Fill Out a Valid Generic Direct Deposit Template

Form Specs

| Fact Name | Details |

|---|---|

| Purpose | The Generic Direct Deposit form is used to authorize the transfer of funds directly into a bank account. |

| Personal Information | Users must provide their last name, first name, middle initial, and Social Security Number. |

| Account Types | Depositors can choose between a checking or savings account for direct deposits. |

| Routing Number | The routing transit number must consist of 9 digits, and the first two digits must be between 01-12 or 21-32. |

| Account Ownership | Account ownership options include self, joint, or other. This must be indicated on the form. |

| Signature Requirement | Both the account holder and any joint account holders must sign the form to authorize transactions. |

| Effective Date | Users can specify an effective date for when the direct deposit should begin. |

| Verification Tips | It is advisable to verify the account and routing numbers with the financial institution before submission. |

| State-Specific Laws | Direct deposit practices may be governed by state-specific laws, which vary by state. |

| Form Completion | All boxes on the form must be filled out completely before submission. |

Dos and Don'ts

When filling out the Generic Direct Deposit form, it’s important to ensure accuracy and compliance. Here’s a guide on what to do and what to avoid.

- Do fill in all boxes completely to avoid delays.

- Do double-check your Social Security Number for accuracy.

- Do verify the account number and routing transit number with your bank.

- Do sign and date the form to validate your authorization.

- Do call your financial institution to confirm they accept direct deposits.

- Don't use a deposit slip to verify the routing number.

- Don't leave any boxes blank, as this may cause processing issues.

- Don't forget to include hyphens in your account number if required.

- Don't submit the form without ensuring that all signatures are present, especially for joint accounts.

Other PDF Documents

Western Union Receipt - Access our international network to send money to over 200 countries.

The California Homeschool Letter of Intent form is a document that parents must submit to officially declare their intention to homeschool their children. This form is an important step in ensuring compliance with state laws regarding homeschooling. For more information on how to complete and submit this form, parents can visit https://californiadocsonline.com/homeschool-letter-of-intent-form/, which will help them navigate the homeschooling process smoothly.

Act of Donation of a Movable Louisiana - Using this form helps protect both the donor's and recipient’s rights in the transaction.

Common mistakes

-

Inaccurate Account Information: One common mistake is providing incorrect account numbers or routing transit numbers. It is essential to double-check these numbers with your financial institution, as even a single digit error can lead to delays or misdirected deposits.

-

Omitting Required Signatures: Failing to sign the form is another frequent error. Both the account holder and, if applicable, any joint account holders must sign the authorization. Without these signatures, the direct deposit request cannot be processed.

-

Choosing the Wrong Account Type: Selecting the incorrect account type—savings or checking—can also cause issues. Ensure that you choose the type of account where you want the funds deposited, as this affects how the financial institution processes your request.

-

Ignoring the Effective Date: Many individuals forget to specify the effective date for the direct deposit. This date indicates when the deposit should begin, and without it, there may be confusion about when to expect the first payment.

Documents used along the form

When completing the Generic Direct Deposit form, it is often necessary to include additional documents to ensure a smooth processing of your direct deposit request. Below is a list of commonly used forms and documents that may accompany the Direct Deposit form.

- W-4 Form: This form is used to determine the amount of federal income tax withholding from your paycheck. Employees must fill it out when they start a new job or when their tax situation changes.

- Bank Account Verification Letter: A letter from your bank confirming your account details, including the account number and routing number. This letter ensures that the financial institution can accept direct deposits.

- Power of Attorney for a Child Form: To ensure you have the necessary documentation during your absence, refer to this comprehensive Power of Attorney for a Child form for legal authorization regarding your child's care and decisions.

- Employee Information Form: This document collects essential personal information from the employee, such as address, phone number, and emergency contacts. It helps maintain updated records within the employer's system.

- Void Check: A check from your checking account that has "VOID" written across it. It provides the necessary routing and account numbers for setting up direct deposit.

- Direct Deposit Agreement: This document outlines the terms and conditions of the direct deposit service. Both the employee and employer may need to sign it to formalize the arrangement.

