Valid Gift Deed Form

State-specific Gift Deed Documents

Form Specifications

| Fact Name | Description |

|---|---|

| Definition | A Gift Deed is a legal document used to transfer ownership of property from one person to another without any exchange of money. |

| Voluntary Transfer | The transfer of property must be voluntary, meaning the giver (donor) cannot be coerced or pressured into making the gift. |

| Consideration | Unlike sales, a Gift Deed does not require consideration, which is typically payment or something of value exchanged for the property. |

| Legal Capacity | Both the donor and the recipient (donee) must have the legal capacity to enter into a contract. This generally means they must be of legal age and mentally competent. |

| State-Specific Laws | Gift Deeds are governed by state laws, which can vary. For example, in California, the relevant laws are found in the California Civil Code. |

| Written Requirement | A Gift Deed must be in writing to be legally enforceable. Oral gifts are typically not recognized under the law. |

| Tax Implications | Gifts may have tax implications for both the donor and donee. The IRS allows a certain amount to be gifted tax-free each year. |

| Revocation | Once executed, a Gift Deed is generally irrevocable unless specific conditions allow the donor to reclaim the property. |

Dos and Don'ts

When filling out a Gift Deed form, it's important to follow certain guidelines to ensure the process goes smoothly. Here are some key do's and don'ts to keep in mind:

- Do provide accurate information about the donor and the recipient.

- Do clearly describe the property or item being gifted.

- Do ensure that both parties sign the document.

- Do check for any specific state requirements that may apply.

- Don't leave any sections of the form blank; fill in all required fields.

- Don't use ambiguous language that could lead to misunderstandings.

Create Popular Types of Gift Deed Documents

United States Tod - The property owner retains full control of the property during their lifetime with a Transfer-on-Death Deed.

California Corrective Deed - Using a Corrective Deed can be an efficient way to resolve past issues.

A Quitclaim Deed is a legal document used in Ohio to transfer ownership of property from one party to another without guaranteeing the title's validity. This form is often used among family members or in situations where the parties know each other well. Understanding how to properly fill out and file this form is crucial for a smooth transfer of property rights, and you can find more information by visiting Ohio PDF Forms.

Free Lady Bird Deed Form - Employing a Lady Bird Deed can establish clear communication about property inheritance intentions.

Common mistakes

-

Incomplete Information: Many people forget to fill in all required fields. Missing details can delay the process or cause the deed to be invalid.

-

Incorrect Names: Spelling errors in the names of the giver or recipient can lead to confusion. Always double-check the spelling.

-

Wrong Property Description: A vague or incorrect description of the property can create issues. Make sure to provide a clear and accurate description.

-

Not Notarizing the Document: Failing to have the deed notarized can render it unenforceable. A notary public verifies the identities of the parties involved.

-

Missing Signatures: Both the giver and recipient must sign the deed. Forgetting a signature can lead to complications.

-

Ignoring State Laws: Each state has its own rules regarding gift deeds. Not following these can result in legal problems.

-

Failure to Record the Deed: After completing the deed, it should be recorded with the appropriate local authority. This step is crucial for legal recognition.

-

Not Consulting a Professional: Some individuals attempt to complete the form without professional help. This can lead to mistakes that could have been easily avoided.

Documents used along the form

A Gift Deed is a legal document that outlines the transfer of property or assets from one individual to another without any exchange of payment. When executing a Gift Deed, it is often necessary to accompany it with other forms and documents to ensure clarity and legality. Below is a list of commonly used forms and documents associated with a Gift Deed.

- Affidavit of Gift: This document is a sworn statement that confirms the intent of the donor to gift the property. It serves as additional evidence of the donor's wishes and can be important for legal purposes.

- Title Transfer Document: This document facilitates the official transfer of ownership of the property from the donor to the recipient. It is crucial for updating property records and ensuring that the recipient has legal ownership.

- WC-200a Form: This form is essential for those looking to change their treating physician or seek additional treatment with consent, highlighting its importance in the workers' compensation process. For more information, visit georgiaform.com/.

- Property Deed: A property deed outlines the specifics of the property being gifted, including its legal description and boundaries. This document is essential for verifying the property details in the Gift Deed.

- Gift Tax Return: Depending on the value of the gift, a gift tax return may be required. This document informs the IRS about the transfer and ensures compliance with tax regulations.

- Notarized Consent: If the property is jointly owned or if there are multiple heirs, a notarized consent form from all parties may be necessary. This document confirms that all relevant parties agree to the gift and its terms.

