Legal Compliance | Invoicing must comply with local laws, including those related to sales tax and consumer protection. |

| Accessibility | The PDF format allows for easy sharing via email or print, making it accessible to clients and vendors alike. |

| Record Keeping | Maintaining copies of sent invoices is crucial for financial record-keeping and tax purposes. |

Dos and Don'ts

When filling out the Free And Invoice Pdf form, it is essential to follow certain guidelines to ensure accuracy and compliance. Here are some dos and don'ts to consider:

- Do read all instructions carefully before starting.

- Do use clear and legible handwriting or type your responses.

- Do double-check all figures and calculations for accuracy.

- Do keep a copy of the completed form for your records.

- Don't leave any required fields blank; fill in all necessary information.

- Don't use correction fluid or tape; if you make a mistake, start over.

- Don't submit the form without reviewing it for errors.

- Don't forget to sign and date the form where required.

Other PDF Documents

Dd Form 2656 March 2022 - Filing the DD 2656 is a responsible action that all military members should take seriously.

Cg 2010 - Additional exclusions apply regarding completed work and usage by others.

Army Form for Awards - It is crucial to provide accurate dates related to the period of the award being recommended.

Common mistakes

-

Missing Contact Information: Many individuals forget to include their phone number or email address. This can lead to delays in communication and processing.

-

Incorrect Invoice Dates: It's common to see people enter the wrong date on invoices. This can create confusion about payment timelines.

-

Not Specifying Payment Terms: Failing to clearly outline payment terms can result in misunderstandings. Specify when payments are due to avoid issues later.

-

Omitting Item Descriptions: Some forget to provide detailed descriptions of the services or products. Clear descriptions help clients understand what they are paying for.

-

Incorrect Calculations: Simple math errors can happen when adding up totals. Double-check your calculations to ensure accuracy.

-

Not Including Tax Information: If applicable, failing to include tax can lead to unexpected costs for clients. Always clarify if tax is included in the total amount.

-

Using Unprofessional Language: A casual tone may not convey the seriousness of the transaction. Maintain professionalism throughout the form.

-

Neglecting to Proofread: Spelling or grammatical errors can undermine credibility. Take a moment to review the form before submission.

Documents used along the form

When managing financial transactions, several forms and documents complement the Free And Invoice PDF form. Each document plays a crucial role in ensuring clarity and accuracy in business dealings. Below is a list of commonly used forms that can enhance the invoicing process.

- Purchase Order (PO): This document is issued by a buyer to a seller, indicating the types and quantities of products or services required. It serves as a formal request and helps in tracking orders.

- Sales Receipt: A sales receipt is proof of purchase that a seller provides to a buyer. It includes details such as the date of the transaction, items purchased, and the total amount paid.

- Payment Voucher: This document is used to authorize a payment to a vendor or supplier. It includes information about the payment amount, purpose, and the recipient's details.

- Credit Note: A credit note is issued by a seller to a buyer, indicating a reduction in the amount owed. It is often used when goods are returned or when there is an error in the original invoice.

- Statement of Account: This document summarizes all transactions between a buyer and seller over a specific period. It provides a clear overview of outstanding balances and payment history.

- Delivery Note: A delivery note accompanies goods shipped to a buyer. It lists the items delivered and confirms that the delivery has occurred, serving as a record for both parties.

- Work Order: A work order outlines the specifics of a job or service to be performed. It details the scope of work, timelines, and costs, ensuring that both parties are aligned on expectations.

- Service Agreement: This document defines the terms and conditions of a service provided. It outlines responsibilities, payment terms, and the duration of the service, protecting both parties involved.

Utilizing these documents alongside the Free And Invoice PDF form can streamline financial transactions and enhance communication between buyers and sellers. Each document serves a distinct purpose, contributing to a well-organized and efficient invoicing process.

Misconceptions

There are several misconceptions about the Free And Invoice PDF form that can lead to confusion. Here are four common misunderstandings:

- It is only for businesses. Many people believe that the Free And Invoice PDF form is exclusively designed for businesses. In reality, anyone can use this form, whether you are a freelancer, a contractor, or an individual providing services.

- It requires payment to access. Some think that this form comes with a fee. However, it is completely free to download and use. This accessibility allows everyone to manage invoices without financial barriers.

- It is complicated to fill out. Many assume that the form is difficult to complete. In truth, it is user-friendly and straightforward. Most fields are clearly labeled, making it easy to input the necessary information.

- It can only be used for specific types of services. There is a belief that the form is limited to certain services or products. This is not the case. The Free And Invoice PDF form can be customized for various services, allowing users to tailor it to their needs.