- Payroll Authorization Form: This form authorizes the employer to deposit payroll directly into the employee's bank account. It may also include options for deductions or contributions to retirement plans.

Including these documents alongside the Generic Direct Deposit form can help streamline the setup process and avoid any delays in receiving payments. Always verify that all information is accurate before submission to ensure a seamless experience.

Misconceptions

Misconceptions about the Generic Direct Deposit form can lead to confusion and mistakes. Here are four common misunderstandings:

- All fields are optional. Many believe that not every field needs to be filled out. In reality, all boxes on the form must be completed to ensure proper processing. Missing information can delay or even prevent direct deposit.

- Only one signature is required. Some think that only the account holder's signature is necessary. However, if the account is a joint account or in someone else's name, that individual must also sign the form to authorize the deposit.

- Deposit slips are a reliable way to verify account information. It's a common misconception that deposit slips can be used to check account and routing numbers. Instead, it's recommended to directly contact your financial institution for accurate details, as deposit slips can sometimes contain errors.

- The routing number can be any nine-digit number. Some people assume that any nine-digit number will work as a routing number. However, the routing number must be specific to your financial institution and must fall within certain ranges. Double-checking this number is crucial for successful transactions.

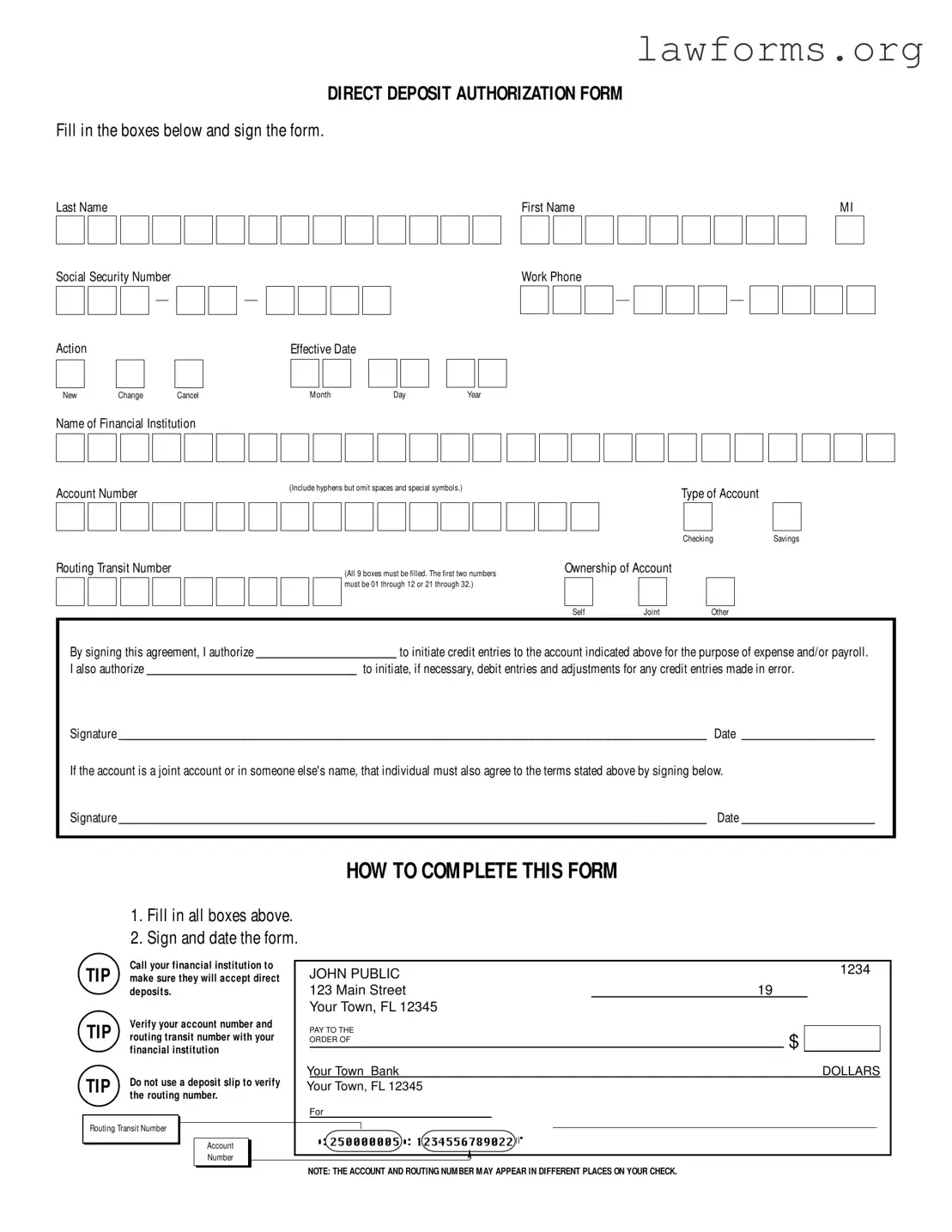

Preview - Generic Direct Deposit Form

DIRECT DEPOSIT AUTHORIZATION FORM

Fill in the boxes below and sign the form.

Last NameFirst NameM I

□□□□□□□□□□□□□□ □□□□□□□□□

□

□

Social Security Number

□□□- □□

- □□□□

- □□□□

Action |

□ □ |

Effective Date |

□New |

□□ □□ □□ |

|

|

ChangeCancel |

M onthDayYear |

Work Phone

Name of Financial Institution

□□□□□□□□□□□□□□□□□□□□□□□□□□

Account Number |

(Include hyphens but omit spaces and special symbols.) |

Type of Account |

|

|

Savings |

||

|

|

Checking |

|

□□□□□□□□□□□□□□□□□ |

□ |

□ |

|

Routing Transit Number

□□□□□□□□□

(All 9 boxes must be filled. The first two numbers |

Ownership of Account |

|

|||

|

|

|

|

|

|

must be 01 through 12 or 21 through 32.) |

|

|

|

|

|

|

|

|

|

|

|

|

Self |

Joint |

Other |

||

|

□ |

□ |

□ |

||

By signing this agreement, I authorize ____________________ to initiate credit entries to the account indicated above for the purpose of expense and/or payroll.

I also authorize ______________________________ to initiate, if necessary, debit entries and adjustments for any credit entries made in error.

Signature ____________________________________________________________________________________ Date ___________________

If the account is a joint account or in someone else's name, that individual must also agree to the terms stated above by signing below.

Signature ____________________________________________________________________________________ Date ___________________

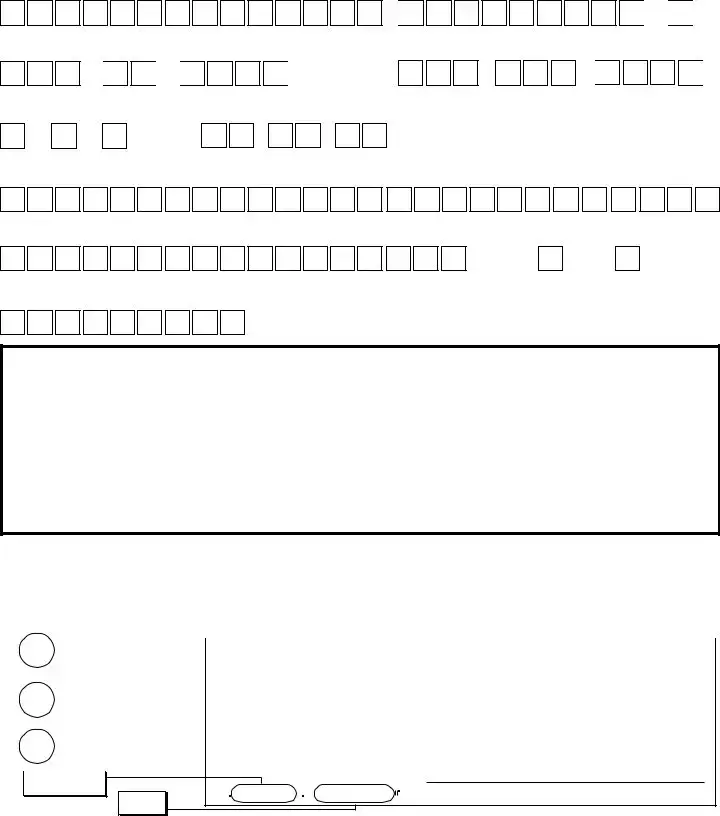

HOW TO COM PLETE THIS FORM

1.Fill in all boxes above.