Each of these documents plays a vital role in the gifting process, ensuring that the transaction is legally sound and that the intentions of the parties involved are clear. It is advisable to consult with a legal professional to ensure all necessary documentation is properly completed and filed.

Misconceptions

When it comes to gift deeds, many people have misunderstandings that can lead to confusion. Below are five common misconceptions about gift deeds, along with clarifications to help set the record straight.

- A gift deed is the same as a will. Many believe that a gift deed functions like a will, but this is not true. A gift deed transfers ownership of property immediately, while a will only distributes property after a person’s death.

- You can revoke a gift deed at any time. Some think that once a gift deed is signed, it can easily be undone. However, revoking a gift deed is not straightforward and typically requires legal processes to ensure it is valid.

- Gift deeds are only for real estate. While many people associate gift deeds with property, they can also apply to personal belongings, stocks, and other assets. The important factor is the transfer of ownership.

- You don't need witnesses for a gift deed. This is a common misconception. Most states require that a gift deed be witnessed or notarized to be legally binding. Without proper witnessing, the deed may not hold up in court.

- Gift deeds are tax-free. Many assume that transferring property through a gift deed incurs no tax implications. However, depending on the value of the gift, there may be gift tax liabilities that the donor must consider.

Understanding these misconceptions can help individuals navigate the complexities of gift deeds more effectively. It is always wise to consult with a legal expert when considering a gift deed to ensure all aspects are properly addressed.