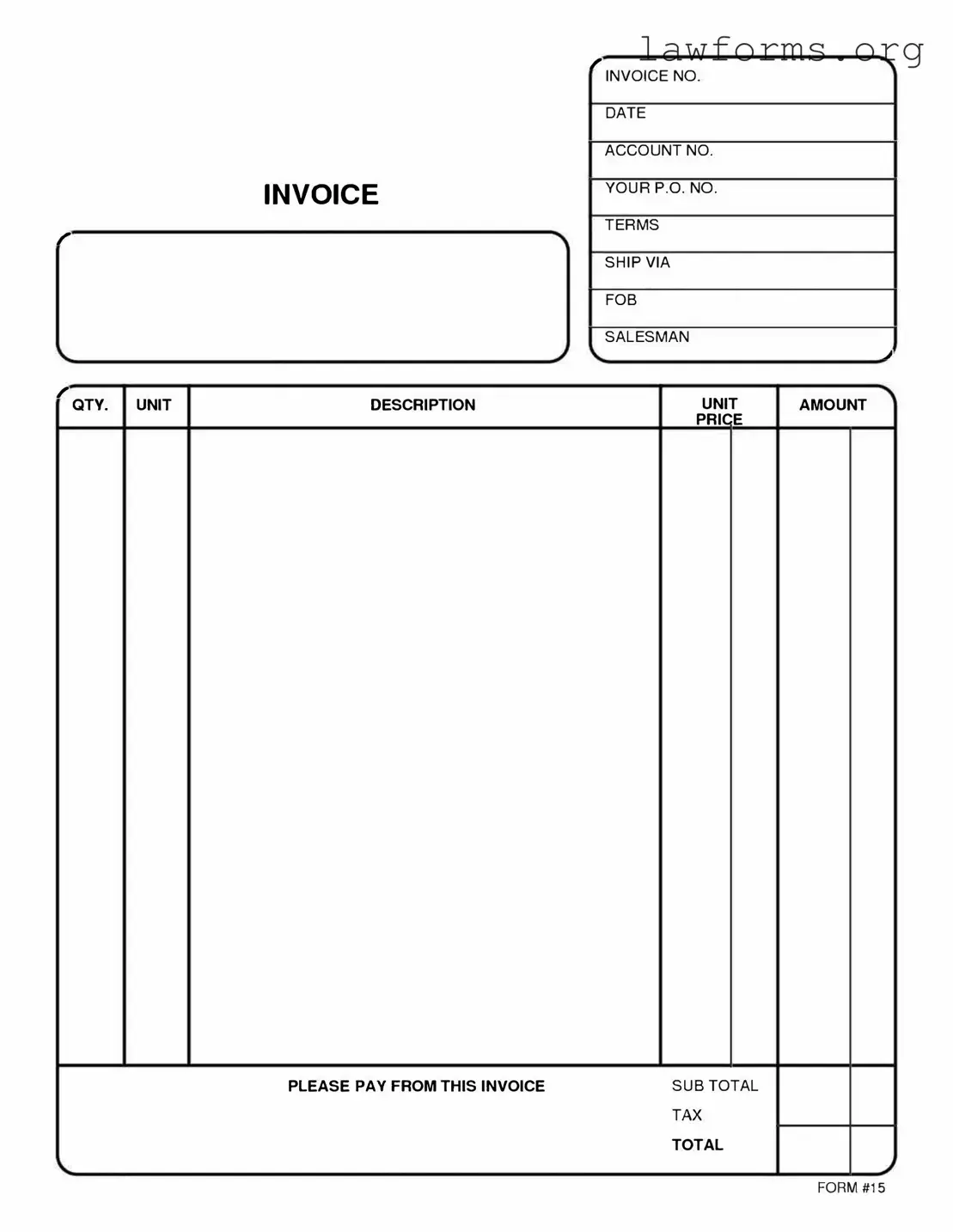

Preview - Free And Invoice Pdf Form

, INVOICENO.

|

|

DATE |

|

|

|

|

INVOICE |

A CCOUNTNO. |

|

|

|

|

|

YOUR Р.О. NO. |

r |

|

TERMS |

|

SHIPVI A |

|

|

|

|

|

|

|

|

|

FOB |

|

|

|

|

|

SALESMAN |

|

|

|

|

� |

, QTY. UNIТ |

DESCRIPTION |

UNIT |

AMOUNT |

|

|

|

PRICE |

|

|

|

|

|

|

|

PLEASE РАУ FROM THIS INVOICE |

SUBTOTAL |

|

ТАХ |

|

TOTAL |

FORM #15

Key takeaways

When filling out and using the Free And Invoice PDF form, there are several important points to keep in mind. Here are key takeaways to ensure you complete the form accurately and effectively:

- Understand the Purpose: This form is designed for invoicing, allowing you to request payment for goods or services provided.

- Gather Necessary Information: Before starting, collect all relevant details such as your business name, contact information, and the specifics of the transaction.

- Use Clear Language: Write clearly and concisely. Avoid jargon to ensure the recipient understands the invoice without confusion.

- Include Payment Terms: Clearly state your payment terms, including due dates and acceptable payment methods. This helps set expectations.

- Double-Check for Accuracy: Review all information for accuracy before sending. Mistakes can lead to delays in payment.

- Save a Copy: Always keep a copy of the completed invoice for your records. This can be useful for tracking payments and for tax purposes.

- Follow Up: If payment is not received by the due date, don't hesitate to follow up with a polite reminder. Communication is key in maintaining good business relationships.

Similar forms

Bill of Sale: This document serves as proof of the transfer of ownership for goods or property, much like an invoice confirms the sale of products or services.

Purchase Order: A purchase order outlines the specifics of a transaction, including quantities and prices, similar to how an invoice details what was purchased and the total amount due.

-

The Emotional Support Animal Letter is crucial for individuals seeking assistance with mental health. It can provide necessary validation for having an emotional support animal and can facilitate access to housing and travel accommodations without extra fees. To understand how to acquire this important document, visit Top Document Templates.

Receipt: A receipt provides evidence of payment for goods or services, just as an invoice indicates what was sold and the payment terms.

Sales Agreement: This document formalizes the terms of a sale between a buyer and seller, similar to how an invoice summarizes the agreed-upon terms after the sale has occurred.

Credit Note: A credit note is issued to a buyer when a return is made or an adjustment is necessary, paralleling how an invoice reflects the original transaction.

Proforma Invoice: This document provides a preliminary bill of sale, outlining the expected costs before a transaction, akin to an invoice that confirms the final sale details.

Statement of Account: This document summarizes all transactions between a buyer and seller over a specific period, much like an invoice details individual transactions.

Work Order: A work order specifies the tasks to be completed and the associated costs, similar to how an invoice details the services rendered and their costs.