2.Sign and date the form.

|

TIP |

Call your financial institution to |

|

JOHN PUBLIC |

1234 |

|

|||||

|

make sure they will accept direct |

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|||

0 deposit s. |

|

123 MAIN STREET |

19 |

|

|

|

|

||||

|

|

|

|

|

YOUR TOWN, FL 12345 |

|

|

|

|

|

|

|

TIP |

Verify your account number and |

|

PAY TO THE |

|

|

|

|

|

||

|

routing transit number with your |

|

ORDER OF |

|

|

|

|

|

|||

0 financial institution |

|

|

|

|

$ |

|

|

|

|||

|

|

|

|

|

|

||||||

YOUR TOWN BANK |

|

|

|

DOLLARS |

|||||||

|

TIP |

Do not use a deposit slip to verify |

|

|

|

|

|

|

|

|

|

|

YOUR TOWN, FL 12345 |

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

||||

|

0 the routing |

number. |

|

FOR |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

IRouting Transit Number |

I |

|

➤ |

I |

Account |

l~::::::::,(~::250000005::)•:(~:=1234556789022~):..1·___________ J |

|

|

|

Number |

➤ |

NOTE: THE ACCOUNT AND ROUTING NUM BER M AY APPEAR IN DIFFERENT PLACES ON YOUR CHECK.

Key takeaways

When filling out the Generic Direct Deposit form, there are several important points to keep in mind to ensure a smooth process. Here are the key takeaways:

- Complete All Fields: Make sure to fill in every box on the form. Missing information can lead to delays or errors in processing your direct deposit.

- Verify Your Numbers: Double-check your account number and routing transit number with your financial institution. This step is crucial to avoid any issues with your deposits.

- Use the Correct Format: When entering your account number, include hyphens but omit any spaces or special symbols. This helps in maintaining accuracy.

- Sign and Date: Don’t forget to sign and date the form. Your signature authorizes the financial institution to process the direct deposits as specified.

- Joint Accounts Require Additional Signatures: If the account is a joint account or in someone else’s name, that person must also sign the form to agree to the terms.

By following these guidelines, you can ensure that your direct deposit setup goes as smoothly as possible, allowing for timely and accurate payments.

Similar forms

- W-4 Form: This form allows employees to indicate their tax withholding preferences. Like the Direct Deposit form, it requires personal information and signatures to authorize changes.

- ACH Authorization Form: Similar to the Direct Deposit form, this document authorizes electronic transfers between bank accounts. Both require account details and signatures to initiate transactions.

- Payroll Deduction Authorization Form: Employees use this form to authorize deductions from their paychecks for various purposes. It shares the need for personal information and consent to process deductions.

- Power of Attorney Form: This legal document is essential for appointing someone to make decisions on your behalf, covering various matters from financial to healthcare. For further understanding of the requirements, refer to the Forms Washington.

- Bank Account Change Form: When individuals want to change their banking information, this form is used. It is similar because it also requires account details and a signature to confirm the changes.

- Direct Payment Authorization Form: This document allows individuals to authorize recurring payments from their bank accounts. Like the Direct Deposit form, it requires banking information and signatures for approval.

- Retirement Account Contribution Form: Employees fill out this form to set up contributions to retirement accounts. Both forms require personal information and consent to manage financial transactions.

- Loan Payment Authorization Form: This form authorizes automatic loan payments from a bank account. It is similar as it requires bank account details and signatures to ensure payment processing.

- Insurance Premium Payment Authorization Form: This document allows for automatic deductions for insurance premiums. Like the Direct Deposit form, it requires personal and banking information along with a signature for authorization.