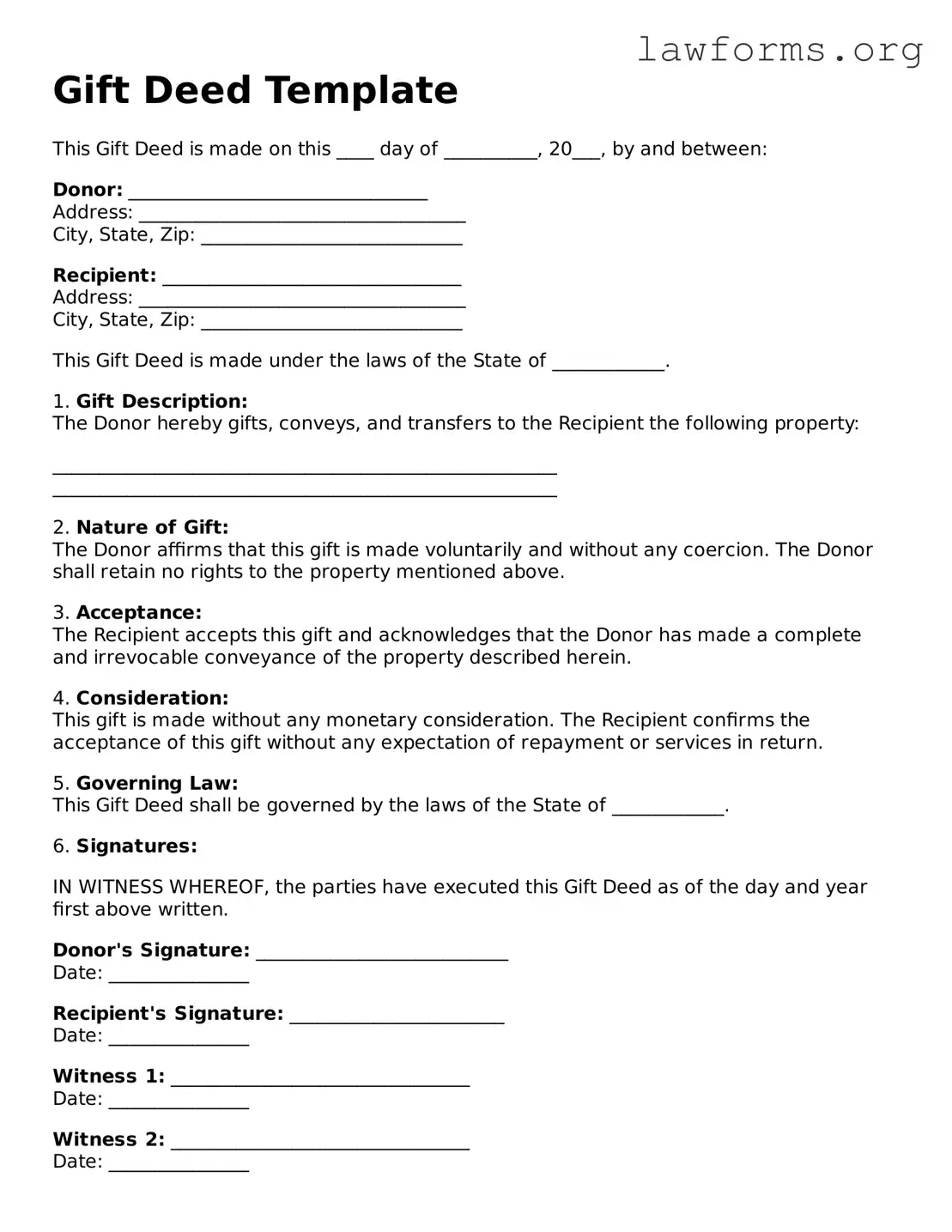

Preview - Gift Deed Form

Gift Deed Template

This Gift Deed is made on this ____ day of __________, 20___, by and between:

Donor: ________________________________

Address: ___________________________________

City, State, Zip: ____________________________

Recipient: ________________________________

Address: ___________________________________

City, State, Zip: ____________________________

This Gift Deed is made under the laws of the State of ____________.

1. Gift Description:

The Donor hereby gifts, conveys, and transfers to the Recipient the following property:

______________________________________________________

______________________________________________________

2. Nature of Gift:

The Donor affirms that this gift is made voluntarily and without any coercion. The Donor shall retain no rights to the property mentioned above.

3. Acceptance:

The Recipient accepts this gift and acknowledges that the Donor has made a complete and irrevocable conveyance of the property described herein.

4. Consideration:

This gift is made without any monetary consideration. The Recipient confirms the acceptance of this gift without any expectation of repayment or services in return.

5. Governing Law:

This Gift Deed shall be governed by the laws of the State of ____________.

6. Signatures:

IN WITNESS WHEREOF, the parties have executed this Gift Deed as of the day and year first above written.

Donor's Signature: ___________________________

Date: _______________

Recipient's Signature: _______________________

Date: _______________

Witness 1: ________________________________

Date: _______________

Witness 2: ________________________________

Date: _______________

Key takeaways

When filling out and using a Gift Deed form, it’s essential to understand several key points to ensure the process goes smoothly. Here are some important takeaways:

- Understand the Purpose: A Gift Deed is a legal document that transfers ownership of property from one person to another without any exchange of money. It’s important to know this to avoid confusion.

- Identify the Parties: Clearly identify the donor (the person giving the gift) and the donee (the person receiving the gift). Full names and addresses should be included to avoid any disputes later.

- Describe the Gift: Provide a detailed description of the property being gifted. This may include the address, legal description, or any identifying features that make it clear what is being transferred.

- Consider Tax Implications: Be aware that gifting property may have tax consequences. It’s advisable to consult with a tax professional to understand any potential liabilities or benefits.

- Signatures Are Crucial: Both the donor and donee must sign the Gift Deed for it to be valid. In some cases, having witnesses or notarization can strengthen the document’s legitimacy.

- Record the Deed: After completing the Gift Deed, consider recording it with the appropriate local government office. This step can help protect the rights of the donee and provide public notice of the transfer.

By keeping these points in mind, you can navigate the process of creating and using a Gift Deed more effectively.

Similar forms

The Gift Deed form shares similarities with several other legal documents. Each of these documents serves a specific purpose in the transfer of property or assets. Below is a list of six documents that are similar to the Gift Deed form:

- Warranty Deed: This document provides a guarantee that the grantor holds clear title to the property and has the right to transfer it. Like a Gift Deed, it transfers ownership but includes warranties against future claims.

- Quitclaim Deed: This document transfers whatever interest the grantor has in the property without any guarantees. It is similar to a Gift Deed in that it can be used to transfer property without a sale, but it offers less protection to the recipient.

- Transfer on Death Deed (TOD): This allows an individual to transfer property upon their death without going through probate. Like a Gift Deed, it involves the transfer of property but is effective only after the grantor's death.

- Bill of Sale: This document transfers ownership of personal property, such as vehicles or equipment. Similar to a Gift Deed, it can be used to transfer ownership without payment, emphasizing the intent to give.

- Trust Agreement: This document establishes a trust where a trustee manages assets for beneficiaries. Like a Gift Deed, it involves transferring assets but is structured to provide ongoing management and protection for the beneficiaries.

- California Form REG 262 - This form is crucial for transferring ownership of a vehicle or vessel in California, ensuring compliance with state laws. You can find more information at californiadocsonline.com/california-fotm-reg-262-form/.

- Power of Attorney: This document grants someone the authority to act on behalf of another person. While it does not transfer property, it can facilitate the transfer of assets similar to a Gift Deed by allowing the agent to execute the transfer.